Dr. David Edward Marcinko MBA MEd CMP

SPONSOR: http://www.MarcinkoAssociates.com

***

***

An Examination of Their Purpose and Impact

Blinded medical payments have emerged as a compelling approach to addressing some of the most persistent challenges in modern healthcare systems. At their core, these payment structures are designed to separate the financial aspects of care from the clinical decision‑making process. By obscuring or “blinding” the cost of specific services from either the patient, the provider, or both, the model aims to reduce conflicts of interest, encourage unbiased medical judgment, and create a more equitable healthcare experience. Although the concept may seem counterintuitive in a system where transparency is often championed, blinded payments offer a nuanced strategy for improving trust, fairness, and outcomes.

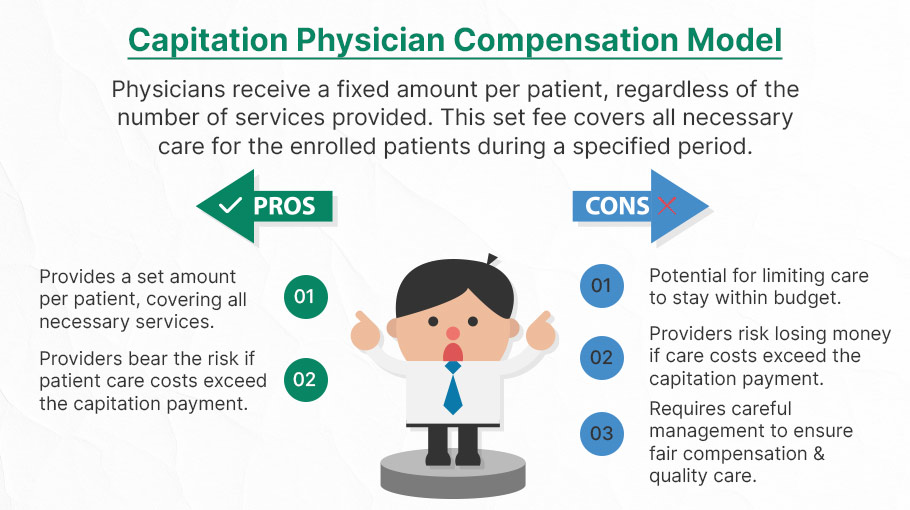

One of the primary motivations behind blinded medical payments is the desire to minimize the influence of financial incentives on clinical decisions. In many traditional payment models, providers are acutely aware of the reimbursement rates associated with different procedures. This awareness can unintentionally shape treatment recommendations, even when clinicians strive to act solely in the patient’s best interest. Blinded payment systems attempt to remove this pressure by ensuring that providers do not know the exact compensation tied to each service. Without this knowledge, the theory goes, decisions are more likely to be guided by clinical need rather than financial reward. This can be particularly valuable in specialties where high‑cost procedures are common and where the potential for overuse is well documented.

Patients, too, can benefit from a degree of blinding. When individuals are confronted with detailed cost information at the point of care, they may feel compelled to make decisions based on price rather than medical necessity. This dynamic can lead to underuse of essential services, delayed treatment, or heightened anxiety during an already stressful moment. By shielding patients from granular cost details until after care is delivered, blinded payment systems aim to preserve the integrity of the clinical encounter. The patient can focus on understanding their condition and the recommended treatment, rather than navigating a complex and often confusing financial landscape.

Another important dimension of blinded medical payments is their potential to reduce disparities. In many healthcare systems, providers may unconsciously adjust their recommendations based on assumptions about a patient’s ability to pay. Even well‑intentioned clinicians can fall into patterns of offering different options to different socioeconomic groups. Blinding payment information helps counteract this tendency by ensuring that all patients are presented with the same range of medically appropriate choices. This can contribute to more consistent care across populations and help narrow gaps in outcomes that have persisted for decades.

***

***

However, blinded medical payments are not without challenges. Critics argue that withholding cost information from patients undermines their autonomy. In an era where consumer‑driven healthcare is increasingly emphasized, some believe that individuals should have full access to pricing details so they can make informed decisions about their care. Others worry that blinding providers to reimbursement rates may reduce accountability or make it more difficult to evaluate the cost‑effectiveness of different treatments. These concerns highlight the delicate balance between transparency and impartiality, and they underscore the need for thoughtful implementation.

Operationally, blinded payment systems require sophisticated administrative structures. Healthcare organizations must develop mechanisms to process claims, allocate funds, and track utilization without revealing sensitive financial details to clinicians or patients. This can be resource‑intensive, especially for smaller practices or systems with limited technological infrastructure. Additionally, the success of blinded payments depends on trust—trust that the system is fair, that reimbursement is adequate, and that no party is being disadvantaged by the lack of visibility.

Despite these complexities, blinded medical payments represent a meaningful attempt to address the misaligned incentives that often distort healthcare delivery. They challenge the assumption that more information is always better and instead propose that strategic withholding of information can sometimes lead to more ethical and equitable outcomes. As healthcare systems continue to evolve, blinded payments may serve as one of several innovative tools aimed at creating a more patient‑centered and value‑driven environment.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Doctors Only", Ask a Doctor, CMP Program, economics, finance, Glossary Terms, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, Marcinko Associates | Tagged: Blinded Medical Payments, david marcinko, healthcare economics, Healthcare Finance | Leave a comment »