Market Neutral Funds Demystified

[A Special Report]

By Dimitri Sogoloff MD MBA & Dr. David E. Marcinko MBA MEd CMP

***

Introduction

SPONSOR: https://marcinkoassociates.com/

It’s hard to believe that just 30 years ago, physician investors had only two primary asset classes from which to choose: U.S. equities and U.S. bonds.

Today, the marketplace offers a daunting array of investment choices. Rapid market globalization, technology advancements and investor sophistication have spawned a host of new asset classes, from the mundane to the mysterious.

Even neophyte medical investors can now buy and sell international equities, emerging market debt, mortgage securities, commodities, derivatives, indexes and currencies, offering infinitely more opportunities to make, or lose, money.

Amidst this ongoing proliferation, a unique asset class has emerged, one that is complex, non-traditional and not easily understood like stocks or bonds. It does, however, offer one invaluable advantage; its returns are virtually uncorrelated with any other asset class. When this asset class is introduced into a traditional investment portfolio, a wonderful thing occurs; the risk-return profile of the overall portfolio improves dramatically.

This asset class is known as a Market-Neutral strategy. The reason few medical professionals have heard of market neutral strategies is that most of them are offered by private investment partnerships otherwise known as hedge funds.

To the uninitiated, “hedge fund” means risky, volatile or speculative. With a market-neutral strategy however, just the opposite is true. Funds utilizing market-neutral strategies typically emphasize the disciplined use of investment and risk control processes. As a result, they have consistently generated returns that display both low volatility and a low correlation with traditional equity or fixed income markets.

Definition of Market-Neutral

All market-neutral funds share a common objective: to achieve positive returns regardless of market direction. Of course, they are not without risk; these funds can and do lose money. But a key to their performance is that it is independent of the behavior of the markets at large, and this feature can add tremendous value to the rest of a portfolio.

A typical market-neutral strategy focuses on the spread relationship between related securities, which is what makes them virtually independent of underlying debt or equity markets. When two related securities are mispriced in relation to one another, the disparity will eventually disappear as the result of some external event. This event is called convergence and may take the form of a bond maturity, completion of a merger, option exercise, or simply a market recognizing the inefficiency and eliminating it through supply and demand.

Here’s how it might work

When two companies announce a merger, there is an intended future convergence, when the shares of both companies will converge and become one. At the time of the announcement, there is typically a trading spread between two shares. A shrewd trader, seeing the probability of the successful merger, will simultaneously buy the relatively cheaper share and sell short the relatively more expensive share, thus locking in the future gain.

Another example of convergence would be the relationship between a convertible bond and its underlying stock. At the time of convergence, such as bond maturity, the two securities will be at parity. However, the market forces of supply and demand make the bond underpriced relative to the underlying stock. This mispricing will disappear upon convergence, so simultaneously buying the convertible bond and selling short an equivalent amount of underlying stock, locks in the relative spread between the two.

Yet another example would be two bonds of the same company – one junior and one senior. For various reasons, the senior bond may become cheaper relative to the junior bond and thus display a temporary inefficiency that would disappear once arbitrageurs bought the cheaper bond and sold the more expensive bond.

While these examples involve different types of securities, scenarios and market factors, they are all examples of a market-neutral strategy. Locking a spread between two related securities and waiting for the convergence to take place is a great way to make money without ever taking a view on the direction of the market.

How large are these spreads, you may ask? Typically, they are tiny. The markets are not quite fully efficient, but they are efficient enough to not allow large price discrepancies to occur.

In order to make a meaningful profit, a market-neutral fund manager needs sophisticated technology to help identify opportunities, the agility to rapidly seize those opportunities, and have adequate financing resources to conduct hundreds of transactions annually.

Brief Description of Strategies

SPONSOR: http://www.CertifiedMedicalPlanner.org

The universe of market-neutral strategies is vast, spanning virtually every asset class, country and market sector. The spectrum varies in risk from highly volatile to ultra conservative. Some market-neutral strategies are more volatile than risky low-cap equity strategies, while others offer better stability than U.S Treasuries.

One unifying factor across this vast ocean of seemingly disparate strategies is that they all attempt to take advantage of a relative mispricing between various securities, and all offer a high degree of “market neutrality,” that is, a low correlation with underlying markets.

[A] Convertible Arbitrage

Convertible arbitrage is the oldest market-neutral strategy. Designed to capitalize on the relative mispricing between a convertible security (e.g. convertible bond or preferred stock) and the underlying equity, convertible arbitrage was employed as early as the 1950s.

Since then, convertible arbitrage has evolved into a sophisticated, model-intensive strategy, designed to capture the difference between the income earned by a convertible security (which is held long) and the dividend of the underlying stock (which is sold short). The resulting net positive income of the hedged position is independent of any market fluctuations. The trick is to assemble a portfolio wherein the long and short positions, responding to equity fluctuations, interest rate shifts, credit spreads and other market events offset each other.

A convertible arbitrage strategy involves taking long positions in convertible securities and hedging those positions by selling short the underlying common stock. A manager will, in an effort to capitalize on relative pricing inefficiencies, purchase long positions in convertible securities, generally convertible bonds, convertible preferred stock or warrants, and hedge a portion of the equity risk by selling short the underlying common stock. Timing may be linked to a specific event relative to the underlying company, or a belief that a relative mispricing exists between the corresponding securities.

Convertible securities and warrants are priced as a function of the price of the underlying stock, expected future volatility of returns, risk free interest rates, call provisions, supply and demand for specific issues and, in the case of convertible bonds, the issue-specific corporate/Treasury yield spread.

Thus, there is ample room for relative misvaluations. Because a large part of this strategy’s gain is generated by cash flow, it is a relatively low-risk strategy.

[B] Fixed-Income Arbitrage

Fixed-income arbitrage managers seek to exploit pricing inefficiencies across global markets.

Examples of these anomalies would be arbitrage between similar bonds of the same company, pricing inefficiencies of asset-backed securities and yield curve arbitrage (price differentials between government bonds of different maturities). Because the prices of fixed-income instruments are based on interest rates, expected cash flows, credit spreads, and related factors, fixed-income arbitrageurs use sophisticated quantitative models to identify pricing discrepancies.

Similarly to convertible arbitrageurs, fixed-income arbitrageurs rely on investors less sophisticated than themselves to misprice a complex security.

[C] Equity Market-Neutral Arbitrage

This strategy attempts to offset equity risk by holding long and short equity positions. Ideally, these positions are related to each other, as in holding a basket of S&P500 stocks and selling S&P500 futures against the basket. If the manager, presumably through stock-picking skill, is able to assemble a basket cheaper than the index, a market-neutral gain will be realized.

A related strategy is identifying a closed-end mutual fund trading at a significant discount to its net asset value. Purchasing shares of the fund gains access to a portfolio of securities valued significantly higher. In order to capture this mispricing, one needs only to sell short every holding in the fund’s portfolio and then force (by means of a proxy fight, perhaps) conversion of the fund from a closed-end to an open-end (creating convergence).

Sounds easy, right?

In considering equity market-neutral, you must be careful to differentiate between true market-neutral strategies (where long and short positions are related) and the recently popular long/short equity strategies.

In a long/short strategy, the manager is essentially a stock-picker, hopefully purchasing stocks expected to go up, and selling short stocks expected to depreciate. While the dollar value of long and short positions may be equivalent, there is often little relationship between the two, and the risk of both bets going the wrong way is always present.

[D] Merger Arbitrage (a.k.a. Risk Arbitrage)

Merger arbitrage, while a subset of a larger strategy called event-driven arbitrage, represents a sufficient portion of the market-neutral universe to warrant separate discussion.

Merger arbitrage earned a bad reputation in the 1980s when Ivan Boesky and others like him came to regard insider trading as a valid investment strategy. That notwithstanding, merger arbitrage is a respected stratagey, and when executed properly, can be highly profitable. It bets on the outcomes of mergers, takeovers and other corporate events involving two stocks which may become one.

A textbook example was the acquisition of SDL Inc (SDLI), by JDS Uniphase Corp (JDSU). On July 10, 2000 JDSU announced its intent to acquire SDLI by offering to exchange 3.8 shares of its own shares for one share of SDLI.

At that time, the JDSU shares traded at $101 and SDLI at $320.5. It was apparent that there was almost 20 percent profit to be realized if the deal went through (3.8 JDSU shares at $101 are worth $383 while SDLI was worth just $320.5). This apparent mispricing reflected the market’s expectation about the deal’s outcome. Since the deal was subject to the approval of the U.S. Justice Department and shareholders, there was some doubt about its successful completion. Risk arbitrageurs who did their homework and properly estimated the probability of success bought shares of SDLI and simultaneously sold short shares of JDSU on a 3.8 to 1 ratio, thus locking in the future profit.

Convergence took place about eight months later, in February 2001, when the deal was finally approved and the two stocks began trading at exact parity, eliminating the mispricing and allowing arbitrageurs to realize a profit.

Merger Arbitrage, also known as risk arbitrage, involves investing in securities of companies that are the subject of some form of extraordinary corporate transaction, including acquisition or merger proposals, exchange offers, cash tender offers and leveraged buy-outs. These transactions will generally involve the exchange of securities for cash, other securities or a combination of cash and other securities.

Typically, a manager purchases the stock of a company being acquired or merging with another company, and sells short the stock of the acquiring company. A manager engaged in merger arbitrage transactions will derive profit (or loss) by realizing the price differential between the price of the securities purchased and the value ultimately realized when the deal is consummated. The success of this strategy usually is dependent upon the proposed merger, tender offer or exchange offer being consummated.

When a tender or exchange offer or a proposal for a merger is publicly announced, the offer price or the value of the securities of the acquiring company to be received is typically greater than the current market price of the securities of the target company.

Normally, the stock of an acquisition target appreciates while the acquiring company’s stock decreases in value. If a manager determines that it is probable that the transaction will be consummated, it may purchase shares of the target company and in most instances, sell short the stock of the acquiring company. Managers may employ the use of equity options as a low-risk alternative to the outright purchase or sale of common stock. Many managers will hedge against market risk by purchasing S&P put options or put option spreads.

[E] Event-Driven Arbitrage

Funds often use event-driven arbitrage to augment their primary market-neutral strategy. Generally, any convergence which is produced by a future corporate event would fall into this category.

Accordingly, Event-Driven investment strategies or “corporate life cycle investing” involves investments in opportunities created by significant transactional events, such as spin-offs, mergers and acquisitions, liquidations, reorganizations, bankruptcies, recapitalizations and share buybacks and other extraordinary corporate transactions.

Event-Driven strategies involve attempting to predict the outcome of a particular transaction as well as the optimal time at which to commit capital to it. The uncertainty about the outcome of these events creates investment opportunities for managers who can correctly anticipate their outcomes.

As such, Event-Driven trading embraces merger arbitrage, distressed securities and special situations investing. Event-Driven managers do not generally rely on market direction for results; however, major market declines, which would cause transactions to be repriced or break, may have a negative impact on the strategy.

Event-driven strategies are research-intensive, requiring a manager to do extensive fundamental research to assess the probability of a certain corporate event, and in some cases, to take an active role in determining the event’s outcome.

Risk and Reward Characteristics

To help understand market-neutral performance and risk, let’s take a look at the distribution of returns of individual strategies and compare it to that of traditional asset classes.

Table 1: Average Return / Volatility of Market Neutral Strategies And Selected Traditional Asset Classes

| Strategy |

Average Return |

Annualized Volatility |

| Convertible Arbitrage |

11.95% |

3.57% |

| Fixed Income Arbitrage |

8.33% |

4.90% |

| Equity Market-Neutral |

11.62% |

4.95% |

| Merger Arbitrage |

13.29% |

3.51% |

| Relative Value Arbitrage |

15.69% |

4.31% |

| Traditional Asset Classes: |

|

|

| S&P 500 |

12.62% |

13.72% |

| MSCI World |

8.57% |

13.05% |

| High Grade U.S. Corp. Bonds |

7.26% |

3.73% |

| World Government Bonds |

5.91% |

5.96% |

The most important observation about this chart is that the Market Neutral funds exhibits considerably lower risk than most traditional asset classes.

While market-neutral strategies vary greatly and involve all types of securities, the risk-adjusted returns are amazingly stable across all strategies. The annualized volatility – a standard measure of performance risk – varies between 3.5 and 5 percent, comparable to a conservative fixed-income strategy.

Another interesting statistics is the correlation between Market Neutral strategies and traditional asset classes and traditional asset classes

Table 2: Correlation between Market Neutral Strategies and Traditional Asset Classes

| Asset Class/Strategy |

S&P500 |

MSCI World |

GovBonds |

CorpBonds |

The correlation of all market neutral strategies to traditional assets is quite low, or negative in some cases. This suggests that these strategies would indeed play a useful role in the ultimate goal of efficient portfolio diversification.

To test the “market neutrality” of these strategies, we asked, “How well, on average, did these strategies perform during bad, as well as good, market months?”

It turns out, in good times and bad, these strategies displayed consistent solid performance. From 12/31/91, in months when S&P 500 was down, the average down month was 3.03 percent. Market Neutral strategies performed as follows:

| Strategy |

Average Monthly Return |

| Convertible Arbitrage |

+ 0.65% |

| Fixed Income Arbitrage |

+ 0.50% |

| Equity Market-Neutral |

+ 1.19% |

| Merger Arbitrage |

+ 0.88% |

| Relative Value Arbitrage |

+ 0.81% |

In months when S&P 500 was up, the average up month was +3.24 percent. Market Neutral strategies performed as follows:

| Strategy |

Average Monthly Return |

| Convertible Arbitrage |

+1.17% |

| Fixed Income Arbitrage |

+1.20% |

| Equity Market-Neutral |

+1.37% |

| Merger Arbitrage |

+0.60% |

| Relative Value Arbitrage |

+1.25% |

Clearly, a compelling picture emerges. While these strategies, on average, underperform during good times, they show a positive average return during both good and bad markets.

Inclusion of Market-Neutral in a Long-term Investment Portfolio

A critical concern for any medical investor considering a foray into a new asset class is how it will alter the long-term risk/reward profile of the overall portfolio. To better understand this, we constructed several hypothetical portfolios consisting of traditional asset classes:

· US Treasuries (Salomon Treasury Index 10yrs+)

· High Grade Corporate Bonds (Salomon Investment Grade Index)

· Speculative Grade Corporate Bonds (High Yield Index)

· US Blue chip equities (Dow Jones Industrial Average)

· US mid-cap equities (S&P 400 Midcap Index)

· US small-cap equities (S&P 600 Smallcap Index)

Portfolios varied in the level of risk from 100 percent U.S Treasuries (least risky) to 100 percent small-cap equities (most risky), and are ranked from 1 to 10, 1 representing the least risky portfolio.Each portfolio was analyzed on a Risk/Return basis using monthly return data since December 1991. The results are shown in Chart 1.Predictably, the least risky portfolio produced the smallest return, while the riskiest produced the highest return. This is perfectly understandable – you would expect to be compensated for taking a higher level of risk.

Chart 1: Risk/Return characteristics of traditional portfolios vs. Market Neutral strategies

Clearly, the risk-return picture offered by Market Neutral strategies is much more compelling (lower risk, higher return) than that offered by portfolios of traditional assets. What happens if we introduce these market-neutral strategies into traditional portfolios? Let’s take 20 percent of the traditional investments in our portfolio and reinvest them in market-neutral strategies.

The change is dramatic: the new portfolios (denoted 1a through 10a) offer significantly less risk for the same return. The riskiest portfolio, for instance (number 10) offered 20 percent less risk for a similar return of a new portfolio containing market-neutral strategies (number 10a).

Chart 2: Result of inclusion of 20% of Market Neutral strategies in traditional portfolios

This is quite a difference. Everything else being equal, anyone would choose the new, “improved” portfolios over the traditional ones.

How to invest

The mutual fund world does not offer a great choice of market neutral strategies.

Currently, there are only a handful of good mutual funds that label themselves market-neutral (AXA Rosenberg Market Netural fund and Calamos Market Neutral fund are two examples).

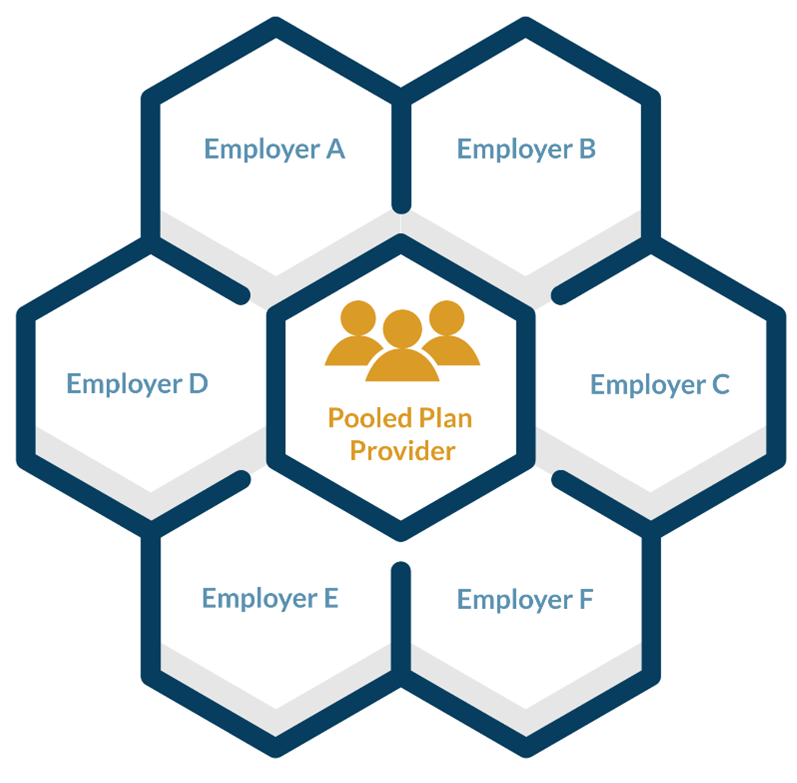

Mutual fund offerings are slim due to excessive regulations imposed by the SEC with respect to short selling and leverage, and consequently these funds lack flexibility in constructing truly hedged portfolios. The dearth of market-neutral offerings among mutual funds is offset by a vast array of choices in the hedge fund universe. Approximately 400 market-neutral funds, managing $60 billion, represent roughly 25% of all hedge funds.

Therefore, further focus will relate to the hedge fund universe, rather than the limited number of market-neutral mutual funds.

Direct investing in a market-neutral hedge fund is restricted to qualifying individuals who must meet high net worth and/or income requirements, and institutional investors, such as corporations, qualifying pension plans, endowments, foundations, banks, insurance companies, etc.

This does not mean that retail investors cannot get access to hedge fund exposure. Various private banking institutions offer funds of funds with exposure to hedge funds. Maaket-neutral funds are nontraditional investments. They are part of a larger subset of strategies known as alternative investments, and there is nothing traditional in the way doctors invest in them.

Hedge funds are private partnerships, which gives them maximum flexibility in constructing and managing portfolios, but also requires medical investors to do a little extra work.

[A] Lockup Periods

One of the main differences between mutual funds and hedge funds is liquidity. Market-neutral strategies have less liquidity than traditional portfolios. Quarterly redemption policies with 45- or 60-days notice are common. Many funds allow redemptions only once a year and some also have lock-up periods. In addition, few of these funds pay dividends or make distributions. These investments should be regarded strictly as long-term strategies.

[B] Managerial Risks

Success of a market-neutral strategy depends much less on the market direction than on the manager’s skill in identifying arbitrage opportunities and capitalizing on them.

Thus, there is significantly more risk with the manager than with the market. It’s vital for investors to understand a manager’s style and to monitor any deviations from it due to growth, personnel changes, bad decisions, or other factors.

[C] Fees

If you are accustomed to mutual fund fees, brace yourself; market-neutral investing does not come cheap.

Typical management fees range from 1 to 2 percent per year, plus a performance fee averaging 20 percent of net profits. Most managers have a “high watermark” provision; they cannot collect the performance fees until investors recoup any previous losses. Look for this provision in the funds’ prospectus and avoid any fund that lacks it. Even with higher fees, market-neutral investing is superior to most traditional mutual fund investing on a risk-adjusted return basis.

[D] Transparency

Mutual funds report their positions to the public regularly. This is not the case with market-neutral hedge funds. Full transparency could jeopardize accumulation of a specific position. It also generates front running: buying or selling securities before the fund is able to do so. While you should not expect to see individual portfolio positions, many hedge fund managers do provide a certain level of transparency by indicating their geographical or sector exposures, level of leverage and extent of hedging.

It does take a bit of education to understand these numbers, but the effort is definitely worthwhile.

[E] Taxation

The issue of hedge fund taxation is quite complex and is often dependent on the fund and the personal situation of the investor. Advice from a competent accountant, specialized financial advisor, tax attorney with relevant experience is worthwhile. The bottom line is that investing in market-neutral funds is not a tax-planning exercise and it will not minimize your taxes.

On the other hand, it should not generate any more or fewer taxes than if you invested in more traditional funds.

From the medical investor’s perspective, the principal advantages of market-neutral investing are attractive risk-adjusted returns and enhanced diversification.

Ten years of data indicate that market-neutral portfolios have produced risk-adjusted returns superior to traditional investments. In addition, the correlation between the returns of market-neutral funds and traditional asset classes has been historically negligible.

Adding exposure of market-neutral return strategies to the asset mix within a consistent, long-term investment program offers a medical investor the opportunity to improve overall returns, as well as achieving some protection against negative market movements.

Now, after all of the above, has your impression of hedge funds in general or MN funds in particular, changed?

APPENDIX:

Asset class weighting in traditional portfolios:

| Portfolio |

US Treasuries |

US High Grade Corp Bonds |

US Low Grade Corp Bonds |

Large Cap Stocks |

Mid Cap Stocks |

Small Cap Stocks |

| 1 |

50% |

50% |

|

|

|

|

| 2 |

|

50% |

50% |

|

|

|

| 3 |

10% |

30% |

50% |

40% |

|

|

| 4 |

|

50% |

|

50% |

|

|

| 5 |

|

10% |

10% |

50% |

30% |

|

| 6 |

|

|

10% |

50% |

20% |

20% |

| 7 |

|

|

10% |

30% |

20% |

40% |

| 8 |

|

|

|

20% |

20% |

60% |

| 9 |

|

|

|

|

20% |

80% |

| 10 |

|

|

|

|

|

100% |

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Alternative Investments, Career Development, CMP Program, Experts Invited, Investing, Risk Management, Touring with Marcinko | Tagged: Alternative Investments, Certified Medical Planner™, CMP, Investing Basics, Marcinko, market neutral fund | 2 Comments »