By Staff Reporters

***

DEFINE: https://wordpress.com/post/medicalexecutivepost.com/274910

DEFINITION: https://www.cfainstitute.org/-/media/documents/issue-brief/payment-for-order-flow.ashx

CITE: https://www.r2library.com/Resource/Title/082610254

***

***

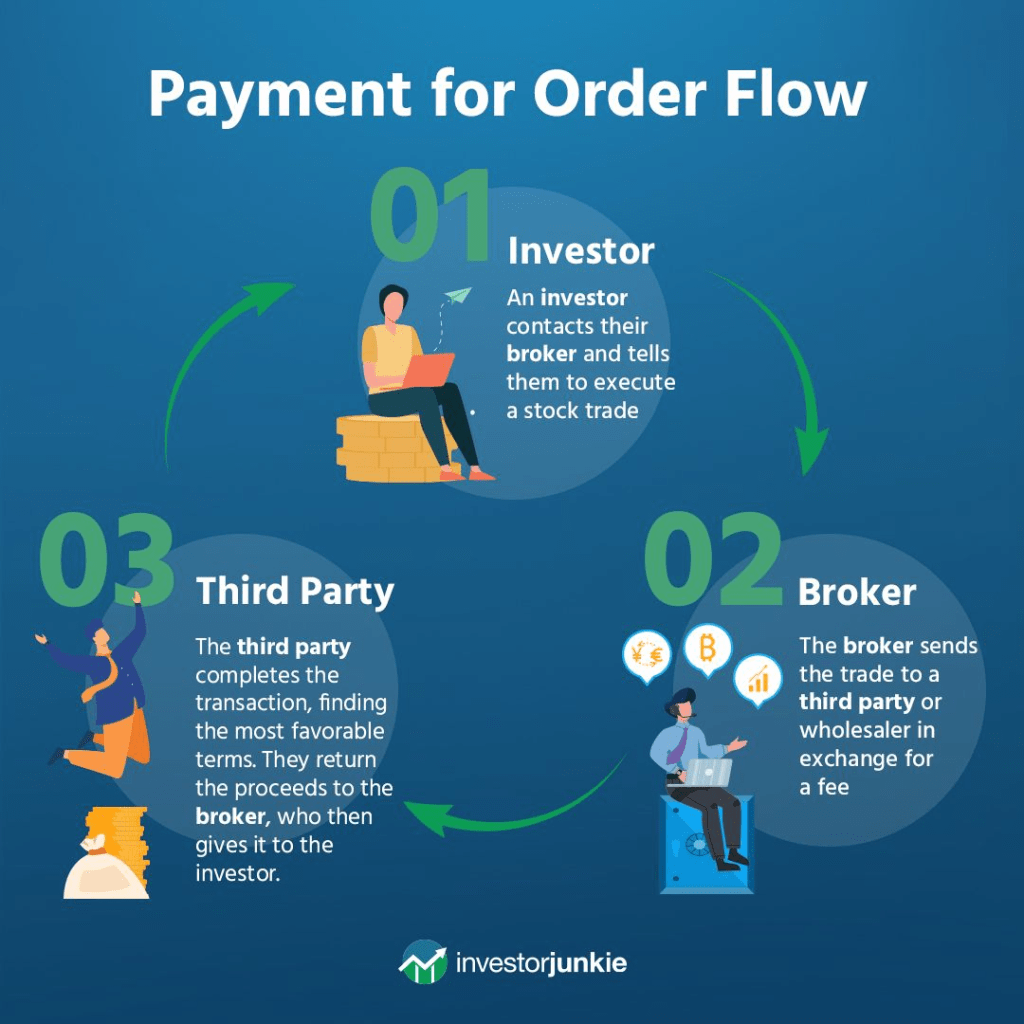

Yesterday the SEC proposed the biggest update to the stock trading rules book since 2005. The four proposed rules may become the magnum opus of Gary Gensler, who took over as SEC chair after the meme stock mayhem of 2021. The rules aim to get retail traders better prices by targeting a method of executing trades called payment for order flow (PFOF). PFOF works like this:

- Brokers like Robinhood send trades to wholesalers like Citadel, which profit off the difference between the individual trader’s proposed price and the price they actually make the trade for.

- Wholesalers pay brokers a small fee for the privilege of making the trade, and *juicy detail alert* those “small fees” make up a huge chunk of the brokers’ revenue.

Gensler has long argued that PFOF limits competition and encourages brokers to gamify risky trading behavior—like vetting your life savings on GameStop stock. The practice is banned in the UK and Canada.

But the SEC has definitely put it in the “no longer sparks joy” pile

Under the most significant rule proposed yesterday, the “order competition” rule, wholesalers would have to send most retail investors’ trades to an auction where dealers compete to fulfill them for the best price.

The wholesaler only gets to fulfill any leftover trades that no one has bid on. Some on Wall Street argue this will be the most common scenario so the rule won’t have its intended effect, but Gensler thinks auctions could save individual traders up to $1.5 billion per year.

***

***

COMMENTS APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", Breaking News, Ethics, Industry Indignation Index, Information Technology, Investing | Tagged: Payment for Order Flow, PFOF, PFOF Rules, PFOF: Rules Not Thrown Out Entirely!, SEC | Leave a comment »