By Vitaliy Katsenelson CFA

***

***

Embracing Stock Market Stoicism

2024 brought me back to a core Stoic principle that I hold close to my heart: the dichotomy of control. Here’s the gist: Some things are within our power—our values, our character, our decisions—and some aren’t—like your brother-in-law’s random (and possibly dumb) comment, your spouse’s mood, or the fact that every traffic light turns red right as you pull up.

In investing, it’s the same. We can control:

- The quality of our research—being logical and thorough in our research

- Our decisions and discipline—systematically following our research

- Our reactions—how we react to the news and external environmental pressure (I will discuss this at the end of the letter)

The market can price our stocks however it pleases on a month-to-month—or even year-to-year—basis. That’s the part we can’t control. We have to remember that these market prices are merely opinions, not final verdicts. The Stoics teach us to focus our energy on what we can influence (our process) and accept what we can’t (the market’s whims).

This probably sounds straightforward, but there’s a twist that makes it harder for you, the client, to see how this all plays out in real time. You can easily check the portfolio’s value—my decisions, not so much. In theory, I could make subpar investments and hide behind fancy Stoic talk.

That’s exactly the why of these very detailed letters: to show you our thinking, walk you through our individual decisions. I write, you read—that’s our agreement. You’re the judge of whether my process makes sense. But I can’t do that part for you.

CONTINUE READING: https://investor.fm/embracing-stock-market-stoicism/?mc_cid=25f3bd9eb4&mc_eid=7a63a03234

COMMENTS APPRECIATED

Like, Refer and Subscribe

***

***

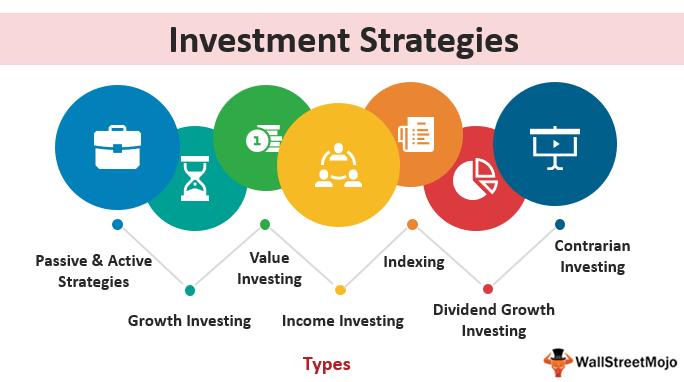

Filed under: "Ask-an-Advisor", CMP Program, Experts Invited, Financial Planning, Funding Basics, Interviews, Investing | Tagged: mindfulness, personal-growth, philosophy, stock market stoicism, stock markets, stoic, stoicism, value investing, Vitaliy Katsenelson CFA | Leave a comment »