Former: CEO and Founder

Superior Consultant Company, Inc.

[SUPC-NASD]

EDITOR’S NOTE: I first met Rich in B-school, when I was a student, back in the day. He was the Founder and CEO of Superior Consultant Holdings Corp. Rich graciously wrote the Foreword to one of my first textbooks on financial planning for physicians and healthcare professionals. Today, Rich is a successful entrepreneur in the technology, health and finance space.

-Dr. David E. Marcinko MBA MEd CMP®

***

By Richard Helppie

Today for your consideration – How to fix the healthcare financing methods in the United States?

I use the term “methods” because calling what we do now a “system” is inaccurate. I also focus on healthcare financing, because in terms of healthcare delivery, there is no better place in the world than the USA in terms of supply and innovation for medical diagnosis and treatment. Similarly, I use the term healthcare financing to differentiate from healthcare insurance – because insurance without supply is an empty promise.

This is a straightforward, 4-part plan. It is uniquely American and will at last extend coverage to every US citizen while not hampering the innovation and robust supply that we have today. As this is about a Common Bridge and not about ideology or dogma, there will no doubt be aspects of this proposal that every individual will have difficulty with. However, on balance, I believe it is the most fair and equitable way to resolve the impasse on healthcare funding . . . .

CITE: https://www.r2library.com/Resource/Title/0826102549

Let me start in an area sure to raise the ire of a few. And that is, we have to start with eliminating the methods that are in place today. The first is the outdated notion that healthcare insurance is tied to one’s work, and the second is that there are overlapping and competing tax-supported bureaucracies to administer that area of healthcare finance.

Step 1 is to break the link between employment and health insurance. Fastest way to do that is simply tax the cost of benefits for the compensation that it is. This is how company cars, big life insurance policies and other fringe benefits were trimmed. Eliminating the tax-favored treatment of employer-provided healthcare is the single most important change that should be made.

Yes, you will hear arguments that this is an efficient market with satisfied customers. However, upon examination, it is highly risky, unfair, and frankly out of step with today’s job market.

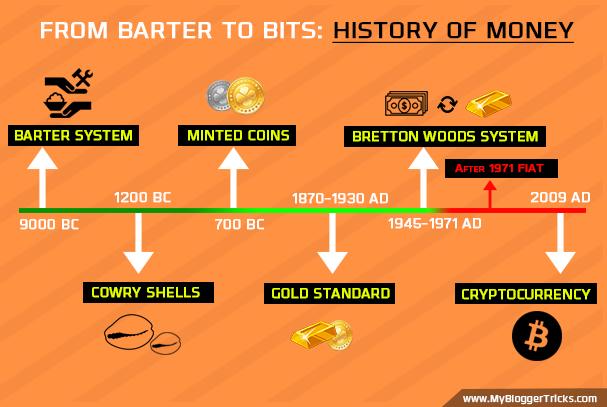

Employer provided health insurance is an artifact from the 1940’s as an answer to wage freezes – an employer could not give a wage increase, but could offer benefits that weren’t taxed. It makes no sense today for a variety of reasons. Here are a few:

1. Its patently unfair. Two people living in the same apartment building, each making the same income and each have employer provided health insurance. Chris in unit 21 has a generous health plan that would be worth $25,000 each year. Pays zero tax on that compensation. Pat, in unit 42 has a skimpy plan with a narrow network, big deductibles and hefty co-pays. The play is worth $9,000 each year. Pat pays zero tax.

3. The insurance pools kick out the aged. Once one becomes too old to work, they are out of the employer plan and on to the retirement plan or over to the taxpayers (Medicare).

4. The structure is a bad fit. Health insurance and healthy living are longitudinal needs over a long period of time. In a time when people change careers and jobs frequently, or are in the gig economy, they are not any one place long enough for the insurance to work like insurance.

5. Creates perverse incentives. The incentives are weighted to have employers not have their work force meet the standards of employees so they don’t have to pay for the health insurance. Witness latest news in California with Uber and Lyft.

6. Incentives to deny claims abound. There is little incentive to serve the subscriber/patient since the likelihood the employer will shop the plan or the employee will change jobs means that stringing out a claim approval is a profitable exercise.

7. Employers have difficulty as purchasers. An employer large enough to supply health insurance has a diverse set of health insurance needs in their work force. They pay a lot of money and their work force is still not 100% happy.

Net of it, health insurance tied to work has outlived its usefulness. Time to end the tax-favored treatment of employer-based insurance. If an employer wants to provide health insurance, they can do it, but the value of that insurance is reflected in the taxable W-2 wages – now Pat and Chris will be treated equally.

Step 2 is to consolidate the multiple tax-supported bureaus that supply healthcare. Relieve the citizens from having to prove they are old enough, disabled enough, impoverished enough, young enough. Combine Medicare, Medicaid, CHIP, Tricare and even possibly the VA into a single bureaucracy. Every American Citizen gets this broad coverage at some level. Everyone pays something into the system – start at $20 a year, and then perhaps an income-adjusted escalator that would charge the most wealthy up to $75,000. Collect the money with a line on Form 1040.

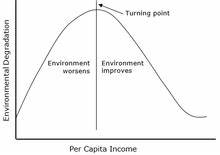

I have not done the exact math. However, removing the process to prove eligibility and having one versus many bureaucracies has to generate savings. Are you a US Citizen? Yes, then here is your base insurance. Like every other nationalized system, one can expect longer waits, fewer referrals to a specialist, and less innovation. These centralized systems all squeeze supply of healthcare services to keep their spend down. The reports extolling their efficiencies come from the people whose livelihoods depend on the centralized system. However, at least everyone gets something. And, for life threatening health conditions, by and large the centralized systems do a decent job. With everyone covered, the fear of medical bankruptcy evaporates. The fear of being out of work and losing healthcare when one needs it most is gone.

So if you are a free market absolutist, then the reduction of vast bureaucracies should be attractive – no need for eligibility requirements (old enough, etc.) and a single administration which is both more efficient, more equitable (everyone gets the same thing). And there remains a private market (more on this in step 3) For those who detest private insurance companies a portion of that market just went away. There is less incentive to purchase a private plan. And for everyone’s sense of fairness, the national plan is funded on ability to pay. Bearing in mind that everyone has to pay something. Less bureaucracies. Everyone in it together. Funded on ability to pay.

Step 3 is to allow and even encourage a robust market for health insurance above and beyond the national plan – If people want to purchase more health insurance, then they have the ability to do so. Which increases supply, relieves burden on the tax-supported system, aligns the US with other countries, provides an alternative to medical tourism (and the associated health spend in our country) and offers a bit of competition to the otherwise monopolistic government plan.

Its not a new concept, in many respects it is like the widely popular Medigap plans that supplement what Medicare does not cover.

No one is forced to make that purchase. Other counties’ experience shows that those who choose to purchase private coverage over and above a national plan often cite faster access, more choice, innovation, or services outside the universal system, e.g., a woman who chooses to have mammography at an early age or with more frequency than the national plan might allow. If the insurance provider can offer a good value to the price, then they will sell insurance. If they can deliver that value for more than their costs, then they create a profit. Owners of the company, who risk their capital in creating the business may earn a return.

For those of you who favor a free market, the choices are available. There will be necessary regulation to prevent discrimination on genetics, pre-existing conditions, and the like. Buy the type of plan that makes you feel secure – just as one purchases automobile and life insurance.For those who are supremely confident in the absolute performance of a centralized system to support 300+ million Americans in the way each would want, they should like this plan as well – because if the national plan is meeting all needs and no one wants perhaps faster services, then few will purchase the private insurance and the issuers will not have a business. Free choice. More health insurance for those who want it. Competition keeps both national and private plans seeking to better themselves.

Step 4 would be to Permit Access to Medicare Part D to every US Citizen, Immediately

One of the bright spots in the US Healthcare Financing Method is Medicare Part D, which provides prescription drug coverage to seniors. It is running at 95% subscriber satisfaction and about 40% below cost projections.

Subscribers choose from a wide variety of plans offered by private insurance companies. There are differences in formularies, co-pays, deductibles and premiums.

So there you have it, a four part plan that would maintain or increase the supply of healthcare services, universal insurance coverage, market competition, and lower costs. Its not perfect but I believe a vast improvement over what exists today. To recap:

1. Break the link between employment and healthcare insurance coverage, by taxing the benefits as the compensation they are.

2. Establish a single, universal plan that covers all US citizens paid for via personal income taxes on an ability-to-pay basis. Eliminate all the other tax-funded plans in favor of this new one.

3. For those who want it, private, supplemental insurance to the national system, ala major industrialized nations.

4. Open Medicare Part D (prescription drugs) to every US citizen. Today.

YOUR THOUGHTS ARE APPRECIATED.

Thank You

***

HOSPITALS: https://www.amazon.com/Financial-Management-Strategies-Healthcare-Organizations/dp/1466558733/ref=sr_1_3?ie=UTF8&qid=1380743521&sr=8-3&keywords=david+marcinko

***

HEALTHCARE: https://www.amazon.com/Hospitals-Healthcare-Organizations-Management-Operational/dp/1439879907/ref=sr_1_4?s=books&ie=UTF8&qid=1334193619&sr=1-4

***

Filed under: Career Development, Experts Invited, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, Op-Editorials, Quality Initiatives | Tagged: Common Bridge, Health Insurance, medicare, Medicare Advantage, medigap, Part C, Part D, Richard Helppie, Solution for Healthcare | Leave a comment »