Feeling the Pressure to “Give”

Are you feeling any pressure this Christmas season to give, give, give? Keeping up with the Joneses all year is hard enough. It gets even worse during the holidays, when we feel pressured to keep up, not just with the Joneses, but also with the expectations others, and ourselves, put on Santa Claus.

Some Christmas shoppers overspend on gifts and end up paying off credit card bills for months. Others drive themselves crazy trying to find exactly the right gifts for the right people. Others hate the whole idea of shopping so much that they find it hard to enjoy the season.

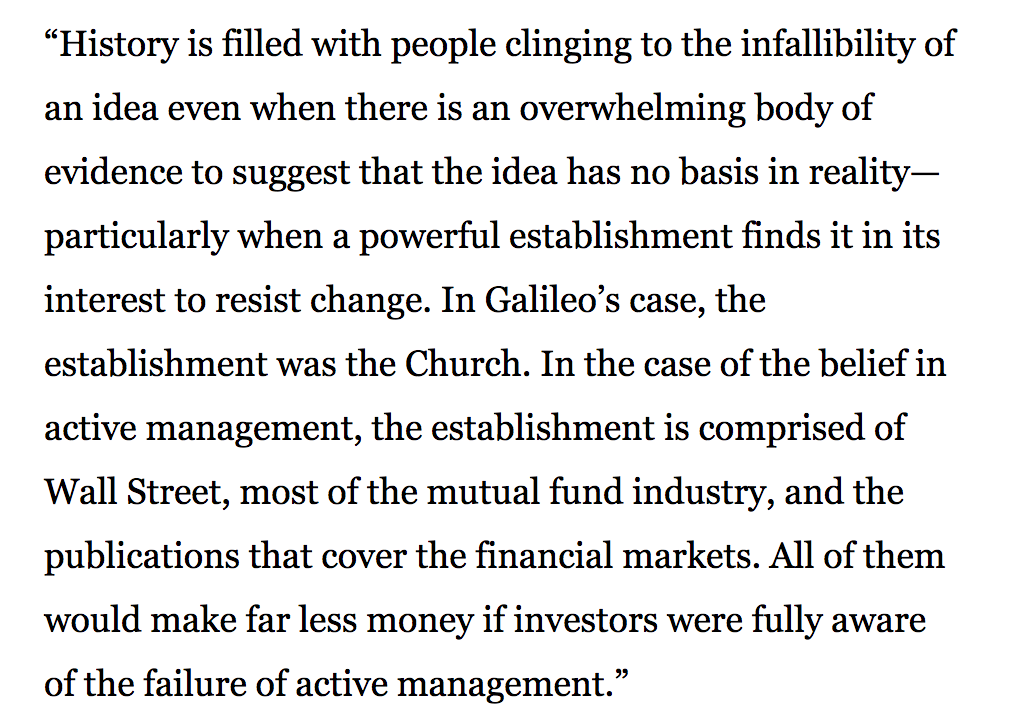

If you fit into any of these categories, the cause may be your money scripts. The unconscious beliefs about money that we all hold are especially likely to kick in this time of year. We are surrounded by expectations and pressures about “ideal” holiday celebrations with the perfect gifts, the perfect decorations, and the perfect foods. As a result, we are especially vulnerable to making money decisions blindly in response to beliefs we don’t even realize we hold.

You may be one of those who regularly end up spending significantly more on gifts than you intended to. You may impulsively buy additional, unbudgeted gifts for people you’ve already bought presents for. You may not even try to set holiday spending limits. You may overspend on things for yourself while you’re Christmas shopping.

- If any of these are true for you, you may have some unconscious beliefs about money that drive you to overspend. See whether any of the following money scripts might fit for you:

- “The more you spend, the more love you show.”

- “It takes the joy out of giving if you pinch pennies.”

- “It’s the season for giving lavishly, not for being a Scrooge.”

- “If I don’t buy just the right gifts, people won’t like or respect me.”

- “I need to give my kids more than I got when I was a child.”

- “More gifts and more spending will make the holidays okay (and make my guilt go away).”

- “It’s tradition. Everyone expects (whatever) from me.”

- “I do so much for everyone else; I deserve something for myself, too.”

It’s also possible you may go to the opposite extreme and be a Grinch when it comes to the holidays. If you hate Christmas shopping, grumble about the holiday being so commercialized, and look forward to January, it’s possible you may hold some money scripts that drive you to underspend. Your beliefs may be similar to the following:

- “It’s wrong to spend money except on necessities.”

- “You aren’t a spiritual or religious person if you spend too much money.”

- “Christmas shouldn’t be about money.”

- “It’s wrong to spend money on luxuries when poor people are suffering.”

- “It isn’t good for kids to get too much.”

- “My kids shouldn’t have more than I had when I was a child.”

If you’d like to change some aspects of what you do and how you feel about holiday spending, you may find it useful to take a closer look at your own beliefs about the season. One way to begin this is to quickly write answers (short statements are best) to the following questions: What do I believe about money and each of the following? Christmas? Family celebrations? Presents? Giving? Spending? Receiving?

Assessment

You may uncover some money scripts similar to the ones listed above. Learning why you tend to overspend or under spend this time of year won’t instantly change what you do. Yet understanding what is behind your pattern of holiday spending is an important way to start becoming a more conscious Christmas shopper.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

***

Filed under: "Ask-an-Advisor", Ethics, Experts Invited, Financial Advisor Listings, Financial Planning, LifeStyle | Tagged: . Christmas, “Money Scripts”, Christmas Giving, jones, psychology, Rick Kahler MS CFP®, X-mass | Leave a comment »

***

***