Understanding FMV Methodology

Dr. David Edward Marcinko; MBA, CMP™

[Publisher-in-Chief]

For doctors, buying or selling a practice may be the biggest financial transaction of their lives. Reasons for appraising practice worth include: succession, retirement and estate planning; partnership disputes and divorce; or as an important tool for organic growth and strategic planning.

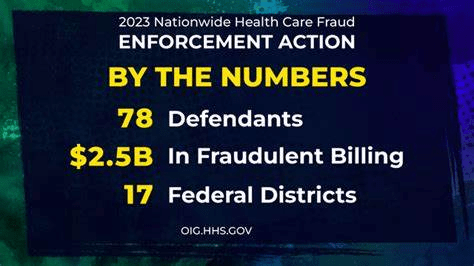

However, the transaction is fraught with many pitfalls to avoid and no medical specialty seems immune; especially when it comes to contentious fair market value [FMV] appraisals.

“Rule-of-Thumb” Formulas – Now Considered Archaic

As readers of the Executive-Post know, in the stable past, physicians occasionally used “rule-of-thumb” formulas to value their medical practices.

“Rules” typically were expressed as benchmark calculations, formulas or multipliers (e.g. “one times revenues” or “five times cash flow”).

Today, because of the economic volatility in the healthcare industrial complex, “rules of thumb” should not be used to value any medical practice (other than as general internal managerial sanity checks).

Moreover, they are fraught with legal liability should the deal sour, as such benchmarks general hold little to no weight with the IRS.

Yet, Thumbs Still Used

Yet, thumb-rules are still used by misguided physicians because of their simplicity and price; as the cost of a “rule-of-thumb” valuation is hard to beat; $0. Keep in mind that in most cases, you will want to ensure the value determination will stand up to IRS scrutiny, so the $0 rule-of-thumb is not really an option

And so, a reasonable inquiry is: How is a proper Uniform Standards of Professional Appraisal Practice [USPAP] styled Opinion-of-Value crafted, and what is contained in the report?

Opinions of Value – Often Proprietary

For obvious reasons, an Opinion of Value structure is both standardized, yet inherently different for each valuation firm and often a proprietary and carefully guarded secrete; not unlike legal work-products.

However, according to Hope Rachel Hetico; RN, MHA – and a Certified Medical Planner™ from the Institute of Medical Business Advisors Inc, in Atlanta GA [www.MedicalBusinessAdvisors.com] – a typical modern opinion might contain the following information; more or less depending on the client and nature of engagement.

Sample Table of Contents*

Part I—Planning the Medical Practice Valuation

-

Purpose of the Appraisal

-

Goals and Objectives of the Appraisal

-

Source Data and Fact Gathering

-

Due Diligence Preparation

-

Professional Practice Comparative Information

-

Sources of Professional Practice Industry Financial Data

-

Selecting the Valuation Method of Choice

Part 2—Professional Practice Valuation Approaches

Part 3—Fractional Practice Ownership Interests and Estimated Value

-

Reasons to Appraise a Fractional Ownership Interest

-

Approaches to the Valuation of Percentage Ownership Interests

-

Percentage Ownership Interest Valuation Discounts and Premiums

-

Discount/Premium for Lack/Mandate of Control (Minority versus Majority)

-

Discount/Premium for Lack/Mandate of Marketability and Sale

-

Discounts and Premiums for Other Nonsystematic Risk Factors

-

Sequencing of Discounts and Premiums

-

Medical Practice Capitalization Rate Construction

-

The Reconciliation and Review Process

-

Relationship of Review Valuation Process

-

Reconciliation Criteria

-

Final Value Estimate

-

Valuation Conclusion

-

Presentation of Valuation Conclusion

-

Independence Statement

-

Opinion of Value Range

-

Summary Report to Principals

Part 4—Reporting the Professional Practice Valuation Results

-

Introduction to Valuation Reporting Standards

-

Appraisal Reporting Standards

-

Elements of the Appraisal

-

Retention of Appraisal Reports and Files

-

USPAP Format and Style

-

Confidentiality Provisions

-

Glossary of Terms

-

Summary and Conclusion

Part 5—Appendices

-

Appendix: Bibliography of Principle Valuators

-

Appendix: Standards of the American Society of Appraisers; etc

-

Appendix: Standards of the Institute of Business Appraisers; etc

* TOC and acuity subject to engagement specificity

Assessment

Legalistically, a landmark legal case in business valuation was the Estate of Edgar A. Berg v. Commissioner (T. C. Memo 1991-279).

The Court criticized the CPAs as not being qualified to perform valuations, failing to provide analysis of an appropriate discount rate, and making only general references to justify their “Opinion of Value.”

In rejecting these experts, the Court accepted the IRS’s expert because he possessed the background, education and training; and developed discounts, and demonstrating how reproducible evidence applied to the assets being examined.

The Berg decision marked the beginning of the Tax Court leaning toward the side with the most comprehensive appraisal. Previously, it had a tendency to “split the difference.”

Now, some feel the Berg case launched the business valuation profession.

Conclusion

And so, is the Opinion of Value another reason why you should retain a fiduciary health economist to appraise your medical practice at arms-length; rather than seek a broker, agent or commissioned-salesman? Please comment and opine?

Engagements: Above is the link for an abbreviated list of several sample engagements completed by the Institute of Medical Business Advisors, Inc www.MedicalBusinessAdvisors.com

Its purpose is to demonstrate the protean diversity and vast nature of similar medical client engagements.

Speaker: If you need a moderator or a speaker for an upcoming event, Dr. David Edward Marcinko; MBA – Editor and Publisher-in-Chief – is available for speaking engagements. Contact him at: MarcinkoAdvisors@msn.com

Filed under: Practice Worth | Leave a comment »