A Seldom Discussed Topic Among Medical Professionals

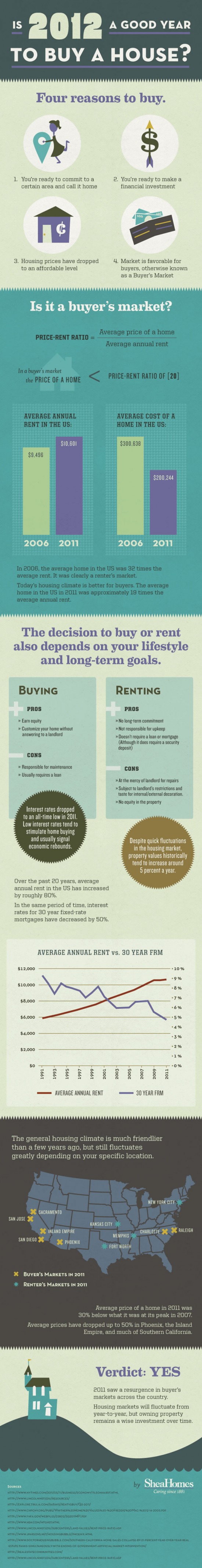

The housing market across the country has tanked. That should mean lower property taxes, right?

It’s true that property taxes do fall when housing values drop. But, this fall doesn’t happen in perfect time with the market. There’s usually a delay. And even when property taxes do fall, it’s often not enough to satisfy cash-strapped doctors and other homeowners.

Plummeting Home Values

This isn’t surprising. Homeowners today are struggling with plummeting home values. Those who bought their homes in 2004, 2005 or early 2006, especially, have most likely seen their homes lose tens of thousands of dollars in value.

This isn’t surprising. Homeowners today are struggling with plummeting home values. Those who bought their homes in 2004, 2005 or early 2006, especially, have most likely seen their homes lose tens of thousands of dollars in value.

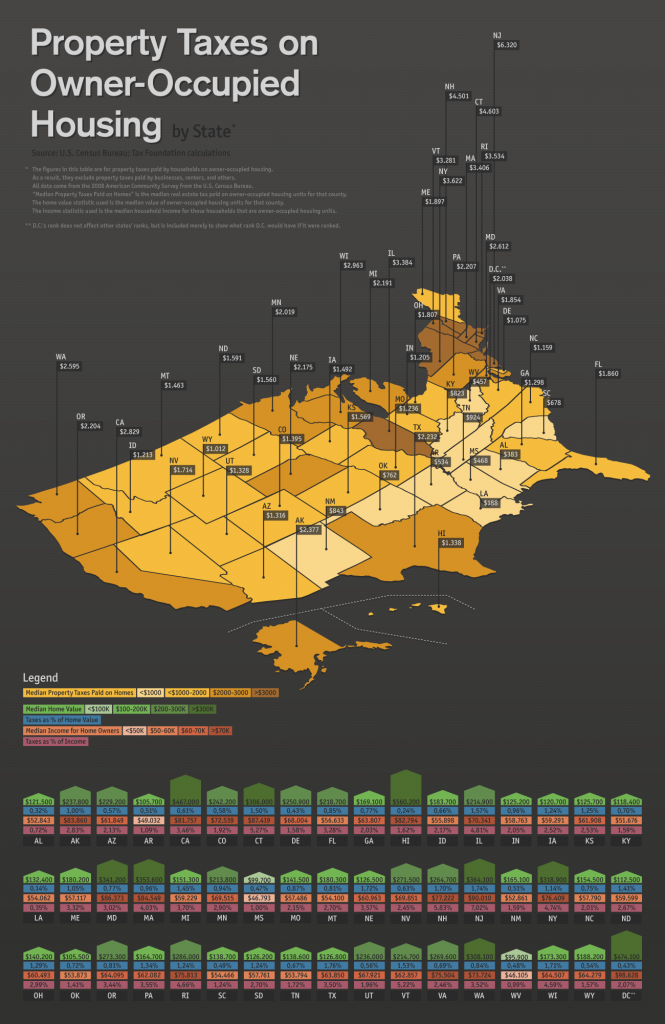

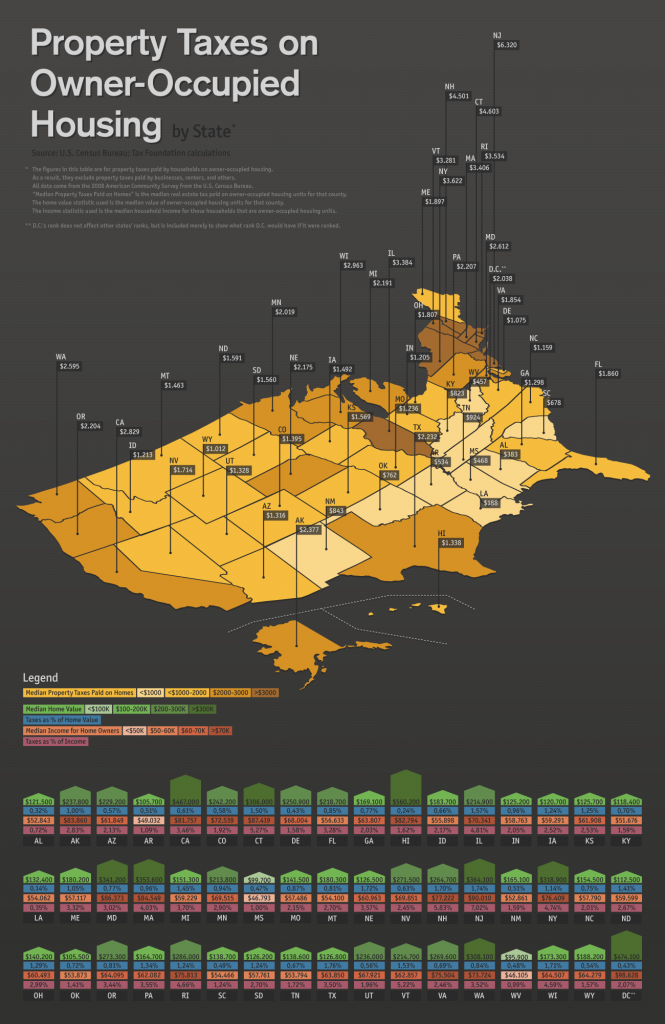

It is little wonder, then, that physicians and others homeowners today are taking a closer look at their property taxes. Here is a look at what type of property taxes you pay depending on the state that you call home.

For example, if you live in New Jersey, you might not want to open that property tax bill. The state featured the highest median property taxes on owner-occupied housing, according to 2008 data by the U.S. Census Bureau. Homeowners here paid a median of $6,320 in property taxes each year. Connecticut came in second with a median property tax of $4,603 on its households. Right behind was New Hampshire, $4,501; and New York, $3,622.

Other states with high median property taxes include Rhode Island, $3,534; Massachusetts, $3,404; and Vermont, $3,281. Looks like you shouldn’t buy a home in the East if you want to pay lower property taxes.

On other end of the scale, Louisiana homeowners paid a median of $188 on their property taxes. In Arkansas, that number rose a bit to $383, while it stood at a still low $457 in West Virginia. In Mississippi, this median value stood at $468. Other states with low median property tax figures were South Carolina, $678; Oklahoma, $762; and New Mexico, $843.

Median Values

In general, these median property tax numbers do make sense. The states that have the highest median property taxes tend to have the highest median housing values, too. The opposite holds true, too.

For instance, the states with the lowest median housing values include West Virginia, $95,900; Mississippi, $99,700; Arkansas, $105,700; Oklahoma, $105,500; North Dakota, $112,500; and Alabama, $121,500. These states also tend to have some of the lowest property taxes.

Highest Median Home Values

Some of the states with the highest median home values include Hawaii, with a median value of $560,000; California, $467,000; New Jersey, $364,100; Massachusetts, $353,600; and Maryland, $341,200. Again, the property taxes tend to align well with these prices. Homeowners in these states pay some of the higher median property taxes in the country.

Relation to Home Values

The most important number, though, when analyzing property taxes isn’t what homeowners pay in each state. It’s how high this figure is in relation to home values.

For instance, Texans don’t pay the highest median property taxes in the country. They do, though, pay the highest percentage of their home values in property taxes, 1.76 percent.

Other states fare poorly in this measure, too: New Jersey, 1.74 percent; Nebraska, 1.72 percent; Wisconsin, 1.71 percent; and New Hampshire, 1.70 percent.

If you want to live somewhere where property taxes take up the lowest percentages of your home’s value, you might want to consider moving to the South.

For instance, homeowners in Louisiana pay 0.14 percent of their home values in property taxes, lowest in the nation. Hawaii comes in second with a figure of 0.24 percent. In Arkansas, that number is a still low 0.32 percent, while it’s at 0.47 percent in Mississippi. In West Virginia, the percentage rises to a still low 0.47 percent.

Assessment

Analyzing the impact of property taxes is far from an exact science. But by looking at how large of a percentage these taxes take up when compared to housing values, homeowners will get a better idea of what kind of financial burden property taxes are placing on them.

Source: www.CreditLoan.com

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Our Other Print Books and Related Information Sources:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Healthcare Organizations: www.HealthcareFinancials.com

Physician Advisors: www.CertifiedMedicalPlanner.com

Subscribe Now: Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest ME-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Sponsors Welcomed: And, credible sponsors and like-minded advertisers are always welcomed.

Link: https://healthcarefinancials.wordpress.com/2007/11/11/advertise

Filed under: Mortgage Electronic Registry System, Taxation | Tagged: home values, mortgages, Property Taxes, Property Taxes in America, sub-prime mortgages | Leave a comment »