SPONSOR: http://www.MarcinkoAssociates.com

By Dr. David Edward Marcinko; MBA MEd CMP™

***

***

SPONSOR: http://www.CertifiedMedicalPlanner.org

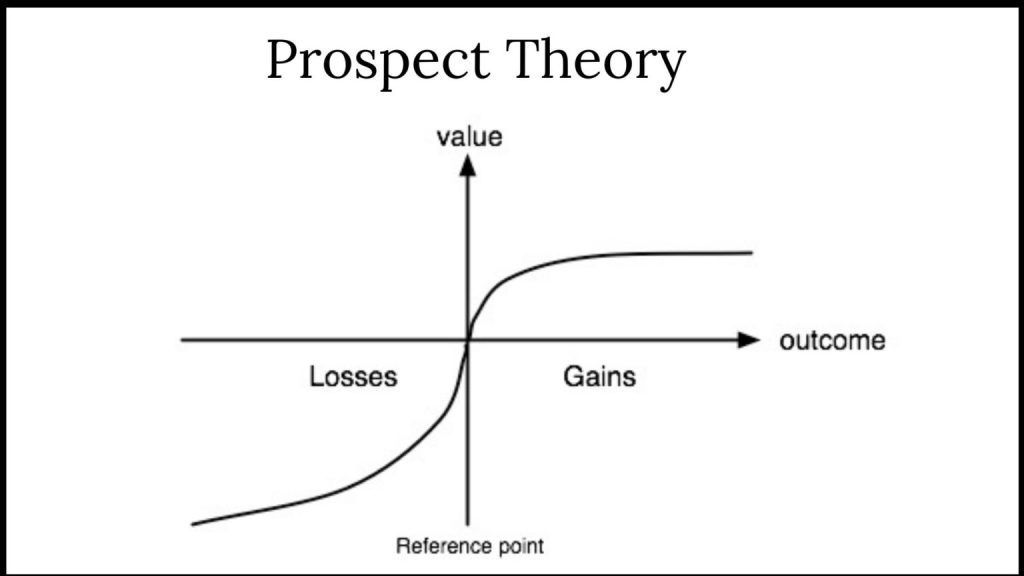

Life planning and behavioral finance as proposed for physicians and integrated by the Institute of Medical Business Advisors Inc., is unique in that it emanates from a holistic union of personal financial planning, human physiology and medical practice management, solely for the healthcare space. Unlike pure life planning, pure financial planning, or pure management theory, it is both a quantitative and qualitative “hard and soft” science, with an ambitious economic, psychological and managerial niche value proposition never before proposed and codified, while still representing an evolving philosophy. Its’ first-mover practitioners are called Certified Medical Planners™.

Life planning, in general, has many detractors and defenders. Formally, it has been defined by Mitch Anthony, Gene R. Lawrence, AAMS, CFP© and Roy T. Diliberto, ChFC, CFP© of the Financial Life Institute, in the following trinitarian way.

Financial Life Planning is an approach to financial planning that places the history, transitions, goals, and principles of the client at the center of the planning process. For the financial advisor or planner, the life of the client becomes the axis around which financial planning develops and evolves.

Financial Life Planning is about coming to the right answers by asking the right questions. This involves broadening the conversation beyond investment selection and asset management to exploring life issues as they relate to money.

Financial Life Planning is a process that helps advisors move their practice from financial transaction thinking, to life transition thinking. The first step is aimed to help clients “see” the connection between their financial lives and the challenges and opportunities inherent in each life transition.

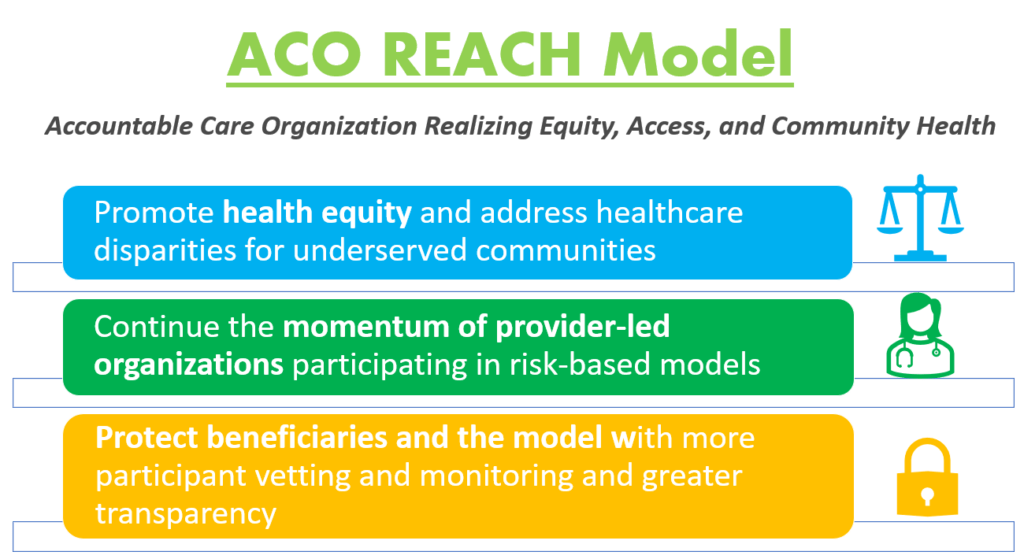

But, for informed physicians, life planning’s quasi-professional and informal approach to the largely isolate disciplines of financial planning and medical practice management is inadequate. Today’s practice environment is incredibly complex, as compressed economic stress from HMOs managed care, financial insecurity from insurance companies, ACOs and VBC, Washington DC and Wall Street; liability fears from attorneys, criminal scrutiny from government agencies, and IT mischief from malicious electronic medical record [eMR] hackers. And economic bench marking from hospital employers; lost confidence from patients; and the Patient Protection and Affordable Care Act [PP-ACA] more than a decade ago. All promote “burnout” and converge to inspire a robust new financial planning approach for physicians and most all medical professionals.

The iMBA Inc., approach to financial planning, as championed by the Certified Medical Planner™ professional certification designation program, integrates the traditional concepts of financial life planning, with the increasing complex business concepts of medical practice management. The former topics are presented in this textbook, the later in our recent companion text: The Business of Medical Practice [Transformational Health 2.0 Skills for Doctors].

***

***

For example, views of medical practice, personal lifestyle, investing and retirement, both what they are and how they may look in the future, are rapidly changing as the retail mentality of medicine is replaced with a wholesale and governmental philosophy. Or, how views on maximizing current practice income might be more profitably sacrificed for the potential of greater wealth upon eventual practice sale and disposition.

Or, how the ultimate fear represented by Yale University economist Robert J. Shiller, in The New Financial Order: Risk in the 21st Century, warns that the risk for choosing the wrong profession or specialty, might render physicians obsolete by technological changes, managed care systems or fiscally unsound demographics. OR, if a medical degree is even needed for future physicians?

Say, what medical license?

Dr. Shirley Svorny, chair of the economics department at California State University, Northridge, holds a PhD in economics from UCLA. She is an expert on the regulation of health care professionals who participated in health policy summits organized by Cato and the Texas Public Policy Foundation. She argues that medical licensure not only fails to protect patients from incompetent physicians, but, by raising barriers to entry, makes health care more expensive and less accessible. Institutional oversight and a sophisticated network of private accrediting and certification organizations, all motivated by the need to protect reputations and avoid legal liability, offer whatever consumer protections exist today.

Yet, the opportunity to revise the future at any age through personal re-engineering, exists for all of us, and allows a joint exploration of the meaning and purpose in life. To allow this deeper and more realistic approach, the informed transformation advisor and the doctor client, must build relationships based on trust, greater self-knowledge and true medical business management and personal financial planning acumen.

[A] The iMBA Philosophy

As you read this ME-P website, we hope you will embrace the opportunity to receive the focused and best thinking of some very smart people. Hopefully, along the way you will self-saturate with concrete information that proves valuable in your own medical practice and personal money journey. Maybe, you will even learn something that is so valuable and so powerful, that future reflection will reveal it to be of critical importance to your life. The contributing authors certainly hope so.

At the Institute of Medical Business Advisors, and thru the Certified Medical Planner™ program, we suggest that such an epiphany can be realized only if you have extraordinary clarity regarding your personal, economic and [financial advisory or medical] practice goals, your money, and your relationship with it. Money is, after only, no more or less than what we make of it.

Ultimately, your relationship with it, and to others, is the most important component of how well it will serve you.

COMMENTS APPRECIATED

Read, Subscribe, Like and Refer

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit a RFP for speaking engagements: CONTACT: MarcinkoAdvisors@outlook.com

***

Filed under: "Ask-an-Advisor", "Doctors Only", CMP Program, Experts Invited, Financial Planning, Glossary Terms, Health Economics, Healthcare Finance, iMBA, iMBA, Inc., Insurance Matters, Investing, Managed Care, Marcinko Associates, Op-Editorials, Portfolio Management, Practice Management, Practice Worth, Professional Liability, Recommended Books, Touring with Marcinko | Tagged: ACA, ACOs, behavioral finance, certified medical planner, CFP, CMP, DO, doctors practice management, DPM, finance, Financial Planning, HMO, iMBA, Investing, life planning, Marcinko, MBA, MD, medical business advisors, personal-finance, PPACA, PPO, retirement planning, VBC | 1 Comment »

***

***

STUPID COMMENTS: Financial Advisors Say to Physician Clients

BY DR. DAVID EDWARD MARCINKO; MBA MEd CMP®

***

***

SPONSOR: http://www.MarcinkoAssociates.com

***

Some Stupid Things Financial Advisors Say to Physician Clients

A few years ago and just for giggles, colleague Lon Jefferies MBA CFP® and I collected a list of dumb-stupid things said by some Financial Advisors to their doctor, dentist, nurse and and other medical professional clients, along with some recommended under-breath rejoinders:

So, don’t let these aphorisms blind you to the critical thinking skills you learned in college, honed in medical school and apply every day in life.

COMMENTS APPRECIATED

Refer, Like and Subscribe

***

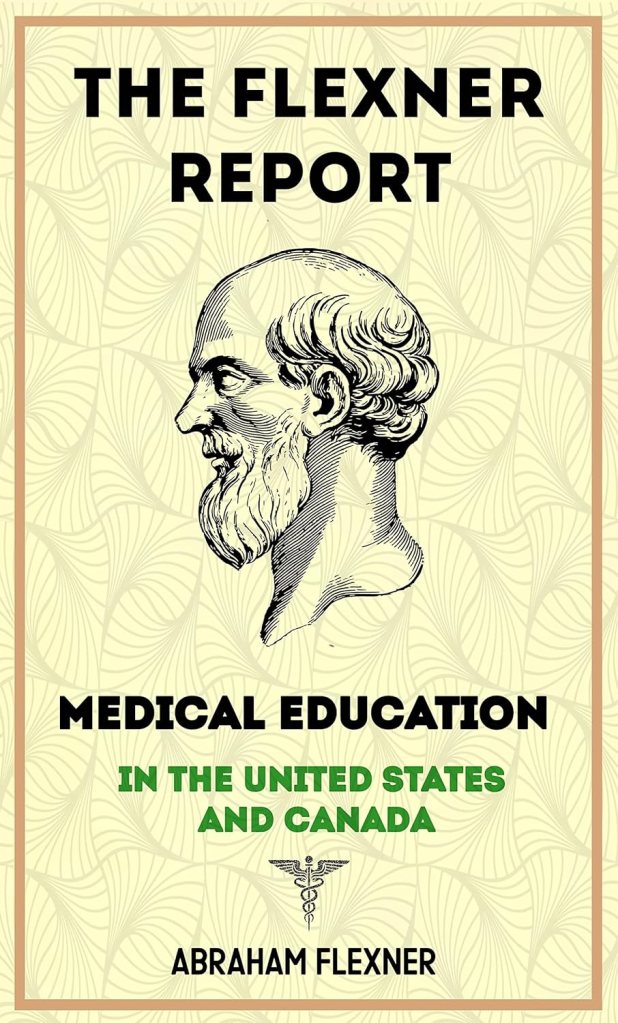

EDUCATION: Books

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit a RFP for speaking engagements: CONTACT: MarcinkoAdvisors@outlook.com

***

***

Share this:

Filed under: "Advisors Only", "Doctors Only", Ethics, Jokes and Puns, LifeStyle | Tagged: bears, bulls, crypto, DO, doctor clients, DPM, dumb comments, finance, financial advisors, financial planners, Investing, Lon Jefferies, Marcinko, MD, personal-finance, Physician Clients, physicians, Ponzi, stocks, stupid comments, Wall Street | Leave a comment »