MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2024 |

REFER A COLLEAGUE: MarcinkoAdvisors@msn.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

***

Here’s where the major benchmarks ended:

America’s oldest popular stock index, the Dow Jones Industrial Average, hit a brief record high yesterday morning when it traded above 40,000, reflecting renewed hope for the market’s health after Wednesday’s promising inflation report.

- The S&P 500® index (SPX) fell 11.05 points (0.2%) to 5,297.10; the Dow Jones Industrial Average declined 38.62 points (0.1%) to 39,869.38; the NASDAQ Composite® ($COMP) shed 44.07 points (0.3%) to 16,698.32.

- The 10-year Treasury note yield (TNX) rose more than 2 basis points to 4.381%.

- The CBOE Volatility Index® (VIX) dropped 0.03 to 12.42.

Walmart’s strength fueled a strong day for consumer staples shares. The S&P 500 Consumer Staples ($SP500#30), which includes Walmart as well as companies like Coca-Cola (KO) and Procter & Gamble (PG), surged 1.5% to its highest level in over two years.

Among other companies, Applied Materials (AMAT) fell 1.6% ahead of the semiconductor industry supplier’s quarterly earnings report, which is expected after Thursday’s close.

CITE: https://www.r2library.com/Resource

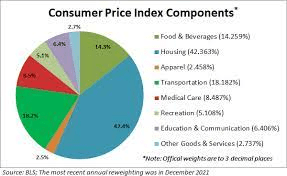

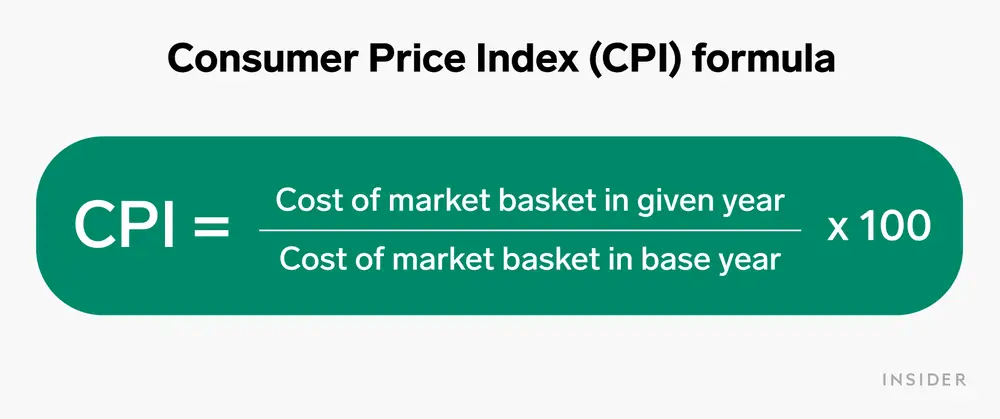

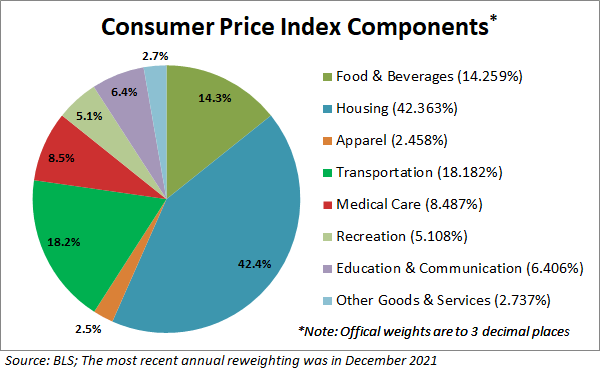

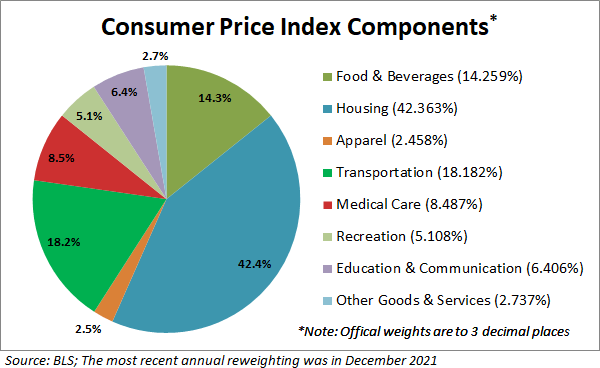

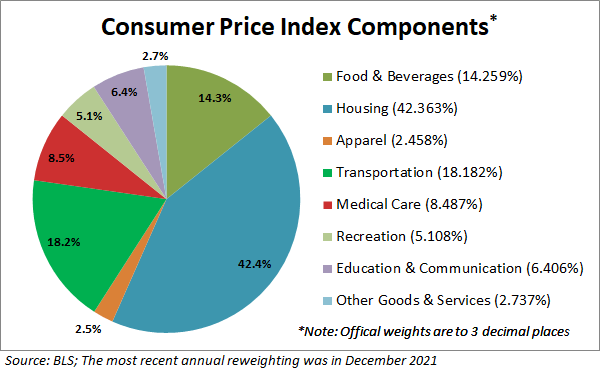

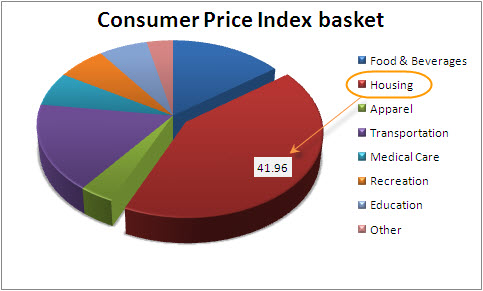

And, Core CPI, which tracks the price of goods and services excluding volatile food and energy prices and is closely watched as an inflation indicator, rose 3.6% from the same period last year. That’s the smallest annual increase since April 2021. On a monthly basis, core CPI rose 0.3%, marking the first time in six months that its growth slowed from the prior month. Other good signs include:

- Grocery prices dropped 0.2% from March, the first decrease in a year.

- Health insurance and car insurance increased more slowly in April than in March.

- A separate report released yesterday showed consumer spending stayed steady last month.

CITE: https://tinyurl.com/2h47urt5

Finally, Joe Manchin (D-W.Va.) and a group of Republican senators are moving to overturn a retirement investment planning rule that was finalized by the Labor Department last month. The Labor Department unveiled the new rule last month that would update the definition of an investment advice fiduciary under the Employee Retirement Income Security Act. Manchin and 15 Republican senators joined in co-sponsoring a Congressional Review Act (CRA) resolution that would overturn this new rule.

CITE: https://tinyurl.com/tj8smmes

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@msns.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: "Ask-an-Advisor", Breaking News, Experts Invited, Financial Planning, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, iMBA, Inc., Information Technology, Investing, Marcinko Associates, Recommended Books, Sponsors, Touring with Marcinko | Tagged: advice fiduciary, AMAT, Applied Materials, ARK invest, Cathie Wood, CBOE, Coca-Cola, coinbase, Consumer Price Index, core CPI, CPI, DJIA, fiduciary, ko, Manchin, Marcinko, NASDAQ, Palantir, PG, Procter & Gamble, S&P 500, textbooks, VIX, Walmart | Leave a comment »