By Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.MarcinkoAssociates.com

***

***

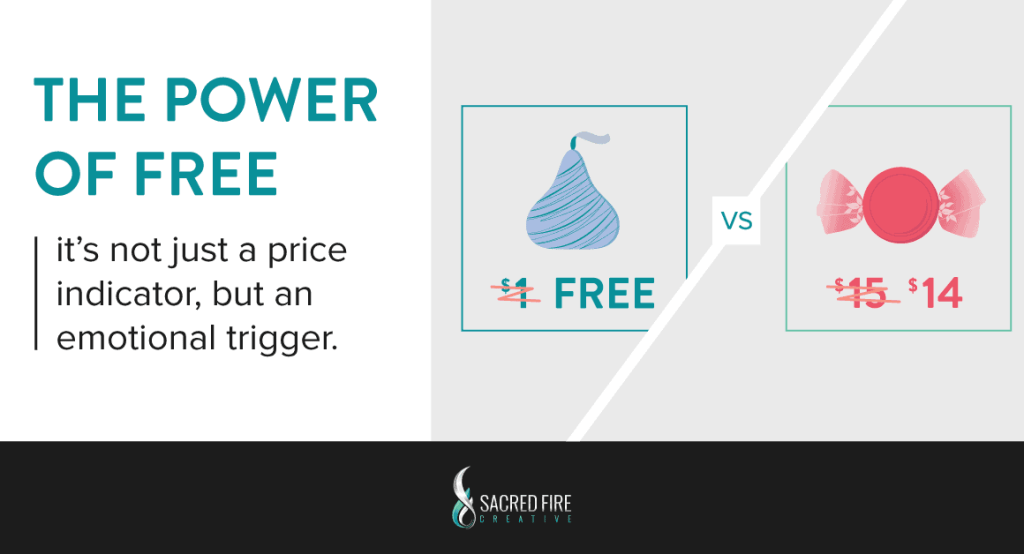

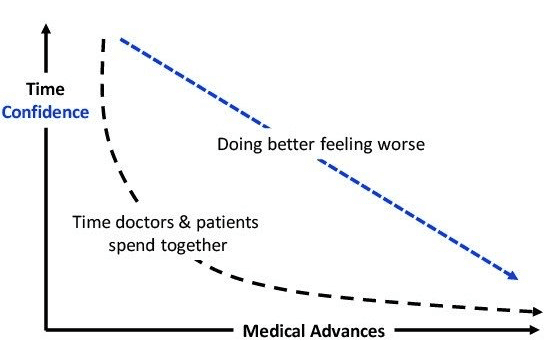

Choice Overload is the difficulty in making a decision when faced with too many options. It’s like standing in front of an ice cream counter with 31 flavors and feeling paralyzed.

Among personal decision-makers, a prevention focus is activated and people are more satisfied with their choices after choosing among few options compared to many options, i.e. choice overload. However, individuals can also experience a reverse choice overload effect when acting as proxy decision-maker, too.

It is widely accepted that having more choices is inherently positive. When there are more available options from which to choose, an individual is more likely to be able to select the particular option that is the best fit and most likely to satisfy them. Choice is typically thought to be related to personal freedom and enhanced well-being.

Therefore, according to colleague Neal Baum MD, for most individuals the ultimate goal is to constantly maximize their choices in life to increase their overall satisfaction and well-being. The decision-making process, however, is a complex cognitive task that does not always lead to positive outcomes.

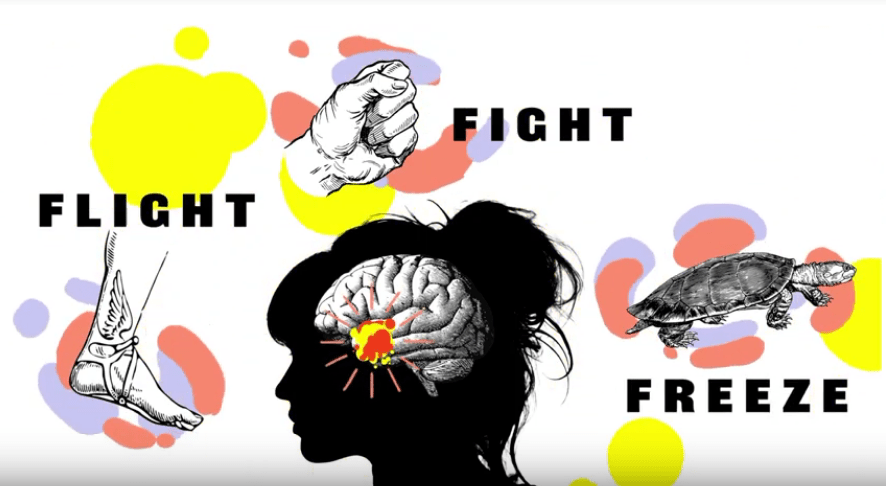

Thus, while having options is generally good, too many choices can lead to anxiety and decision fatigue. This is why curated selections and recommendations are so popular – they simplify the decision-making process’ according to another colleague Dan Ariely PhD.

So, when you’re overwhelmed by choices, narrow them down to a manageable number and make your decision easier.

COMMENTS APPRECIATED

Please Subscribe!

***

***

Filed under: "Doctors Only", CMP Program, Ethics, Glossary Terms, iMBA, iMBA, Inc., LifeStyle, mental health, Military Medicine | Tagged: choice overload, CMP, Dan Ariely, iMBA, Institute Medical Business Advisors, medical executive post, mental health, Neal Baum, psychology, reverse choice overload, sychiatry | Leave a comment »