MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2024 |

REFER A COLLEAGUE: MarcinkoAdvisors@msn.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

***

Microsoft unveiled new PCs with AI-powered features.

CITE: https://www.r2library.com/Resource

Hims & Hers stock soared as much as 38% on the news that it’ll provide GLP-1 injections with the same active ingredient as Ozempic or Wegovy for just $199/month—an 85% discount compared to Wegovy’s ~$1,350 monthly price tag (without insurance).

***

FDIC Chair Martin Gruenberg will resign after an investigation found widespread sexual harassment at the agency. But he won’t step down until a successor is named.

CITE: https://tinyurl.com/2h47urt5

The FDA granted Elon Musk’s neurotech company Neuralink, approval to place its brain chip into a second human test subject using a new method designed to correct issues that arose after its inaugural insertion in January, per the Wall Street Journal.

And, Optum Rx is shaking up its pharmacy model. The business says it will make drug costs more predictable and transparent for clients.

CITE: https://tinyurl.com/tj8smmes

- All three indexes ended the day higher after Fed Governor Christopher Waller stopped by CNBC and mentioned he doesn’t think raising interest rates is in the cards, even if the Fed is waiting for more data before making cuts. The NASDAQ continued to hit new all-time highs today as investors place their bets before Nvidia’s earnings announcement tomorrow afternoon, and the S&P 500 hit yet another record.

- Copper continued to rise as the market comes to terms with the metal’s importance, while oil fell on the news that the Biden administration will release 1 million barrels of gasoline this summer from the Northeast reserve. Meanwhile, ethereum continued to climb on the news that a new ETF may be joining the fray.

Here’s where the major benchmarks ended:

- The S&P 500 index rose 13.28 points (0.3%) to 5,321.41; the Dow Jones Industrial Average® ($DJI) gained 66.22 points (0.2%) to 39,872.99; the NASDAQ Composite advanced 37.75 points (0.2%) to 16,832.62.

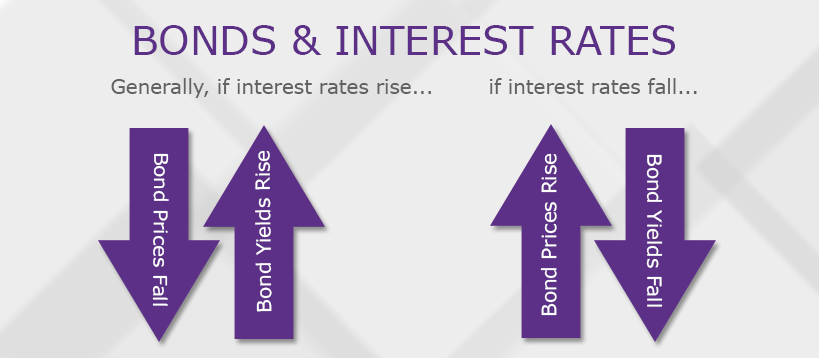

- The 10-year Treasury note yield (TNX) lost more than 2 basis points to 4.414%.

- The CBOE Volatility Index® (VIX) fell 0.29 to 11.86.

Banking and consumer staples were among the market’s strongest performers Tuesday, while utility shares extended a sharp upswing over the past month. The Dow Jones Utility Average® ($DJU) added 0.5% and closed at a 12-month high. Transportation companies were among the weakest performers.

In other markets, Gold (/GC) futures slipped from Monday’s record high above $2,454 per ounce, while Silver (/SI) futures ended near a 12-year high around $32.21. Gold futures are still up 17% this year due to several factors, including reports of China’s central bank buying actual gold as well as escalating conflict in the Middle East. Gold is viewed by some as a safe-haven asset during periods of heightened geopolitical tension.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@msns.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: "Ask-an-Advisor", Breaking News, Drugs and Pharma, Experts Invited, Financial Planning, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, Information Technology, Investing, Marcinko Associates, Recommended Books, Touring with Marcinko | Tagged: AI, ARK invest, Cathie Wood, CBOE, Christopher Waller, coinbase, DJIA, elon musk, Ethereum, FDA, FDIC, fed, FOMC, gold, Hims & Hers, Marcinko, Martin Gruenberg, MSFT, NASDAQ, Neuralink, Nvidia, Optum Rx, Ozempic, Palantir, S&P 500, silver, textbooks, VIX, Wegovy, WSJ | Leave a comment »