MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

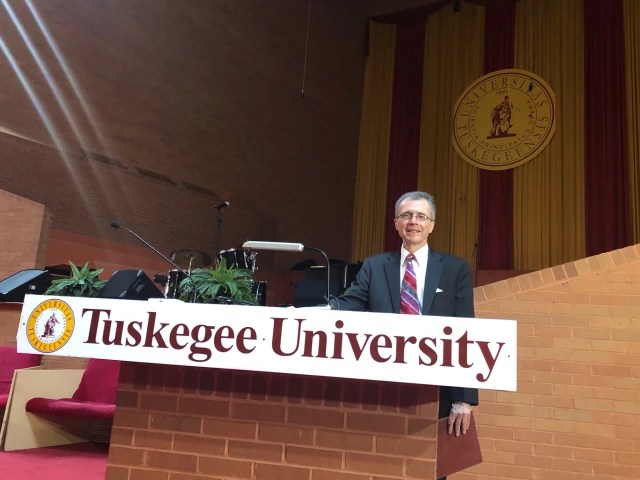

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2025 |

REFER A COLLEAGUE: MarcinkoAdvisors@outlook.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

CITE: https://www.r2library.com/Resource

🟢 What’s up

- Ford managed to rise 2.45% despite the automaker suspending its 2025 fiscal guidance, citing “industrywide supply chain disruption impacting production.”

- WeRide skyrocketed 31.68% on the news that it’s expanding its partnership with Uber to include rolling out robotaxis in 15 new cities. Pony AI soared 47.63% thanks to its bigger role helping Uber grow throughout the Middle East.

- Hims & Hers Health gained 18.12% after the telehealth stock beat analyst forecasts last quarter,even though it provided lower-than-expected revenue guidance this quarter.

- Celsius Holdings missed on both top and bottom line expectations, but shares of the energy drink maker still managed to bubble 4.81% higher.

- Mattel rose 2.78% even though the toy company paused its fiscal guidance and warned it will raise prices in the US.

- Upwork, everyone’s favorite side-gig platform, soared 18.02% as Americans brace for economic upheaval by finding second jobs.

- Constellation Energy may have missed Wall Street forecasts last quarter, but shareholders pushed the stock 10.29% higher on upbeat fiscal guidance.

- SolarEdge Technologies climbed 11.22% on a smaller-than-expected loss last quarter and projections that tariffs won’t be as bad as feared.

- Neurocrine Biosciences popped 8.36% thanks to strong revenue growth due to high sales of its movement disorder treatment Ingrezza.

What’s down

What’s down

- Tesla fell 1.75% on the latest data showing its sales plummeted in Europe last month, including a 46% decline in Germany.

- Pharma stocks took a beating after the FDA announced that industry critic Dr. Vinay Prasad will be named its top vaccine regulator. Moderna lost 12.25%, Novavax fell 3.19%, Merck sank 4.59%, and Pfizer fell 4.15%.

- Clorox got taken to the cleaners, losing 2.41% after missing Wall Street’s profit forecasts.

- Vertex Pharmaceuticals fell 10.03% thanks to big misses across the board last quarter due to higher costs.

- Lattice Semiconductor lost 9.28% after management warned that tariffs will have indirect consequences on its business.

CITE: https://tinyurl.com/2h47urt5

- US gross domestic product (GDP) contracted 0.3% in Q1, the Commerce Department reported yesterday, missing economists’ expectations of a 0.4% increase.

- That drop can likely be attributed to a massive spike in imports (roughly a 41% increase from the previous quarter) from companies stocking up on goods and materials before President Trump’s tariffs took effect. The Commerce Department counts imports as a negative in GDP calculations as they represent spending on foreign goods.

CITE: https://tinyurl.com/tj8smmes

Visualize: How private equity tangled banks in a web of debt, from the Financial Times.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@outlook.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: Drugs and Pharma, Information Technology, Investing, Marcinko Associates, Recommended Books, Sponsors | Tagged: commerce, Commerce Department, DJIA, DOW, GDP, GDP down, google, internet, Marcinko, NASA, NASDAQ, S&P 500, Technology, textbooks | Leave a comment »