By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

You’ve got a sense of your ideal retirement age. And you’ve probably made certain plans based on that timeline. But what if you’re forced to retire sooner than you expect? Aging baby-boomers, corporate medicine, the medical practice great resignation and/or the pandemic, etc?

RESIGNATION: https://medicalexecutivepost.com/2021/12/12/healthcare-industry-hit-with-the-great-resignation-retirement/

Early retirement is nothing new, but it’s clear how much the COVID-19 pandemic has affected an aging workforce. Whether due to downsizing, objections to vaccine mandates, concerns about exposure risks, other health issues, or the desire for more leisure time, the retired general population grew by 3.5 million over the past two years—compared to an annual average of 1 million between 2008 and 2019—according to the Pew Research Center.1 At the same time, a survey conducted by the National Institute on Retirement Security revealed that more than half of Americans are concerned that the COVID-19 pandemic has impacted their ability to achieve a secure retirement.2

***

***

There’s no need to panic, but those numbers make one thing clear, says Rob Williams, managing director of financial planning, retirement income, and wealth management for the Schwab Center for Financial Research. Flexible and personalized financial planning that addresses how you’d cope if you had to retire early can help you make the best use of all your resources.

So – Here are six steps to follow. We’ll use as an example a person who’s seeing if they could retire five years early, but the steps remain the same regardless of your individual time frame.

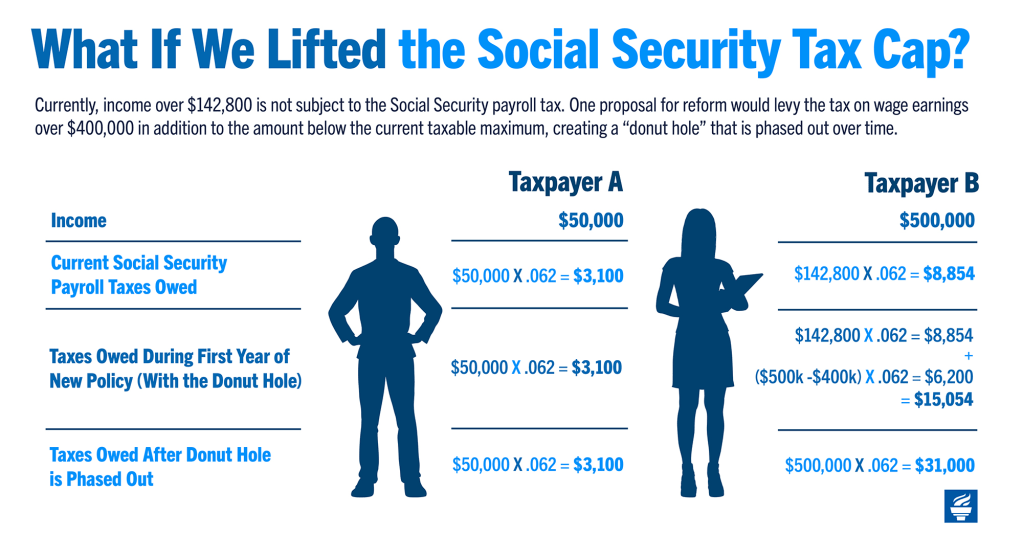

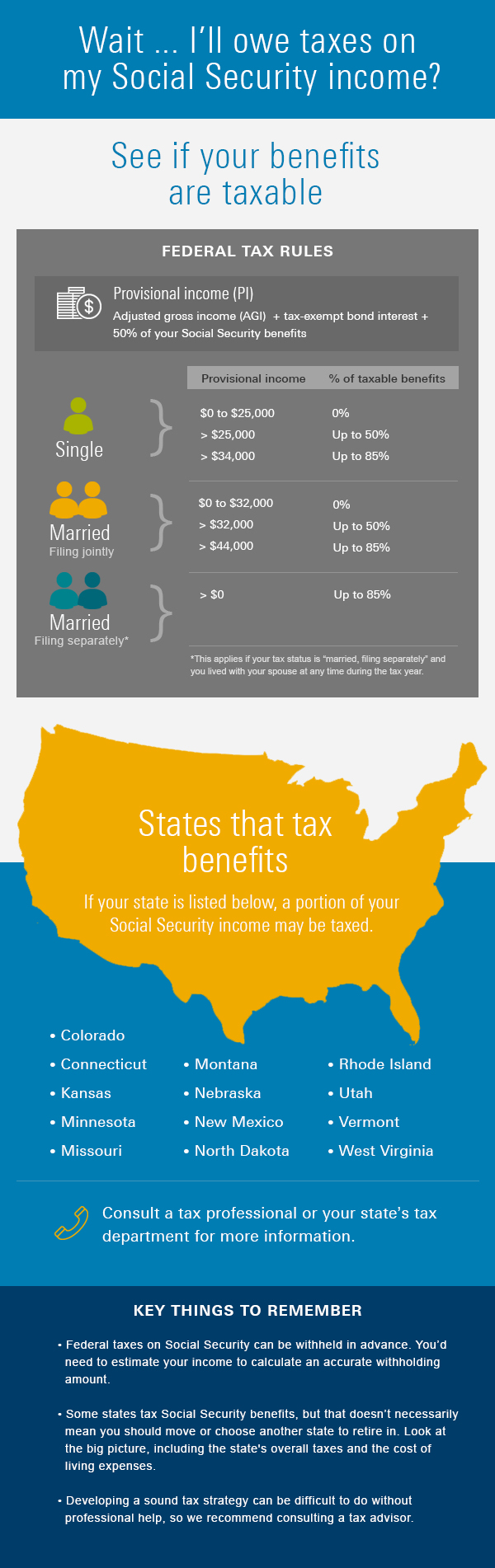

Step 1: Think strategically about pension and Social Security benefits

For most retirees, Social Security and (to a lesser degree) pensions are the two primary sources of regular income in retirement. You usually can collect these payments early—at age 62 for Social Security and sometimes as early as age 55 with a pension. However, taking benefits early will mean that you get smaller monthly benefits for the rest of your life. That can matter to your bottom line, even if you expect Social Security to be merely the icing on your retirement cake.

On the Social Security website, you can find a projection of what your benefits would be if you were pushed to claim them several years early. But if you’re part of a two-income couple, you may want to make an appointment at a Social Security office or with a financial professional to weigh the potential options.

For example, when you die, your spouse is eligible to receive your monthly benefit if it’s higher than his or her own. But if you claim your benefits early, thus receiving a reduced amount, you’re likewise limiting your spouse’s potential survivor benefit.

If you have a pension, your employer’s pension administrator can help estimate your monthly pension payments at various ages. Once you have these estimates, you’ll have a good idea of how much monthly income you can count on at any given point in time.

***

Step 2: Pressure-test your 401(k)

In addition to weighing different strategies to maximize your Social Security and/or pension, evaluate how much income you could potentially derive from your personal retirement savings—and there’s a silver lining here if you’re forced to retire early.

Rule of 55

Let’s say you leave your job at any time during or after the calendar year you turn 55 (or age 50 if you’re a public safety employee with a government defined-benefit plan). Under a little-known separation-of-service provision, often referred to as the “rule of 55,” you may be able take distributions (though some plans may allow only one lump-sum withdrawal) from your 401(k), 403(b), or other qualified retirement plan free of the usual 10% early-withdrawal penalties. However, be aware that you’ll still owe ordinary income taxes on the amount distributed.

This exception applies only to the plan (including any consolidated accounts) that you were contributing to when you separated from service. It does not extend to IRAs.

4% rule

There’s also a simple rule of thumb suggesting that if you spend 4% or less of your savings in your first year of retirement and then adjust for inflation each year following, your savings are likely to last for at least 30 years—given that you make no other changes to your withdrawals, such as a lump sum withdrawal for a one-time expense or a slight reduction in withdrawals during a down market.

To see how much monthly income you could count on if you retired as expected in five years, multiply your current savings by 4% and divide by 12. For example, $1 million x .04 = $40,000. Divide that by 12 to get $3,333 per month in year one of retirement. (Again, you could increase that amount with inflation each year thereafter.) Then do the same calculation based on your current savings to see how much you’d have to live on if you retired today. Keep in mind that your money will have to last five years longer in this instance.

Knowing the monthly amount your current savings can generate will give you a clearer sense of whether you’ll have a shortfall—and how large or small it might be. Use our retirement savings calculator to test different saving amounts and time frames.

Step 3: Don’t forget about health insurance, doctor!

Nobody wants to spend down a big chunk of their retirement savings on unanticipated healthcare costs in the years between early retirement and Medicare eligibility at age 65. If you lose your employer-sponsored health insurance, you’ll want to find some coverage until you can apply for Medicare.

Your options may include continuing employer-sponsored coverage through COBRA, insurance enrollment through the Health Insurance Marketplace at HealthCare.gov, or joining your spouse’s health insurance plan. You may also find discounted coverage through organizations you belong to—for example, the AARP.

Step 4: Create a post-retirement budget

To make sure your retirement savings will cover your expenses, add up the monthly income you could get from pensions, Social Security, and your savings. Then, compare the total to your anticipated monthly expenses (including income taxes) if you were to retire five years early and are eligible, and choose to file, for Social Security and pension benefits earlier.

Take into account various life events and expenditures you may encounter. You may not pay off your mortgage by the date you’d planned. Your spouse might still be working (which can add income but also prolong certain expenses). Or your children might not be out of college yet.

You’re probably fine if you anticipate that your monthly expenses will be lower than your income. But if you think your expenses would be higher than your early-retirement income, some suggest that you take one or more of these measures:

- Retire later; practice longer.

- Save more now to fill some of the potential gap.

- Trim your budget so there’s less of a gap down the road.

- Consider options for medical consulting or part-time work—and begin to explore some of those opportunities now.

To the last point, finding a physician job later in life can be challenging, but certain employment agencies specialize in this area. If you can find work you like that covers a portion of your expenses, you’ll have the option of delaying Social Security and your company pension to get higher payments later—and you can avoid dipping into your retirement savings prematurely.

***

***

Step 5: Protect your portfolio

When you retire early, you have to walk a fine line with your portfolio’s asset allocation—investing aggressively enough that your money has the potential to grow over a long retirement, but also conservatively enough to minimize the chance of big losses, particularly at the outset.

“Risk management is especially important during the first few years of retirement or if you retire early,” Rob notes, because it can be difficult to bounce back from a loss when you’re drawing down income from your portfolio and reducing the overall number of shares you own.

To strike a balance between growth and security, start by making sure you have enough money stashed in relatively liquid, relatively stable investments—such as money market accounts, CDs, or high-quality short-term bonds—to cover at least a year or two of living expenses. Divide the rest of your portfolio among stocks, bonds, and other fixed-income investments. And don’t hesitate to seek professional help to arrive at the right mix.

***

SPONSOR: http://www.CertifiedMedicalPlanner.org

Many people are unaccustomed to thinking about their expenses because they simply spend what they make when working, Rob says. But one of the most valuable decisions you can make about your life in retirement is to reevaluate where your money is going now.

This serves two aims. First, it’s a reality check on the spending plan you’ve envisioned for retirement, which may be idealized (e.g., “I’ll do all the home maintenance and repairs!”). Second, it enables you to adjust your spending habits ahead of schedule—whichever schedule you end up following. This gives you more control and potentially more income.

Step 6: Reevaluate your current spending

For example, if you’re not averse to downsizing, moving to a less expensive home could reduce your monthly mortgage, property tax, and insurance payments while freeing up equity that could also be invested to provide additional monthly income.

“When you are saving for retirement, time is on your side”. You lose that advantage when you’re forced to retire early, but having a backup plan that anticipates the possibility of an early retirement can make the unknowns you face a lot less daunting.

CITE: https://www.r2library.com/Resource/Title/082610254

References:

1Richard Fry, “Amid the Pandemic, A Rising Share Of Older U.S. Adults Are Now Retired”, Pew Research Center, 11/04/2021, https://www.pewresearch.org/fact-tank/2021/11/04/amid-the-pandemic-a-rising-share-of-older-u-s-adults-are-now-retired/.

2Tyler Bond, Don Doonan and Kelly Kenneally, “Retirement Insecurity 2021: Americans’ Views of Retirement”, Nirsonline.Org, 02/2021, https://www.nirsonline.org/wp-content/uploads/2021/02/FINAL-Retirement-Insecurity-2021-.pdf.

COMMENTS APPRECIATED.

Thank You

Subscribe to the Medical Executive-Post

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", Career Development, CMP Program, Estate Planning, Investing, Retirement and Benefits | Tagged: ACA, ACO, Certified Medical Planner™, CMP, covid, doctor retirement, Estate Planning, great resignation, medicare, pandemic, Physician retirement, retirement, retirement planning, social security | Leave a comment »