Understanding Horizontal and Vertical Integration

[By Robert James Cimasi MHA, AVA, CMP™]

Health Capital Consultants, LLC

St. Louis MO

Several potential benefits are associated with the integration of companies in the same or related industries. These synergistic benefits depend upon the type of companies and their integration strategies, as well as whether the anticipated transaction is a manifestation of horizontal consolidation or vertical integration.

Horizontal consolidation is “the acquisition and consolidation of like organizations or business ventures under a single corporate management, in order to produce synergy, reduce redundancies and duplication of efforts or products, and achieve economies of scale while increasing market share.”

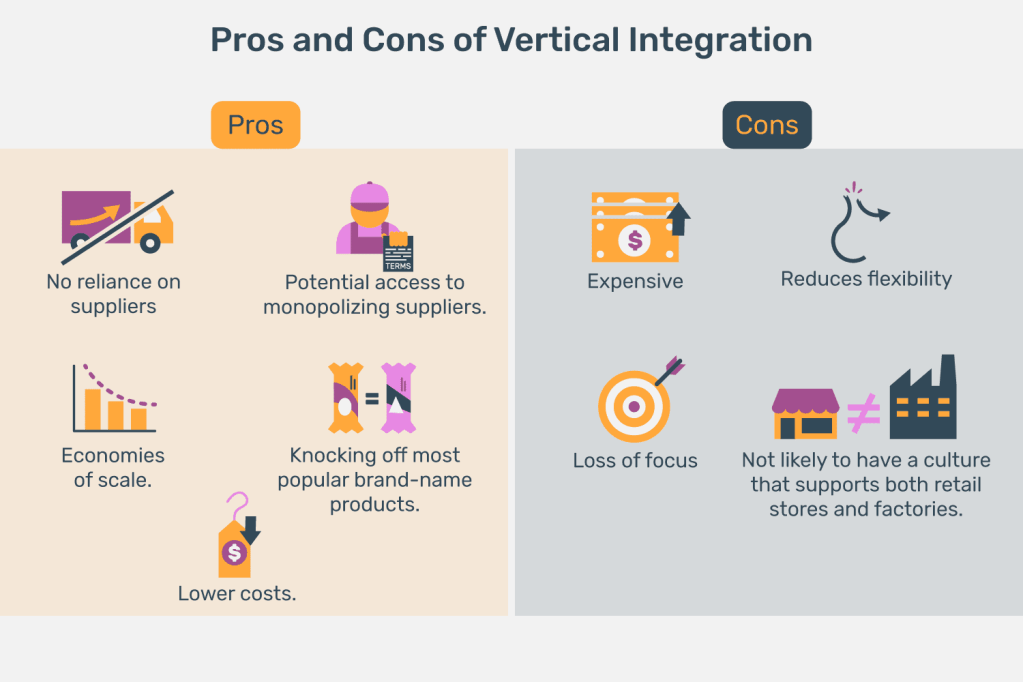

Vertical integration involves the joining of organizations that are fundamentally different in their product and/or services offerings, i.e., “the aggregation of dissimilar but related business units, companies, or organizations under a single ownership or management in order to provide a full range of related products and services.”

Healthcare Locality

As healthcare is essentially a local business, horizontal integration within the local market has been limited by antitrust laws. Therefore, in order to control greater market share, a hospital’s strategy has required vertical integration. Healthcare providers and organizations have placed much emphasis on the benefits of vertical system integration in the last 10 or more years, whereby a single healthcare organization owns all of the elements needed to provide a continuum of care for all the needs of a given patient population. Much of this effect has stemmed from the desire to be able provide a “continuum of care,” i.e., to be able to single source contract for the healthcare needs of a patient population and to profit from implementing preventative healthcare and utilization management measures. The relative economic benefits of this type of vertical integration versus horizontal integration strategies remain the subject of great debate in academia and among the strategic managers of other industries. One lesson that may be drawn from other industries is that neither of these forms of integration is universally applicable or beneficial to every organization and market. There are also great costs to integration, which must be outweighed by the benefits. Each specific benefit should be identified and researched when examining the probable effects of integration, consolidation, mergers or divestitures as a competitive strategy.

Rapid Consolidation Periods

During the rapid consolidation and integration of healthcare providers, insurers, and purchasers, in recent years, there was much discussion of a concept termed “managed competition.” This term appears to have been an outgrowth of the term “managed care” and was viewed by many as the logical result of the integration of healthcare markets nationally. The concept of “managed competition” apparently related to an idealized vision of competition between very large, integrated providers (organized into integrated delivery systems), large, national managed care payors, and purchasing group coalitions that could achieve a balance of power between these interacting groups. However, many believe that the result of such an arrangement would more likely be a reduction in competition between members of each of these three groups and the creation of powerful bureaucratic and intractable organizations. Further, this scenario does not appear to effectively remove any of the existing barriers to competition and therefore doesn’t introduce any additional incentives for innovation to produce value for consumers which, of course, is the “sine qua non” of competition.

Disadvantages

The disadvantages of integration are becoming apparent, including:

- the loss of autonomy;

- increased bureaucracy;

- difficulty in aligning incentives; and

- other failed expectations.

Many organizations that sought strategic advantage through integration are ending those arrangements and now divesting acquired organizations.

Other Industries

In other industries, specialized providers of goods and services are increasingly able to offer customers a full range of services through affiliation and affinity with other independent specialists, made more seamless through the use of increasingly sophisticated communications and computing technologies. However, this move to “dis-integration” must also be carefully considered if organizations are not to make further costly organizational changes inspired by a rushed judgment of general market trends.

Porter Speaks

Michael Porter (et al.) wrote in the Harvard Business Review that,

In industry after industry, the underlying dynamic is the same: competition compels companies to deliver increasing value to customers. The fundamental driver of this continuous quality improvement and cost reduction is innovation. Without incentives to sustain innovation in health care, short-term cost savings will soon be overwhelmed by the desire to widen access, the growing health needs of an aging population, and the unwillingness of Americans to settle for anything less than the best treatments available. Inevitably, the failure to promote innovation will lead to lower quality or more rationing of care — two equally undesirable results.

Assessment

Therefore, if the emerging healthcare industry is to respond successfully to the Affordable Care Act [ACA] and related market pressures to reduce costs, then the healthcare market must first create incentives for innovation. The barriers to competition cannot include barriers to innovation as many do now. Physicians, nurses, healthcare purchasers, managers, and legislators must ensure innovation takes the forefront of any reform, if it is to be effective.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Experts Invited, Practice Management, Research & Development | Tagged: Affordable Care Act., Health Capital Consultants LLC, healthcare reform, Horizontal Integration, michael porter, robert james cimasi, Vertical Integration, www.healthcarefinancials.com | 6 Comments »