[By Dr. David Edward Marcinko MBA MEd CMP®]

[By Dr. David Edward Marcinko MBA MEd CMP®]

http://www.CertifiedMedicalPlanner.org

OK – I was a Certified Financial Planner® before my academic team launched the Certified Medical Planner™ online and on-ground chartered education and board certification designation program a few years ago. I am now CFP reformed and in remission.

MORE: Enter CPMs

Enter the Certified Medical Planner™ Chartered Designation

Today, we are of course, gratified that Certified Medical Planner™ mark notoriety is growing organically in the healthcare, as well as financial services, industry.

Even uber-blogger Mike Kitces MSFS, MTAX, CFP, CLU, ChFC, RHU, REBC, CASL has taken note of us in his musings on the Nerd’s Eye View website. And, the reality is that there are a growing number of CFP educational programs at the post-CFP niche market level.

But, none for healthcare industrial complex: for doctors … by doctors!

Popularity of our Text Books

However, it is our modern, innovative and proprietary Certified Medical Planner™ textbooks and dictionaries that have exploded in the academic marketplace.

In fact, they are now redacted in thousands of medical, graduate, law and B-schools and libraries, as well as colleges and universities throughout the nation. This includes the Library of Congress, National Institute of Health and the Library of Congress.

What Gives?

We have been told that this textbook popularity and publishing success is because of their balanced and peer-reviewed nature; something not very widespread in the financial services industry that is prone to gross and overstated advertising, salesmanship and marketing hyperbole. And, for this we are very gratified.

But, is there another reason our books are so popular?

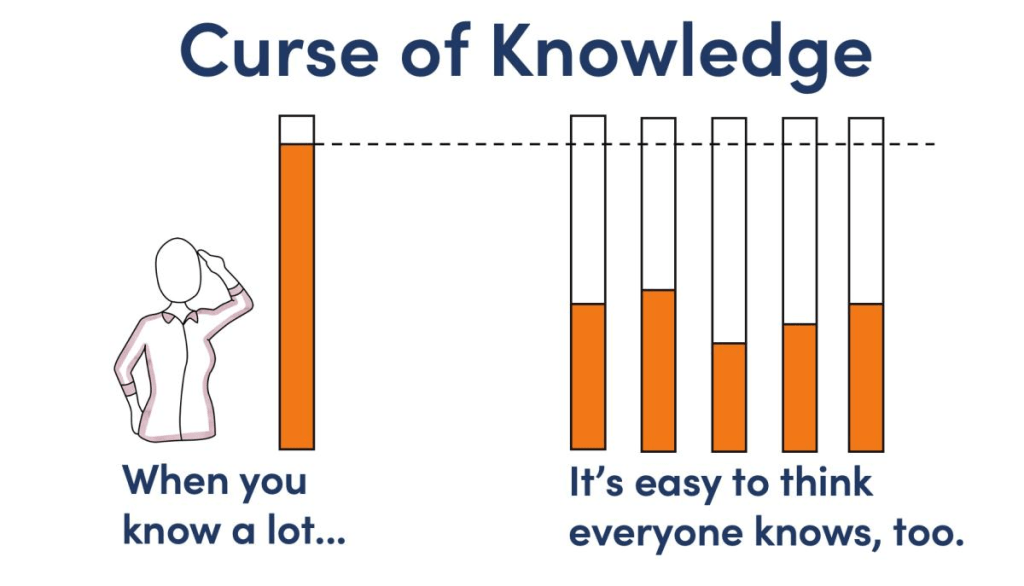

A bit of networking and research suggests that interested folks may be eschewing the actual course work in favor of just the high quality textbooks! UGH!

Another reason may be that our books and curricula are kept fresh and updated on our corporate website: http://www.MedicalBusinessAdvisors.com

Assessment

So, what do you think? Matriculation with the professional mark versus self study without the designation mark. Please opine.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

DOCTORS:

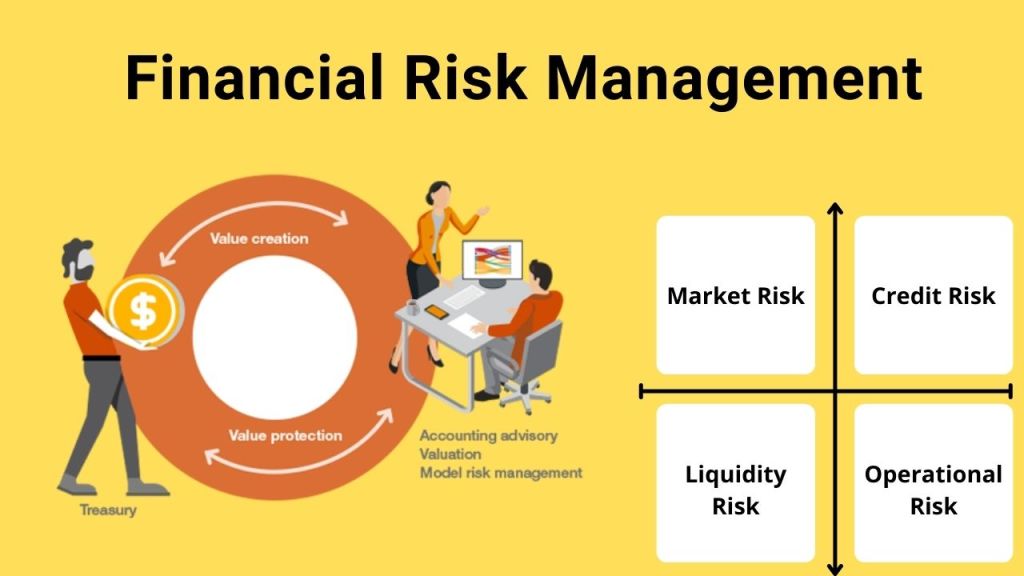

“Insurance & Risk Management Strategies for Doctors” https://tinyurl.com/ydx9kd93

“Fiduciary Financial Planning for Physicians” https://tinyurl.com/y7f5pnox

“Business of Medical Practice 2.0” https://tinyurl.com/yb3x6wr8

HOSPITALS:

“Financial Management Strategies for Hospitals” https://tinyurl.com/yagu567d

“Operational Strategies for Clinics and Hospitals” https://tinyurl.com/y9avbrq5

Adult Learners and Students:

***