Physicians Must Appreciate the Differences

By Daniel B. Moisand; CFP® and the ME-P Staff

Here are a few questions for all physician-investors to consider in 2009:

1. True or False?

The key to investment success is to pay as little for a trade as possible.

2. True or False?

The higher the number of trades in an investment account, the better the investment results.

3. True or False?

The majority of revenue of a discount or on-line brokerage comes from trades.

A: The answers should be crystal clear! False, False and True. It is almost entirely that simple.

Cost Control

Much like a medical practice, keeping costs down is an important objective of personal finance but, it is certainly not the key to success. There are many studies that show that active trading garners inferior results compared to a longer term buy and hold type of strategy. One of the most publicized recently was conducted by a UC-Davis team led by Dr. Terrance Odean. The study examined the actual tracing activity of thousands of self-directed accounts at a major discount brokerage over a six-year period. The results were clear. Regardless of trading level, most of the accounts underperformed the market and showed that the higher the number of trades, the worse the result.

Of Bulls and Bears

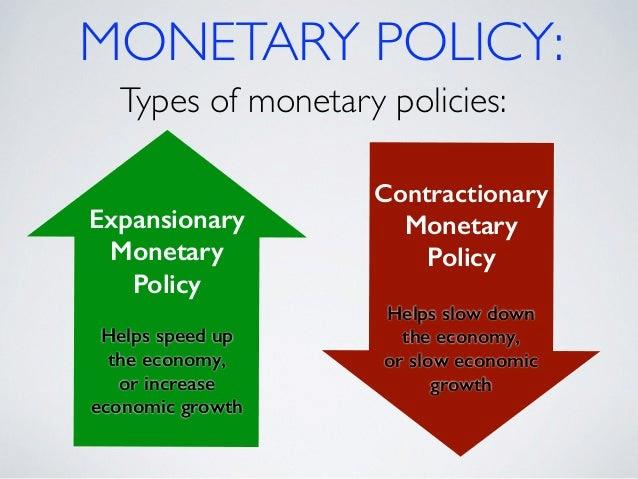

While the U.S. markets were on a dramatic upswing a decade ago, the general interest level in them increased as well. More households owned financial assets than ever before. Demographics drive much of this surge. The older edge of the baby boom generation is finding that as the children leave home, they have more income than ever before and saving for retirement becomes a higher priority. The proliferation of defined contribution [401-k, 403-b] retirement plans has also forced more people to take responsibility for their long-term security. When, the US stock market was on a tear; one would have be wise to remember an old Wall Street saying – “Don’t confuse brains with a bull market.” Unfortunately today, far too many self-directed investors did not heed the warnings. The media is full of stories about investors whose portfolios were decimated by the recent bear market. While this loss of wealth is somewhat tragic, in almost all cases the losses were made possible by poor planning and/or poor execution that a mediocre advisor would have avoided.

The Business of Advice

One also cannot conclude that everyone is acting as his or her own investment advisor. The advice business continues to thrive. Sales of load mutual funds have continued to grow, as has commission revenue at full-service firms. No-load funds have continued to grow as well and gain market share from the load funds. However, it would be inaccurate to tie that growth to do-it-yourselfers. Much of the growth of no-load funds can be attributed to the advice of various types of advisors who are recommending the funds. In addition, several traditionally no-load fund families have begun to offer funds through brokers for a load.

The Discounters

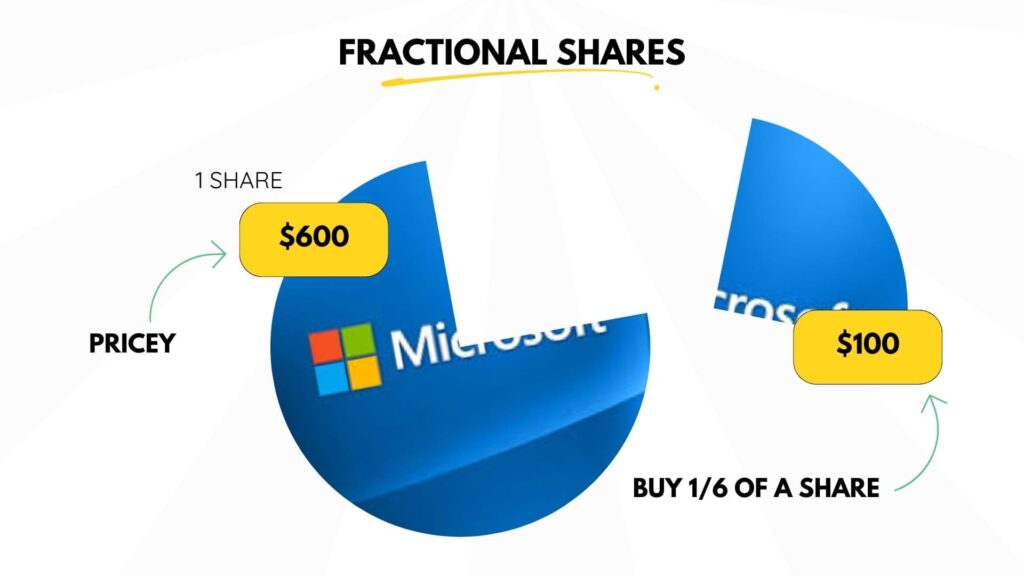

For physicians and all clients, the primary attraction to a discounter is cost. Everyone loves a bargain. Once it is determined that it is a good idea to buy say 100 shares of IBM, the trade needs to get executed. When the trade settles one owns 100 shares of IBM, regardless of what was paid for the trade. There is no harm in saving a few bucks. However, the decision to buy the IBM shares and when to sell those shares will have a far greater impact on the investment results than the cost of the trade as long as the level of trading is kept at a prudent level. The fact is that most good advisors use discount firms for custodial and transaction services. The leading providers to advisors are Schwab, Fidelity, and Waterhouse.

Ego Driven

In addition to cost savings, discounters appeal to one’s ego for business. Everyone wants to feel like a smart investor; especially doctors. Often, marketing materials will cite the IBM example and portray the cost difference as an example of how the investor is either stupid or being ripped off. There is also a strong appeal to one’s sense of control. An investor is made to feel like they are the masters of their own destiny. All of this is a worthy goal. One should feel confident, in control, and smart about financial issues. Hiring a professional should not result in losing any of these feelings, rather solidify them. Getting one’s affairs in order is smart. The advisor works for the client so a client should maintain control by only delegating tasks to the extent one is comfortable. Knowing that the particular circumstances are being addressed effectively should yield enhanced confidence.

Sales Pressure Release

The final reason people turn to discount and on-line brokerages is to avoid sales pressure. Unlike the stereotypical stockbroker, no one calls to push a particular stock. Instead, sales pressure is created within the mind of the investor. By maintaining a steady flow of information about stocks and the markets to the account holders, brokerages keep these issues in the forefront of the investor’s minds. This increases the probability that the investor will act on the information and execute a trade. Add some impressive graphics and interfaces and the brokerage can keep an investor glued to the screen. The Internet has made this flow easier and cheaper for the brokerages, lowering costs and increasing the focus on trade volume to achieve profitability.

Assessment

The pressurized information flow however, does little to protect investors during a bear market. Ironically, this focus on trading is one of the very conflicts investors are trying to avoid by fleeing a traditional full service broker.

Conclusion

And so, your thoughts and comments on this Medical Executive-Post are appreciated. What are your feelings on discount and internet brokers? Tell us what you think. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, be sure to subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Get our Widget: Get this widget!

Our Other Print Books and Related Information Sources:

Practice Management: http://www.springerpub.com/prod.aspx?prod_id=23759

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Healthcare Organizations: www.HealthcareFinancials.com

Health Administration Terms: www.HealthDictionarySeries.com

Physician Advisors: www.CertifiedMedicalPlanner.com

Subscribe Now: Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest ME-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Sponsors Welcomed

And, credible sponsors and like-minded advertisers are always welcomed.

Link: https://healthcarefinancials.wordpress.com/2007/11/11/advertise

Filed under: "Doctors Only", Book Reviews, CMP Program, Financial Planning, Portfolio Management, Recommended Books, Risk Management | Tagged: certified financial planner, certified medical planner, CFP, CMP, common stock, daniel moisand, david marcinko, DDS, discount broker, DO, DPM, Dr. Terrance Odean, Fidelity, financial advisors, Financial Planning, internet broker, Investing, load funds, MD, Mutual Funds, no-load funds, online broker, Schwab, stock broker, stock shares, Waterhouse, www.certifiedmedicalplanner.com | 2 Comments »

What’s down

What’s down