***

***

By Dr. David Edward Marcinko MBA MEd

***

Milton Friedman: Champion of Free Markets

Milton Friedman was a towering figure in the field of economics, renowned for his unwavering advocacy of free-market capitalism and limited government intervention. Born in 1912 in New York City and raised in Rahway, New Jersey, Friedman rose from modest beginnings to become a Nobel laureate and a leading voice of the Chicago School of Economics.

Friedman’s academic journey began at Rutgers University, where he earned a degree in mathematics and economics. He later pursued graduate studies at the University of Chicago and Columbia University, where he was mentored by prominent economists like Simon Kuznets. His intellectual foundation laid the groundwork for a career that would challenge prevailing economic thought and reshape public policy.

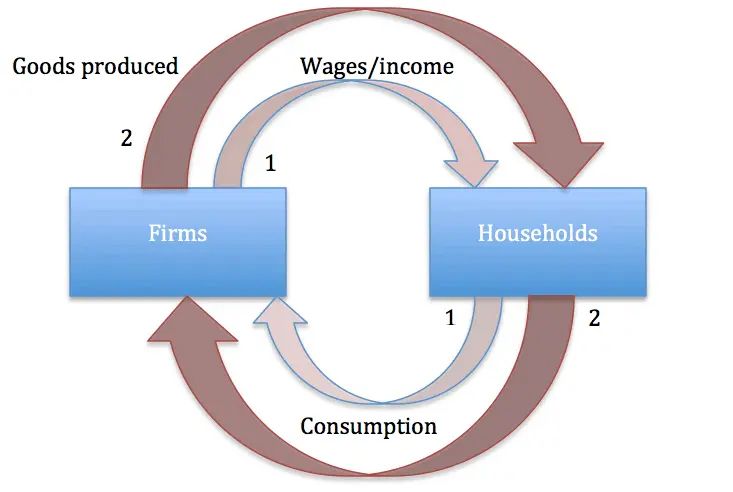

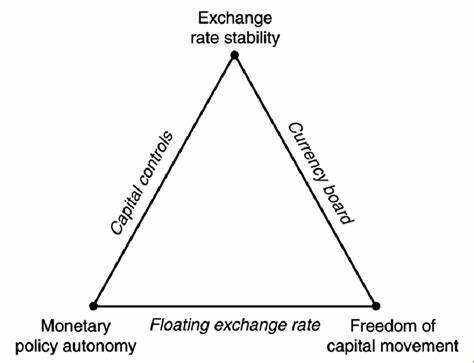

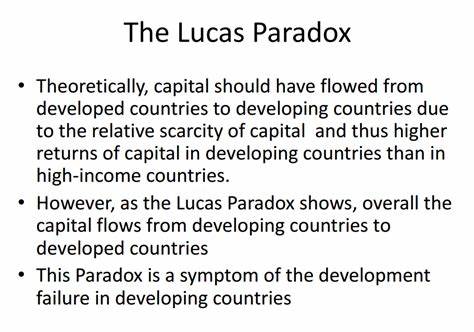

One of Friedman’s most significant contributions was his development of monetarism, a theory emphasizing the role of governments in controlling the money supply to manage inflation and economic stability. In contrast to Keynesian economics, which advocated for active fiscal policy and government spending, Friedman argued that excessive government intervention often led to inefficiencies and inflation. His research demonstrated that inflation is “always and everywhere a monetary phenomenon,” a principle that became central to modern macroeconomic policy.

Friedman’s influence extended beyond academia. His 1962 book, Capitalism and Freedom, articulated a powerful case for economic liberty as a foundation for political freedom. He argued that voluntary exchange and competitive markets were essential for individual choice and prosperity. The book also introduced the Friedman Doctrine, which posited that the primary responsibility of business is to increase its profits, a view that sparked ongoing debates about corporate social responsibility.

In 1976, Friedman was awarded the Nobel Memorial Prize in Economic Sciences for his work on consumption analysis, monetary history, and stabilization policy. His Permanent Income Hypothesis, which suggests that people base their consumption on expected long-term income rather than current income, revolutionized understanding of consumer behavior.

Friedman’s ideas had profound policy implications. He was a vocal critic of the draft and successfully advocated for an all-volunteer military. He also proposed the concept of school vouchers, allowing parents to choose schools for their children, which laid the foundation for modern school choice movements. His work influenced leaders like Ronald Reagan and Margaret Thatcher, who embraced free-market reforms during their administrations.

Despite his acclaim, Friedman’s views were not without controversy. Critics argued that his emphasis on deregulation and privatization sometimes overlooked social equity and environmental concerns. Nonetheless, his legacy remains deeply embedded in economic thought and public discourse.

Milton Friedman passed away in 2006, but his ideas continue to shape debates on economic policy, freedom, and the role of government. His belief in the power of markets and individual choice remains a cornerstone of classical liberalism and a guiding light for economists and policymakers around the world.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Advisors Only", "Ask-an-Advisor", CMP Program, curated experts,, economics, Financial Planning, Funding Basics, Health Economics, Marcinko Associates, Portfolio Management | Tagged: Booz Allen Hamilton, economics, Free Markets, friedman doctrine, Keynes, Keynesian, Marcinko, Milton Friedman, monetarism, Permanent Income Hypothesis, politics, school vouchers, simon kuznets | Leave a comment »