UPDATE

At least three people are dead and multiple people are injured following a shooting at the Natalie Building at St. Francis Hospital in Tulsa, Oklahoma.

Link: https://www.msn.com/en-us/news/crime/at-least-3-dead-multiple-people-injured-in-shooting-at-oklahoma-medical-office/ar-AAXYITO?li=BBnb7Kz

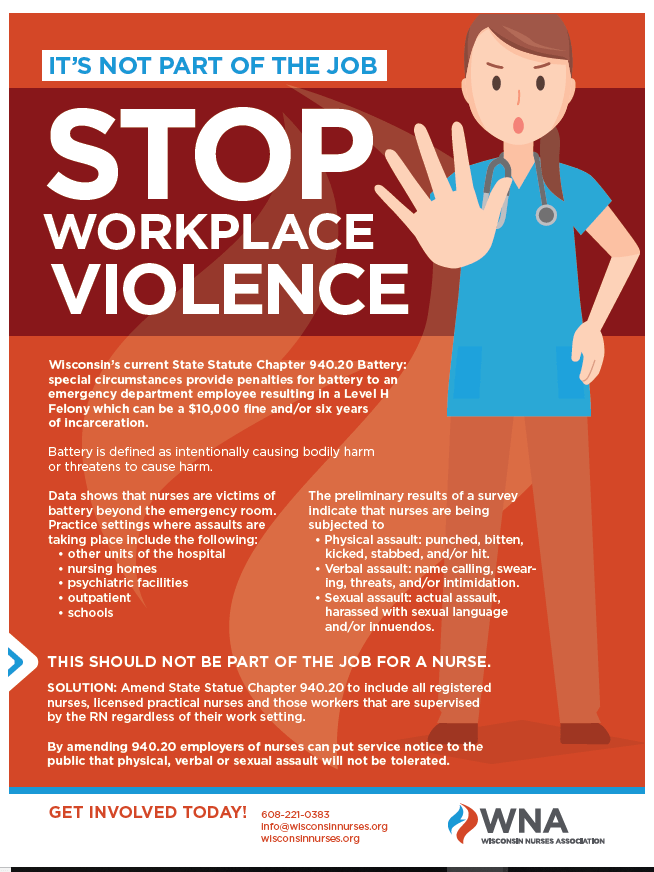

More than Physical Assault

[By Staff Reporters and Dr. David E. Marcinko MBA]

Workplace violence is more than physical assault.

Workplace violence is more than physical assault.

According to trauma specialist Eugene Schmuckler; PhD, MBA, CTS opining and writing in www.BusinessofMedicalPractice.com; workplace violence is any act in which a person is abused, threatened, intimidated, harassed, or assaulted in his or her employment. Swearing, verbal abuse, playing “pranks,” spreading rumors, arguments, property damage, vandalism, sabotage, pushing, theft, physical assaults, psychological trauma, anger-related incidents, rape, arson, and murder are all examples of workplace violence.

The RNANS

The Registered Nurses Association of Nova Scotia [RNANS], a leading study group, defines violence as “any behavior that results in injury whether real or perceived by an individual, including, but not limited to, verbal abuse, threats of physical harm, and sexual harassment.” As such, medical workplace violence includes:

· threatening behavior — such as shaking fists, destroying property, or throwing objects;

· verbal or written threats — any expression of intent to inflict harm;

· harassment — any behavior that demeans, embarrasses, humiliates, annoys, alarms, or verbally abuses a person and that is known or would be expected to be unwelcome. This includes words, gestures, intimidation, bullying, or other inappropriate activities;

· verbal abuse — swearing, insults, or condescending language;

· muggings — aggravated assaults, usually conducted by surprise and with intent to rob; or

· physical attacks — hitting, shoving, pushing, or kicking.

Cause and Affect

Workplace violence can be brought about by a number of different actions in the workplace. It may also be the result of non-work related situations such as domestic violence or “road rage.” Workplace violence can be inflicted by an abusive employee, a manager, supervisor, co-worker, customer, family member, patient, physician, nurse, or even a stranger.

The UI-IPRC

The University of Iowa – Injury Prevention Research Center [UI-IPRC] classifies most workplace violence into one of four categories.

· Type I Criminal Intent — Results while a criminal activity (e.g., robbery) is being committed and the perpetrator had no legitimate relationship to the workplace.

· Type II Customer/Client — The perpetrator is a customer or client at the workplace (e.g., healthcare patient) and becomes violent while being assisted by the worker.

· Type III Worker on Worker — Employees or past employees of the workplace are the perpetrators.

· Type IV Personal Relationship — The perpetrator usually has a personal relationship with an employee (e.g., domestic violence in the workplace).

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

ADVISORS: www.CertifiedMedicalPlanner.org

PODIATRISTS: www.PodiatryPrep.com

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Career Development, Ethics, Practice Management, Professional Liability, Research & Development, Risk Management | Tagged: assault, battery, healthcare violence, nurse abuse, physician abuse, workplace violence | 19 Comments »

***

***