A Primer for Physician Investors and Medical Professionals

By: Dr. David Edward Marcinko; MBA, MEd, CMP™

http://www.CertifiedMedicalPlanner.org

[PART 7 OF 8]

University of Pennsylvania

NOTE: This is an eight part ME-P series based on a weekend lecture I gave more than a decade ago to an interested group of graduate, business and medical school students. The material is a bit dated and some facts and specifics may have changed since then. But, the overall thought-leadership information of the essay remains interesting and informative. We trust you will enjoy it.

Introduction

Securities are bought and sold every day by medical investors who never meet each other. The market impersonally enables transfer (or sale) of securities from individuals who are selling to those who are buying. These trades may occur on an organized exchange such as the New York Stock Exchange, or, a decentralized, dealer to dealer market, which is called the over-the-counter (OTC). Any transaction that does not take place on the floor of an exchange, takes place over-the-counter.

The over-the-counter market is a national negotiated market, without a central market place, without a trading floor, composed of a network of thousands of brokers and dealers who make securities transactions for themselves and their customers. Professional buyers and sellers seek each other out electronically and by telephone and negotiate prices on the most favorable basis that can be achieved. Often, these negotiations are accomplished m a matter of seconds, there is no auction procedure comparable to that on the floor of an exchange.

The over-the-counter market is far the largest market in terms of numbers of securities issues traded. There are over 30,000 issues on which regular quotations are published OTC, while there are less than 4,000 stocks listed on all securities exchanges. There are frequently days when the reported volume of over-the-counter trades exceeds that of the NYSE. What really is the over-the-counter market? Is it where securities of inferior quality trade?

Here is a list to remember of the types of securities traded exclusively over-the- counter:

- All Government bonds. .

- All municipal bonds. .

- All mutual funds.

- All new issues (primary distributions). .

- All variable annuities.

- All tax shelter programs.

- All equipment trust certificates.

Of course, the OTC market is also where all of the “unseasoned ” issues are traded and most of them are quite speculative, but there certainly are many high quality issues available over-the- counter. Now, let’s take a look at how this over- the-counter market works.

Market Maker

Whereas, the “main player” on the exchange is the specialist, his OTC counter part, in terms of importance, is the market maker. In the over-the-counter market, many securities firms act as dealers by creating and maintaining markets in selected securities. Dealers act as principals in a securities transaction and buy and sell securities for their own account and risk. Since they do not act as agents or brokers but instead as principals or dealers in securities transactions, they do not receive any commission for their services but instead buy at one price and sell at a higher price making a profit from “mark-up” on the security price. A dealer is said to have a position in a stock when he purchases and holds a security in his inventory. He, of course takes a risk that the market price of the security he holds may decline in value. This is how dealers make money; they buy wholesale and sell it retail, and the medical investor pays retail.

The OTC market bears little resemblance to the one of the mid-sixties. The major difference has been the electronic technological advances as embodied by the NASDAQ system. NASDAQ stands for National Association of Securities Dealers Automated Quotation system. Back in 1966, if you wanted to find out who was the market maker in the particular security you would go to a brightly colored stack of papers called the pink sheets, containing a listing, alphabetically, of over-the-counter stocks and underneath each issue is listed the name of one or more market makers, securities firms willing to trade that stock. After each firm name is the firm’s telephone number and a ‘bid and ask price”, that is, an approximate price representing what the dealer is asking for the stock and is bidding for the stock.

Back 25 years ago, the only way of locating a market maker was by using the pink sheets, while 0-T-C traded corporate bonds are quoted on yellow sheets. Under certain conditions, it could take a good deal of effort to try to get the best deal. Today, with the computer that sits on doctor’s desks, you can push a few buttons and instantaneously see the best bid and the best offer that exists right now on over 4,000 of the most active over-the- counter stocks. Not only that, you can pull up the names of every market maker in that particular stock and the actual (firm) quotes on those securities right now.

Electronic Sources of Securities Information

Level 1 service, available on the stock broker’s desk top, provides price information only on the highest bid and the lowest offer (the inside market). No market makers are identified, and since this is an inside quote, it may not be used by the registered representative (stock broker) for giving firm quotes.

Level 2 service provides a doctor subscriber with price information and quotation sizes of all participating registered market makers. When a trader, or medical investor, looks at his computer screen on Level 2, he sees who’s making a market, their firm bid, or ask, and the size of the market. One can get firm calls from level 2 information.

Level 3 takes it one step further; and allows registered market makers to enter bid and ask prices (quotes) and quotation sizes into the NASDAQ system and to report their trades. This is the level of service maintained by market makers.

Third Market

In most cases, a market maker of a stock in the NASDAQ system must report his trade in 90 seconds, but there is another circumstance in which the trade must be reported. This is called the third market, and is defined as transactions in exchange listed securities in the OTC market. For example, even though IBM is listed on the NYSE, an OTC market marking firm can acquire the IBM stock and begin to make a market for it just like an OTC stock. All of these trades are considered the third market, and are reported to the Consolidated Quotation System (CQS) within 90 seconds of the trade.

Fourth Market

The fourth market is defined as private transactions made directly between large medical investors, institutions such as banks, mutual funds, and insurance companies, without the use of a securities firm. In other words, fourth market trading is usually one institution swapping securities in its portfolio with another large institution. From the stock broker’s viewpoint, there is one problem with the fourth market. Since no broker/dealer is involved, no registered representative is involved and there is no commission to be earned. These trades are reported on a system called Instinet. This is advantageous to larger medial foundations or institutional investors.

BROKERAGE ACCOUNTS, MARGIN AND DEBT

Most medical professionals execute orders, and buy securities, for cash. This occurs either through a stock broker, telephone order, computerized on-line trade or the rapid fire buy/sell momentum of day trading. Regardless, since cash is used, this brokerage account is known as a cash account. Now, will explore the use of credit to buy securities. This process, called buying on margin, is done in a margin account, and is allowed through an SEC ruling known as Regulation T.

Regulation T

Regulation T, of the Securities Exchange Act of 1934, defined the two basic types of accounts, cash and margin. A cash account is one in which the medical professional agrees to pay the full purchase price of his trade within 3 full business days of the trade date. The trade date is the day on which the buy order was executed, either on an exchange, or over-the-counter (0TC). Regulation T requires a broker/dealer to cancel the trade if payment is not made on time.

If the doctor has made a partial payment but owes more than $1,000 by the end of the 3rd business day, the unpaid portion will be sold off. If, however, only $1,000 or less is owed, the broker/dealer is permitted to use its own best judgment as to whether to give the doctor client more time to come up with the amount owed.

If a doctor feels his reasons for not paying on time are exceptional, a request can be made by the broker/dealer for an extension of the 3 business day time limit. Only three organizations can approve such an extension: a national securities exchange, the National Association of Securities Dealers (NASD), or a Federal Reserve Bank.

If a doctor violates Regulation T, his broker/dealer will cancel the trade or liquidate the unpaid portion, and his cash account will be frozen for 90 calendar days. This means that if the doctor wishes to purchase additional securities in his cash account during the next 90 days, he must pay for the trade in full in advance. An easy way to remember the rule is: in a frozen cash account, cold cash up front is required for new purchases. Interestingly, margin accounts are never frozen, only cash accounts.

Regulation T Percentage (Credit)

The use of credit to finance securities transactions is governed by Regulation T of the Securities Exchange Act of 1934. Regulation T empowers the Federal Reserve Board to establish standards by which such transactions may take place. These standards include margin ability (which securities may be purchased on credit), and the applicable percentage of down payment required from the doctor when financing such a transaction. This percentage is commonly referred to as the Regulation T percentage, or just Regulation T.

Although Regulation T is 50% today, and has been since January, 1974, the following examples will assume a Regulation T of 60% (unless otherwise stated), strictly for the purposes of clarity since using 50 % can sometimes become confusing when discussing the 50% down payment versus the other 50%, which is the loan value.

Margin Terms and Definitions

1. A Margin Account is opened for the purposes of engaging in securities transactions using credit extended by the brokerage firm.

2. Hypothecation is the pledging of securities as collateral for a margin loan. Before a brokerage firm can lend any money whatsoever, the law requires the loan to be secured or collateralized. The doctor desiring the loan hypothecates the stock in order to obtain the financing in the margin account.

3. Rehypothecation is a brokerage firm’s pledge of a doctor’s securities to secure loans from a bank.

These loans help the brokerage industry to afford to carry margin accounts for their doctor clients. Legally, the maximum dollar amount of a securities that may be re-hypothecated for carrying a margin account is 140% of the loan.

4. Street Name Registration occurs so a broker may be in a position to liquidate the loan collateral quickly, since the securities are registered in the name of the brokerage firm, or its nominee.

5. Beneficial Owner represents the healthcare professional whose securities are registered in street name remains the actual owner of all benefits of ownership, such as dividends or interest, capital appreciation, voting rights, pre-emptive rights, and, of course, the right to sellout the position and liquidate the account in whole or in part. Remember, though, the securities are actually in the name of the brokerage firm.

6. Commingling is an abuse that occurs when a brokerage firm mixes, or combines, its own securities with those of its clients to obtain loans and other benefits that go beyond what is fair and reasonable according to the law. This is an illegal practice.

7. Debit Balance is the amount of the loan from the brokerage firm, to the doctor, to finance the purchase of margin able securities.

Now let’s learn the mechanics of the loan by working a problem from the inception of Dr. William D. Smith’s margin purchase through the effects of market fluctuations on the account’s status.

Initial Margin Call and Equity

Let’s suppose that Dr Smith purchases 100 shares of Microsoft stock, at $100 per share, in a margin account, with Regulation T at 60%. To calculate the initial margin call, use the formula: Regulation T times purchase price, or, 60% x $10,000 = $6,000. A phrase to clearly express equity in a margin account is: “what you own, minus what you owe, is your equity”.

Note, since the doctor is required to put up $6,000, the broker is lending the other $4,000, or 40%, of the purchase price. This 40% figure is known as the loan value of the account and represents the maximum loan the broker is permitted to extend to Dr. Smith based upon current market value. This percentage and the Regulation T % will always add up to 100%.

Securities in Lieu of Cash

An initial margin call may also be met with securities, in lieu of cash. Since a stock broker (registered representative) is permitted to loan 40% of the current market value (CMV )of their securities (Regulation T @ 60% ), Dr. Smith can deposit into his margin account stock he owns outright, obtain a loan of 40% of CMV, and utilize that loan to meet a margin call on a purchase.

For instance, in the initial example in which Dr. Smith purchased $10,000 worth of Microsoft stock, the margin call could have been satisfied with $15,000 worth of fully-paid-for margin able stock in lieu of cash: 60% / 40% x $10,000 = $15,000.

In other words, the $10,000 purchase would require a cash deposit of 60% or $6,000. Since Dr. Smith is not going to put up cash, he must deposit margin able securities with a loan value of $6,000. The broker/dealer will loan him the $6,000, if he will deposit $15,000 of paid for securities. Again, here’s how he does it: $ 6,000 / 40% = $15,000

Excess Equity (SMA) and Buying Power

Let’s look at what happens should Microsoft stock appreciate in value. Suppose the stock rises in price from $100, to $120 per share, or to $ 12,000. The main thing to keep in mind is that while the market value of the shares changes continuously in the marketplace, Dr. Smith’s original loan from the broker does not change. The debit balance remains constant. An analogy that may be helpful is that homeowner Dr. Smith’s mortgage does not change when there is a rise in the value of his property.

Note that since the debit does not change, the equity increased exactly $2,000, the same as the amount of increase in the CMV ($12,000 -$10,000). Any change in market value (either up or down) causes a dollar for dollar change in equity. When securities purchased in a margin account increase in value, we have a situation called excess equity. Let’s examine this concept further by looking at the example after its appreciation to the new CMV of $12,000.

Your broker is permitted to give loans of 40% of the current market value of Microsoft, with Regulation T at 60%. Thus, the amount that could be loaned to Dr. Smith, on securities which are now worth $12,000, is $4,800. (40% times $12,000). However, the doctor has only borrowed $4,000 to this point in time. Therefore, there is an $800 ($4,800 -$4,000) amount that represents additional borrowing power available to Dr. Smith if, and when, he wishes to utilize it. This $800 is called excess equity, also referred to as SMA, which is the Special Memorandum Account that brokers use to record excess equity. Dr Smith has three distinct choices regarding excess equity.

1. First, he could borrow it in cash and remove it from the account.

In this case, the doctor requests that the cashier forward a check for $800. When this is done, the doctor’s new debit balance is $4,800, because he is, in fact, borrowing the money. It may be easier to understand SMA, if you consider the initials to stand for, Second Mortgage Account. In the same way that an increase in the market value of a home makes it possible to obtain a second mortgage (the lender is willing to loan money on the higher collateral value), an increase in the market value of an account gives more collateral which translates into more loan value, or, SMA. But, just as taking out a second mortgage (or home equity loan) on your home increases total indebtedness (your first and second mortgages), removing your SMA increases your debit balance.

2. Second, he could use it to buy more Microsoft stock.

In this case, Dr. Smith may make an additional purchase in his margin account and utilize the excess equity to “offset” his Regulation T down payment requirement on the new purchase. For example, he could make a $12,000 new purchase and be required to deposit only $6,400, instead of the $7,200 that would have been required under Regulation T had there been no excess equity in the account.

3. Thirdly, he could reserve the right to do either l, or 2, at a later time.

Now let’s compute the exact amount of securities he can buy without putting up any new money, using only excess equity to meet the call, with the formula:

EXCESS EQUITY / REGULATION T = $800 / 60% = $1,333.33, called BUYING POWER.

This means that if Dr. Smith were to place an order to buy exactly $1,333.33 worth of Microsoft stock on margin, he would not have to put up a penny out of his own pocket. To verify, compute the normal Regulation T margin call on a $1,333.33 purchase: 60% x $1,333.33 = $800. This “call” for $800 would be “met” by instructing his-broker that he wishes to use the excess equity of $800 in his account for that purpose.

The easiest way to remember the formula for buying power is by using the expression SMA/RT.

In this case, SMA / RT means SMA divided by the Regulation T%, by remembering the expression, “it’s SMART to use your buying power”. In this case, Dr. Smith chooses to wait until a later time to utilize his excess equity and his buying power. To this end, brokerage firms normally make a written record of the amount of the excess equity at the time it is created by a rise in CMV. In this way, it is reserved for future use.

From an accounting point of view, the broker will make a written entry in the Special Memorandum Account (SMA). Among other things, this special account is used to record these additional loan amounts that result due to market value increases. What do you think happens when a cash dividend is received on stock held in a margin account? Dr. Smith has the option of taking the dividend out of the account or leaving the money in. If he chooses the latter, from a bookkeeping standpoint, the cash is used to reduce the debit balance and the SMA is increased by that amount.

Once the excess equity amount has been entered into the SMA, it remains there until used, even if the market turns down subsequently. This is done primarily to encourage additional transactions, by Dr. Smith, even if he don’t wish to act at the precise moment the excess equity comes into existence. Remember this important statement about SMA: You only loose it, if you use it! Excess equity has been given many names in Wall Street jargon. Among them are: equity excess, margin excess, Regulation T excess, SMA, or additional loan value.

Restricted Accounts

Let’s now take a look at what happens in a margin account when CMV declines. In the following examples, Regulation T of 50% is used. Assume a purchase of l00 Microsoft shares at $80, followed by a decline in CMV to $70. Note as before, the debit balance is constant and the equity changed exactly

$1,000, the same amount the CMV changed downward.

Initial CMV CMV After Decline

CMV $ 8,000 CMV $ 7,000

(-) Debit $ 4,000 (-) $ 4,000

____________________________________________

Equity $ 4,000 Equity $ 3,000

A margin account in which the equity has fallen below the Regulation T percentage is called a Restricted Margin Account. Therefore, the account is restricted since it has less than $3,500 equity and the equity percentage is 43% ($3,000 / $ 7,000), rather than 50% ($3,500 / $ 3,500). What are the consequences of a restricted account on subsequent purchases, and sales?

Purchases – A doctor wishing to buy additional securities in a restricted account will find there are no restriction on the ability to do so. He is only required to deposit the Regulation T percentage on each new purchase, just as in a non-restricted account.

Sales – A doctor wishing to liquidate some of his holdings in a restricted margin account will find that the Retention Rule of the Federal Reserve comes into play. The Retention Rule requires the brokerage firm to retain 50% of the sale proceeds and use this retention to reduce the client’s debit balance. The other 50% is made available to the client to do with as he so chooses. He may take it in cash, buy more stock, or leave it in the account for future use.

For instance, in the above example, suppose Dr. Smith sells 10 of his 100 Microsoft shares, at the CMV of $70 per share. What transpires?

Liquidation proceeds = 10 x $ 70 = $ 700

Retention by broker = 50% x $ 700 = $ 350

Available to Dr. Smith = $700 – $ 350 = $ 350

Failure to Meet A Margin Call

If a medical professional doesn’t meet an initial margin call under Regulation T in an existing margin account, the firm is required to sell off securities in the account in an amount equal to twice the margin call, assuming Regulation T is 50%. However, the account would not be frozen, since only a cash account can be frozen.

Withdrawal of Distributions in a Restricted Account

In a restricted account, it is the usual industry practice that all dividends and interest received are automatically taken out of the margin account, and put into the SMA (Special Memorandum Account) on the day received. For example, if dividends of $200 were received into the account, the debit balance would be reduced by $200 and the SMA increased by that same $200.

Same Day Substitutions

This term refers to the netting of a purchase and sale of different securities in a doctor’s restricted margin account, on the same day. A determination of any margin call due, or proceeds due a doctor, is done by the brokerage firm, at the end of the day.

Example: If, in a restricted margin account, Dr. Jones makes a same day substitution by selling $ 5,000 of Lucent stock, and then purchases $ 6,000 of Cisco systems, with Regulation T at 60%, the required margin deposit would be $ 600. The net trade in this case is a buy of $1,000. The Regulation T on a buy of $1,000 is 60% of that, or $600.

Sales in a Non-Restricted Account

If a doctor’s equity is equal to the Regulation T percentage, a sale of securities in her account releases proceeds equal to the Regulation T percentage.

For example:

$ 10,000 CMV Sell $ 1,000 worth of securities

– $ 4,000 Debit $ 1,000 X 60% = $ 600 to Dr. Jones

$ 6,000 Equity (60% = Reg T) $ 1,000 X 40% = $ 400 to pay down debit balance.

Minimum Maintenance Requirements (Long Cash Account)

What happens if the market continues to decline, say to $50 per share? Again, keep in mind that the debit balance remains constant, as the market value changes. Then, $5,000 CMV – $ 4,000 debit = $ 1,000 equity. Again as before, the doctor’s equity has changed by the exact amount of the change in CMV (a $3,000 decline in the market = a $3,000 decline in equity).

And suppose the market continued to decline to a point below $40 per share? In what position would that put the brokerage firm? It would be holding collateral worth less than $4,000 on a loan of $4,000 which is an intolerable situation for any lender! In fact, to prevent this from occurring, the SROs created a rule which requires a client to maintain at all times an equity of at least 25% of the market value of the securities in his margin account. This is known as the Minimum Maintenance Requirement.

To better understand maintenance, let’s look again at the above account with the $1,000 equity and the $5,000 CMV. The NYSE / NASD minimum equity requirement of this account is 25% of $5,000 or $1,250. Therefore, there is a deficiency of $250 ($1,250- $1,000) in this account.

An account with equity below the NYSE / NASQ minimum maintenance requirement is called an under margined account. NYSE / NASD rules insist that if equity drops below 25%, it must be brought back up to 25 % immediately. Note that there is no requirement to bring the equity back to a point higher than the minimum 25% level. The doctor in this example will be issued a maintenance margin call in the amount of the $250 deficiency. The $250 is used by the firm to reduce the debit balance.

Note: Before the maintenance call was satisfied, the equity percentage was 20% ($1,000/$5,000). After the call was satisfied, the equity percentage rose to 25% ($1,250/$5,000), which is the minimum equity percentage allowed under this SRO rule.

Example:

Suppose a doctor wanted to know how low his account market value could fall before the account would be at the maintenance level. Can he determine the minimum market value down to which an account may drop without incurring a maintenance call? Yes -multiply the doctor’s debit balance by 4/3.

In the example we have been using, the doctor’s debit balance is $4,000. We can immediately compute the market value down to which the account may drop as follows:

4/3 x Debit. = maintenance Level

4/3 x $ 4,000 = $ 5,333.33

This means, if the stock drops from $80 per share to $53.33 per share, the equity in the account will have fallen to the NYSE minimum level of 25%. ($ 5,333.33 CMV – $ 4,000 debit = $ 1,333.33).

Part 6 of 8: About Securities Order and Position Types

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

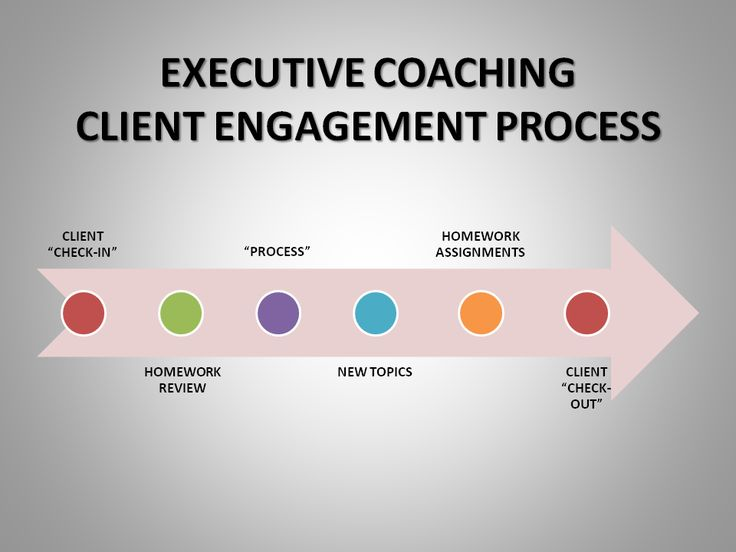

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

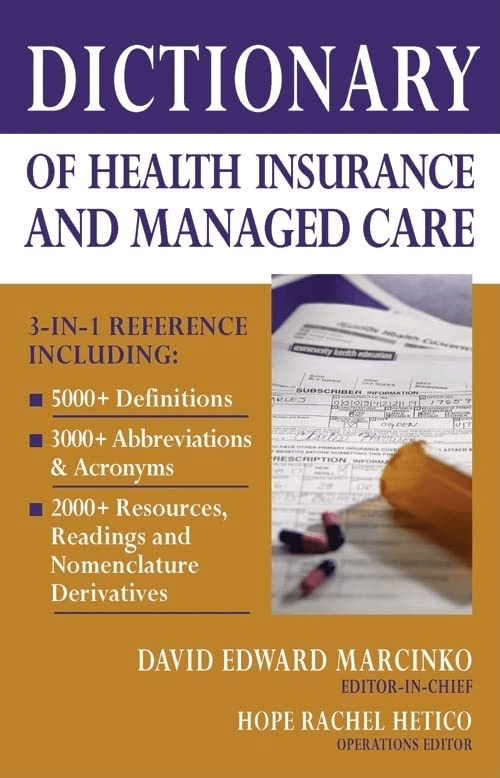

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

8

8

***

***

Filed under: "Advisors Only", Investing, Marcinko Associates, Portfolio Management | Tagged: Hypothecation, margin account, Margin Call, NASDAQ system, OTC, Over The Counter Markets, Regulation T, Rehypothecation, Restricted Account, Securities Margin Account, SMA | 3 Comments »