Dr. Gary Bode; MSA CPA CMP

Dr. David Edward Marcinko; MBA MEd CMP

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

Purpose, Scope and Impact

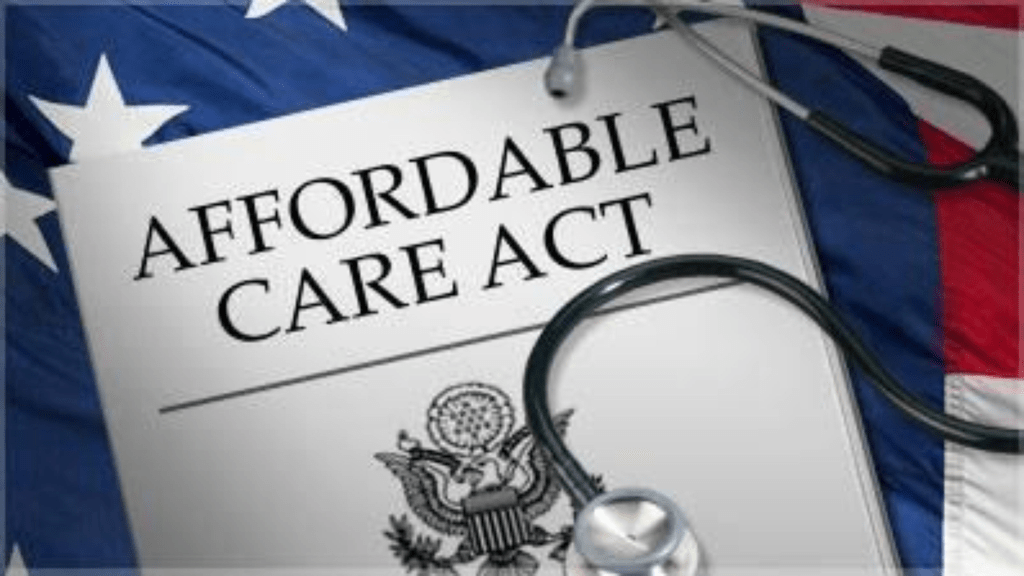

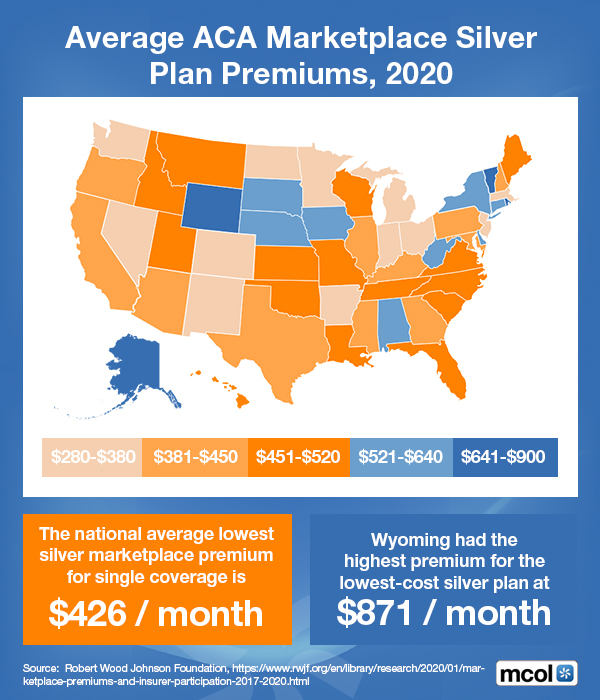

The Net Investment Income Tax (NIIT) occupies a distinctive place in the modern U.S. tax landscape. Introduced as part of the Affordable Care Act, it was designed to generate revenue from higher‑income households by taxing certain forms of unearned income. Although it affects a relatively small portion of taxpayers, its implications reach into investment strategy, tax planning, and broader debates about fairness and economic policy. Understanding how the NIIT works—and why it exists—offers insight into the evolving relationship between tax policy and wealth in the United States.

At its core, the NIIT is a 3.8 percent surtax applied to specific types of investment income for individuals whose modified adjusted gross income exceeds statutory thresholds. These thresholds—$200,000 for single filers and $250,000 for married couples filing jointly—are not indexed for inflation. As a result, over time, more taxpayers may find themselves subject to the tax even if their real purchasing power has not increased. This “bracket creep” is one of the subtle but important features of the NIIT, shaping its long‑term reach.

The tax applies only to “net investment income,” a term that includes interest, dividends, capital gains, rental income, royalties, and passive business income. It does not apply to wages, self‑employment earnings, or distributions from qualified retirement plans. The logic behind this distinction is straightforward: the NIIT targets income derived from wealth rather than labor. In practice, this means that two taxpayers with identical total income may face different NIIT liabilities depending on how much of their income comes from investments versus work.

The mechanics of the NIIT involve a comparison between two amounts: net investment income and the excess of modified adjusted gross income over the applicable threshold. The tax is applied to whichever of these two figures is smaller. This structure ensures that the NIIT functions as a surtax on high‑income households without taxing investment income for those below the threshold. It also means that taxpayers with large investment portfolios but modest overall income may avoid the tax entirely, while those with high wages and relatively small investment income may still owe it.

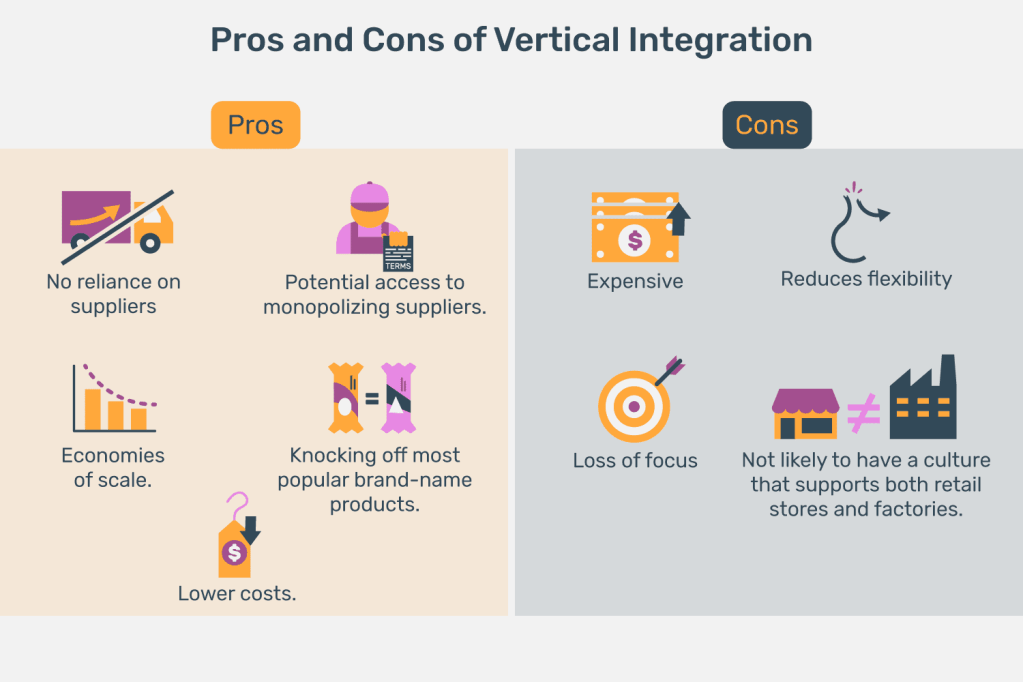

One of the most significant effects of the NIIT is its influence on investment behavior. Because the tax applies to capital gains, it can affect decisions about when to sell appreciated assets. Taxpayers may choose to time sales to avoid pushing their income above the threshold in a given year. Others may shift toward tax‑exempt investments, such as municipal bonds, or toward assets that generate unrealized rather than realized gains. The NIIT therefore becomes not just a revenue tool but a factor shaping the broader investment landscape.

The tax also interacts with other parts of the tax code in ways that can be complex. For example, rental real estate income is generally subject to the NIIT unless the taxpayer qualifies as a real estate professional and materially participates in the activity. Trusts and estates face their own NIIT rules, often reaching the surtax threshold at much lower income levels than individuals. These layers of complexity mean that the NIIT is often a central topic in tax planning for high‑income households, especially those with diverse investment portfolios.

Beyond its technical features, the NIIT reflects broader policy debates about equity and the distribution of tax burdens. Supporters argue that it helps ensure that high‑income individuals contribute a fair share to the cost of public programs, particularly those related to health care. Because investment income is disproportionately concentrated among wealthier households, the NIIT is seen as a way to align tax policy with ability to pay. Critics, however, contend that the tax discourages investment, adds unnecessary complexity, and imposes an additional layer of taxation on income that may already be subject to corporate taxes or other levies.

Despite these debates, the NIIT has become a stable part of the federal tax system. It raises billions of dollars annually and plays a role in funding health‑related initiatives. As discussions about tax reform continue, the NIIT often resurfaces as policymakers consider how best to balance revenue needs with economic incentives. Whether it remains unchanged, is expanded, or is modified in future legislation, the NIIT will continue to shape the financial decisions of high‑income taxpayers and contribute to the ongoing conversation about how the United States taxes wealth.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Accounting, CMP Program, Experts Invited, finance, Funding Basics, Glossary Terms, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, Taxation, Touring with Marcinko | Tagged: ACA, accountant, CMP, CPA, david marcinko, economy, finance, Gary Bode, Health Insurance, income tax, interest rates, Investing, IRS, net investment income tax, NIIT, personal-finance, politics, tax | Leave a comment »

***

***