By Staff Reporters

***

SPONSOR: http://www.MarcinkoAssociates.com

***

After grappling with high inflation for more than two years, American consumers are now seeing an economic trend that many might only dimly remember: falling prices — but only on certain types of products.

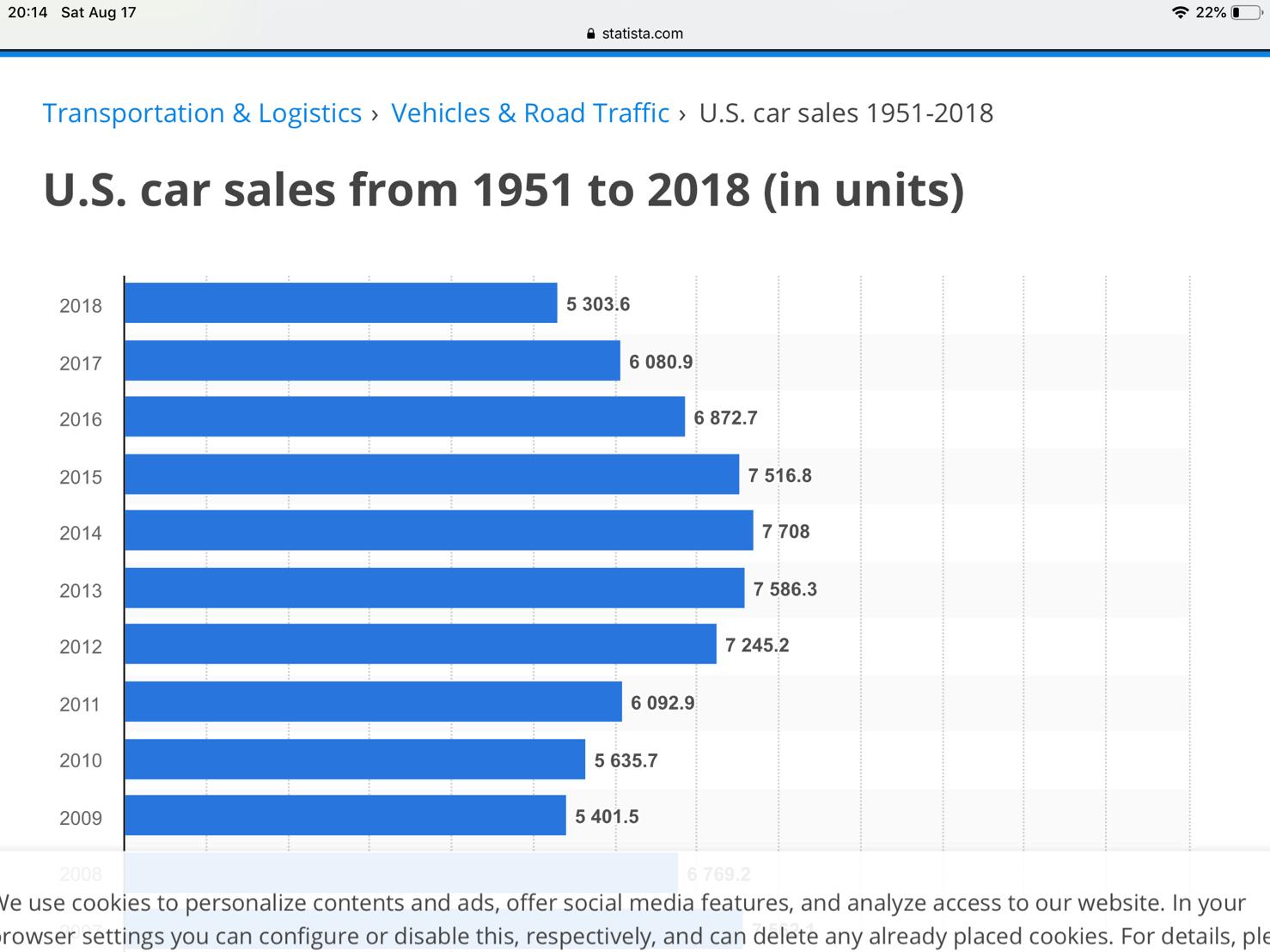

Deflation is impacting so-called durable goods, or products that are meant to last more than three years, Wall Street Journal reporter David Harrison told CBS News. As Harrison noted in his reporting, durable goods have dropped on a year-over-year basis for five straight months and dropped 2.6% in October from their September 2022 peak.

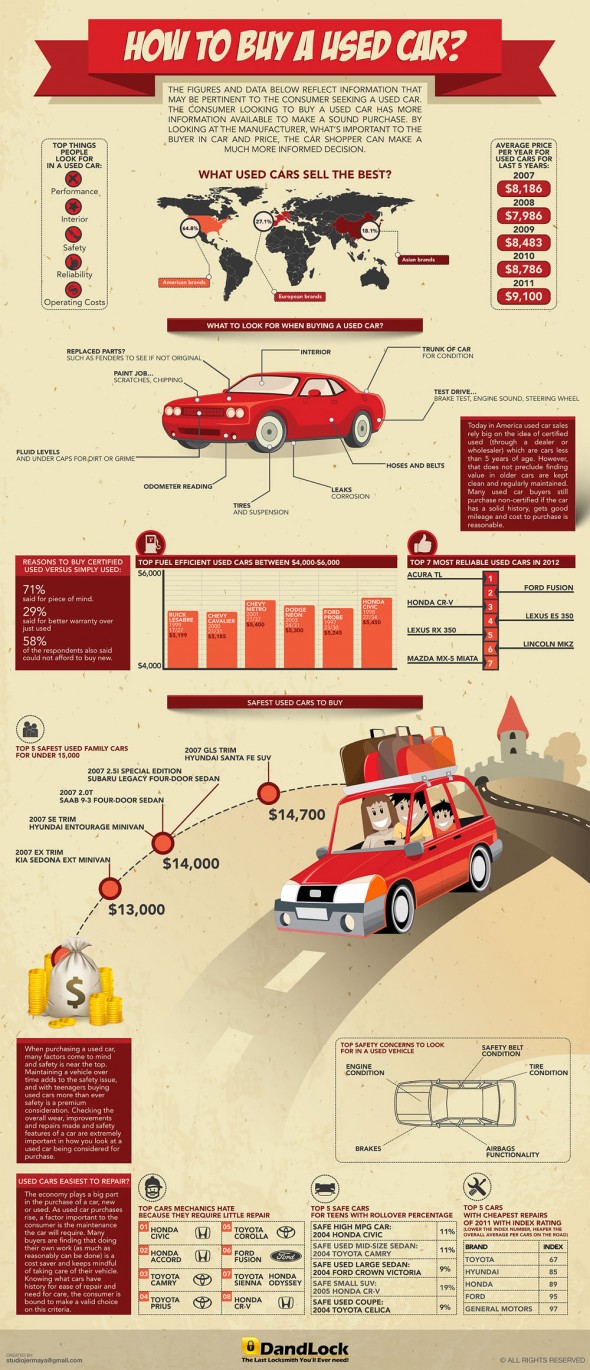

These items are products such as used cars, furniture and appliances, which saw big run-ups in prices during the pandemic. Used cars in particular were a pain point for U.S. households, with pre-owned cars seeing their prices jump more than fifty percent in the first two years of the pandemic.

Here is where the major benchmarks ended:

- The S&P 500 Index was up 36.25 points (0.8%) at 4,585.59; the Dow Jones Industrial Average was up 62.95 points (0.2%) at 36,117.38; the NASDAQ Composite was up 193.28 points (1.4%) at 14,339.99.

- The 10-year Treasury note yield (TNX) was up about 2 basis points at 4.144%.

- The CBOE® Volatility Index (VIX) was up 0.09 at 13.06.

Tech sector strength was highlighted by the Philadelphia Semiconductor Index (SOX), which gained nearly 3%. Financial shares were also among the strongest performers, as the KBW Regional Banking Index (KRX) rose 2% and ended at a four-month high. In other markets, WTI crude oil futures (/CL) posted the market’s first gain in six days after earlier dropping to its lowest level since late June.

COMMENTS APPRECIATED

Refer a Colleague: MarcinkoAdvisors@msn.com

Your referral Count: 0

Thank You

***

***

Filed under: Alternative Investments, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Investing, Touring with Marcinko | Tagged: banks, cars, CBS, crude, david harrison, deflation, DJIA, energy, falling prices, gold, inflation, KRX, Marcinko, markets, metals, NASDAQ, oil, real-estate, Russell Index 2000, RUT, S&P 500, SOX, stock markets, TNX, used cars, utilities, VIX | Leave a comment »