Update on Some Interesting and Important Financial Calculations

By Timothy J. McIntosh MBA CFP® MPH

By Dr. David Edward Marcinko MBA CMP™

By Jeffrey S. Coons PhD CFA

-INTRODUCTION-

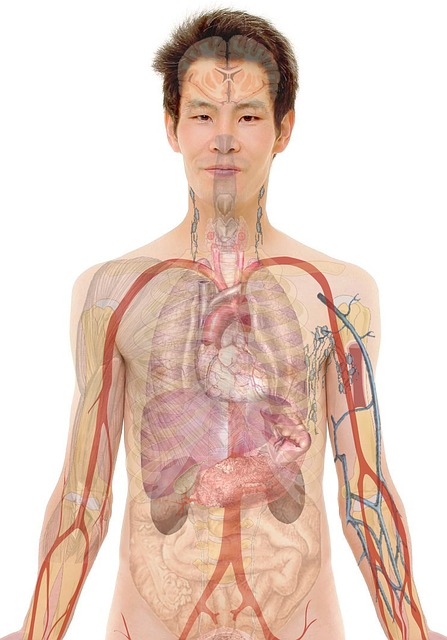

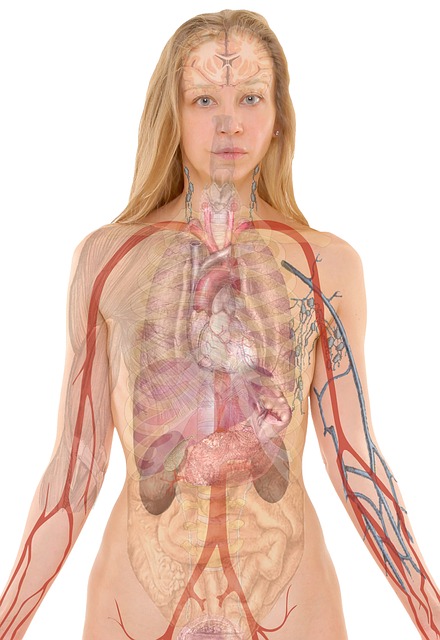

Performance measurement, like an annual physical, is an important feedback loop to monitor progress towards the goals of the medical professional’s investment program. Performance comparisons to market indices and/or peer groups are a useful part of this feedback loop, as long as they are considered in the context of the market environment and with the limitations of market index and manager database construction.

Inherent to performance comparisons is the reality that portfolios taking greater risk will tend to out-perform less risky investments during bullish phases of a market cycle, but are also more likely to under-perform during the bearish phase. The reason for focusing on performance comparisons over a full market cycle is that the phases biasing results in favor of higher risk approaches can be balanced with less favorable environments for aggressive approaches to lessen/eliminate those biases.

So, as physicians and other investors, can we eliminate the biases of the market environment by adjusting performance for the risk assumed by the portfolio? While several interesting calculations have been developed to measure risk-adjusted performance, the unfortunate answer is that the biases of the market environment still tend to have an impact even after adjusting returns for various measures of risk.

However, medical professionals and their advisors will have many different risk-adjusted return statistics presented to them, so understanding the Sharpe ratio, Treynor ratio, Jensen’s measure or alpha, Morningstar star ratings, etc. and their limitations should help to improve the decisions made from the performance measurement feedback loop.

[a] The Treynor Ratio

The Treynor ratio measures the excess return achieved over the risk free return per unit of systematic risk as identified by beta to the market portfolio. In practice, the Treynor ratio is often calculated using the T-Bill return for the risk-free return and the S&P 500 for the market portfolio.

[b] The Sharpe Ratio

The Sharpe ratio, named after CAPM pioneer William F. Sharpe, was originally formulated by substituting the standard deviation of portfolio returns (i.e., systematic plus unsystematic risk) in the place of beta of the Treynor ratio. Thus, a fully diversified portfolio with no unsystematic risk will have a Sharpe ratio equal to its Treynor ratio, while a less diversified portfolio may have significantly different Sharpe and Treynor ratios.

***

8

***

[c] The Jensen Alpha Measure

The Jensen measure, named after CAPM research Michael C. Jensen, takes advantage of the CAPM equation discussed in the Portfolio Management section to identify a statistically significant excess return or alpha of a portfolio. The essential idea is that to investigate the performance of an investment manager you must look not only at the overall return of a portfolio, but also at the risk of that portfolio.

For instance, if there are two mutual funds that both have a 12 percent return, a lucid investor will want the fund that is less risky. Jensen’s gauge is one of the ways to help decide if a portfolio is earning the appropriate return for its level of risk. If the value is positive, then the portfolio is earning excess returns. In other words, a positive value for Jensen’s alpha means a fund manager has “beat the market” with his or her stock picking skills compared with the risk the manager has taken.

[d] Database Ratings

The ratings given to mutual funds by databases, such as Morningstar, and various financial magazines are another attempt to develop risk-adjusted return measures. These ratings are generally based on a ranking system for funds calculated from return and risk statistics.

A popular example is Morningstar’s star ratings, representing a weighting of three, five and ten year risk/return ratings. This measure uses a return score from cumulative excess monthly fund returns above T-Bills and a risk score derived from the cumulative monthly return below T-Bills, both of which are normalized by the average for the fund’s asset class. These scores are then subtracted from each other and funds in the asset class are ranked on the difference. The top 10 percent receive five stars, the next 22.5 percent get four stars, the subsequent 35 percent receive three stars, the next 22.5 percent receive two stars, and the remaining 10 percent get one star.

***

***

Assessment

Unfortunately, these ratings systems tend to have the same problems of consistency and environmental bias seen in both non-risk adjusted comparisons over 3 and 5 year time periods and the other risk-adjusted return measures discussed above. The bottom line on performance measurement is that the medical professional should not take the easy way out and accept independent comparisons, no matter how sophisticated, at face value. Returning to our original rules-of-thumb, understanding the limitations of performance statistics is the key to using those statistics to monitor progress towards one’s goals.

This requires an understanding of performance numbers and comparisons in the context of the market environment and the composition/construction of the indices and peer group universes used as benchmarks.

Another important rule-of-thumb is to avoid projecting forward historical average returns, especially when it comes to strong performance in a bull market environment. Much of an investment or manager’s performance may be environment-driven, and environments can change dramatically.

Channel Surfing

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

ABOUT

Timothy J. McIntosh is Chief Investment Officer and founder of SIPCO. As chairman of the firm’s investment committee, he oversees all aspects of major client accounts and serves as lead portfolio manager for the firm’s equity and bond portfolios. Mr. McIntosh was a Professor of Finance at Eckerd College from 1998 to 2008. He is the author of The Bear Market Survival Guide and the The Sector Strategist. He is featured in publications like the Wall Street Journal, New York Times, USA Today, Investment Advisor, Fortune, MD News, Tampa Doctor’s Life, and The St. Petersburg Times. He has been recognized as a Five Star Wealth Manager in Texas Monthly magazine; and continuously named as Medical Economics’ “Best Financial Advisors for Physicians since 2004. And, he is a contributor to SeekingAlpha.com., a premier website of investment opinion. Mr. McIntosh earned a Bachelor of Science Degree in Economics from Florida State University; Master of Business Administration (M.B.A) degree from the University of Sarasota; Master of Public Health Degree (M.P.H) from the University of South Florida and is a CERTIFIED FINANCIAL PLANNER® practitioner. His previous experience includes employment with Blue Cross/Blue Shield of Florida, Enterprise Leasing Company, and the United States Army Military Intelligence.

Dr. Jeffrey S. Coons is the Co-Director of Research at Manning & Napier Advisors, Inc. with primary responsibilities focusing on the measurement and management of portfolio risk and return relative to client objectives. This includes providing analysis across every aspect of the investment process, from objectives setting and asset allocation to on-going monitoring of portfolio risk and return. Dr. Coons is also member of the Investment Policy Group, which establishes and monitors secular investment trends, macroeconomic overviews, and the investment disciplines of the firm. Dr. Coons holds a doctoral degree in economics from Temple University, graduated with distinction from the University of Rochester with a B.A. in Economics, holds the designation of Chartered Financial Analyst, and is one of the employee-owners of Manning and Napier.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

8

8

Sponsors Welcomed

And, credible sponsors and like-minded advertisers are always welcomed.

Support Med Executive-Post

Filed under: iMBA, Investing, Portfolio Management, Risk Management | Tagged: David Edward Marcinko, Jeffery S. Coons, Jensen Alpha Measure, Morningstar ratings, Risk Adjusted Stock Market Performance?, Sharpe Ratio, Timothy J. McIntosh, Treynor Ratio | 2 Comments »