Yep – Even the Smart Folks!

By Lon Jefferies MBA CMP® CFP®

Dr. David Edward Marcinko MBA MEd CMP®

In the Business Insider, Mandi Woodruff describes nine mental blocks that cause smart people to do dumb things. Review the list and itemize the factors that have negatively impacted your finances.

The Factors

- Anchoring happens when we place too much emphasis on the first piece of information we receive regarding a given subject. For instance, when shopping for a wedding ring a salesman might tell us to spend three months’ salary. After hearing this, we may feel like we are doing something wrong if we stray from this advice, even though the guideline provided may cause us to spend more than we can afford.

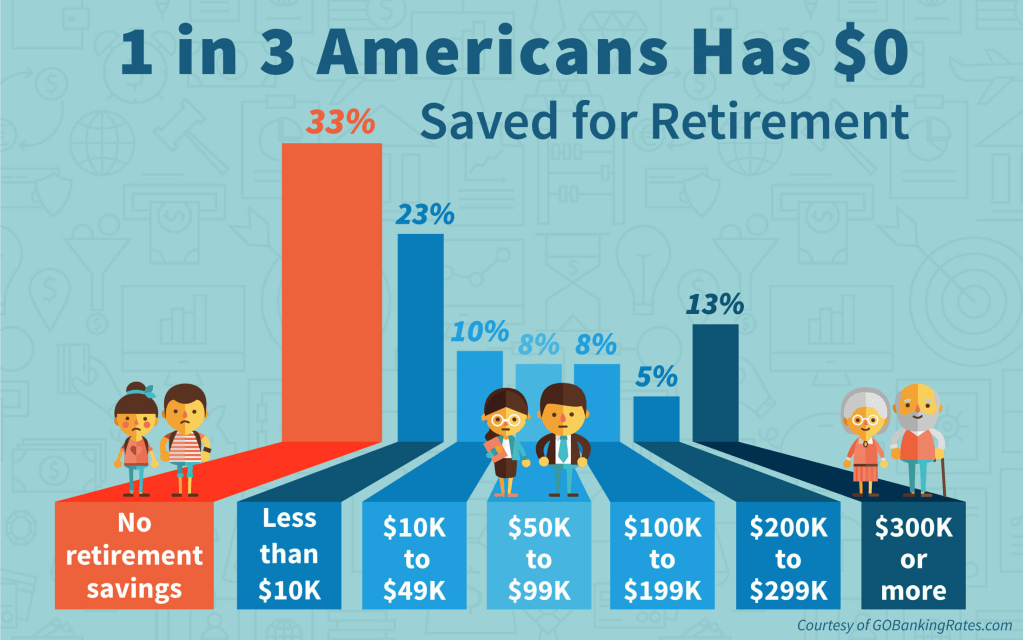

- Myopia (or nearsightedness) makes it hard for us to imagine what our lives might be like in the future. For example, because we are young, healthy, and in our prime earning years now, it may be hard for us to picture what life will be like when our health depletes and we know longer have the earnings necessary to support our standard of living. This short-sightedness makes it hard to save adequately when we are young, when saving does the most good.

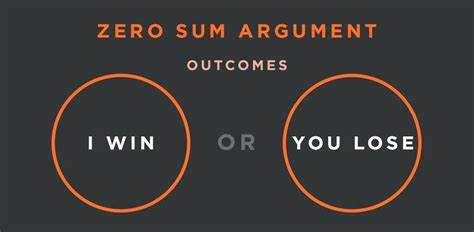

- Gambler’s fallacy occurs when we subconsciously believe we can use past events to predict the future. It is common for the hottest sector during one calendar year to attract the most investors the following year. Of course, just because an investment did well last year doesn’t mean it will continue to do well this year. In fact, it is more likely to lag the market.

- Avoidance is simply procrastination. Even though you may only have the opportunity to adjust your health care plan through your employer once per year, researching alternative health plans is too much work and too boring for us to get around to it. Consequently, we stick with a plan that may not be best for us.

- Confirmation bias causes us to place more emphasis on information that supports the opinion we already have. Consequently, we tend to ignore or downplay opinions that don’t mirror our own, leading us to make uninformed decisions.

NOTE: An interesting example of the confirmation bias is the case of David Rosenberg, who is one of the most well-known perpetual bears on Wall Street. In October, Mr. Rosenberg’s analysis forced him to warm to the current investment environment. His fans and followers, rather than appreciating his research and ability to adjust to new information, criticized him for changing his opinion.

As it turned out Mr. Rosenberg had fans not because of his expert analysis, but because he added intellectual heft to his followers pessimism and quasi-political desire for the system to collapse. Their view was that things were in permanent decline and his analysis, charts, and voice added respectability to their pre-existing bias. Mr. Rosenberg has now lost his fan base not because he was wrong for the last four years, but because he changed his mind.

- Loss aversion affected many investors during the crash of 2008. During the crash, many people decided they couldn’t afford to lose more and sold their investments. Of course, this caused the investors to sell at market troughs and miss the quick, dramatic recovery.

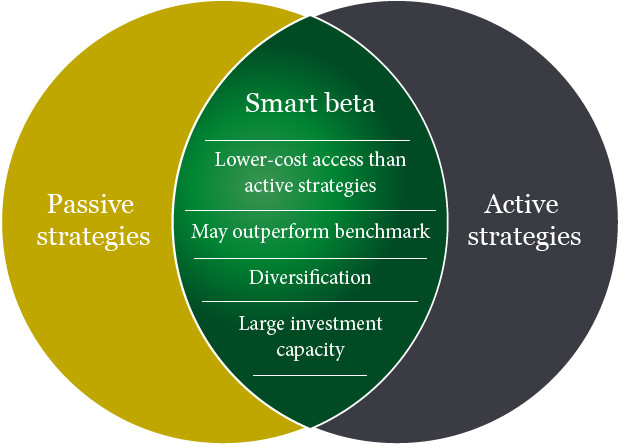

- Overconfident investing happens when we believe we can out-smart other investors via market timing or through quick, frequent trading. Data convincingly shows that people who trade most often underperform the market by a significant margin over time.

- Mental accounting takes place when we assign different values to money depending on where we get it from. For instance, even though we may have an aggressive saving goal for the year, it is likely easier for us to save money that we worked for than money that was given to us as a gift.

- Herd mentality makes it very hard for humans to not take action when everyone around us does. For example, we may hear stories of people making significant profits buying, fixing up, and flipping homes and have the desire to get in on the action, even though we have no experience in real estate.

Assessment

The good news is that being aware of these tendencies can help us avoid mistakes. We’ll never be perfect, but avoiding detrimental decisions based on mental prejudices can give us an advantage in our financial and retirement planning efforts.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

ADVISORS: www.CertifiedMedicalPlanner.org

BLOG: www.MedicalExecutivePost.com

Invite Dr. Marcinko

***

Filed under: "Ask-an-Advisor", Career Development, Ethics, Financial Planning, Investing, LifeStyle, mental health | Tagged: behavioral economics, behavioral finance, Behavioral Psychology, biases, David Rosenberg, dumb money, iMBA, Institute Medical Business Advisors, Lon Jefferies, Marcinko, money | 1 Comment »