By Dr. David Edward Marcinko MBA MEd

DEFINED

***

***

A physician practice management corporation (PPMC) is a business entity that provides non-clinical administrative and operational support to medical practices, allowing physicians to focus on patient care while the corporation handles the business side of healthcare.

Physician practice management corporations emerged in response to the increasing complexity of running a medical practice. As healthcare regulations, insurance requirements, and operational costs grew, many physicians found it challenging to manage both clinical responsibilities and business operations. PPMCs offer a solution by taking over the administrative burdens, enabling physicians to concentrate on delivering quality care.

At their core, PPMCs are responsible for a wide range of non-medical services. These include billing and coding, human resources, payroll, marketing, compliance, information technology, and financial management. By centralizing these functions, PPMCs can achieve economies of scale, reduce overhead costs, and improve operational efficiency for the practices they manage. This model is particularly attractive to small and mid-sized practices that may lack the resources to manage these functions independently.

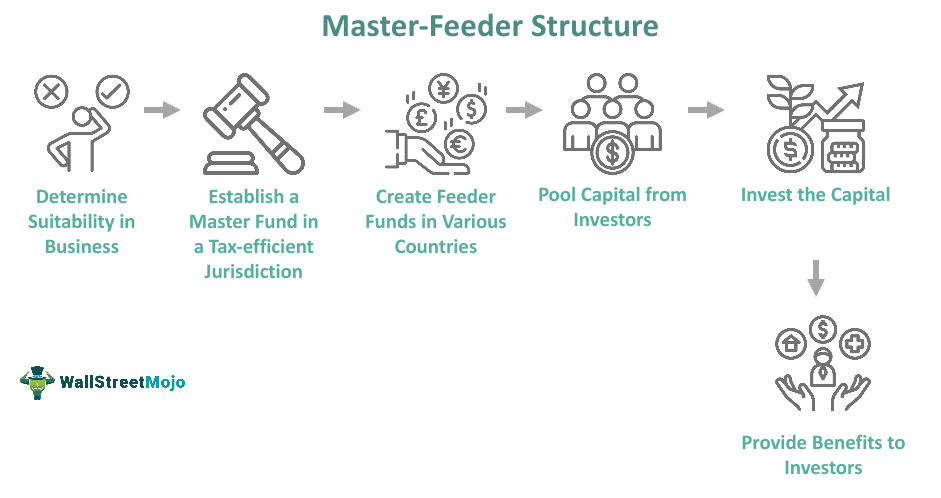

PPMCs typically enter into long-term management agreements with physician groups. In some cases, they may purchase the non-clinical assets of a practice—such as equipment, office space, and administrative staff—while the physicians retain control over clinical decisions and patient care. This arrangement allows for a clear division between medical and business responsibilities, which is essential for maintaining compliance with healthcare regulations like the Stark Law and the Anti-Kickback Statute.

A physician practice management corporation (PPMC) is a business entity that provides non-clinical administrative and operational support to medical practices, allowing physicians to focus on patient care while the corporation handles the business side of healthcare.

Physician practice management corporations emerged in response to the increasing complexity of running a medical practice. As healthcare regulations, insurance requirements, and operational costs grew, many physicians found it challenging to manage both clinical responsibilities and business operations. PPMCs offer a solution by taking over the administrative burdens, enabling physicians to concentrate on delivering quality care.

PPMCs: https://medicalexecutivepost.com/2019/11/18/on-the-ppmcs-of-yester-year-and-today/

At their core, PPMCs are responsible for a wide range of non-medical services. These include billing and coding, human resources, payroll, marketing, compliance, information technology, and financial management. By centralizing these functions, PPMCs can achieve economies of scale, reduce overhead costs, and improve operational efficiency for the practices they manage. This model is particularly attractive to small and mid-sized practices that may lack the resources to manage these functions independently.

PPMCs typically enter into long-term management agreements with physician groups. In some cases, they may purchase the non-clinical assets of a practice—such as equipment, office space, and administrative staff—while the physicians retain control over clinical decisions and patient care. This arrangement allows for a clear division between medical and business responsibilities, which is essential for maintaining compliance with healthcare regulations like the Stark Law and the Anti-Kickback Statute.

***

***

One of the key advantages of working with a PPMC is access to capital and advanced infrastructure. PPMCs often invest in state-of-the-art electronic health record (EHR) systems, data analytics tools, and revenue cycle management platforms. These technologies can enhance patient care, streamline operations, and improve financial performance. Additionally, PPMCs may offer strategic guidance on practice expansion, mergers and acquisitions, and payer contract negotiations.

However, the relationship between physicians and PPMCs must be carefully managed. While PPMCs bring valuable expertise and resources, there is a risk that business priorities could overshadow clinical autonomy. To mitigate this, successful PPMCs prioritize physician engagement, transparent governance, and aligned incentives. They work collaboratively with physicians to ensure that business strategies support, rather than hinder, the delivery of high-quality care.

The physician practice management industry has evolved significantly over the past few decades. After a wave of failures in the 1990s due to overexpansion and misaligned incentives, modern PPMCs have adopted more sustainable and physician-centric models. Today, they play a crucial role in helping practices adapt to value-based care, population health management, and other emerging trends in healthcare delivery.

In conclusion, a physician practice management corporation serves as a strategic partner to medical practices, offering the business acumen and operational support needed to thrive in a complex healthcare environment. By offloading administrative tasks and providing access to advanced resources, PPMCs empower physicians to focus on what they do best—caring for patients—while ensuring the long-term success and sustainability of their practices.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com

Like, Refer and Subscribe

***

***

Filed under: "Doctors Only", Ask a Doctor, Career Development, Glossary Terms, Health Law & Policy, Management, Marcinko Associates, Practice Management | Tagged: Anti-Kickback Statute, david marcinko, health, healthcare, medicine, physician practice management, physician practicement corporations, PPMC, PPMCs, Stark laws, Technology | Leave a comment »