Filed under: iMBA, Inc. | Leave a comment »

Anthem is Now Elevance Health

By Jakob Emerson, beckerspayer.com

***

***

The company formerly known as Anthem commemorated its official rebranding to Elevance Health on June 28th by ringing the opening bell at the New York Stock Exchange and beginning to trade under the new ticker symbol “ELV”. The former Anthem website now reflects the name change, which is a combination of the words elevate and advance to represent the company’s commitment to “elevating the importance of whole health and advancing health beyond healthcare for consumers.”

When it first announced the rebrand in March, the payer said Blue Cross Blue Shield health plan names would not change, though it planned to narrow the number of brands under its umbrella. The company owns BCBS plans in 14 states. On June 15, the company launched two new subsidiaries under the Elevance name: Carelon and Wellpoint.

Carelon, a healthcare services brand, will consolidate the company’s existing portfolio of capabilities and services businesses under a single name. The Wellpoint health plan brand will unify the company’s Medicare, Medicaid, and commercial health plans in select markets.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Breaking News, Experts Invited, Health Economics, Health Insurance | Tagged: Anthem, Anthem is Now Elevance Health, Beckerspayer, Carelon, Elevance Health, Jakob Emerson, WellPoint | Leave a comment »

UPDATE: Crypto IRS, Mid-Year Markets and the Inflation Economy

By Staff Reporters

***

***

Under a law passed by Congress last November, cryptocurrency firms are supposed to begin recording their clients’ detailed transaction data in 2023, with reports sent to the IRS and to investors the following year. From the beginning, industry executives have pushed back, complaining that the legislation was drafted too broadly. Now, the Treasury Department and the Internal Revenue Service are likely to push off a January date for the firms to begin tracking data such as customers’ capital gains and losses, according to anonymous insiders. The move would mean the tax agency waits longer to get the kind of data it gets for stocks or bonds.

| Bitcoin: $20,289.61 |

Markets: After another boring trading session, stocks wait to complete the first half of 2022—which will come at 4pm ET today. And, the carnage from Bed Bath & Beyond is a result of the company reporting a big sales decline from the previous year and showing CEO Mark Tritton the door.

Economy: Fed Chair Jerome Powell and two other central bank chiefs spoke about their inflation-combating efforts at a conference in Portugal. All three acknowledged that recent economic shocks (COVID, the war in Ukraine) have upended how inflation was understood for decades. “I think we now understand better how little we understand on inflation,” Powell said.

10 Year: 3.096%

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Glossary Terms, Health Economics, Investing, LifeStyle | Tagged: covid, crypro, Crypto IRS, cryptocurrency, economy, inflation, IRS, IRS Crypto, Jerome Powell, markets, midyear, the Markets and the Inflation Economy, Ukraine | Leave a comment »

Value v. Growth Fund Managers

Understanding Investment Styles

By Dr. David Edward Marcinko; MBA, CMP™

A mutual or hedge fund manager’s investment style is defined by the means or strategies used to accomplish the fund’s stated objective. Most managers have a strategy they believe to be the key to maximizing risk-adjusted investment returns. For example, two equity managers may seek growth of capital or capital appreciation over the long term. The strategies they use to achieve that goal can be vastly different, however, as evidenced by their choice of securities.

Style Characteristics

Astute physician-investors are aware that there are four, main manager style characteristics: value vs. growth, top-down vs. bottom-up—which can be refined further by additional approaches. Certain statistics and information reveal a manager’s style. An investor may prefer one style or one combination over another

Approaches Vary

Style approaches can be used in tactical asset allocation. Research has shown that one style tends to outperform the other during certain periods. If investors believe they can identify when one style will outperform the other, they could overweight the favored approach. More and more fund complexes are now offering funds in each style; especially for large healthcare entities and other institutions.

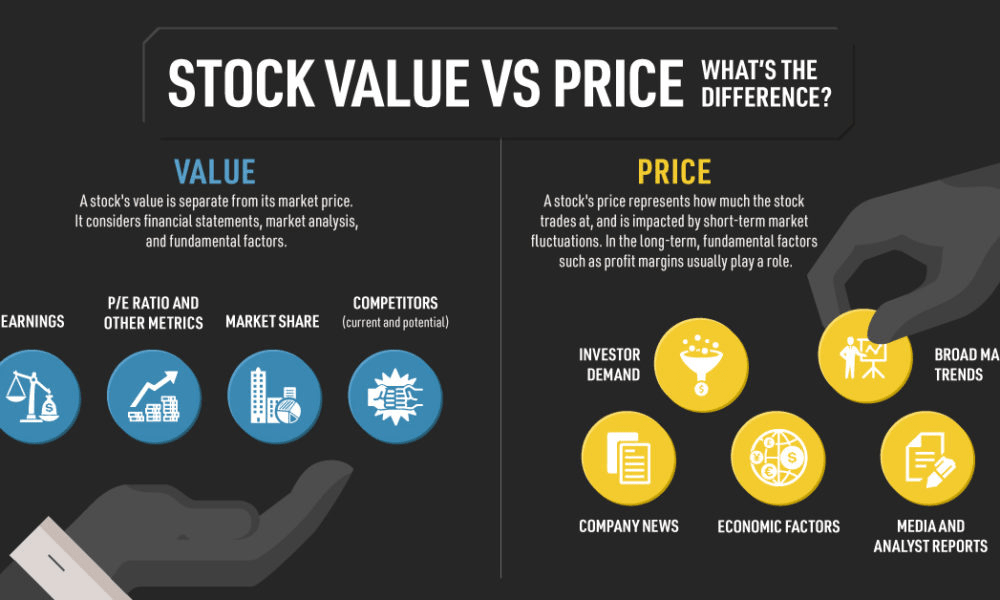

Value vs. Growth

Manager autonomy and style is an important consideration.

-

Value managers focus on a company’s assets or net worth and attempt to place a value on such assets: if their valuation is greater than the market’s valuation, the security is a candidate for ownership. Benjamin Graham, the father of value investing, believed this approach to selecting securities would eventually be recognized by the market, rewarding patient, long-term investors. In today’s service economy, value managers also attempt to value the intangible assets of a company, such as franchise value or human capital. Value managers tend to be contrarians—they buy out-of-favor stocks or stocks not widely followed or recommended by analysts. Value managers also look at the breakup value of a company (what the individual parts could be sold for). They buy cheap stocks: stocks with low P/E ratios or low price-to-book value relative to the market, and stocks of established companies that pay dividends.

-

Growth managers look at corporate earnings and focus on improving or accelerating earnings. They look at the trend of an industry or market sector (for example, environmental technology) to see if there is future sales-growth potential. They may lean toward companies that are dominant in the industry or have a product or service that will dramatically improve their market share. Growth managers typically own stocks with higher P/E ratios than the market average; these stocks may not be out of favor, but they may have been overlooked by market analysts. Growth stocks usually are not high-income-paying stocks.

Assessment

Prior to the recent financial meltdown, growth and momentum investing was the norm. Now it is value investing. What about the future for the physician-investor?

Conclusion

And so, your thoughts and comments on this Medical Executive-Post are appreciated.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Filed under: Financial Planning, Investing, Portfolio Management | Tagged: growth investing, value investing | 4 Comments »

IMHO @TeamCigna Should Treat their Dentists Better!

***

By Darrell Pruitt DDS

***

***

“How Is The Market Feeling About Cigna?” Spoiler – According to Benzinga insights, the market is not optimistic about Cigna’s future. Neither am I. But then, I’m only their clients’ dentist.

Link: https://www.benzinga.com/short-sellers/22/06/27888029/how-is-the-market-feeling-about-cigna

Tomorrow is my last day as a Cigna Preferred Provider .. Never Again!

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Career Development, Glossary Terms, Health Economics, Insurance Matters, Managed Care, Op-Editorials, Pruitt's Platform | Tagged: Cigna, Darrell Pruitt, DDS, dentists, TeamCigna Should Treat their Dentists Better! | Leave a comment »

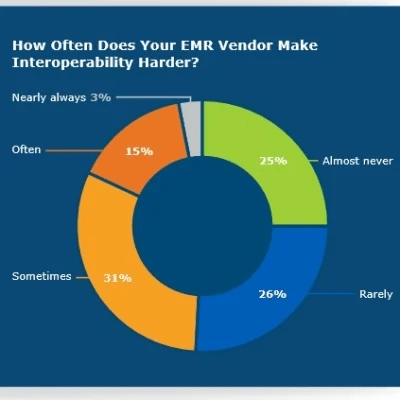

PODCAST: Healthcare I.T. Interoperability Rankings

By Eric Bricker MD

***

***

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Doctors Only", Career Development, Experts Invited, Glossary Terms, Health Economics, Information Technology, Videos | Tagged: EHRs, EMRs, Eric Bricker MD, Healthcare IT Interoperability Rankings | Leave a comment »

UPDATE: Boring US Stock Markets

By Staff Reporters

***

***

- Markets: Stocks were directionless dipping slightly lower without much market-moving news. But, Robinhood shares popped after a Bloomberg report claimed that the crypto exchange FTX is debating whether it might be able to buy the trading app. Sam Bankman-Fried, the CEO of FTX, already owns 7.6% of Robinhood.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Investing | Tagged: Boring US Stock Markets, markets, stock markets | Leave a comment »

Business Plan for Creatives … and Doctors!

A Detailed Plan for Medical Professionals

By Dr. David Edward Marcinko MBA CMP

http://www.CertifiedMedicalPlanner.org

***

***

MBA Business Plan CAPSTONE Outline

PODCAST Transcript: Podcast

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, urls and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

[PRIVATE MEDICAL PRACTICE BUSINESS MANAGEMENT TEXTBOOK – 3rd. Edition]

[Foreword Dr. Hashem MD PhD] *** [Foreword Dr. Silva MD MBA]

***

Filed under: CMP Program, iMBA, Inc., Marketing & Advertising, Practice Management | Tagged: certified medical planner, CMP™ Class, Daivd Marcinko, Medical practice business plan | Leave a comment »

ENTREPRENEURIAL MANAGEMENT EFFICIENCY: “Slowly I Turned … Step by Step … Inch by Inch”

By Staff Writers

***

***

Venture capitalists who are in a rut should stop talking about how hard it is to raise a $100 million fund. Instead, raise a $5 million fund.

Rather, they should stop trying to invest $5 million at a time (with an 18-month window before going public). A better strategy is to start doing smaller investments with longer time horizons.

CITE: https://www.r2library.com/Resource/Title/082610254

Just like chili, low and slow is the way to maximum flavor.

READ: https://tinyurl.com/2ewwvz2c

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Glossary Terms, iMBA, Inc., Op-Editorials, Practice Management, Research & Development | Tagged: ENTREPRENEURIAL MANAGEMENT EFFICIENCY: “Slowly I Turned … Step by Step … Inch by Inch", Inch by Inch, management efficiency, Slowly I Turned, Step by Step, venture capitalists | Leave a comment »

U.S. Supreme Court Sides with Doctors Challenging Opioid Convictions

***

By Nate Raymond

***

***

(Reuters) – The U.S. Supreme Court just made it harder for prosecutors to win convictions of doctors accused of running “pill mills” and excessively prescribing opioids and other addictive drugs by requiring the government to prove that defendants knew their prescriptions had no legitimate medical purpose.

READ FULL STORY: https://www.msn.com/en-us/news/us/u-s-supreme-court-sides-with-doctors-challenging-opioid-convictions/ar-AAYUg31?cvid=c26cb4159770466e984575227031e724

Related: https://medicalexecutivepost.com/2012/02/26/medical-uses-of-abused-drugs/

FAKE Rx: https://medicalexecutivepost.com/2022/05/10/fake-prescription-drug-rx-example/

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Breaking News, Drugs and Pharma, Ethics, Glossary Terms | Tagged: Nate Raymond, opioid, Opioid Crisis, pill mills, Reuters, Supreme Court, U.S. Supreme Court Sides with Doctors Challenging Opioid Convictions | Leave a comment »

REPORT: Digital Health Technology

By Staff Reporters and MCOL

***

***

Digital Health Tech Report – 5 Key Findings

• 48% of hospitals don’t have a strong digital health strategy.

• 90% believe a strong digital health strategy is critical to improving outcomes, increasing productivity, and enhancing clinician satisfaction.

• 55% receive more than 11 vendor calls and emails from digital health solution vendors per week.

• 95% say it’s challenging to narrow down the list of digital health solutions to evaluate.

• 25% are “very confident” that, after selecting a new digital health solution, it’s truly the best one for their unique needs.

Source: Panda Health, April 2022

***

***

***

Filed under: Glossary Terms, Information Technology | Tagged: Dictionary of Health Information Technology and Security, digital health strategy, digital health tech, health information technology, HIT, IT, MCOL, Panda Health | Leave a comment »

HEALTH TECH: Technology Giants?

***

Dr. Bertalan Meskó, MD PhD

***

The Medical Futurist

***

- Google in healthcare: The search giant has repeatedly successfully transferred its in-depth knowledge of algorithms in the field of medicine, particularly since it acquired DeepMind.

- Apple in healthcare: Apple will keep on working on expanding the health features of its devices, Apple Watch and iPhones included.

- Microsoft in healthcare: Microsoft’s cloud solutions provide integrated capabilities that make it easier to improve the healthcare experience.

- Amazon in healthcare: Amazon will make further use of its vast knowledge of online shopping trends and behavior and will keep on providing what people need, from medicine to wearables.

- IBM in healthcare: IBM has a lot to offer in federated learning, blockchain, and quantum computing

- Nvidia in healthcare: NVIDIA seems incredibly focused on its approach to healthcare. We can expect NVIDIA to be a leader in the use of artificial intelligence in healthcare

- Facebook in healthcare: The Metaverse developed by Facebook/Meta has incredible potential to revolutionize healthcare.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Experts Invited, Glossary Terms, Health Economics, Healthcare Finance, Information Technology | Tagged: Bertalan Meskó, Dictionary of Health Information Technology and Security, HEALTH TECH: Technology Giants?, healthcare technology giants, HT, IT, Technology Giants | Leave a comment »

UPDATE: Market Predictions and the Global Economy?

By Staff Reporters

***

***

- Predictions: The stock market could surge 7% this week as quarter-end re-balancing leads to a buying spree in equities, according to JPMorgan. The bank expects re-balancing trades to favor equities after a year-to-date decline of nearly 20%. “Next week’s re-balance is important since equity markets were down significantly over the past month, quarter and six-month time periods.”

- Markets: With the S&P having plunged nearly 18% this year, expect W. Buffett to preach the value of value stocks (aka steady, non-flashy public companies). By one measure, they’re on track to beat growth stocks by the widest margin in more than two decades, according to the WSJ.

- Global economy: Russia defaulted on its foreign-currency sovereign debt for the first time since the Bolshevik Revolution in 1918 after failing to pay bondholders $100 million worth of interest by the end of a 30-day grace period. The default marks the beginning of a complex legal journey for bondholders, but it’s not expected to have any major consequences for the Russian economy, which has already been battered by Western sanctions.

CITE: https://www.r2library.com/Resource/Title/0826102549

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Breaking News, Experts Invited, Financial Planning, Glossary Terms, Investing | Tagged: Buffett, Global Economy, JPMorgan, Market predictions, russian default, S&P, WSJ | Leave a comment »

Ransomware Simplified?

***

By Darrell K. Pruitt DDS

***

***

“We’re now truly in the era of ransomware as pure extortion without the encryption –

Why screw around with cryptography and keys when just stealing the info is good enough”

–Jessica Lyons Hardcastle

{The Register, June 25, 2022]

READ: https://www.theregister.com/2022/06/25/ransomware_gangs_extortion_feature/

***

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Doctors Only", Career Development, Experts Invited, Information Technology, Pruitt's Platform | Tagged: Darrell Pruitt, EHRs, EMRs, RansomWare, Ransomware Simplified | Leave a comment »

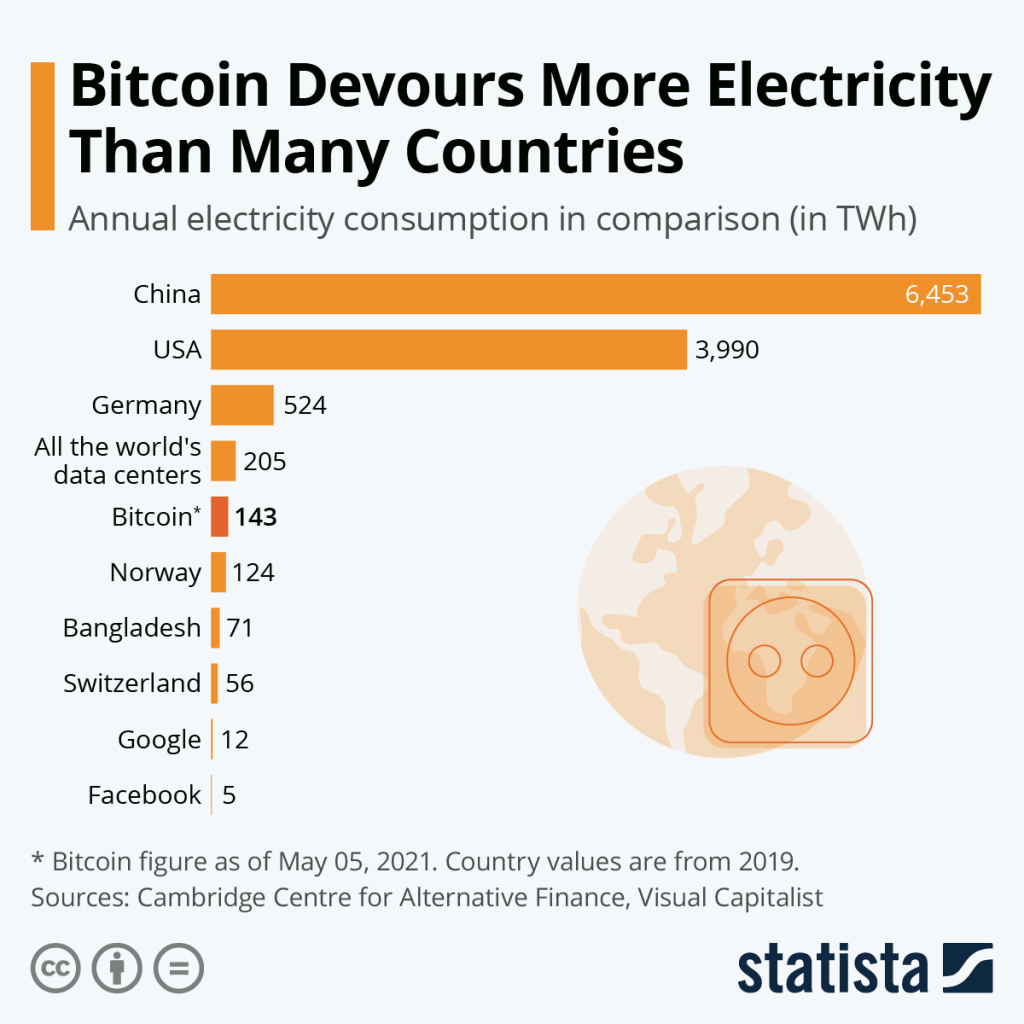

UPDATE: Crypto Energy Use and the Markets

By Staff Reporters

***

***

Bitcoin’s energy hunger, which has alarmed environmentalists and consumer advocates concerned about pollution and utility prices, comes from the process of mining new tokens. Bitcoin miners earn new tokens by validating transactions through an inherently energy-inefficient process, using specialized machines to solve complex puzzles. All that computing by all those machines has led to an energy appetite rivaling that of entire nations. Bitcoin’s annualized energy consumption has fallen from about 204 terawatt-hours (TWh) per year on June 11th to around 132 TWh per year on June 23rd. But even though its electricity use has plunged, it’s still very high — roughly equivalent to the amount of electricity Argentina uses in a single year.

Editor’s Note: Incidentally, colleague Mike Burry MD, the Scion Asset Management boss has also compared the crypto boom to the dot-com and housing bubbles, and cautioned that retail buyers of meme stocks and crypto are barreling towards the “mother of all crashes.” – DE Marcinko

Markets: Finally, and according to preliminary data, the S&P 500 gained 116.98 points, or 3.08%, to end at 3,912.71 points, while the NASDAQ Composite gained 380.21 points, or 3.38%, to 11,612.40. The Dow Jones Industrial Average rose 839.93 points, or 2.70%, to 31,505.59.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Glossary Terms, Investing, LifeStyle | Tagged: bitcoin electricity, bitcoin's energy, crypto, crypto energy, DJIA, Dow Jones Industrial Average, markets, Mike Burry MD, NASDAQ, S&P | Leave a comment »

What is Techno SCAM-BAITING?

BY ANONYMOUS

SPONSOR: http://www.CertifiedMedicalPlanner.org

Scam-Baiting Behind the Scenes

The most basic form of scambaiting sets out to waste a scammer’s time. At a minimum, scambaiters attempt to make scammers answer countless questions or perform pointless and random tasks. By keeping a scammer busy, scambaiters claim they’re preventing the scammer from defrauding a real victim.

Scambaiting may also be conducted with a specific purpose in mind. Sometimes scambaiters attempt to obtain an offender’s bank account information, for instance, which they then report to a financial institution. But there are other, less benevolent motives in the scambaiting community.

Thousands of scambaiters are organised on the 419eater forum, which describes itself as the “largest scambaiting community on earth”, with over 1.7 million forum threads. The forum was first established in 2003 to tackle the growing issue of 419 emails – a scam that promises people huge sums of cash in return for a small upfront fee.

419eater provides a particularly interesting case study because members are incentivised and rewarded for their scambaits through a unique system of icons, regarded as trophies, that they can obtain in their profile’s signature lines.

***

***

Healthcare: https://www.scamwatch.gov.au/types-of-scams/buying-or-selling/health-medical-products

Medical Insurance: https://www.reddit.com/r/scambait/comments/jsgffx/just_got_a_scam_call_to_sign_me_up_for_bogus/

YOUR COMMENTS ARE APPRECIATED.

***

THANK YOU

***

Filed under: Breaking News, Career Development, CMP Program, Ethics, Glossary Terms, Information Technology, LifeStyle, mental health, Op-Editorials | Tagged: 419eater forum, behind scenes scam-baiting, Certified Medical Planner™, CMP, internet fraud, phone fraud, scam baiting, scambaiting | Leave a comment »

SUPREME COURT: Rules Against HHS Drug Pricing [340-B] Program

By Health Capital Consultants, LLC

***

***

U.S. Supreme Court Rules Against HHS in 340B Case

On June 15, 2022, the U.S. Supreme Court released its decision regarding the cuts made by the Department of Health and Human Services (HHS) to the 340B Drug Pricing Program, finding that HHS acted outside its statutory authority in changing reimbursement rates for one group of hospitals without first surveying them on their costs.

The 340B Drug Pricing Program allows hospitals and clinics that treat low-income, medically underserved patients to purchase certain “specified covered outpatient drugs” at discounted prices. (Read more…)

***

COMMENTS APPRECIATED

Thank You

***

***

***

Filed under: Accounting, Breaking News, Drugs and Pharma, Events-Planner, Health Insurance, Op-Editorials | Tagged: 340-B, Health Capital Consultants LLC, HHS, Rules Against HHS Drug Pricing [340-B] Program, Supreme Court | Leave a comment »

UPDATE: Berkshire Hathaway, Sectors and the Surging Markets

***

***

W. Buffett’s Berkshire Hathaway purchased roughly 9.5 million shares of Occidental over the past week at a cost of nearly $530 million, according to a new regulatory filing late on Wednesday. Buffett’s investing conglomerate now owns roughly 152 million shares of Occidental—a 16.3% stake worth nearly $8.5 billion that makes Berkshire by far and away the largest shareholder in the energy giant.

Sectors: Sectors like utilities, consumer staples, and real estate helped push the market higher yesterday. Today, however, we could see a lot spicier action. Index provider FTSE Russell is re-balancing its stock benchmarks, which will send investors scrambling to trade an estimated $112 billion just before the market closes. Among other tweaks it’s making, Russell will now label Meta, Netflix, and PayPal as “value” stocks.

Markets:

- The Dow Jones Industrial Average DJIA, +2.68% gained 823.32 points, or 2.7%, to close at 31,500.68, its largest daily percentage gain since May 4.

- The S&P 500 SPX jumped 116.01 points, or 3.1%, to finish at 3,911.74, its biggest daily percentage gain since May 18, 2020.

- The NASDAQ Composite COMP, +3.34% surged 375.43 points, or 3.3%, to end at 11,607.62, its largest daily percentage gain since May 13.

For the week, the Dow booked a 5.4% gain, while the S&P 500 climbed 6.5% and the NASDAQ jumped 7.5%, according to Dow Jones Market Data. The Dow and S&P 500 each saw their biggest weekly gain since late May, while the NASDAQ had its best week since March.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Investing, LifeStyle | Tagged: Berkshire Hathaway, DJIA, FTSE, FTSE Russell, markets, NASDAQ, S&P, sectors, value stocks, Warren Buffett | Leave a comment »

What is Stock Price STRENGTH

By Staff Reporters

A few big stocks can skew returns for the market. It’s important to also know how many stocks are doing well versus those that are struggling. This shows the number of stocks on the NYSE at 52-week highs compared to those at 52-week lows.

When there are many more highs than lows, that’s a bullish sign and signals Greed.

CITE: https://www.r2library.com/Resource/Title/0826102549

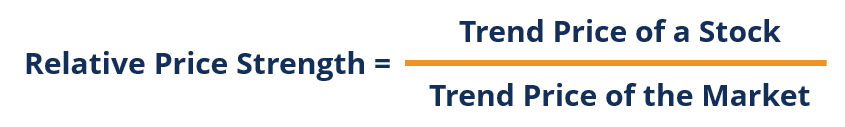

Now; Relative Price Strength (RPS) compares the price trend of a stock to the market.

An RPS > 1 indicates that the stock outperformed the market, an RPS < 1 indicates that the stock underperformed the market, and an RPS = 1 indicates that the stock performed on par with the market.

RPS can be misleading as it uses historical data and does not take into account risk.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Glossary Terms, Investing | Tagged: relative price strength, RPS, stock price breadth | Leave a comment »

Mutual Fund Terms and Definitions for Physicians

A “Need-to-Know” Glossary for all Medical Professionals

http://www.HealthDictionarySeries.org

[ME-P Staff Writers]

ADV: A two-part form filed by investment advisors who register with the Securities and Exchange Commission (SEC), as required under the Investment Advisers Act. ADV Part II information must be provided to potential investors and made available to current investors.

Alpha: A measure of the amount of a portfolio’s expected return that is not related to the portfolio’s sensitivity to market volatility. A benchmark that uses beta as a measure of risk, a benchmark and a risk free rate of return (usually T-bills) to compare actual performance with expected performance.

For example, a fund with a beta of .80 in a market that rises 10% is expected to rise 8%.

If the risk-free return is 3%, the alpha would be –.6%, calculated as follows: (Fund return – Risk-free return) – (Beta x Excess return) = Alpha (8% – 3%) – [.8 × (10% – 3%)] = (–) .6%

Note: A positive alpha indicates out-performance while a negative alpha means underperformance.

Asset allocation: Strategic asset allocation refers to the long-term targets for allocation of a percentage of a portfolio among different asset classes. In contrast, tactical asset allocation refers to short-term targets.

Average maturity: The average weighted maturity of the bonds in a portfolio providing an indication of interest rate risk.

Benchmark: An index, managed portfolio, or fund used to compare performance characteristics with the targeted portfolio or fund.

Beta: A statistically computed measure of the portfolio’s relationship to changes in market value. If, compared to the S&P 500, a fund has a beta of .80; it is expected to underperform a rising market by 20% and outperform a falling market by 20%.

Bond: Publicly traded debt instruments that are issued by governments and corporations. The issuer agrees to pay a fixed amount of interest over a specified time period and to repay the principal at maturity.

Closed-end mutual fund: An investment company that registers shares in accordance with SEC regulations and is traded in securities markets at prices determined by investments.

Diversification: Buying a number of different investment vehicles to protect against default of a single vehicle, thereby reducing the risk of the portfolio.

Duration: A more technical calculation of interest rate risk exposure that uses the present value of expected cash flows to be returned to the bond holder over the term of the bond.

Fundamental analysis: An analysis of a company’s stock that focuses on the economic environment, the industry the company is in, and the company’s financial situation and operating results.

Mutual fund: A regulated investment company that manages a portfolio of securities for its shareholders.

Net asset value (NAV): The value of fund assets fewer liabilities divided by outstanding shares.

Open-end mutual fund: An investment company that invests money in accordance with specific objectives on behalf of investors. Fund assets expand or contract based on investment performance, new investments and redemptions.

Portfolio manager: The person(s) who is/are responsible for managing the portfolio in accordance with the objectives dictated by an investor or a fund’s prospectus.

Prospectus: A disclosure document filed with the SEC and made available to prospective and current investors. The prospectus covers sales charges, expenses, investment objectives and restrictions, management fees, financial highlights, and other information.

R-squared (R2): Relationship of a fund or portfolio’s performance to a benchmark index.

For example, a fund R-squared of .5 means only 50% of its return is explained by the index. Other factors are responsible for the balance of performance.

SEC yield: A standardized calculation of yield over a 30-day period, sometimes quoted as the “30-day yield.” It takes into account yield-to-maturity rather than current dividends.

Standard deviation: A statistic that looks at a series of returns and expresses the average deviation from the mean return.

Statement of additional information: A disclosure document filed with the SEC that supplements the prospectus. It is made available to investors upon request.

Technical analysis: An analysis that focuses on trends in financial markets generally.

For example, a technical analyst may view an entire industry’s group of stocks to be declining. Although the analyst may be correct about the group of stocks as a whole, there may be exceptions represented by specific, individual companies.

Total return: The combination of investment return from income, such as dividends and interest, and appreciation or depreciation in the value of the investment (Income returns plus capital return.)

Turnover: Under SEC rules, a figure computed that indicates how often securities in the portfolio are bought and sold. For example, if turnover is 100% over a one-year period, the securities (on average) were replaced once.

12b-1 fee: The maximum annual fee payable from fund assets for distribution and sales costs as allowed by the SEC.

MORE: Glossary Terms Ap 3

Filed under: Glossary Terms, Investing | Leave a comment »

MARK CUBAN’s: “Cost Plus Drugs”. com

By Staff Reporters

***

***

Mark Cuban: The billionaire owner of the Dallas Mavericks just launched an online pharmacy for generic drugs that looks to cut out middlemen and combat pharmaceutical industry price gouging by offering steep discounts.

Set up as CostPlusDrugs.com with 100 generic drugs to treat conditions like diabetes and asthma. Cost Plus will not accept health insurance but claims its prices will still be lower than what people would typically pay at a pharmacy.

“All drugs are priced at cost plus 15%!” Cuban tweeted.

READ: https://medicalexecutivepost.com/2022/01/23/podcast-the-mark-cuban-cost-plus-drug-co-mccpdc/

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Drugs and Pharma, Health Economics, Health Insurance | Tagged: Cost plus Drugs, Cuban, Mark Cuban | Leave a comment »

The Market Technicians

Technical Analysis – Defined

[By Julia O’Neal; MA, CPA with Staff writers]

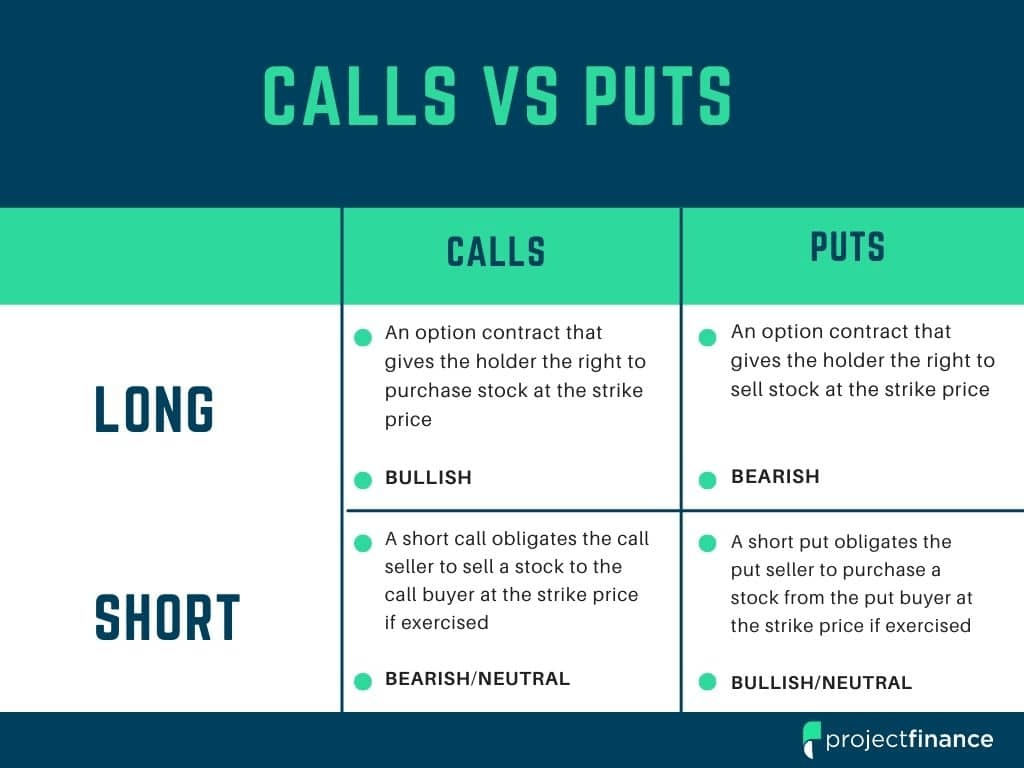

Technical market analysis focuses on the historical price and volume changes that occur as a stock trades, and it attempts to predict the stock’s future behavior based on prior patterns.

Technical analysis is not concerned with the financials of a company; it assumes that fundamental factors are already reflected in the market behavior of a stock and that the history of that behavior gives a strong clue to the future. The focus on price and volume in technical analysis could also be considered a study of supply and demand.

Technical analysis applies technical market theories to stock market data on stock prices, indexes, and trading. Technicians identify market trends and try to predict future movements.

Theoretically, technical and fundamental analysis exist in opposition to each other, but in reality, most fundamental analysts sneak a look at the charts from time to time and technical analysts pay attention to some fundamentals.

Both schools of thought are based on the possibility of predicting the future using the past. Market psychology, which does not always follow rhyme or reason, can prove both types of analysis wrong.

Technical analysis involves discovering patterns that repeat themselves. Patterns can exist for an individual stock or for an index, and stocks can be compared to their respective indexes.

Stocks (and indexes) are said to trade in a range. When prices go above this range, they often encounter selling pressure. This is called an area of resistance, and stocks are characterized as “overbought.”

Conversely, a decline below a level of support will instigate buying, because the stock seems cheap or “oversold.”

When a breakout occurs above a resistance level – or below a support level – technical analysts predict the stock will stay on the new course.

Methods for taking advantage of anticipated upward trends include buying stop orders or call options at a level slightly above the resistance level. To profit from downward trends, physician investors would enter a sell-stop order, sell short, or purchase put options at a price slightly below the support level.

- Accumulation areas occur when medical buyers are accumulating stock and the support level is moving up.

- Distribution areas occur when physician selling is occurring and the stock is considered weak.

- A sideways movement (the stock continues to be bought and sold at the same price for some time) is called an area of consolidation.

Other technical patterns:

A head and shoulders pattern may be either above (“head and shoulders top”) or below (“head and shoulders bottom”) a constant trend line. This theory assumes that after a top there will be a reverse; after a bottom, there will be a move back to a top.

Rising bottoms and ascending tops/falling bottoms and descending tops. A rising trend in the low prices of a security shows higher and higher support levels. Combined with ascending tops, this would be a bullish indicator. The reverse would be bearish.

Double top and double bottom show resistance and support levels. A double bottom shows the stock could break below support levels and reach new lows; a stock with a double top pattern might be expected to move on to a new high.

Assessment

What kind of physician investor are you; fundamental or technical?

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Our Other Print Books and Related Information Sources:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Hospitals: http://www.crcpress.com/product/isbn/9781439879900

Physician Advisors: www.CertifiedMedicalPlanner.org

***

Invite Dr. Marcinko

***

Filed under: Investing | Tagged: Investing Basics | 4 Comments »

UPDATE: Inflation, Gasoline & Oil Prices, Online Crypto Trading Firms and Altria

***

***

The rate of inflation rose again in May, remaining at 40-year highs, the Office for National Statistics revealed. The rate of Consumer Prices Index [CPI] inflation rose slightly to 9.1 per cent in May from 9 per cent in April, according to the ONS. The increase matches what analysts had expected. And, supply constraints, exacerbated by Russia’s war in Ukraine account for about half of the surge in US inflation, with demand currently making up a third of the increase, according to new research from the Federal Reserve Bank of San Francisco.

US gasoline futures are about 13% below the record high seen earlier this month and pump prices have dropped for more than seven days straight — the biggest run of losses since April — after rising to a fresh peak early last week, as recession concerns grip the market. Oil prices have tumbled toward $100 a barrel as traders fear that sharply higher interest rates would slow down economic growth and lead to demand destruction. The AAA reports that the average price of a gallon of regular gas slipped 6 cents since last week, to $4.955.

U.S. online trading firms specializing in crypto were hit hard after BinanceUS, an arm of the word’s biggest digital currency exchange, eliminated its bitcion spot trading fees. BinanceUS will now allow its users to trade bitcoin, the biggest cryptocurrency, against assets such as the U.S. dollar, tether, and other dollar-backed stablecoins for free, eliminating its prior levy of 0.1% on transaction valued at less than $50,000.00.

Altria’s big tumble—the tobacco company owns a 35% stake in Juul, and a WSJ report suggested the FDA could order Juul to yank its products off the market imminently.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Drugs and Pharma, Investing, LifeStyle | Tagged: Altria, crypto, gas, gasoline, inflation, Juul, oil, online crypto trading firms | Leave a comment »

SURVEY: Primary Care Doctor Trust or NOT?

By Staff Reporters

***

***

75% Trust Their Primary Care Physicians

• Primary care physicians: 75%

• Specialty care physicians: 66%

• Pharmacies: 59%

• Hospitals and clinics: 58%

• Health insurance company: 51%

• Government: 24%

Source: Health Sparq, “2022 Annual Consumer Sentiment Benchmark Report,” January 2022

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Career Development, Glossary Terms, Health Insurance, LifeStyle, Managed Care, Practice Management, Surveys and Voting | Tagged: physican trust, Primary Care Doctor Trust?, Primary Care Doctors, primary care trust, SURVEY: Primary Care Doctor Trust? | Leave a comment »

UPDATE: Cathie Wood, IRS Back-Log, US Single Family Rent and the Markets

***

***

- Cathie Wood warned that the Federal Reserve could cause a recession if it keeps hiking interest rates. The US central bank is ignoring three indicators that might show inflation easing, according to the Ark Invest CIO. First, aggressive hikes are unnecessary because inflation is already easing. Second, she pointed to the stagnating prices of gold and lumber, which are often seen as leading inflation indicators. “After soaring from $1,350/ounce pre-COVID to a peak of nearly $2,000 [an ounce] during 2020, the gold price has dropped back to $1,840 [an ounce] during the past two years. “The lumber price has dropped more than 50%.” Finally, Wood said fuel prices have likely peaked as Americans increasingly turn to electric vehicles. Surging oil prices have been one of the main drivers of inflation this year, with Brent crude up 48.3% to over $115 a barrel.

- The IRS says it is climbing out from under the unprecedented stack of tax returns that piled up after the agency had to scale back its operations and close facilities in 2020 following the onset of the pandemic. The agency announced that by the end of this week it will have cleared all original individual tax returns that were filed in 2021 and that didn’t contain any major mistakes. “Due to issues related to the pandemic and staffing limitations, the IRS began 2022 with a larger than usual inventory of paper tax returns and correspondence filed during 2021,” the IRS said in a statement. “The IRS took a number of steps to address this, and the agency is on track to complete processing of originally filed Form 1040 (individual tax returns without errors) received in 2021 this week.”

- Another record for US single-family rents, which jumped 14% year-over-year in April, marking the 13th period of record-breaking annual gains.

- Markets: Stocks bounced yesterday after their worst week in two years, led by energy stocks and Big Tech companies. Cypto even rose. Today, investors will be glued to Fed Chair Jerome Powell’s testimony on Capitol Hill. They want to know whether Powell expects to hike interest rates by another 75 basis points next month.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Investing | Tagged: brent, Cathie Wood, crypto, gas, IRS, IRS backlog, oil, rents, stock markets, US rent | Leave a comment »

Money Management and Portfolio Performance

Money Management and Portfolio Performance

By Jeffrey S. Coons; PhD, CFA

By Christopher J. Cummings; CFA, CFP™

Evaluating portfolio performance is a vital and often contentious topic in monitoring progress towards a physician’s investment goals.

Introduction

A typical portfolio’s objective may be to preserve the purchasing power of its assets by achieving returns above inflation – or to have total returns adequate to satisfy an annual spending need without eroding original capital, etc. Whatever the absolute goal for the doctor; performance numbers need to be evaluated based on an understanding of the market environment over the period being measured.

One way to put a portfolio’s a time-weighted return in the context of the overall market environment is to compare the performance to relevant alternative investment vehicles. This can be done through comparisons to either market indices, which are board baskets of investable securities, or peer groups, which are collections of returns from managers or funds investing in a similar universe of securities with similar objectives as the portfolio.

By evaluating the performance of alternatives that were available over the period, the physician investor and/or his/her advisor are able to gain insight to the general investment environment over the time period.

The Indices

Market indices are frequently used to gain perspective on the market environment and to evaluate how well the portfolio performed relative to that environment.

Market indices are typically segmented into different asset classes.

Common stock market indices include the following:

· Dow Jones Industrial Average – a price-weighted index of 30 large U.S. corporations.

· Standard & Poor’s (S&P) 500 Index – a capitalization-weighted index of 500 large U.S. corporations.

· Value Line Index – an equally-weighted index of 1700 large U.S. corporations.

· Russell 2000 – a capitalization-weighted index of smaller capitalization U.S. companies.

· Wilshire 5000 – a cap weighted index of the 5000 largest U.S. corporations.

· Morgan Stanley Europe Australia, Far East (EAFE) Index – a capitalization-weighted index of the stocks traded in developed economies.

Common bond market indices include the following:

· Lehman Brothers Government Credit Index – an index of investment grade domestic bonds excluding mortgages.

· Lehman Brothers Aggregate Index – the LBGCI plus investment grade mortgages.

· Solomon Brothers Bond Index – similar in construction to the LBAI.

· Merrill Lynch High Yield Index – an index of below investment grade bonds.

· JP Morgan Global Government Bond – an index of domestic and foreign government-issued fixed income securities.

Assessment

The selection of an appropriate market index depends on the goals of the portfolio and the universe of securities from which the portfolio was selected.

Just as a portfolio with a short-time horizon and a primary goal of capital preservation should not be expected to perform in line with the S&P 500, a portfolio with a long-term horizon and a primary goal of capital growth should not be evaluated versus Treasury Bills.

Conclusion

While the Dow Jones Industrial Average and S&P 500 are often quoted in the newspapers, there are clearly broader market indices available to describe the overall performance of the U.S. stock market.

Likewise, indices like the S&P 500 and Wilshire 5000 are capitalization-weighted, so their returns are generally dominated by the largest 50 of their 500 – 5000 stocks.

Fortunately, capitalization-bias does not typically affect long-term performance comparisons, but there may be periods of time in which large cap stocks out-or under-perform mid-to-small cap stocks, thus creating a bias when cap-weighted indices are used versus what is usually non-cap weighted strategies of managers or mutual funds.

Finally, the fixed income indices tend to have a bias towards intermediate-term securities versus longer-term bonds. Therefore, a physician investor with a long-term time horizon, and therefore potentially a higher allocation to long bonds, should keep this bias in mind when evaluating performance.

How do you evaluate your portfolio?

Do you evaluate it on a risk-adjusted basis?

***

Filed under: Portfolio Management | Tagged: Investing Basics | 1 Comment »

UPDATE: Corona-Virus, Silver Lining for Interest Rate Hikes with Stock Market Pessimism

By Staff Reporters

***

***

For the last two years, the Corona Virus killed Americans on a brutal, predictable schedule: A few weeks after infections climbed so did deaths, cutting an unforgiving path across the country. But that pattern appears to have changed. Nearly three months since an ultra-contagious set of new Omicron variants launched a springtime resurgence of cases, people are nonetheless dying from COVID at a rate close to the lowest of the pandemic. The spread of the virus and the number of deaths in its wake, two measures that were once yoked together, have diverged more than ever before, epidemiologists said. Deaths have ticked up slowly in the northeastern United States, where the latest wave began, and are likely to do the same nationally as the surge pushes across the South and West. But the country remains better fortified against COVID deaths than earlier in the pandemic, scientists said.

***

The recent FOMC interest rate hike campaign is not all bad news. There is a silver lining for savers. “Rising interest rates represent a turn of fortunes for savers as interest earnings are finally on the rise, and eventually those higher interest rates will help reduce inflation,” Greg McBride, Bankrate’s chief financial analyst, told ABC News. “This is the opposite of what savers have endured the past three years when interest rates fell and then inflation took off.”

***

Markets: Of the 17 times the S&P has dropped more than 15% since 1950, on 11 of those occasions stocks bottomed out only when the FOMC began to signal a loosening of monetary policy, according to an analysis by Goldman Sachs.

HAPPY SUMMER SOLSTICE 2022

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", Alerts Sign-Up, Investing | Tagged: corona, Corona-Virus, interest rates, IR, IR Hikes, market pessimism, Silver Lining for Interest Rate Hikes | Leave a comment »

Four Health 2.0 Innovators to Know

Tell Us What You Think!

By Staff Reporters

1. Price Doc

The mission of PriceDoc is to reduce the cost of medical and dental procedures while making the practices of physicians and dentists more efficient and profitable. PriceDoc benefits both providers and consumers. Providers always desire pre-payment with cash. It reduces office paperwork and overhead and thereby provides an opportunity for cost savings for consumers. Using the PriceDoc to match patients and doctors on the web makes it easier to:

- Locate and review providers in each vicinity

- Optimize office scheduling and management

- Cost compare for office visits and procedures

- Find competitive pricing for best case healthcare

Pricing transparency is fair and balanced and allows healthcare providers to focus on what they do best – taking care of patients. PriceDoc will help consumers make more informed buying decisions and will help keep pricing open and honest. PriceDoc doesn’t solve the healthcare crisis in America, but goes a long way to advancing the solution.

Link: www.PriceDoc.com

2. Search America

SearchAmerica leads the healthcare industry in financially clearing patients who have payment liability. The company provides a range of Software-as-a-Service (SaaS) services to more than 500 hospitals that produce a healthier bottom line. SearchAmerica is a part of Experian.

Link: http://www.searchamerica.com/

3. Trust HCS

With decades of coding and auditing experience, the firm aims to deliver the right people and technology to improve coding compliance and financial results. From remote, outsourced coding services to compliance monitoring, auditing and cancer registry support, TrustHCS aims to deliver the experts needed to ensure better health information outcomes.

Link: http://www.trusthcs.com/

4. Advanced MD

Headquartered in Draper, Utah, provides a market-leading Software-as-a-Service (SaaS) electronic health record and practice management software platform delivered to more than 10,000 providers and 300 billing service providers nationwide. As a complete Medical Practice Optimization solution, the product combines the clinical with the financial to improve workflow and revenue capture. The software suite allows for configurable charting through an integrated EHR, with rich features such as patient portal, scheduling, electronic eligibility verification, electronic prescribing, and mobile access for the practice, as well as sophisticated, efficient claims processing, denial tracking and revenue management for the billing professional.

Link: www.AdvancedMD.com

Assessment

Give any, or all, of the above sites a click, and tell us what you think! Better yet, if you are a client, customer, vendor, patient, payer, doctor or other stakeholder.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Alerts Sign-Up, Breaking News, Career Development, Practice Management | Tagged: AdvancedMD, PriceDoc, SearchAmerica, TrustHCS | 4 Comments »

Schulze School of Entrepreneurship

State Economy Engine

Since launching a two-year commercial course in 1895, the University of St. Thomas has placed an emphasis on helping the state of Minnesota create entrepreneurial endeavors that contribute to the state’s thriving, diverse economy.

Opus College of Business

More than 150 years later, the university’s Opus College of Business continues that tradition, as this interactive graphic shows.

Download a PDF of the full infographic for larger viewing

More:

- A New Book for Physician Entrepreneurs and Innovators

- Four Health 2.0 Innovators to Know

- For physician entrepreneurs: FutureMed – a future glimpse of medicine

- Healthcare Innovation Is Not Just About Cutting Costs

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Practice Management, Research & Development | Tagged: Opus College of Business, Schulze School of Entrepreneurship, University of St. Thomas | 3 Comments »

SURVEY: Medical Imaging A.I. Adoption?

By MCOL

***

***

Medical Imaging A.I. Adoption Survey [3 Takeaways]

• When it comes to specific activities, 88% of respondents trust or are neutral about AI’s role in making appointments.

• Only 19% of respondents believed they received care supported by AI, while 24% did not know, and 58% believed they had not.

• 60% think that AI will perform over half of radiology services in five years, with that number increasing to 75% of respondents in the next 20 years.

Source: Intelerad via HIT Consultant, “Patient Trust Not a Barrier to AI Medical Imaging Adoption,” May 31, 2022

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Career Development, Information Technology, Surveys and Voting | Tagged: AI, health information technology, HIT, HIT Consultant, Intelerad | Leave a comment »

UPDATE: The Markets!

By Staff Reporters

***

***

CELEBRATE JUNETEENTH

- The Markets: Can an extra day of rest change the market’s fortune?

- As the Fed has escalated its fight against inflation, the S&P has fallen for 10 weeks out of the last 11. And not even American blue-chip firms have been spared from the carnage.

- The Dow Jones Industrial Average closed below 30,000 for the first time since January 2021.

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Investing | Tagged: DJIA, S&P, The Markets | Leave a comment »

PODCAST: Health Tech Faves & Investment Trends from Entrepreneurs

START-UPS AND INNOVATIONS

Health tech investment raced ahead in 2020. Join innovation insiders for a discussion on new health technologies, health-care’s digital transformation timeline, and what to expect for mid- to long-term health tech investment.

Your thoughts are appreciated.

THANK YOU

***

Filed under: Experts Invited, Health Economics, Healthcare Finance, Information Technology, Investing, Research & Development, Videos | Tagged: Health Care Entrepreneurs, healthcare technology, HIT, medical entrepreneurs | Leave a comment »

UPDATE: A Recession with Opinions?

By Staff Reporters

***

***

- Recession fears overtook the S&P 500 a day after the Fed meeting, reversing gains seen midweek.

- The S&P 500 has been higher only 43.5% of all trading days in 2022, a gloomy marker, according to Bespoke Investment Group.

- Meanwhile, it said the Fed is facing a “policy error” in focusing on headline inflation that’s swayed by high gas prices.

This year’s dismal performance in US equities worsened this week as a post-Fed rally fizzled and investors cemented the S&P 500 to one of its shabbiest mid-year showings in decades, all taking place with poor economic data piling up.

***

Goldman Sachs’ President John Waldron admitted at a June 2 conference that this is “among—if not the most—complex, dynamic environments” that he’s ever experienced. As a result, investment banks and economists are split on what the most likely outcome will be for the U.S. economy moving forward. Deutsche Bank has argued since April that we’re headed for a “major” recession, but Morgan Stanley’s CEO James Gorman said on Monday the odds of even a minor recession are more like 50-50.

Bank of America believes we will most likely avoid a recession altogether and instead face “extended weakness,” while the economist and Nobel laureate Paul Krugman appeared to side with more optimistic Fed officials arguing that we could be headed for a ”goldilocks” scenario, where economic growth slows enough to cool inflation without instigating a recession.

HAPPY FATHER’S DAY 2022

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Experts Invited, Investing, LifeStyle, Op-Editorials | Tagged: recession, recession opinions, S&P | Leave a comment »

HEALTHCARE MERGERS & ACQUISITIONS: 2021 in Review

By Staff Reporters

***

Healthcare Partnerships – 5 Takeaways

• This year had the largest percentage of announced “mega merger” transactions in the last six years at 16.3% and, in more than one out of every 10 transactions, the smaller partner had a credit rating of A- or higher in 2021.

• Since 2011, average smaller partner size by annual revenue has increased at a compound annual growth rate (CAGR) of approximately 8.0%.

• Transactions involving a not-for-profit partner represented 87% of announced transactions.

• Transactions involving rural or urban/rural sellers increased to 31% of announced transactions.

Source: KaufmanHall, January 10, 2022

CITE: https://www.r2library.com/Resource/Title/082610254

****

COMMENTS APPRECIATED

Thank You

Subscribe to the Medical Executive-Post

***

***

Filed under: Accounting, Health Economics, Healthcare Finance, Taxation | Tagged: Health M&As, Healthcare M&As, M&A, M&As, Mergers & Acquisitions | Leave a comment »

Professor VERSUS Entrepreneur

Teaching / Educating

As a teacher educating is your job. It’s what you enjoy. There’s a fairly lax time schedule and resources are already built in the equation. Little accountability because the ultimate burden and measure of success is placed on the student to pass a test. If they don’t do well, it’s the student not directly the teacher who pays the price.

Now, I work with first year students who don’t know what a red blood cell looks like (biconcave disc, you thought I forgot, didn’t you) all the way to a chief resident who can probably do some surgeries better than me. It’s my job to take that first year student and turn them into a chief resident.

As an entrepreneur with limited resources, time, and energy, you don’t have the luxury to continuously teach, develop, and convince. You need people who simply get it especially in strategic positions. You don’t have the luxury of time or resources. You also are directly accountable if they don’t understand because you have a burn rate that probably just got worse. So how much “oxygen” do you allocate when trying to build your team?

Different story for Apple, Boeing and others that can create academies and educational tracks to teach and develop internally.

ASSESSMENT: Your thoughts are appreciated.

Filed under: Career Development, CMP Program, Experts Invited, Interviews, Op-Editorials | Tagged: bill hennessey md, Entrepreneurs, professor, teacher | Leave a comment »

Employee Engagement for Startups and Entrepreneurs

Jonathan Mase | Jonathan A. Mase's WordPress Blog

Operating as a startup company will present many challenges, but you should take heart in knowing that many of today’s biggest companies were once in your position. If you wish for your startup company to succeed, then employee engagement will be a crucial factor. Keep reading to learn more about the importance of employee engagement for startups. It should allow you to figure out the right path forward to find the success you desire.

It Makes Employees Loyal

When employees are engaged in the work they are doing, they will be more likely to be loyal to your company. Having loyal employees will benefit you in several different ways, but one of the most important ones is that they will work harder. When employees are engaged in the work that they’re doing, then that means that they truly care about it. They’re going to take things seriously, and you will…

View original post 228 more words

Filed under: Career Development, Experts Invited, Investing | Leave a comment »

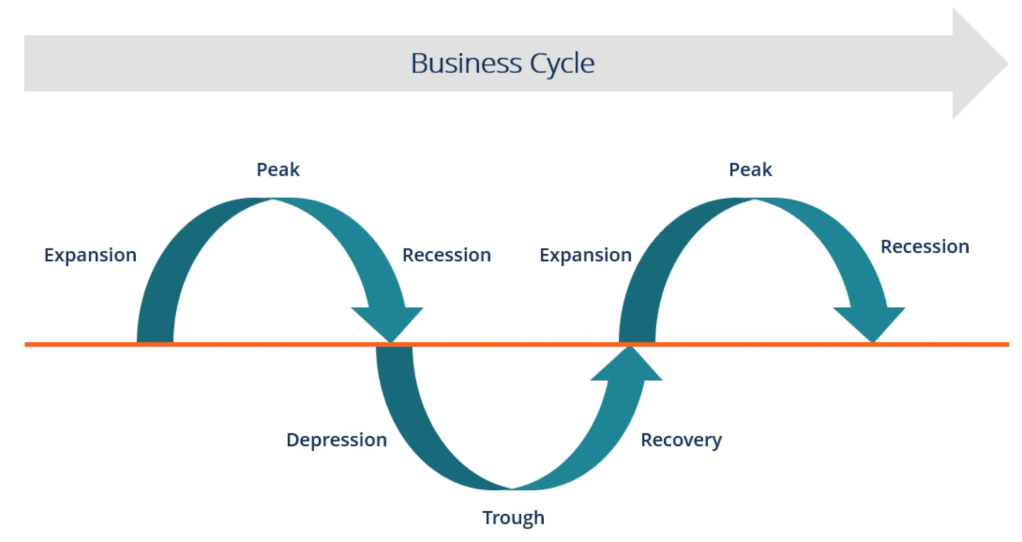

The Real Economic Business Cycle?

REALLY?

By Dr. David Edward Marcinko MBA

***

The business cycle is also known as the economic cycle and reflects the expansion or contraction in economic activity. Understanding the business cycle and the indicators used to determine its phases may influence investment or economic business decisions and financial or medical planning expectations.

Although often depicted as the regular rising and falling of an episodic curve, the business cycle is very irregular in terms of amplitude and duration. Moreover, many elements move together during the cycle and individual elements seldom carry enough momentum to cause the cycle to move.

However, elements may have a domino effect on one another, and this is ultimately drives the cycle, too. We can also have a large positive cycle, coincident with a smaller but still negative cycle, as may be seen in the current healthcare climate of today.

- First Phase: Trough to Recovery (service and production driven)

Scenario: A depressed GNP leads to declining industrial production and capacity utilization. Decreased workloads result in improved labor productivity and reduced labor (unit) costs until actual producer (wholesale) prices decline.

- Second Phase: Recovery to Expansion (patient and consumer driven)

Scenario: CPI declines (due to reduced wholesale prices) and consumer real income rises, improving consumer sentiment and actual demand for consumer goods.

- Third Phase: Expansion to Peak (service and production driven)

Scenario: GNP raises leading to increased industrial production and capacity utilization. But, labor productivity declines and unit labor costs and producer (wholesale) prices rise.

- Fourth Phase: Peak to Contraction (patient and consumer driven)

Scenario: CPI rises making consumer real income and sentiment erode until consumer demand, and ultimately purchases, shrink dramatically. Recessions may occur and economists have an alphabet used to describe them.

For example, with a “V” graph shape, the drop and recovery is quick. For a “U” shaped graph, the economy moves up more sluggishly from the bottom. A “W” is what you would expect: repeated recoveries and declines. An “L” shaped recession describes a prolonged dry economic spell or even depression.

And now, the REAL Cycle?

MORE: https://etonomics.com/2021/11/09/real-business-cycle-theory/

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Glossary Terms, Health Economics, Investing, Touring with Marcinko | Tagged: business cycle, David Marcinko MBA, economic business cycle, real business cycle | Leave a comment »

UPDATE: Stock Market History, S&P Performance and COVID Vaccines for Kids

***

By Staff Reporters

***

***

Per history, Bank of America’s Global Investment Strategy chief investment officer, Michael Hartnett, pointed out that the average peak-to-trough bear-market decline is 37.3% over a span of 289 days. Matching that pattern would put the end of current pain on Oct. 19th, 2022. This happens to mark the 35th anniversary of Black Monday, as the stock-market crash of 1987 is widely known. And according to statistical averages, the S&P 500 will likely bottom at 3,000.

Despite rising slightly, the S&P just posted its worst week since March 2020. Even energy stocks, one of the lone bright spots in the market, have taken a beating during this higher interest-rate era

The FDA just authorized two Covid-19 vaccines, Pfizer and Moderna, for kids under five—a year and a half after vaccines were approved for adults 16+.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Drugs and Pharma, Ethics, Health Economics, Investing, LifeStyle | Tagged: Moderna, pediatric covid vaccines, S&P, S&P performance, stock market, stock market history, vaccines kids | Leave a comment »

JUNK-BOND Demand

By Staff Reporters

***

Junk bonds carry a higher risk of default compared to other bonds. Bond yields – or the return you get on investing in a bond – dip when prices go up. If investors crave junk bonds, the yields drop. Likewise, yields rise when people are selling.

So a smaller difference (or spread) between yields for junk bonds and safer government bonds is a sign investors are taking on more risk. A wider spread shows more caution. The Fear & Greed Index uses junk bond demand as a signal for Greed.

CITE: https://www.r2library.com/Resource/Title/082610254

***

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Investing | Tagged: bonds, junk bond, junk bond demand, junk bonds | Leave a comment »

UPDATE: Dr. Fauci, the Yen, Markets and Global Economy

By Staff Reporters

***

***

- Dr. Anthony Fauci, the leader of the U.S. government’s Covid pandemic response effort tested positive for the coronavirus. Fauci, who is fully vaccinated against Covid, is experiencing mild symptoms. “Dr. Fauci will isolate and continue to work from home,” a statement said. “He has not recently been in close contact with President [Joe] Biden or other senior government officials.”

- The yen fell after Japan’s central bank kept its ultra-low interest rates on hold even as policy makers around the world hike cost of borrowing to tackle rising prices. The Bank of Japan (BOJ) also says it will continue its program of buying huge amounts of government bonds. This week central banks in the US, UK and Switzerland raised interest rates as they try to curb inflation. After the announcement, the US dollar climbed to 134.64 yen, not far from the 24-year peak of 135.6 earlier this week. So far this year the dollar has climbed by 15% against the yen, as the gap between interest rates in Japan and much of the rest of the world continues to grow.

- Markets: Stocks took a big tumble over recession concerns, and blue-chip companies such as Home Depot, Intel, Walgreens, and JPMorgan touched 52-week lows.

- Global economy: European central banks including the Bank of England, the Swiss National Bank, and the National Bank of Hungary increased interest rates yesterday to tame inflation.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, iMBA, Inc., Investing | Tagged: Bank Japan, BOJ, Fauci, Global Economy, inflation, japan, markets, Yen | Leave a comment »

e-Prescriptions for Dentists?

By Darrell K. Pruitt DDS

***

***

Some say e-prescriptions are a swell idea for dentists!

“Over 70% of organizations suffered two or more ransomware attacks in the past 12 months – According to the data presented by the Atlas VPN team based on a Veeam 2022 Ransomware Trends Report, 73% of organizations suffered two or more ransomware attacks in the past 12 months. The majority — 44% of ransomware infections entered through phishing emails, links, and websites. In total, 35% of organizations experienced two ransomware attacks, nearly a quarter (24%) endured three, close to a fifth (9%) of companies had four, and 4% went through five. Meanwhile, 1% of organizations suffered six or more ransomware attacks in the past 12 months. The remaining 27% of organizations faced only one ransomware attack.” By Acrofan, June 15, 2022.

https://us.acrofan.com/detail.php?number=679260

“Why Ransomware Extortion is a Threat – In a typical ransomware extortion scheme, files are not only encrypted, but are also copied and exfiltrated from the network. Then, when the time comes to demand payment, hackers also say that if the business doesn’t meet their ransom demands within a given timeframe, they will publish the stolen files, or undertake some other activity to harm the business, such as a DDoS attack. This is known as double, or even triple extortion, with threats to release confidential information to the public, disrupt internet access or inform customers, shareholders or other partners about the incident unless they pay the ransom. It puts more pressure on businesses to make a quick decision, boosts the odds of criminals getting a big payout and increases the number of risks firms are exposed to, so this type of ransomware is something every firm should be concerned about.” By Brenda Robb for Security Boulevard on June 15, 2022.

https://securityboulevard.com/2022/06/why-ransomware-extortion-is-a-threat/

It is also worth noting that if a dentist suffers a ransomware attack, HIPAA demands that all affected patients be notified that their identities might have been breached and might show up on the internet. If the breach involves 500 or more records, a description of the incident must be reported in the local media. This could easily bankrupt a practice even before the ransom is paid. What’s more, from the increasing numbers of data breaches that are occurring, one can surmise that dentists are not obeying the law … not yet.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Doctors Only", Career Development, Experts Invited, Glossary Terms, Information Technology, Pruitt's Platform | Tagged: Darrell Pruitt, dental prescriptions, dental RXs, e-Prescriptions, eDRs, electronic prescriptions, EMRs, eRx, eRXs | Leave a comment »

On the Society of Physician Entrepreneurs

About the SoPE

***

***

By Dr. David Edward Marcinko MBA

The Society of Physician Entrepreneurs (SoPE) was established as a community of interest in 2008 by several members of the American Academy of Otolaryngology-Head and Neck Surgery (AAO-HNS), including Dr. Arlen Meyers, the President & CEO. SoPE became a separate and independent legal entity; incorporating in Washington, D.C. in January 2011.

It is a 501 (c) 6 member organization with the stated purpose of providing support; idea stage through funding, for physician entrepreneurs with ideas on how to improve healthcare. Currently there are over 1,000 members included in their LinkedIn site.

Vision

SoPE’s vision is to accelerate physician originated biomedical innovation.

The mission of SoPE is to foster scholarship in biomedical entrepreneurship and provide education, training and support; idea stage through funding, to primarily community-based physician entrepreneurs in the interest of better healthcare.

Membership

SoPE membership is open to all physicians and also accepts individuals as associate members; representatives of medical device, legal, venture capital, and other firms with an interest in serving and/or supporting physician entrepreneurs.

Assessment

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

Filed under: Career Development, Touring with Marcinko | Tagged: biomedical innovation., Dr. Arlen Meyers, Marcinko, On the Society of Physician Entrepreneurs, Physician Entrepreneurs, Sope | 6 Comments »

UPDATE: FOMC IRs, Inflation, NASDAQ, Retail Sales and COVID Vaccines

By Staff Reporters

***

***

The Federal Reserve hiked interest rates by three quarters of a percentage point [75 bps], its most aggressive move yet to try to control inflation, as it squeezes the U.S. economy. Through interest rate increases, the Fed is attempting to raise the cost to borrow money, slow economic activity, and bring down inflation that’s at 40-year-highs.

And, as much as we love to think we’re exceptional, inflation has been afflicting countries around the globe. In an analysis of 111 countries, Deutsche Bank found that the US’ inflation rate sits roughly in the middle.

The S&P snapped a five-day losing streak (though it’s still in a bear market), and the NASDAQ soared thanks to a surge in tech shares.

US retail sales fell for the first time in five months in May, as Americans pulled back on buying cars and other expensive items.

Finally, an FDA advisory committee unanimously recommended Moderna’s and Pfizer’s COVID vaccines for children under five, which is the only age cohort in the US that doesn’t yet have an authorized vaccine.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Alerts Sign-Up, Financial Planning, Health Economics, Investing, LifeStyle, Portfolio Management | Leave a comment »

PODCAST: Roadmap to a High Performance Employee Health Plan

By Eric Bricker MD

***

***

COMMENTS APPRECIATED

Thank You

***

CITE: https://www.r2library.com/Resource/Title/082610254

***

***

Filed under: "Doctors Only", Career Development, Events-Planner, Glossary Terms, Health Economics, Health Insurance, Quality Initiatives, Research & Development, Videos | Tagged: Employee Health Plan, Eric Bricker MD, health plan, health plans, PODCAST: Roadmap to a High Performance Employee Health Plan | Leave a comment »

SURVEY: Medicare Part C Plan Enrollment

By Staff Reporters

***

***

Total Medicare Advantage Enrollment 2016-2021

• 2016: 18M

• 2017: 19M

• 2018: 20M

• 2019: 22M

• 2020: 24M

• 2021: 26M

Source: OIG, “Some Medicare Advantage Organization Denials of Prior Authorization Requests Raise Concerns About Beneficiary Access to Medically Necessary Care,” April 2022

***

COMMENTS APPRECIATED

Thank You

***

***

***

Filed under: Ethics, Glossary Terms, Health Economics, Health Insurance, Surveys and Voting | Tagged: Medicare Advantage, Medicare Part C, Medicare Part C Plan Enrollment, Part C | Leave a comment »

ENCORE: The Danger of Groupthink with Endowment Fund Portfolio Managers

A Historical Look-Back to the Future?

By Wayne Firebaugh CPA CFP® CMP™

www.CertifiedMedicalPlanner.org

It is not unusual for endowment fund managers to compare their endowment allocations to those of peer institutions and that as a result, endowment allocations are often similar to the “average” as reported by one or more survey/consulting firms.

One endowment fund manager expanded this thought by presciently noting that expecting materially different performance with substantially the same allocation is unreasonable [personal communication]. It is anecdotally interesting to wonder whether the seminal study “proving” the importance of asset allocation could have even had a substantially different conclusion. It seems likely that the pensions surveyed in the study had very similar allocations given the human tendency to measure one’s self against peers and to use peers for guidance.

Peer Comparison

Although peer comparisons can be useful in evaluating your institution’s own processes, groupthink can be highly contagious and dangerous.

For example, in the first quarter of 2000, net flows into equity mutual funds were $140.4 billion as compared to net inflows of $187.7 billion for all of 1999. February’s equity fund inflows were a staggering $55.6 billion, the record for single month investments. For all of 1999, total net mutual fund investments were $169.8 billion[1] meaning that investors “rebalanced” out of asset classes such as bonds just in time for the market’s March 24, 2000 peak (as measured by the S&P 500).

Of course, investors are not immune to poor decision making in upward trending markets. In 2001, investors withdrew a then-record amount of $30 billion[2] in September, presumably in response to the September 11th terrorist attacks. These investors managed to skillfully “rebalance” their ways out of markets that declined approximately 11.5% during the first several trading sessions after the market reopened, only to reach September 10th levels again after only 19 trading days. In 2002, investors revealed their relentless pursuit of self-destruction when they withdrew a net $27.7 billion from equity funds[3] just before the S&P 500’s 29.9% 2003 growth.

The Travails

Although it is easy to dismiss the travails of mutual fund investors as representing only the performance of amateurs, it is important to remember that institutions are not automatically immune by virtue of being managed by investment professionals.