A Modern Integral Component of Healthcare Training

[By Render S. Davis MHA CHE]

[By Dr. David Edward Marcinko MBA]

***

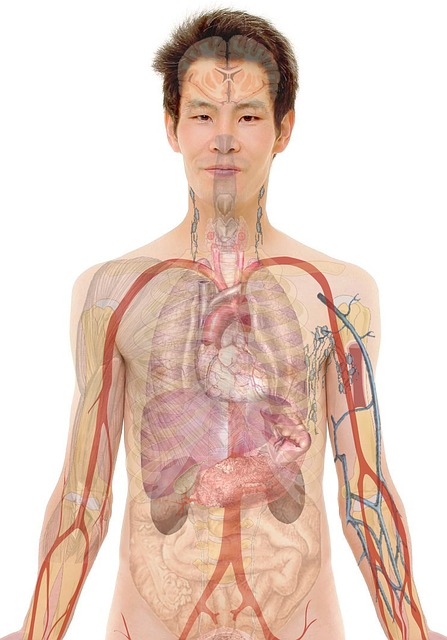

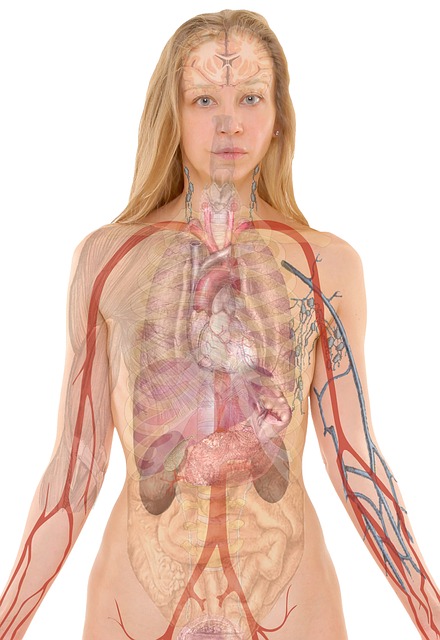

While America has often been called a “nation of immigrants,” it has never been more true than today. Consequently, the challenge for physicians and other health care providers, in both large cities and small communities, is meeting the health care needs of increasingly diverse and multi-cultural populations who speak different languages and have social norms, traditions, and values that may substantially differ from their own. Problems arise when clinicians expect, even demand, that patients and their families discard their cultural foundations and adhere to the health care provider’s view of the care and decision-making process.

Instead, the health care team should be more aware of and sensitive to the values and beliefs of patients who come from other cultures; working within to assure that the patient’s individual rights are supported and wishes honored to the fullest extent possible.

In her award-winning book, The Spirit Catches You and You Fall Down, Ann Fadiman chronicled this tragic clash of two cultures in medical care for a child of the traditional Hmong people of Laos, transplanted to California after the Vietnam War.

In the book, Fadiman recounts a conversation with Professor Arthur Kleinman of Harvard University, a highly regarded expert in multicultural relations and conflict, who noted that “If you cannot see that your own culture has its own set of interests, emotions, and biases, how can you expect to deal successfully with someone else’s culture?”

***

***

Former U.S. Surgeon General David Satcher, M.D., Ph.D., now Director of the Satcher Health Leadership Institute at Morehouse College of Medicine in Atlanta, Georgia, helped develop a special curriculum designed to foster greater cultural competence among physicians and health care providers.

Called the “CRASH Course,” the program emphasizes:

- Cultural Awareness. Acknowledging the diversity and legitimacy of the many cultures that make up the fabric of American Society;

- Respect. Valuing other cultural norms, even if they differ or conflict with your own;

- Assess and affirm. Understanding the points of both congruence and difference among cultural approaches to decision-making; learning how to achieve the best outcomes within the cultural framework of the patient and family unit;

- Sensitivity and self awareness. Being secure in your own values; while willing to be flexible in working through cultural differences with others;

- Humility. Recognizing that every culture has legitimacy and that no one is an expert in what is best for others; being willing to subordinate your values for those of another to achieve the goals of treatment.

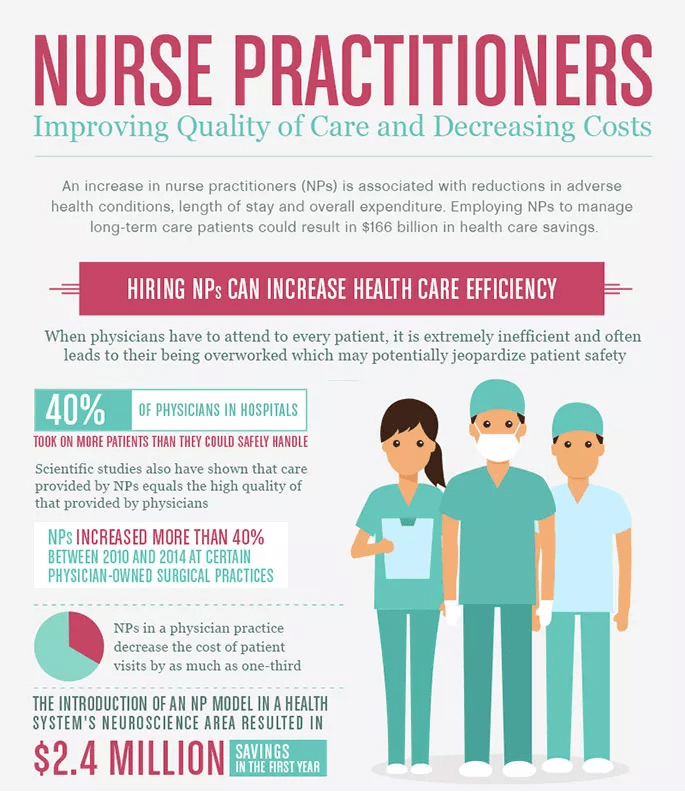

There is little doubt that multi-cultural sensitivity will continue to grow as an increasingly integral component of medical education and risk management in health care practice.

***

**

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

More:

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

About the Author

Render Davis was a Certified Healthcare Executive, now retired from Crawford Long Hospital at Emory University, in Atlanta, GA He served as Assistant Administrator for General Services, Policy Development, and Regulatory Affairs from 1977-95. He is a founding board member of the Health Care Ethics Consortium of Georgia and served on the consortium’s Executive Committee, Advisory Board, Futility Task Force, Strategic Planning Committee, and chaired the Annual Conference Planning Committee, for many years.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

***

Filed under: Ethics, Quality Initiatives, Recommended Books, Risk Management | Tagged: Ann Fadiman, Arthur Kleinman, Cultural Sensitivity in Medical Education, David Edward Marcinko, David Satcher, Healthcare Training, Morehouse College, Render Davis, The Spirit Catches You and You Fall Down | Leave a comment »