***

***

By Dr. David Edward Marcinko MBBS DPM MBA MEd

***

***

Stress, Burnout, Divorce, and Practice Turmoil

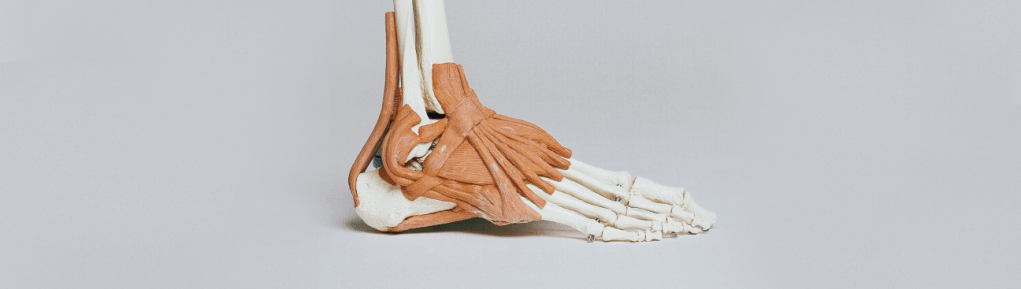

Podiatry, a specialized branch of medicine focused on diagnosing and treating conditions of the foot, ankle, and lower extremities, is often perceived as a stable and rewarding career. However, beneath the surface of clinical success and professional prestige lies a growing concern: the emotional and psychological toll of the profession. Stress, burnout, divorce, and practice turmoil are increasingly common among podiatrists, threatening not only their personal well-being but also the sustainability of their practices and the quality of patient care.

The Nature of Stress in Podiatry

Stress in podiatry arises from multiple sources. Clinical responsibilities, administrative burdens, patient expectations, and financial pressures converge to create a high-stakes environment. Podiatrists often work long hours, manage complex cases, and juggle the demands of running a business. The pressure to maintain high standards of care while navigating insurance reimbursements, staffing issues, and regulatory compliance can be overwhelming.

Moreover, podiatrists frequently deal with chronic conditions that require ongoing management rather than quick resolution. This can lead to emotional fatigue, especially when patients experience limited improvement or express dissatisfaction. The cumulative effect of these stressors can erode a podiatrist’s sense of purpose and satisfaction, leading to burnout.

Burnout: A Silent Epidemic

Burnout is characterized by emotional exhaustion, depersonalization, and a reduced sense of personal accomplishment. In podiatry, it manifests as fatigue, irritability, cynicism, and a decline in empathy toward patients. Burnout not only affects the practitioner’s mental health but also compromises patient safety, increases the risk of medical errors, and contributes to staff turnover.

Studies have shown that healthcare professionals, including podiatrists, are at a higher risk of burnout compared to other professions. The isolation of solo practice, lack of peer support, and limited access to mental health resources exacerbate the problem. Without intervention, burnout can progress to depression, substance abuse, and even suicidal ideation.

Divorce and Personal Strain

The personal lives of podiatrists are not immune to the pressures of the profession. Divorce rates among physicians, including podiatrists, are notably high. The demands of the job often leave little time for family, leading to strained relationships and emotional disconnect. The stress of managing a practice can spill over into home life, creating tension and conflict.

Divorce, in turn, can intensify professional stress. Legal proceedings, financial settlements, and emotional upheaval can distract from clinical duties and disrupt practice operations. The dual burden of personal and professional turmoil can be devastating, leading to a downward spiral that affects every aspect of life.

Practice Turmoil: The Business of Healing

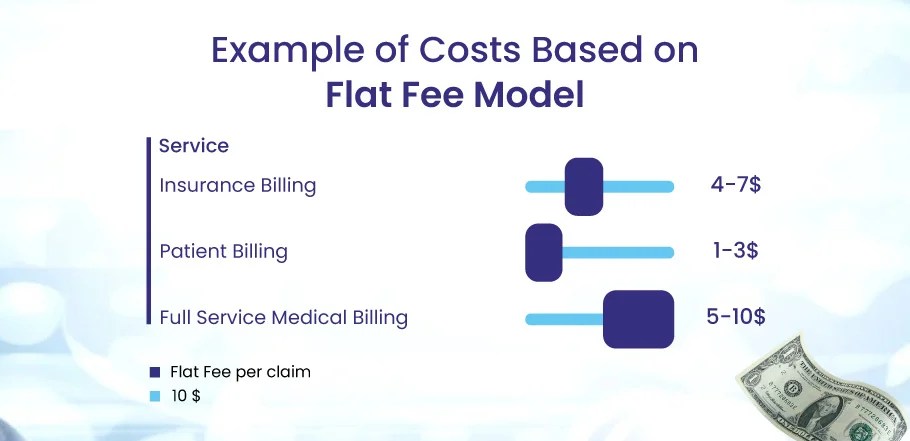

Running a podiatry practice is akin to managing a small business. Beyond clinical expertise, podiatrists must master marketing, human resources, billing, and compliance. Practice turmoil can arise from staff conflicts, financial mismanagement, poor patient retention, or changes in healthcare regulations.

For example, a sudden drop in reimbursements or a lawsuit can destabilize a practice. Staff turnover, especially among key personnel like office managers or billing specialists, can disrupt workflow and erode morale. Inadequate leadership or poor communication can lead to a toxic work environment, further fueling stress and burnout.

Addressing the Crisis

To combat these challenges, podiatrists must prioritize self-care, seek support, and implement systemic changes. Here are several strategies:

- Mental Health Support: Regular counseling, peer support groups, and wellness programs can help podiatrists process stress and prevent burnout.

- Work-Life Balance: Setting boundaries, delegating tasks, and scheduling personal time are essential for maintaining emotional health.

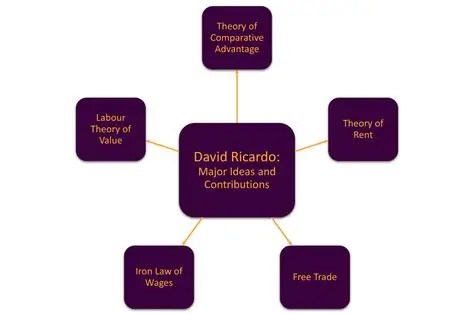

- Practice Management Training: Investing in leadership and business education can improve operational efficiency and reduce turmoil.

- Staff Engagement: Creating a positive work culture, recognizing achievements, and fostering open communication can enhance team cohesion.

- Technology Integration: Utilizing electronic health records, telemedicine, and automation can streamline administrative tasks and reduce workload.

Professional organizations also play a vital role. The American Podiatric Medical Association (APMA) and similar bodies can offer resources, advocacy, and continuing education to support practitioners. Medical schools and residency programs should incorporate wellness training and stress management into their curricula to prepare future podiatrists for the realities of the profession.

Conclusion

Podiatry is a noble and essential field, but it is not without its challenges. Stress, burnout, divorce, and practice turmoil are real and pressing issues that demand attention. By acknowledging these problems and taking proactive steps, podiatrists can safeguard their well-being, strengthen their practices, and continue to provide compassionate care to their patients. The path to healing begins not just with treating others, but with caring for oneself.

COMMENTS APPRECIATED

SPEAKING: ME-P Editor Dr. David Edward Marcinko MBA MEd will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Like, Refer and Subscribe

Filed under: "Doctors Only", Ask a Doctor, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, Practice Management, Professional Liability, Touring with Marcinko | Tagged: APMA, david marcinko, DNS, DPM, exchange-server, podiatric crisis, podiatric medicine, podiatrist, podiatry, powershell, system-center, windows-server | Leave a comment »