Dr. David Edward Marcinko; MBA MEd CMP™

Medical Colleagues Beware the Advisors

***

***

SPONSOR: http://www.MarcinkoAssociates.com

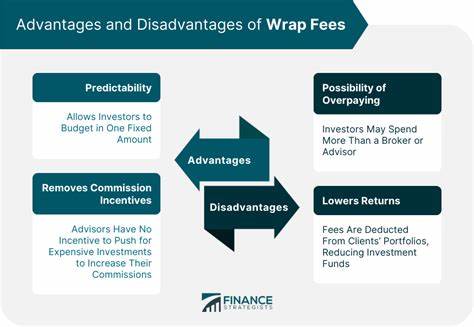

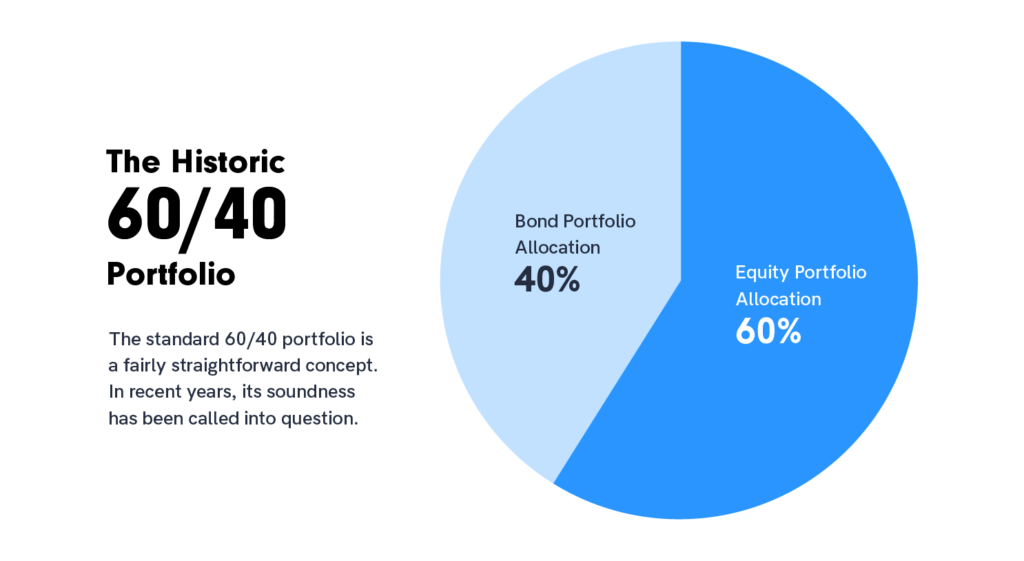

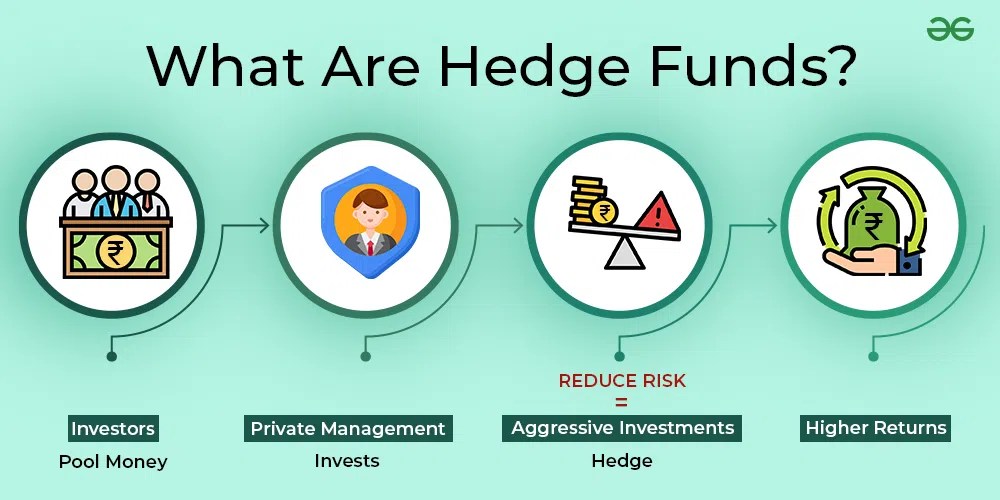

Several years ago a group of highly trusted and deeply experienced financial advisors, insurance service professionals and estate planners noted that far too many of their mature retiring physician clients, using traditional stock brokers, management consultants and financial advisors, seemed to be less successful than those who went it alone. These Do-it-Yourselfers [DIYs] had setbacks and made mistakes, for sure. But, the ME Inc doctors seemed to learn from their mistakes and did not incur the high management and service fees demanded from general or retail one-size-fits-all “advisors.”

In fact, an informal inverse related relationship was noted, and dubbed the “Doctor Effect.” In others words, the more consultants an individual doctor retained; the less well they did in all disciplines of the financial planning and medical practice management, continuum.

Of course, the reason for this discrepancy eluded many of them as Wall Street brokerages and wire-houses flooded the media with messages, infomercials, print, radio, TV, texts, tweets, dinners and internet ads to the contrary. Rather than self-learn the basics, the prevailing sentiment seemed to purse the holy grail of finding the “perfect financial advisor.” This realization confirmed the industry culture which seemed to be:

Bread for the advisor – Crumbs for the client!

And so, Marcinko Associates formed a cadre’ of technology focused and highly educated multi-degreed doctors, nurses, financial advisors, attorneys, accountants, psychologists and educational visionaries who decided there must be a better way for their healthcare colleagues to receive financial planning advice, products and related advisory services within a culture of fiduciary responsibility.

We trust you agree with this specific niche knowledge, and collegial consulting philosophy, as illustrated thru our firm and these two books.

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit a RFP for speaking engagements: MarcinkoAdvisors@outlook.com

COMMENTS APPRECIATED

Like, Refer and Subscribe

***

***

***

Filed under: "Doctors Only", CMP Program, Ethics, Financial Advisor Listings, Financial Planning, Funding Basics, Investing, LifeStyle, Marcinko Associates, Portfolio Management, Touring with Marcinko | Tagged: agents, budgeting, certified medical planner, CFP, CMP, DO, DPM, finance, financial advisors, financial planners, Financial Planning, insurance, Investing, Marcinko, MD, personal-finance, Portfolio Management, RN | Leave a comment »