Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

Financial scams have become a defining challenge of the modern American economy. As technology evolves and financial systems grow more complex, scammers continually adapt, exploiting vulnerabilities in human psychology, digital infrastructure, and regulatory gaps. While the specific tactics shift over time, the underlying goal remains constant: to separate people from their money. Understanding the most prevalent and damaging scams is essential for building a more informed and resilient public. The following analysis explores ten of the most significant financial scams in the United States, examining how they operate and why they continue to succeed.

***

***

1. Phishing and Identity Theft

Phishing remains one of the most widespread and effective financial scams in the country. It relies on deception rather than technical sophistication, tricking individuals into revealing sensitive information such as Social Security numbers, bank credentials, or credit card details. Scammers often impersonate trusted institutions—banks, government agencies, or major retailers—using emails, text messages, or fake websites. Once personal data is obtained, criminals can open fraudulent accounts, drain bank balances, or sell the information on illicit markets. The persistence of phishing stems from its simplicity and the sheer volume of attempts; even a tiny success rate yields substantial profit.

2. IRS and Government Impersonation Scams

Government impersonation scams exploit fear and authority. Fraudsters pose as IRS agents, Social Security officials, or law enforcement officers, claiming the victim owes money, faces arrest, or must verify personal information. These scams often target older adults, immigrants, or individuals unfamiliar with government procedures. The scammers’ aggressive tone and threats of legal consequences create a sense of urgency that overrides rational judgment. Despite widespread public warnings, these scams continue to thrive because they tap into deep-seated anxieties about government power and financial responsibility.

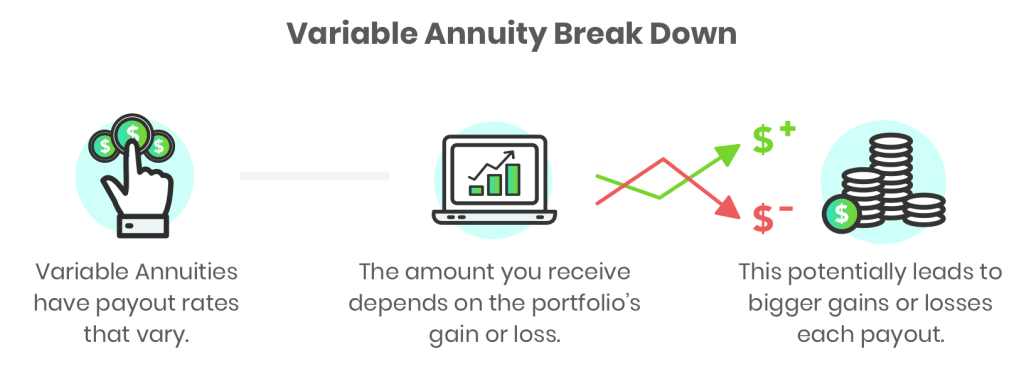

3. Investment and Ponzi Schemes

Investment scams, including Ponzi and pyramid schemes, have a long history in the United States. They promise high returns with little or no risk—an enticing proposition that often lures even financially savvy individuals. Ponzi schemes rely on using new investors’ money to pay earlier participants, creating the illusion of legitimate profit. Eventually, the scheme collapses when new investments dry up. These scams succeed because they exploit trust, often spreading through social networks, religious communities, or professional circles. The combination of social pressure and the allure of easy wealth makes them particularly destructive.

4. Romance Scams

Romance scams have surged with the rise of online dating platforms and social media. Scammers create fake personas, build emotional connections with victims, and eventually fabricate crises that require financial assistance. These scams are not only financially devastating but emotionally traumatic. Victims often feel ashamed, which can delay reporting and allow scammers to continue operating. The success of romance scams lies in their slow, deliberate manipulation; by the time money is requested, the victim may feel deeply bonded to someone who never existed.

5. Tech Support Scams

Tech support scams prey on individuals’ fear of losing access to their devices or data. Scammers pose as representatives from major technology companies, claiming the victim’s computer is infected or compromised. They persuade victims to grant remote access or pay for unnecessary services. Once inside the device, scammers may install malware, steal information, or lock the user out entirely. These scams often target older adults or those less comfortable with technology, but anyone can fall victim during a moment of panic.

6. Credit Repair and Debt Relief Scams

In a country where many people struggle with debt, credit repair and debt relief scams exploit financial vulnerability. Fraudulent companies promise to erase bad credit, negotiate with creditors, or eliminate debt entirely. They often charge high upfront fees and deliver little or nothing in return. Some even instruct clients to engage in illegal practices, such as creating new identities. These scams persist because they offer hope to people who feel overwhelmed by financial pressure, making them susceptible to unrealistic promises.

***

***

7. Lottery and Sweepstakes Scams

Lottery scams typically begin with a message claiming the recipient has won a large prize. To collect it, the victim must pay taxes, processing fees, or insurance costs. Of course, no prize exists. These scams often target older adults, who may be more trusting or more likely to respond to unsolicited communication. The psychological hook is powerful: the idea of sudden wealth can cloud judgment, especially when the scammer uses official‑sounding language and fabricated documentation.

8. Business Email Compromise (BEC)

BEC scams are among the most financially damaging schemes affecting American businesses. Criminals infiltrate or spoof corporate email accounts to trick employees into wiring funds or revealing sensitive information. These scams often involve extensive research and social engineering, making them highly convincing. A scammer might impersonate a CEO requesting an urgent transfer or a vendor sending updated payment instructions. Because the communication appears legitimate and the transactions are often routine, victims may not realize anything is wrong until the money is gone.

9. Mortgage and Real Estate Scams

Real estate transactions involve large sums of money, making them prime targets for fraud. Scammers may pose as lenders offering unrealistic mortgage terms, title companies requesting wire transfers, or landlords advertising properties they do not own. In some cases, criminals steal the identities of property owners and attempt to sell homes without their knowledge. These scams exploit the complexity of real estate processes, where multiple parties and documents create opportunities for deception.

10. Cryptocurrency Scams

The rapid growth of cryptocurrency has created fertile ground for new forms of fraud. Scammers promote fake coins, fraudulent exchanges, or high‑yield investment programs. Some impersonate celebrities or financial influencers to lend credibility to their schemes. Because cryptocurrency transactions are irreversible and often anonymous, victims have little recourse once funds are transferred. The combination of technological novelty, speculative excitement, and limited regulation makes this one of the fastest‑growing categories of financial scams in the United States.

Conclusion

Financial scams in the United States are diverse, adaptive, and increasingly sophisticated. They exploit human emotions—fear, hope, trust, loneliness—as much as technological vulnerabilities. While law enforcement and regulatory agencies work to combat these schemes, public awareness remains the most powerful defense. Understanding how these scams operate empowers individuals to recognize warning signs, question suspicious requests, and protect themselves and their communities. As long as money and technology continue to evolve, scammers will follow, making vigilance an essential part of modern financial life.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Experts Invited, finance, Financial Advisor Listings, Marcinko Associates, mental health | Tagged: Bitcoin, blockchain, credit cards, crypto, cryptocurrency, cryptocurrency scams, david marcinko, debt relief, finance, IRS scams, lottery, mortgage, phising scams, Ponzi, real estate, romance, Top Ten Financial Scams | Leave a comment »