Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.HealthDictionarySeries.org

***

***

For generations, degrees in law [JD] and medicine [MD, DO, DPM] have been treated as the pinnacle of academic achievement—prestigious, demanding, and rewarded with stable, respected careers. Yet the world that created those expectations is not the world students now inhabit. Artificial intelligence is advancing at a pace that outstrips the traditional timelines of professional education, and the mismatch between the speed of technological change and the slow, rigid structure of these degrees raises an uncomfortable question: by the time today’s students finish their training, will AI have already surpassed them in the very tasks they spent a decade learning to perform? Increasingly, the answer looks like yes. The sheer length of law and medical education risks turning these degrees into time-consuming, financially draining commitments that deliver diminishing returns in a world where AI systems are rapidly mastering the core functions of both professions.

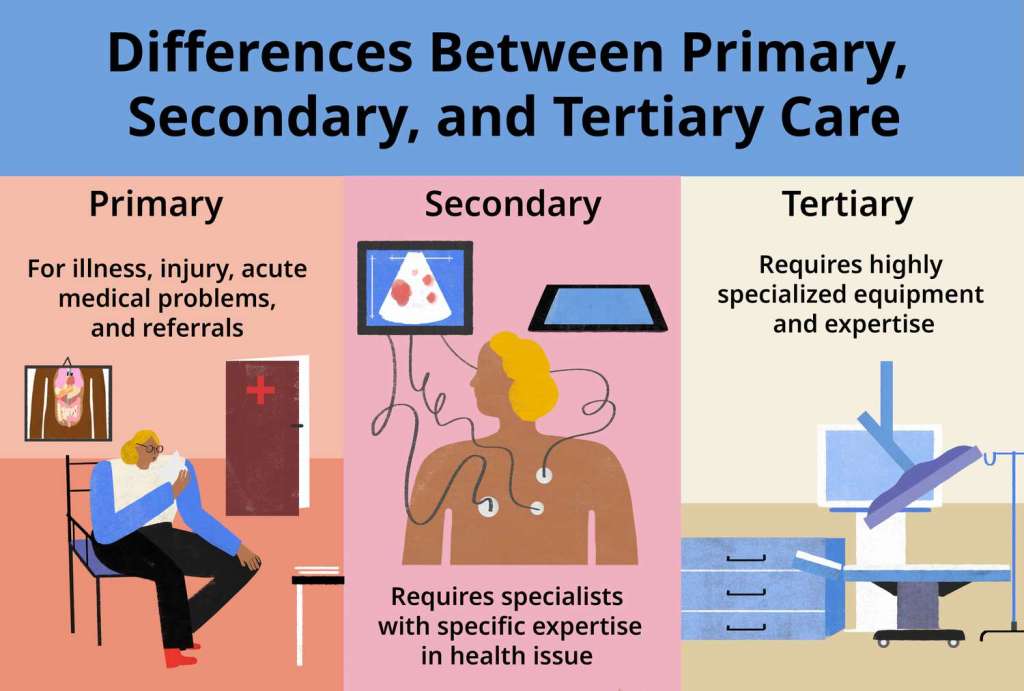

The first problem is the timeline. A typical lawyer spends seven years in higher education before even beginning to practice: four years of undergraduate study, three years of law school, and often additional time preparing for the bar exam. Medical students face an even more daunting path—four years of undergraduate work, four years of medical school, and anywhere from three to seven years of residency. In the most demanding specialties, the total training period can stretch to fifteen years. These timelines were designed for a world in which knowledge advanced slowly and human expertise was the only route to mastery. But AI does not learn on human timescales. It improves continuously, absorbs new information instantly, and scales its capabilities across millions of users simultaneously. A medical student might spend months memorizing diagnostic criteria; an AI system can ingest the entire body of medical literature in minutes and update itself daily. A law student might spend years learning case law; an AI can analyze every precedent ever recorded in seconds.

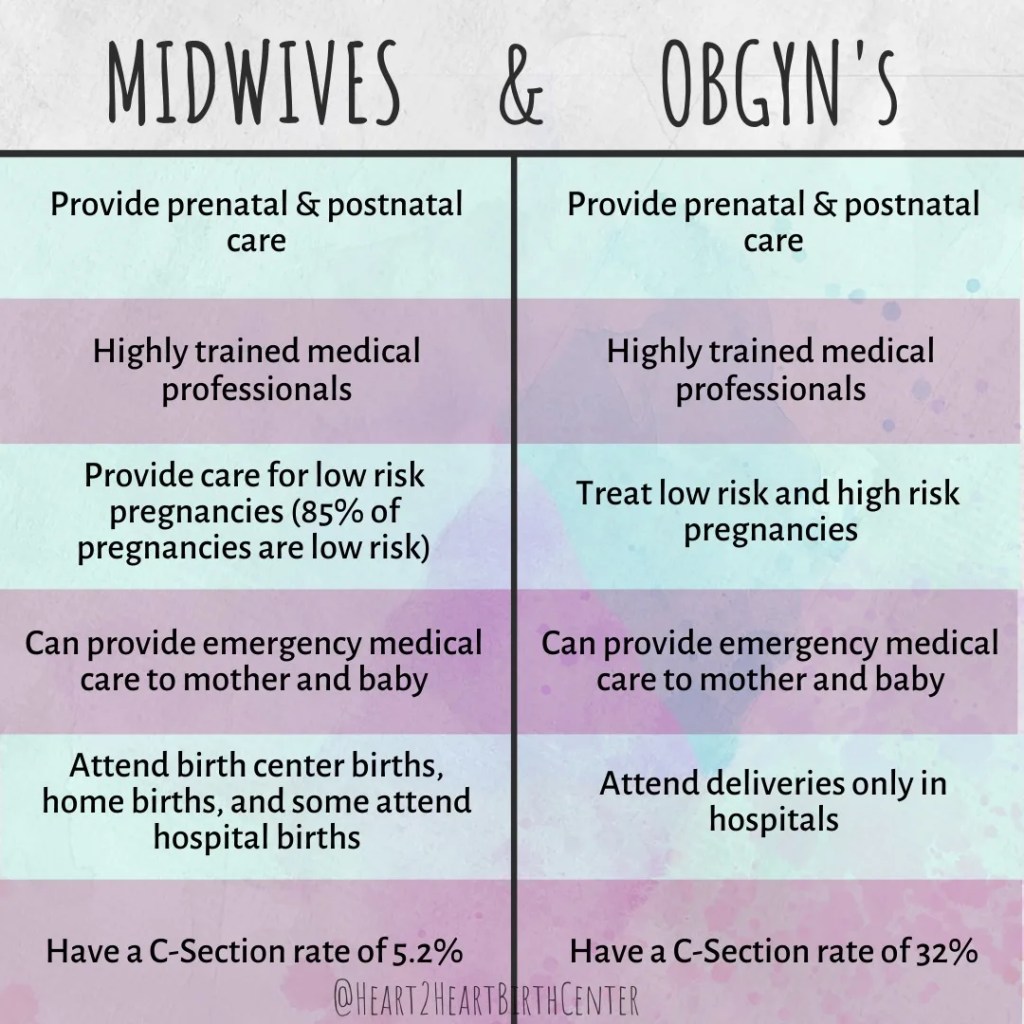

This asymmetry creates a fundamental disadvantage for human learners. By the time a student completes their degree, the landscape of their profession may have shifted so dramatically that the skills they spent years acquiring are no longer the ones most valued. In law, AI systems are already drafting contracts, summarizing case files, generating legal arguments, and predicting case outcomes with accuracy that rivals or exceeds junior associates. In medicine, AI tools can read imaging scans, detect anomalies, propose diagnoses, and recommend treatment plans with increasing precision. These are not fringe experiments—they are rapidly becoming integrated into mainstream practice. The tasks that once justified long, expensive degrees are being automated faster than new graduates can enter the workforce.

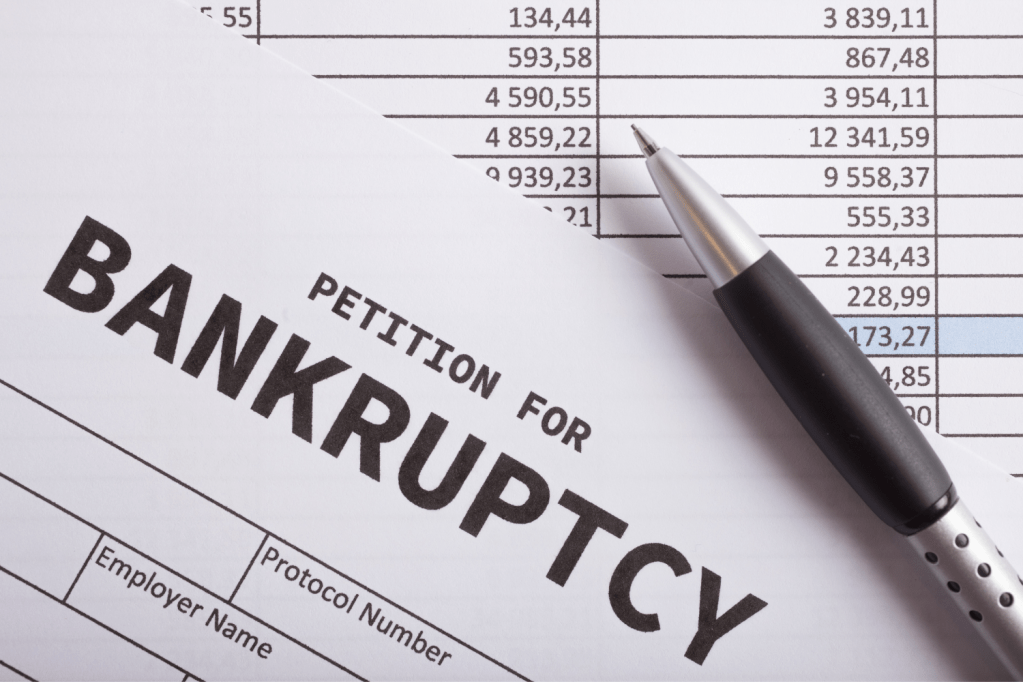

Another issue is the economic cost. Law and medical degrees are among the most expensive educational paths available, often leaving students with six-figure debt before they earn their first paycheck. This debt was once justified by high salaries and stable career prospects. But as AI takes over more of the routine, billable, or diagnostic work, the economic model that sustained these professions begins to erode. Law firms are already reducing the number of entry-level associates they hire because AI tools can perform document review and research more efficiently. Hospitals and clinics are adopting AI-driven diagnostic systems that reduce the need for large teams of specialists. The traditional pyramid structure—many junior workers supporting a few senior experts—is flattening. Students who spend a decade training may find that the jobs they expected simply no longer exist in the same form.

***

***

Even more troubling is the rigidity of these degrees. Law and medicine require students to commit early, specialize deeply, and follow a narrow path with little room for adaptation. But the modern economy rewards flexibility, rapid skill acquisition, and the ability to pivot as technology evolves. AI-driven fields such as data science, machine learning, and computational biology allow students to gain valuable skills in months, not years. These fields are dynamic, interdisciplinary, and aligned with the direction the world is moving. In contrast, law and medicine lock students into long-term commitments that may not align with the future job market. The opportunity cost is enormous: while a medical student is memorizing anatomy for the third time, a peer in technology may have already launched a startup, built a portfolio of projects, or entered a high-paying job that evolves alongside AI rather than competes with it.

There is also a psychological cost. The pressure, burnout, and relentless workload associated with law and medical training are well documented. Students sacrifice their twenties—and often their mental health—for the promise of a stable career. But if that stability is no longer guaranteed, the sacrifice becomes harder to justify. Why endure years of stress, sleepless nights, and financial strain for a profession that may be reshaped beyond recognition by the time one enters it? AI does not get tired, does not need sleep, and does not accumulate debt. Competing with it on its own terms is a losing battle.

None of this means that human lawyers and doctors will disappear entirely. There will always be roles that require human judgment, empathy, and ethical reasoning. But the number of such roles may shrink dramatically, and the value of traditional degrees may decline as AI handles more of the technical workload. The question is not whether law and medicine will change—they already are—but whether it makes sense for students to invest a decade of their lives preparing for professions that are being redefined faster than they can train for them.

In a world where AI evolves exponentially and education moves at a glacial pace, degrees in law and medicine risk becoming relics of a slower era. The time, cost, and rigidity of these programs no longer align with the speed of technological progress. Students entering these fields today may find themselves outpaced by machines before they even begin to practice. The future belongs to those who can adapt quickly, learn continuously, and work alongside AI—not those who spend ten years preparing for a world that may no longer exist when they graduate.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Doctors Only", Career Development, Touring with Marcinko | Tagged: AI, david marcinko, DDS, DO, JD, MD, medicine | Leave a comment »