Transitioning to the End of Your Medical Career

SPONSOR: https://marcinkoassociates.com/

BY DR. DAVID EDWARD MARCINKO MBA MEd CMP®

SPONSOR: http://www.CertifiedMedicalPlanner.org

With the PP-ACA, increased compliance regulations and higher tax rates impending from the Biden administration – not to mention the corona pandemic, venture capital based healthcare corporations and telehealth – physicians are more concerned about their retirement and retirement planning than ever before; and with good reason. After payroll taxes, dividend taxes, limited itemized deductions, the new 3.8% surtax on net investment income and an extra 0.9% Medicare tax, for every dollar earned by a high earning physician, almost 50 cents can go to taxes!

Introduction

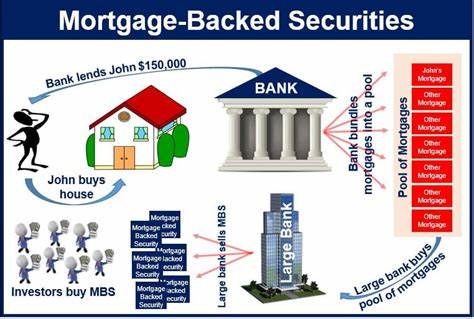

Retirement planning is not about cherry picking the best stocks, ETFs or mutual funds or how to beat the short term fluctuations in the market. It’s a disciplined long term strategy based on scientific evidence and a prudent process. You increase the probability of success by following this process and monitoring on a regular basis to make sure you are on track.

General Surveys

According to a survey from the Employee Benefit Research Institute [EBRI] and Greenwald & Associates; nearly half of workers without a retirement plan were not at all confident in their financial security, compared to 11 percent for those who participated in a plan, according to the 2014 Retirement Confidence Survey (RCS).

In addition, 35 percent of workers have not saved any money for retirement, while only 57 percent are actively saving for retirement. Thirty-six percent of workers said the total value of their savings and investments—not including the value of their home and defined benefit plan—was less than $1,000, up from 29 percent in the 2013 survey. But, when adjusted for those without a formal retirement plan, 73 percent have saved less than $1,000.

Debt is also a concern, with 20 percent of workers saying they have a major problem with debt. Thirty-eight percent indicate they have a minor problem with debt. And, only 44 percent of workers said they or their spouse have tried to calculate how much money they’ll need to save for retirement. But, those who have done the calculation tend to save more.

The biggest shift in the 24 years has been the number of workers who plan to work later in life. In 1991, 84 percent of workers indicated they plan to retire by age 65, versus only 9 percent who planned to work until at least age 70. In 2014, 50 percent plan on retiring by age 65; with 22 percent planning to work until they reach 70.

Physician Statistics

Now, compare and contrast the above to these statistics according to a 2018 survey of physicians on financial preparedness by American Medical Association [AMA] Insurance. The statistics are still alarming:

- The top personal financial concern for all physicians is having enough money to retire.

- Only 6% of physicians consider themselves ahead of schedule in retirement preparedness.

- Nearly half feel they were behind

- 41% of physicians average less than $500,000 in retirement savings.

- Nearly 70% of physicians don’t have a long term care plan.

- Only half of US physicians have a completed estate plan including an updated will and Medical directives.

Thoughts to Ponder

And so, to help make your golden years comfortable and worry free, here are ten important retirement questions for all physicians to consider:

- How much money do you need to retire?

- What is your retirement cash flow?

- What is your retirement vision?

- How to stay on retirement track?

- How to maximize retirement plan contributions such as 401(k) or 403(b)?

- How to maximize retirement income from retirement plans?

- What are some other retirement plan savings options?

- What is your retirement plan and investing style?

- What is the role of social security in retirement planning?

- How to integrate retirement with estate planning?

The opinion of a competent Certified Medical Planner® can assist.

ASSESSMENT: Your thoughts, comments and input are appreciated.

ORDER Textbook: https://www.amazon.com/Comprehensive-Financial-Planning-Strategies-Advisors/dp/1482240289/ref=sr_1_1?ie=UTF8&qid=1418580820&sr=8-1&keywords=david+marcinko

SECOND OPINIONS: https://medicalexecutivepost.com/schedule-a-consultation/

INVITE DR. MARCINKO: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

THANK YOU

***

Filed under: "Doctors Only", Estate Planning, Financial Planning, Retirement and Benefits, Touring with Marcinko | Tagged: David Edward Marcinko, physician retirement planning, retirement, retirement for doctors, retirement planning | Leave a comment »