By Staff Reporters and AI

***

***

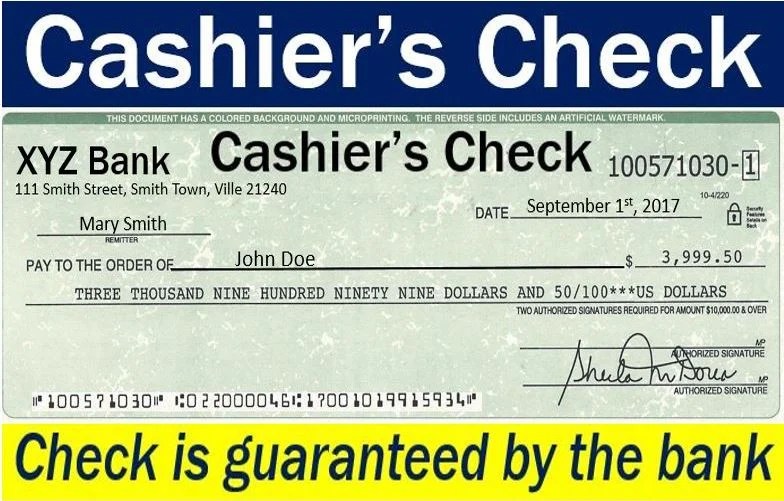

What is a cashier’s check?

Unlike a personal check, a cashier’s check is guaranteed by a bank, drawn from the bank’s own funds, and signed by a bank representative. It’s typically used for large or important transactions, such as buying a car or making a down payment on a home, because it offers more security to the recipient than a personal check.

Traditionally, bank customers obtain a cashier’s check by visiting a bank or credit union in person. There’s usually no limit on the amount of the cashier’s check as long as you have the money to cover it. You and the bank or credit union representative sign the check, and the money is withdrawn from the financial institution’s funds when the check is cashed. However, some online banks may allow you to order a cashier’s check online or over the phone.

If you need a cashier’s check the same day and your bank doesn’t have physical branches, a credit union in your area might issue cashier’s checks even if you’re not a customer. Otherwise, consider signing up with a bank or credit union with physical branches in your area.

There is typically a fee to get a cashier’s check, though the amount isn’t significant. Often, you’ll pay less than $20 even for cashier’s checks of several thousand dollars. The relatively low fees for cashier’s checks and guarantee of funds make them useful when making large, important transactions.

Checks: https://medicalexecutivepost.com/2024/03/27/checks-cashier-v-certified-v-money-order-v-bank-draft/

What is a money order?

A money order is another paper payment method similar to a check. You pay the amount up front (usually in cash or debit), plus a small fee, and the issuer prints a money order that can be filled out to a specific recipient. Because the payment is prepaid, money orders are considered a safe alternative to personal checks, especially for smaller transactions or when sending money through the mail.

Money orders are available at many banks and credit unions as well as some retailers, grocery stores, and post offices. Domestic money orders can’t exceed $1,000, so they aren’t suitable for large transactions. However, while there is a limit on the amount of each money order, you can purchase multiple money orders to pay for more than one expense.

Debit Card Rules: https://medicalexecutivepost.com/2022/10/05/debit-cards-the-new-rules/

Money orders also have relatively low fees. For example, the United States Postal Service (USPS) charges $2.35 for money orders of $0.01 to $500.00, and $3.40 for money orders between $500.01 and $1,000.00

Which payment method is safer: cashier’s check vs. money order?

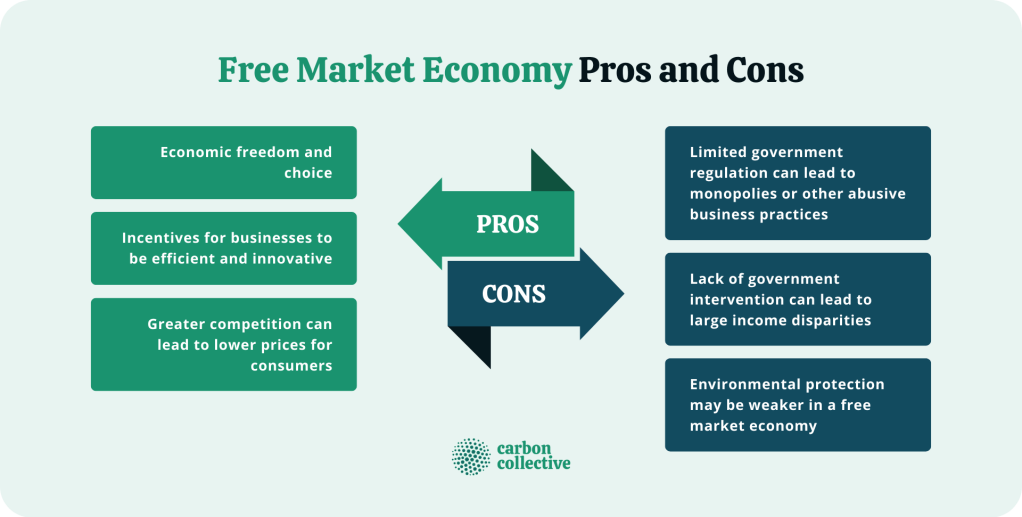

Cashier’s checks and money orders are both relatively safe forms of payment — both ensure the payment will not bounce.

However, cashier’s checks are generally safer due to the process financial institutions follow. Cashier’s checks are backed by a bank’s own funds, not your personal account, and are signed by a bank employee — making them harder to counterfeit and more trusted by recipients. The payee must also provide a photo ID when cashing the check, so only the person the financial institution specifies can access the money.

Money orders are paid from your personal bank account funds. They can be easier to forge, especially the ones purchased at retail outlets rather than banks.

Debit Cards: https://medicalexecutivepost.com/2024/08/17/use-credit-cards-not-debit-cards/

That said, both are safer than personal checks or mailing cash, and both can be tracked if lost. But for high-value purchases, a cashier’s check is the more secure option.

Credit Cards: https://medicalexecutivepost.com/2025/03/17/bin-credit-card-attack/

COMMENTS APPRECIATED

Like and Refer

***

***

Filed under: "Ask-an-Advisor", Financial Planning, Glossary Terms, Investing | Tagged: bank account, banks, cashier's check, checks, credit card, credit cards, Debit cards, finance, money, money order, personal-finance | Leave a comment »