Current Synopsis [Around the Literary World of Economics]

By Dr. Peter Benedek CFA

http://retirementaction.com/

Investors will grapple with more turbulence surrounding Europe’s deepening debt problems this week and the prospect of another round of dismal data on the faltering U.S. economy. So, let us listen while Doctor Benedek speaks.

Dr. David E. Marcinko; FACFAS, MBA, CMP™ [Publisher-in-Chief]

In the Globe and Mail’s “In an emergency, is your info safe?” Dianne Nice suggests a teachable moment associated with the recent US andOntario tornadoes, north-eastern earthquake and hurricane threat. Specifically, she suggests that we consider taking steps to safeguard our important papers, should our home be destroyed. The ICBA recommends keeping important documents in a bank safe: marriage certificate, tax returns, property deeds, birth certificates insurance policies, credit card number, and list of household valuables for insurance claims, paper or electronic copies of important computer records. Additionally consider keeping copies in the home in sealed plastic bags (Probably not a bad idea.)

Scott Willenbrock in the Financial Analysts Journal’s “Diversification return, portfolio rebalancing, and the commodity return puzzle” argues that “the underlying source of the diversification return is the rebalancing, which forces the investor to sell assets that have appreciated in relative value and buy assets that have declined in relative value, as measured by their weights in the portfolio. Although a buy-and-hold portfolio generally has a lower variance than the weighted average variance of its assets, it does not earn a diversification return. Diversification is often described as the only “free lunch’’ in finance because it allows for the reduction of risk for a given expected return. Diversification return might be described as the only “free dessert” in finance because it is an incremental return earned while maintaining a constant risk profile. The contrarian activity of rebalancing, however, must be performed to earn the diversification return; diversification is a necessary but not sufficient condition. Although an un-rebalanced portfolio generally has reduced risk, it does not earn a diversification return and suffers from a varying risk profile. The control of risk, together with the diversification return, is a powerful argument for rebalanced portfolios.”

In the CFA Institute’s Financial Analysts Journal’s “The winners’ game” Charles Ellis looks at the investment profession’s challenges and opportunities. He writes that the investment profession has made three errors: two of commission and one of omission. He writes that “In addition to the two errors of commission—accepting the increasingly improbable prospect of beat-the-market performance as the best measure of our profession and focusing more and more attention on business achievements rather than on professional success— we have somehow lost sight of our best professional opportunity to serve our clients well and shifted our focus away from effective investment counseling. Some of the help clients need is in understanding that selecting managers who will actually beat the market over the long term is no longer a realistic assumption or a “given” … most investors need help in developing a balanced, objective understanding of themselves and their situation: their investment knowledge and skills; their tolerance for risk in assets, incomes, and liquidity; their financial and psychological needs; their financial resources; their financial aspirations and obligations in the short and long run … Our profession’s clients and practitioners would all benefit if we devoted less energy to attempting to “win” the loser’s game of beating the market and more skill, knowledge, and time to helping clients recognize market realities, understand themselves as investors, and clarify their realistic objectives and then stay the course that is best for each of them.” (Charles Ellis is the author of the must read book entitled“Winning the Loser’s Game- Timeless Strategies for Successful Investing”.)

Glenn Ruffenach in the WSJ SmartMoney’s “5 best online retirement guides” provides a list from “One of the most comprehensive and valuable sites online is also among the least known: the Employee Benefits Security Administration.”

In WSJ SmartMoney’s “Why Wall Street’s forecast can’t be trusted” Alex Tarquinio writes that “Over the years, some market forecasters have been about as accurate as, well, weather forecasters… But some financial planners ignore the Wall Street prognostications altogether. George Papadopoulos, the owner of the eponymous financial planning firm in Novi, Mich., says most stock strategists tend to be too bullish, save a few who are “perma-bears.” Ignore the headline number, he says, and “focus on what you can control,” like finding a good balance of stocks and bonds for your portfolio.” (Now there is some sensible advice; ignore talking-heads, ‘strategists’, ‘prognosticators’ and soothsayers. Remember there are very few things that you can actually control: your spend-rate, saving-rate, investment fees and costs, asset allocation and rebalancing.)

In the Globe and Mail’s “Hunting high and low for safe yields” John Heinzl enumerates some of the available options for ‘safe yields’ and concludes that none come even close to paying off your 4% mortgage which at 40% tax rate gives you 6.67% guaranteed.

In Bloomberg’s “Homeowners on East Coast may have to pay for earthquake damage” Leondis and Ody report that “Earthquake protection is generally excluded from standard homeowners’ insurance policies, and consumers have to purchase coverage either as a separate policy…“For most of us, having earthquake insurance doesn’t make sense,” said Sheryl Garrett, founder of Shawnee Mission, Kansas-based Garrett Planning Network Inc., a network of fee-only financial planners. That’s because residents of areas where earthquakes rarely occur generally don’t need the coverage, and policies in parts of the country with frequent earthquakes are more expensive to compensate for the increased risk, she said.”

In the Globe and Mail’s “Vanguard to launch six ETFs in Canada” Shirley Won reports that Vanguard is launching “six exchange-traded funds (ETFs) inCanada. The stock ETFs include Vanguard MSCI Canada and the Vanguard MSCI Emerging Markets, as well as the Vanguard MSCI U.S. Broad Market and Vanguard MSCI EAFE, which will both be hedged to Canadian dollars. The bond category includes Vanguard Canadian Aggregate Bond and Vanguard Canadian Short-Term Bond ETFs.”

Real Estate

On the Canadian front, in the Globe and Mail’s “Most housing ‘reasonably affordable’: RBC” Steve Ladurantaye reports that Vancouver house prices are in “uncharted territory” and “it would take 92 per cent of the median household’s pretax income to own a bungalow in the city at current prices – the highest reading yet in its quarterly national survey on affordability. However according to RBC most (other) Canadian cities offered reasonably affordable” housing options in the second quarter compared to the first. Nationally, a condo required 29.2 per cent of pretax household income (a 0.8 per cent increase), a bungalow 43.3 per cent (1.7 per cent) and a detached home 49.3 per cent (1.8 per cent)… The bank’s affordability index looks at the proportion of pre-tax household income needed to service the costs of owning different categories of homes at current market values. Its standard measure is a 1,200-square-foot bungalow, and the carrying costs include mortgage payments (principal and interest), property taxes and utilities.”

However in the WSJ’s “Toronto wary of condo correction” (note this is in WSJ, not the Globe and Mail or the National Post) Monica Gutschi reports that “A condominium-building boom is lifting Canada’s largest city into the same stratosphere as London, Sydney, Vancouver and Miami, but deepening the worries about a potential tumble…Toronto is a long way from Miami, but the condominium boom north of the border has begun to evoke ominous comparisons, even among real-estate agents. TheToronto area is home to 1,198 condo projects with 210,000 units, according to research firm Urbanation. About 40,000 additional condominium units are under construction, including 16,000 set to hit the market next year. “There’s more supply coming than the market really needs, unless we have a stronger economy than we have today,” says independent housing economist Will Dunning…As many as 60% of recent condominium buyers in Toronto are investors who bought their units from developers before construction began—and then sold their condos…But buyers whose condominiums are investments are getting squeezed. Stagnant rents make it harder to cover mortgage payments.”

On the US front, in Bloomberg’s “Home prices decline 5.9% in second quarter” Kathleen Howley reports that “Home prices in the U.S. fell 5.9 percent in the second quarter from a year earlier, the biggest decline since 2009, as foreclosures added to the inventory of properties for sale…Purchases decreased 3.5 percent to a 4.67 million annual rate, the weakest since November.” Furthermore Nick Timiraos in WSJ’s “Home-loan delinquencies rise again” reports that “The Mortgage Bankers Association said 12.87% of mortgage loans on one-to-four-unit homes were 30 days or longer past due or in the foreclosure process at the end of the second quarter, representing more than 6.3 million households. The second-quarter figure was down from 14.4% one year earlier but up from 12.84% at the end of March…While mortgage delinquencies remain highest in states hard hit by the housing bubble—such as Nevada, California and Florida—the inventory of loans in foreclosure is highest in states that require banks to obtain court approval when they foreclose on homeowners. Nationally, about 4.4% of all loans were in foreclosure at the end of June. Of the nine states that exceeded the national average, all but one—Nevada—have a judicial foreclosure process. Foreclosure rates were highest inFlorida (14.4%),Nevada (8.2%),New Jersey (8%),Illinois (7%),Maine andNew York (5.5%).”

In Florida context, in Palm Beach Post’s “Palm Beach County home sales slump in July from previous month” Kimberly Miller reports that “A Florida Realtors report released Thursday found 972 single-family Palm Beach County homes traded hands in July, a 21 percent increase from the same time in 2010, but an 18 percent drop from the previous month. The median sales price in Palm Beach County fell 17 percent from last year to $187,900 – a price not seen consistently since 2002. Statewide, sales of existing homes fell 12 percent in July from the previous month, but were up 12 percent compared to July 2010. The median sales price of $136,500 remained mostly stable…The inventory of homes for sale in Palm Beach County was down to an eight month supply in June, a 46.5 percent decrease from 2010 and down 62 percent from 2009, according to the Realtors Association of the Palm Beaches. That may change soon. Forbes, as well as Realtor Dean Hooker, owner of Pompano Beach-based Southeast REO, said banks are preparing to release more foreclosures for re-sale. Also in the PBP is Jeff Ostrowski’s article “Foreclosure-related sales’ prices fall, and the discount widens” in which ne reports that “The average price of a foreclosure sold inPalm BeachCounty in the second quarter was $116,642, down from $142,997 a year ago. And the discount for foreclosure sales compared to non-foreclosure sales widened to 38 percent this year from 23 percent a year ago. There were 3,253 distressed sales – including foreclosure sales, pre-foreclosure sales and sales after a lender has taken ownership – inPalm BeachCounty in April, May and June, according to RealtyTrac. Those sales made up 37 percent of all transactions in the county. In St. Lucie County, 701 foreclosure deals in the quarter accounted for 44 percent of all sales. Statewide, there were 34,558 foreclosure sales in the second quarter, accounting for 35 percent of all sales in the state.”

In the Globe and Mail’s “Foreign buyers see value in U.S. real estate” Simon Avery writes that with Florida prices off typically 50% since the peak, low mortgage rates, the strong Canadian dollar: ” As an alternative investment, U.S. real estate may never look so attractive to Canadians again…At the moment, the best deals in the Miami area are in South Beach, an area where the properties on average are older. There are currently 172 properties listed under $150,000 and 50 per cent of them are within walking distance to the beach. Generally, these are small, art deco-style, low rises. Their monthly maintenance fees run $320 or less and the sizes range from 240 square feet to 440 square feet.” (That doesn’t sound that cheap for an average of 340 SF units comes to about $441/SF…bargain??? You be the judge.)

Things to Ponder

In the Globe and Mail’s “Amid slowdown, Fed has few tools left” Kevin Carmichael discusses the limited remaining options available for the Fed to provide stimulus to rekindleUS growth and employment. The real problem, however, might be related to that “these aren’t normal times. When businesses and consumers would rather save than spend, as currently is the case in theUnited States, the power of monetary policy is muted. Corporations are sitting on some $2-trillion (U.S.) in profits and the household savings rate has climbed to more than 5 per cent from zero before the financial crisis, even though the cost of borrowing already is at record-low levels… What theU.S. economy needs is a massive jolt to demand that would encourage companies to hire and invest. The best way to do that, many economists argue, is through fiscal policy.”

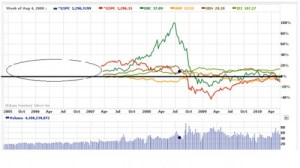

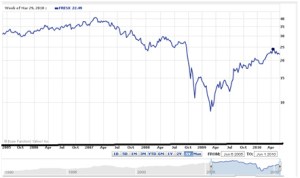

Jack Hough in WSJ SmartMoney’s “Treasurys versus stocks: spot the safe one” provides some support to Jeremy Siegel’s arguments that “bonds are in a bubble and stocks are good deal”. Arnott says that the 10-year Treasurys yield about zero, given nominal yields of 2.1% and past year’s inflation of 3.6%; whereas the S&P 500 dividend yield is 2.3%. “Bond yields are usually larger because stock dividends tend to grow over time and bond coupons don’t, so bond buyers typically want to be compensated for this…The choice is between stocks’ higher and rising yield and bonds’ lower and flat one…The third reason is that stocks have a better chance of keeping up with inflation…Dividends have rarely looked safer…Today’s payments are 29% of S&P 500 profits. That’s the lowest level since 1900, and perhaps in history…(but) Economists have slashed growth forecasts for most rich economies, and many put the chances of renewed U.S. recession at a coin flip.” So it depends on your horizon/risk tolerance, but “savers with a decade to wait” will find the arguments for stocks persuasive. But not everyone agrees that the metrics are valid. For example, in the Financial Times Lex column’s “Equities: metrics of the trade” discusses pundits indicating that based on P/E ratios and dividend yields compared to bond yields, it is time to buy stocks. Lex suggests that “the big flaw with this approach is that current or near-future earnings are very unlikely to represent an equilibrium return from stocks… It is a fact that company returns normalise, so a much longer earnings period against which to compare stock prices is needed. Inflation also needs be taken into account, as do accounting changes over time. Robert Shiller’s cyclically adjusted p/e ratio is a step in the right direction. Such an approach holds the S&P 500 to be anywhere up to 40 per cent overvalued… Likewise, history shows there to be no predictive power comparing equity and bond yields. Why should there be? Dividends are risky and rise with inflation; coupons are risk free and do not. It is like buying apples because pears are cheap. There are good reasons why stocks might rally – flaky valuation metrics are not among them.”

In the Guardian’s “Rating agencies suffer ‘conflict of interest’, says former Moody’s boss” Rupert Neate reports that “ratings agencies suffer from a conflict of interest because they are paid by the banks and companies they are supposed to rate objectively.”This salient conflict of interest permeates all levels of employment, from entry-level analyst to the chairman and chief executive officer of Moody’s corporation,” Harrington said in a filing to theUS financial regulator the Securities and Exchange Commission (SEC), which is considering new rules to reform the agencies. Harrington claims that Moody’s uses a long-standing culture of “intimidation and harassment” to persuade its analysts to ensure ratings match those wanted by the company’s clients.” (Recommended by the CFA Institute Financial Newsbrief)

In Bloomberg’s “Baby Boomers selling shares may depress stocks for decades, Fed paper says” Vivien Lou Chen writes that “Aging baby boomers may hold down U.S. stock values for the next two decades as they sell their investments to finance retirement, according to researchers from the Federal Reserve Bank of San Francisco … Jeremy Siegel, 65, a finance professor at the University of Pennsylvania’s Wharton School in Philadelphia, has also researched the link between demographics and U.S. stocks. He said that growth in developing countries should generate enough demand to absorb a baby-boomer selloff and “keep stock prices high.””

In the Financial Times’ “Inflation a danger for safe havens” Steve Johnson argues that the US/UK/German 10-year government bonds yielding in the 2-2.2% range is due to their perceived “safe haven” status from the wild swings of the markets. “But these miserly yields must also reflect investors’ confidence that inflation will be muted over the next decade. How logical is this assumption?…this insouciance about the prospects for inflation misses the international dimension, that stemming from rising import prices … (but) For the seven US recessions between 1957 and 1991, commodity prices on average fell 1.6 per cent during the period between the start of the recession and two years after its end. The equivalent figure for the two recessions so far this century is a rise of 27.3 per cent… Rather than enjoying a tailwind from falling commodity prices and low inflation rates, it may become the norm for recession-ravaged developed nations to face a commodity headwind and stubbornly high inflation.”

Assessment

And finally, in the NYT’s “In Korea, the game of trading has rules” Floyd Norris writes that “Finance ought to provide an economy with an efficient means of allocating capital. It should provide a means of price discovery of assets, whether real or financial. It should provide a safe and reliable payments system. Financial innovations are worthwhile if, and only if, they help in those areas. All too often, players see financial innovations as providing ways to manipulate the system and make money off less savvy traders.” In South Korea things are changing. Four traders were indicted for intentionally manipulating stock prices for profit, specifically for causing a market drop. “Countries around the world felt called upon to bail out banks during the financial crisis. That made sense because a functioning financial system is necessary. But these kind of games are not necessary, whether or not they are criminal. These charges provide an endorsement of the Volcker Rule, named for Paul A. Volcker, the former Federal Reserve chairman, and included in the Dodd-Frank law in theUnited States, which sought to restrict proprietary trading by banks whose deposits are insured. If such games are to be played, let them be played by others.“ The article concludes with the need for prison terms for these traders to insure a deterrent effect (Thanks to DB for recommending.)

Conclusion

And so, your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speakers: If you need a moderator or speaker for an upcoming event, Dr. Peter Benedek and Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – are available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Other Print Books and Related Information Sources for Doctor and Advisors:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Healthcare Organizations: www.HealthcareFinancials.com

Physician Advisors: www.CertifiedMedicalPlanner.com

Subscribe Now: Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest ME-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Sponsors Welcomed: And, credible sponsors and like-minded advertisers are always welcomed.

Link: https://healthcarefinancials.wordpress.com/2007/11/11/advertise

Filed under: Alternative Investments, Book Reviews, Breaking News, Financial Planning, Investing, Portfolio Management | Tagged: Charles Ellis, Dianne Nice, Dr. Peter Benedek CFA, Financial Planning, Glenn Ruffenach in, housing, Investing, Jeremy Siegel, John Heinzl, Kathleen Howley, Kevin Carmichael, Lou Chen, Peter Benedek, Portfolio Management, real-estate, Rupert Neate, Scott Willenbrock, Sheryl Garrett, Shirley Won, Simon Avery, Steve Johnson | 2 Comments »