Dr. David Edward Marcinko; MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

INVEST Act in Finance

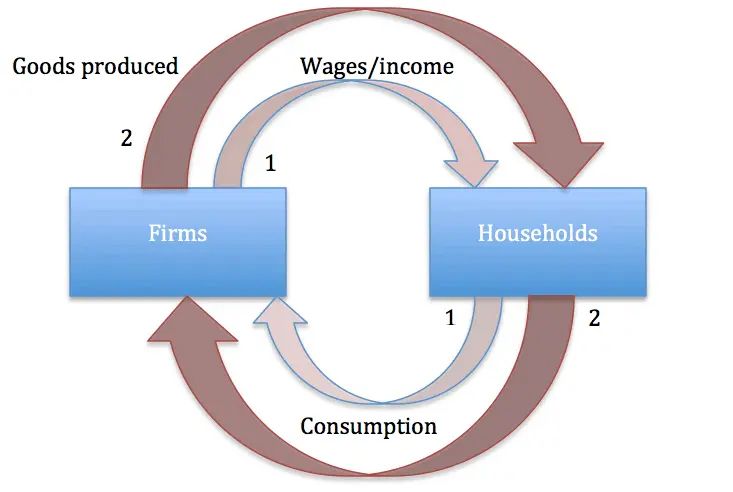

The term “INVEST Act” has appeared in multiple financial policy discussions over the past several years, and although it may sound like a single, well‑defined piece of legislation, it actually refers to a range of proposals aimed at encouraging investment, reforming tax treatment, and strengthening long‑term financial security. In the world of finance, the acronym has been used repeatedly because it signals a clear legislative intention: to stimulate economic growth by making investment easier, more attractive, or more accessible. Understanding the INVEST Act in a financial context therefore requires examining the major themes that these proposals share, the problems they attempt to solve, and the broader implications for investors, businesses, and households.

One of the most common uses of the INVEST Act label appears in proposals designed to increase capital investment within the United States. These versions of the act typically focus on adjusting the tax code to encourage companies to expand, innovate, and hire. They may include provisions such as accelerated depreciation schedules, expanded tax credits for research and development, or incentives for domestic manufacturing. The underlying logic is straightforward: when businesses face lower after‑tax costs for investing in equipment, technology, or facilities, they are more likely to undertake projects that boost productivity and create jobs. By lowering barriers to capital formation, these proposals aim to strengthen the country’s long‑term economic competitiveness.

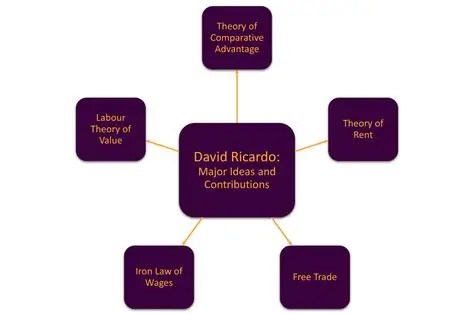

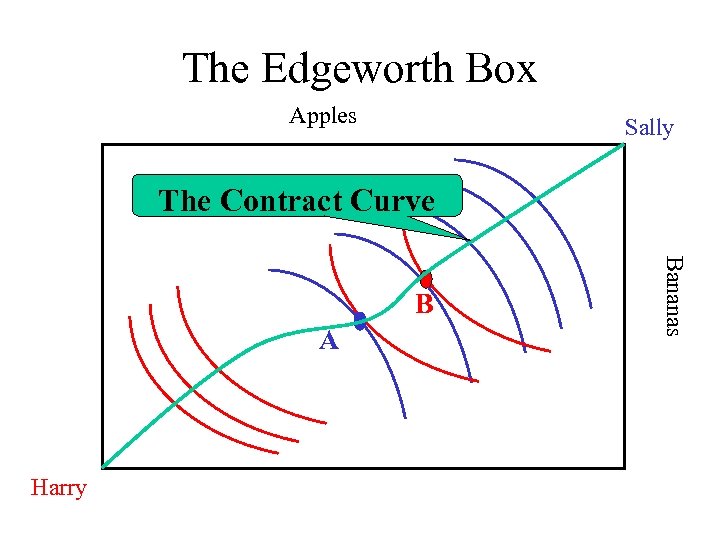

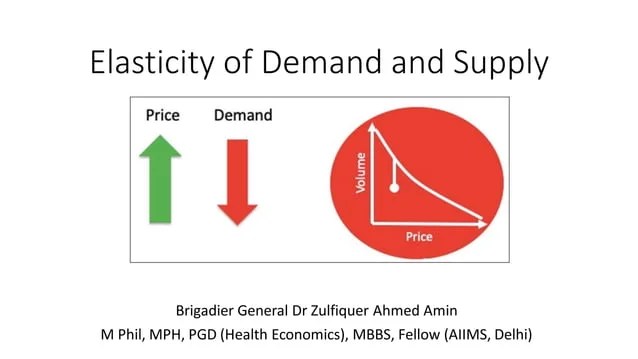

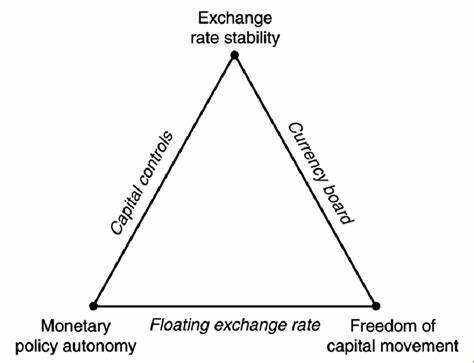

Another major interpretation of the INVEST Act centers on reforming capital gains taxation. In this version, lawmakers propose changes intended to reward long‑term investment rather than short‑term speculation. These reforms might include simplified capital gains brackets, reduced tax rates for assets held over extended periods, or deferral options that allow investors to reinvest gains without immediate tax consequences. The goal is to encourage individuals and institutions to commit capital to productive, long‑horizon ventures such as infrastructure, innovation, or business expansion. Supporters argue that a tax system favoring patient investment helps stabilize financial markets and channels resources toward activities that generate sustainable economic growth.

A third category of INVEST Act proposals focuses on retirement savings. In these cases, the acronym is often used to highlight the importance of long‑term financial security for American workers. These proposals typically aim to expand access to retirement plans, increase contribution limits, or provide tax credits to small businesses that establish retirement programs for their employees. Some versions emphasize automatic enrollment or improved portability, making it easier for workers to maintain consistent savings even as they change jobs. By strengthening the retirement system, these proposals seek to address the growing concern that many households are not saving enough to support themselves later in life. The INVEST Act, in this context, becomes a tool for promoting financial stability and reducing future reliance on social safety nets.

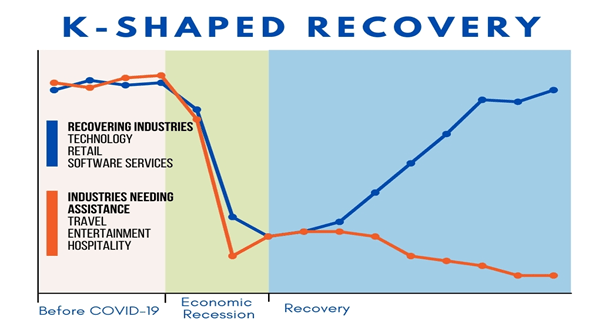

In addition to these targeted reforms, the INVEST Act label has also been applied to broader economic‑development initiatives. These proposals aim to direct private capital into underserved or economically distressed regions. They may expand programs such as Opportunity Zones, offer tax incentives for investment in rural or low‑income areas, or support public‑private partnerships that fund infrastructure and community development. The intention is to use financial policy as a lever to reduce geographic inequality and stimulate growth in areas that have struggled to attract investment. By encouraging capital to flow into regions that need it most, these versions of the INVEST Act attempt to create more balanced and inclusive economic progress.

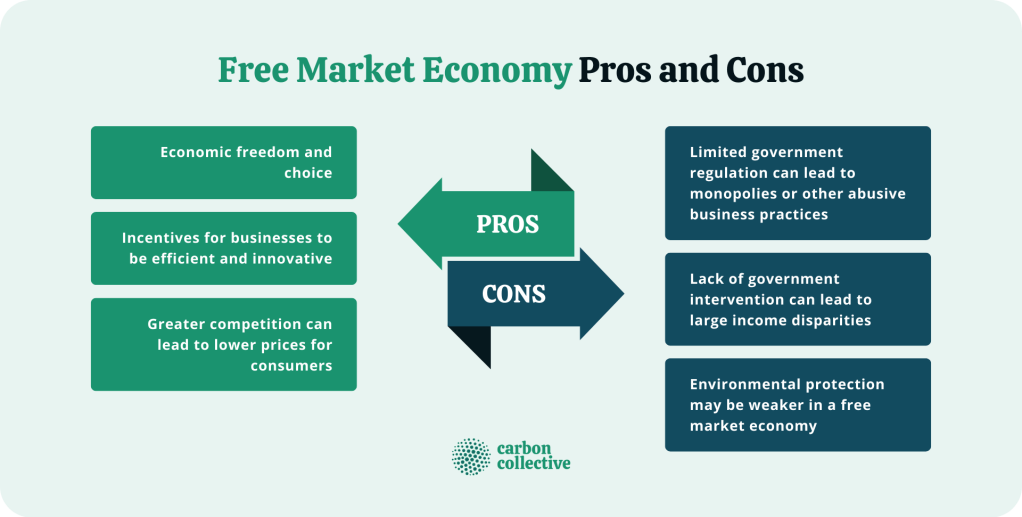

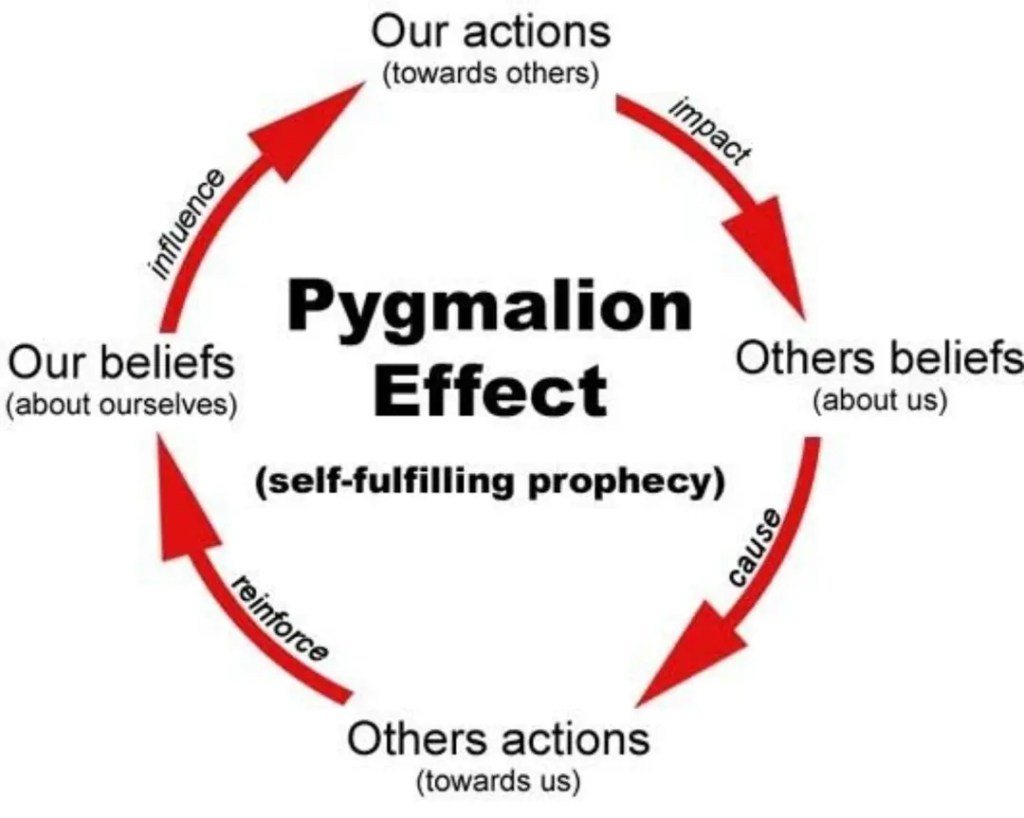

Although the specific details vary across proposals, the financial versions of the INVEST Act share a common philosophy: investment is a cornerstone of economic strength, and public policy can play a meaningful role in shaping how and where investment occurs. Whether the focus is corporate expansion, capital gains reform, retirement security, or regional development, each version reflects an effort to align financial incentives with long‑term national priorities. These proposals recognize that markets do not always allocate capital in ways that maximize social or economic well‑being, and that targeted policy interventions can help correct imbalances or encourage beneficial behavior.

The diversity of proposals that fall under the INVEST Act umbrella also highlights the complexity of financial policymaking. Encouraging investment is not a single, simple task; it touches on taxation, regulation, household behavior, business strategy, and regional development. As a result, the INVEST Act has become a flexible legislative brand—one that can be adapted to different economic challenges and political goals. While this flexibility can sometimes create confusion about what the act specifically entails, it also reflects the broad recognition that investment, in all its forms, is essential to the country’s future prosperity.

In sum, the INVEST Act in finance is best understood not as a single law but as a recurring legislative theme aimed at strengthening the nation’s economic foundation. Whether through tax incentives, retirement reforms, or development programs, these proposals share a commitment to promoting long‑term growth and financial stability. By examining the various interpretations of the INVEST Act, one gains insight into the evolving priorities of financial policy and the ongoing effort to create an economy that supports innovation, security, and opportunity.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: Funding Basics, Investing, "Ask-an-Advisor", Financial Planning, Glossary Terms, Marcinko Associates, economics, finance | Tagged: business, david marcinko, economics, economy, finance, invest act, Investing, personal-finance, retirement | Leave a comment »