By Bill Rusteberg

***

***

The New Payer You Never Heard Of

For 35 years we have lived in the world of managed care. Consumers have been conditioned to believe networks of “preferred” providers ensure better access, better benefits, lower cost and convenient claim settlement.

In the beginning managed care worked. Not all hospitals and physician groups were in networks and competition helped create cost savings for consumers and their employers. But over time consumers demanded more access and eventually almost all providers were “preferred” and in-network. Today less than 5% of all claims are out-of-network yet medical costs have increased. While professional providers are typically paid using managed care fee schedules, hospitals and other facilities are usually paid a percentage of whatever they charge, and over time, those charges have continued to increase.

As a result, we are seeing the rise of Reference Based Pricing (RBP) claim reimbursement strategies. RBP strategies are gaining popularity with self-funded employer plans particularly as a way to bring more transparency and accountability to health care pricing.

The new payer you never heard of are local employers breaking away from the status quo. You will not see recognizable logos or insurance company names on their health insurance I.D. cards. You may wonder “what kind of insurance is this?”

What is Reference Based Pricing?

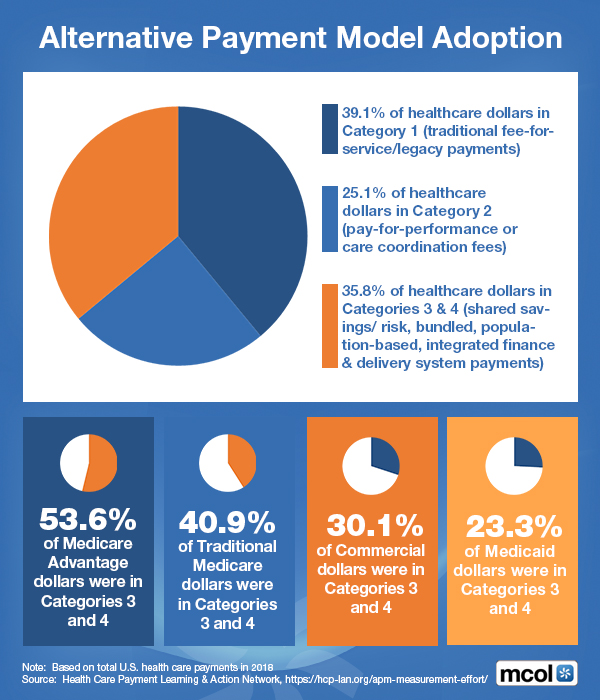

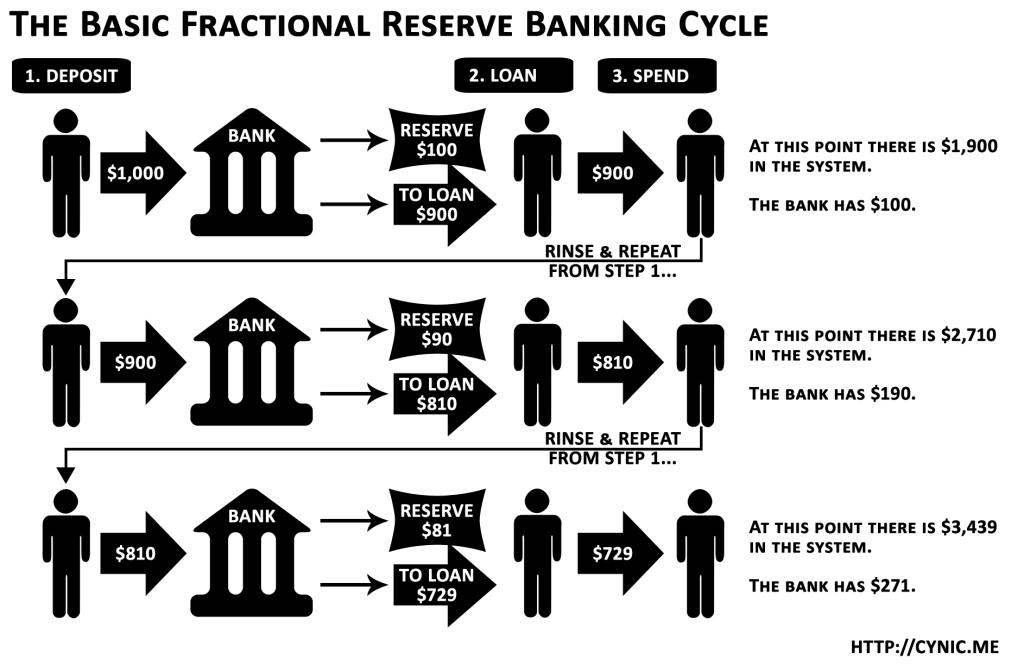

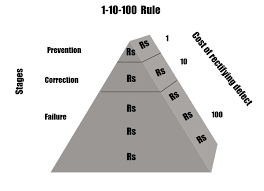

RBP sets uniform provider payments relative to a benchmark. The most commonly used benchmark is the Medicare Fee Schedule, a widely known payment methodology. Because Medicare fee schedules are on the low end of provider reimbursement, RBP health plans typically add a margin to ensure fair and equitable payment and profits for medical care givers. Margins can range from 120% to 150% of Medicare and more.

PPO networks, on the other hand, set opaque pricing at an arbitrary number to which an arbitrary discount is applied. Instead of this top down approach, RBP health plans utilize a bottom up approach.

In addition, employers are not privy to negotiated PPO rates while reimbursement allowances are transparent and clearly disclosed in RBP plans. This is one of several important distinctions between managed care pricing strategies and RBP.

An extension of RBP may include detailed claim audit protocols to facility claims prior to claim settlement. These audits typically produce savings of 5 – 7%. Managed care contracts, on the other hand, typically prohibit or severely limit an employer’s right to audit claims, another important difference.

The Growth of Reference Based Pricing

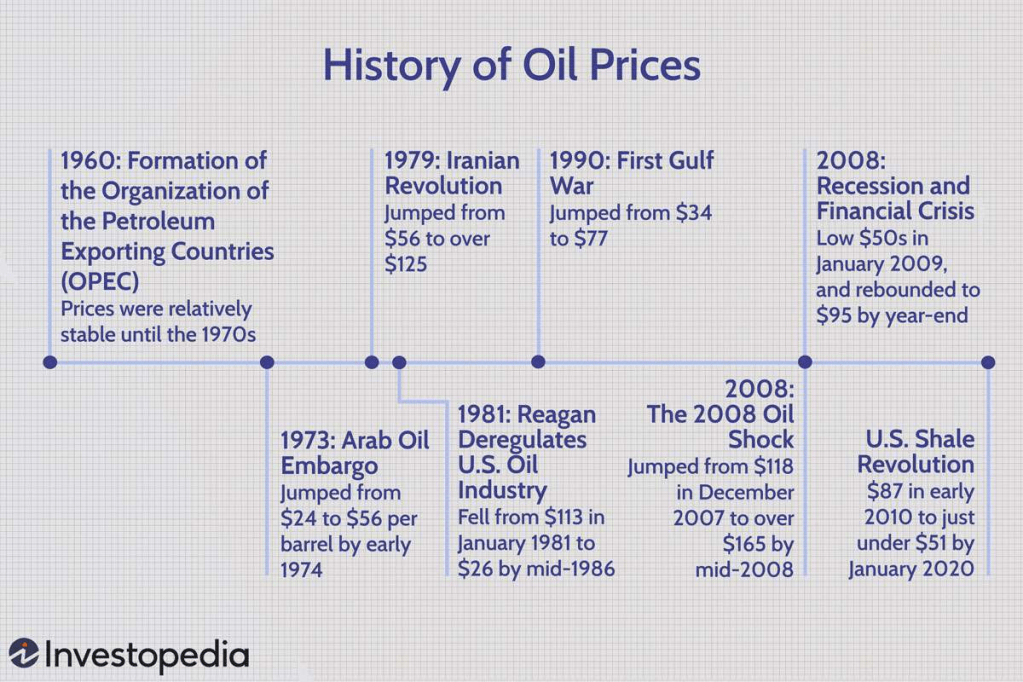

While many readers may view this as something new, it’s simply another form of the indemnity plans that were common prior to the advent of managed care in the early 80’s.

The first RBP health plan in Texas was established in 2008 in San Antonio. Since then the concept has gained national momentum and is growing most rapidly among mid-size self-funded employers. However, we are beginning to see larger employers such as the state of Montana adopting this strategy for their employee benefit program. The Oklahoma State Medical Association adopted RBP strategies for their member health plans several years ago and has since expanded their program offering to Texas medical providers.

Medical Community Reaction

Since inception of Reference Based Pricing plans (RBP) in San Antonio fifteen years ago, professional providers have generally accepted patients insured through these plans. Professional providers, particularly primary care physicians, may earn more under this payment methodology than earned under many managed care contracts. In addition, RBP plans do not intrude on the physician-patient relationship as there are no contractual terms and conditions providers are bound to accept.

Hospitals have generally remained opposed to RBP plans, yet few patients are turned away for care because reimbursement levels are fair and reasonable. In those rare instances a patient is turned away RBP plans often arrange a bundled cash payment at mutually agreed reimbursement levels that are often less than what the plan would have otherwise paid.

Action Plan for Physicians and Their Administrators

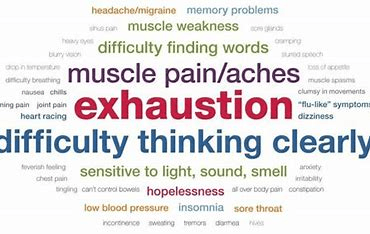

With the explosive grown of RBP plans, physicians and their administrators should establish an action plan for RBP patients or potential patients seeking their services. What transpires at the point of contact with a patient can be critical. A knowledgeable staff insures adequate controls in determining patient financial responsibility. Turning away patients is not always a good business practice and is unnecessary in cases where RBP payment parameters are within a practice’s normal scope of acceptance.

Always check for network logos on the members’ I.D. card. When calling an unfamiliar health plan or TPA to verify eligibility and benefits, ask what provider network(s) the plan uses for physicians and hospitals.

If the customer service representative says that there is no hospital or professional network or that the plan is “open access”, ask whether the plan pays hospitals and/or physicians based on a standard reference price or a fixed % of Medicare.

Staff administration should pre-determine the minimum level of acceptable payment based on a % of Medicare. This will empower intake clerks, at the point of contact, to determine if a plan’s reimbursement level is adequate and approved by administration. This will also assist intake clerks in determining each patient’s responsibility. Some RBP plans clearly indicate the basis of claim payment on member’s I.D. cards, i.e., “Plan Pays XXX% of Medicare.”

If procedures are regularly performed in a facility setting and there is a choice of hospitals or ambulatory surgery centers, staff should ask whether the plan has any direct contracts or has a good working relationship with any of the local facilities. Most RBP plans have established direct agreements with certain local providers or are interested in doing so.

It takes very little effort to certify a patient’s financial ability to pay for services. Verification is a phone call away. Intake clerks should be trained to ask the right questions, applying the answers against pre-determined parameters of acceptance rather than reliance upon a list of “approved insurance plans.” Turning patients away at the front desk when their insurance coverage pays as much as or more than “approved” plans is poor business.

Partnering With Employer Health Plans

A professional provider would be wise to reach out directly to local employers adopting RBP plans to arrange direct agreements, especially when it is discovered an employer important to the practice has adopted RBP. A direct agreement with an employer sponsored health plan would eliminate balance billing and provide steerage. Typically direct RBP agreements are no more than one page in length and contain a 30 day out clause. There are no third party intermediaries involved.

Some RBP plans allow professionals to name their price. A sharing arrangement between the health plan and plan member assures full payment based on a mutually agreed pricing benchmark. For example, a plan may set its claim exposure at 120% of Medicare. A professional provider may agree to accept 150% of Medicare. The 30% differential would be borne by the plan member in the form of a pre-set co-pay amount. There would be no co-pay through providers who have agreed to accept the plans benchmark pricing, in this example 120% of Medicare. A tiered co-pay strategy solves provider access issues, benefiting providers, patients and employer health plan budgetary constraints.

The Future of Reference Based Pricing

RBP strategies are a transitory phenomenon, a bridge serving as a basis for more change to come in a dynamic market.

RBP health plans will continue to gain market share in the next several years as more independent third party administrators (TPAs) and insurance companies are offering RBP options with new entrants into the market almost monthly.

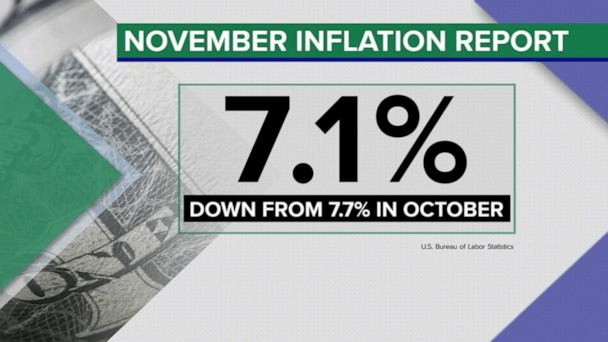

Professional providers should understand that RBP is yet another way to pay health care claims and would be wise to acclimate to this kind of pricing. As the Medicare eligible population of the United States increases from 17% in 2015 to 23% in 2023, professional providers will see more patients at Medicare rates than ever before. The good news for professional providers is RBP plans generally pay more.

There is good news for employers too. RBP plans give self-funded employers a powerful cost containment tool that can make health care more affordable for their employees.

You can expect to see a growing number of patients insured through RBP plans seeking your services. It would be good business to understand this growing trend now in order to accommodate them. RBP will create opportunities for physician-led bundles and other direct contracting strategies that benefit local employers, giving you more control and save money for your patients.

The Future

Reference Based Pricing is a transitory phenomenon leading to something better for all stakeholders. We are seeing a new trend rising in health care financing that removes third party barriers between patients and their physicians.

Removing third party intermediaries between providers and the patients they serve is the foundation on which to provide better benefits at a lower cost for health care consumers. Cash pay settlements at the point of service, in real time, will be a major component of that, getting back to the way care and doctor-patient relationships once were, without the intervention of an insurance company.

Plan members will pay cash at the time of service through plan sponsored funding. Physicians will receive cash payment by way of pre-negotiated electronic super bill at the time of service. No claims filing and no chasing patient share required, saving providers both time and expense. Hospitals will be paid in full on day of service too, saving time and expense filing claims and chasing patient share.

Community based health plans will adopt a cash pay network of medical caregivers. Access and delivery of care on a local, collaborative basis by mutually controlling costs in a direct relationship with one another as opposed to the indirect relationships we find in our current carrier-driven dynamic will be key to providing community members with responsive and affordable access to care.

Community health plans will adopt Direct Primary Care as a key focal point for all subsequent care. Capitated rates will replace fee-for-service fee schedules. Primary care physicians will, for the first time in their careers, devote 100% of their working hours to treating patients, not burdened with EMR’s and other administrative functions at the beck and call of third party intermediaries.

One example of a Community Health Plan is currently under development in central Texas. It will incorporate ER, Lab & Radiology, and direct primary care at a capitated rate of less than $125. A cash based reimbursement wrap for all other covered services through a cash pay provider network will cover remaining covered medical services.

The reader may find this to be a pipe dream that will never happen. On the contrary, it’s happening now and it’s growing faster than a melting raspa on a scorching August afternoon in deep South Texas. It’s the new payer you’ve never heard of.

CITE: https://www.r2library.com/Resource/Title/082610254

MORE: https://medicalexecutivepost.com/2022/09/26/podcast-reference-based-pricing-for-medical-facility-fees/

***

COMMENTS APPRECIATED

Thank You

***

ORDER: https://www.amazon.com/Dictionary-Health-Insurance-Managed-Care/dp/0826149944/ref=sr_1_4?ie=UTF8&s=books&qid=1275315485&sr=1-4

***

Filed under: "Doctors Only", Accounting, Experts Invited, Funding Basics, Glossary Terms, Health Economics, Health Insurance | Tagged: Bill Rusteberg, Future of Health Care, RBP, Reference Based Pricing | 1 Comment »