In The Subprime of His Life – My Story

By Dr. David Edward Marcinko MBA, CMP™

[Editor-in-Chief]

I am a long time fan of financial industry journalist Michael Lewis [Liars’ Poker, Moneyball and others] who just released a new book. The Big Short is a chronicle of four players in the subprime mortgage market who had the foresight [and testosterone] to short the diciest mortgage deals: Steve Eisner of FrontPoint, Greg Lippmann at Deutsche Bank, the three partners at Cornwall Capital, and most indelibly, Wall Street outsider Michael Burry MD of Scion Capital.

They all walked away from the disaster with pockets full of money and reputations as geniuses.

About Mike

Now, I do not know the first three folks, but I do know a little something about my colleague Michael Burry MD; he is indeed a very smart guy. Mike is a nice guy too, who also has a natural writing style that I envy [just request and read his quarterly reports for a stylized sample]. He gave me encouragement and insight early in my career transformation – from doctor to “other”.

And, he confirmed my disdain for the traditional financial services [retail sales] industry, Wall Street and their registered representatives and ‘training’ system, and sad broker-dealer ethos [suitability versus fiduciary accountability] despite being a hedge fund manager himself.

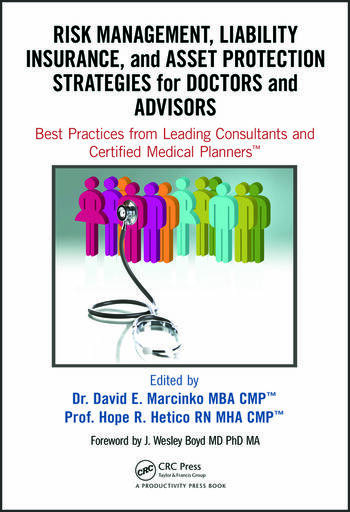

I mentioned him in my book: “Insurance and Risk Management Strategies” [For Physicians and their Advisors].

http://www.amazon.com/Insurance-Management-Strategies-Physicians-Advisors/dp/0763733423/ref=sr_1_2?ie=UTF8&s=books&qid=1269254153&sr=1-2

He ultimately helped me eschew financial services organizations, “certifications”, “designations” and ”colleges”, and their related SEO rules, SEC regulations and policy wonks; and above all to go with my gut … and go it alone!

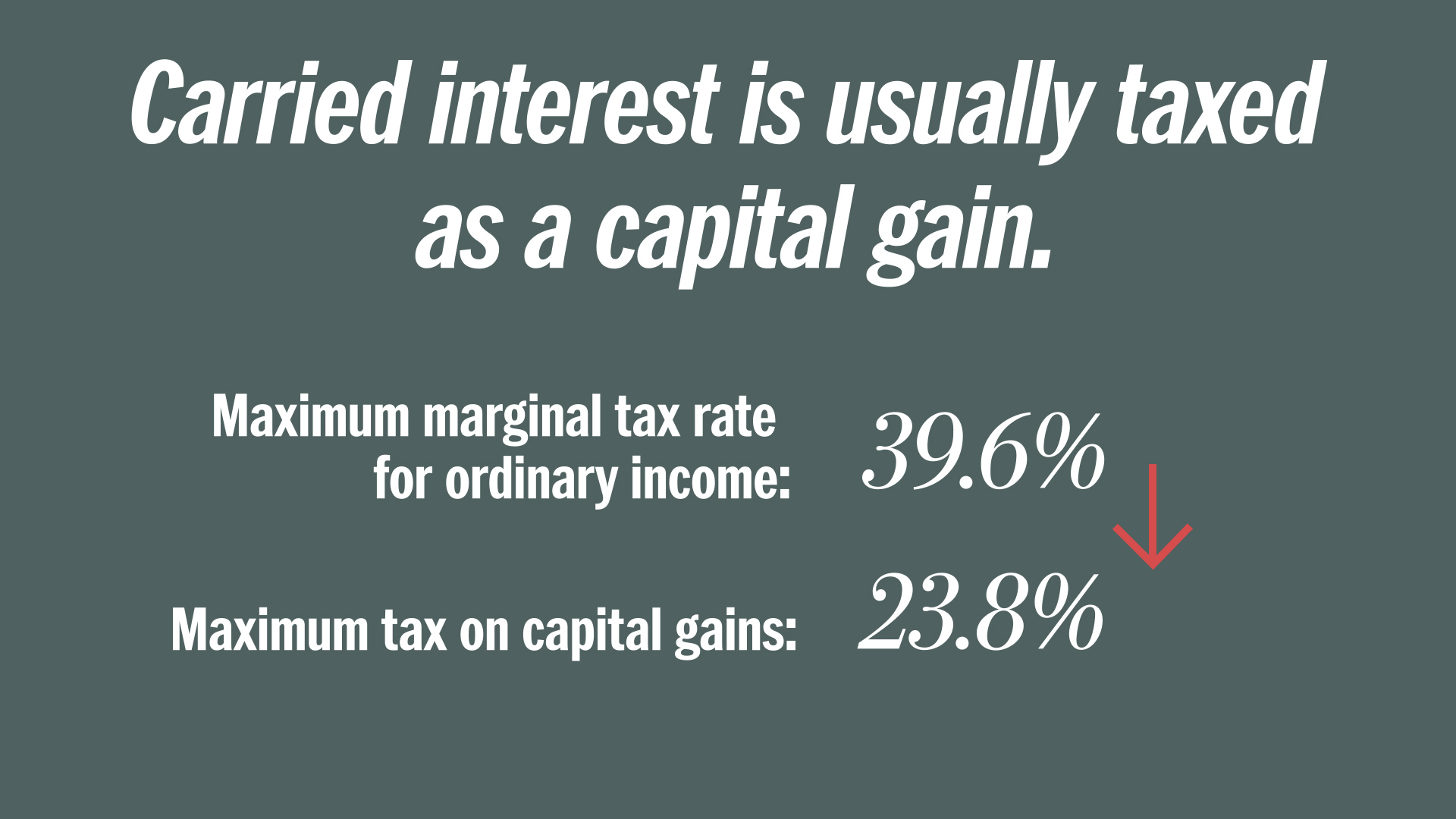

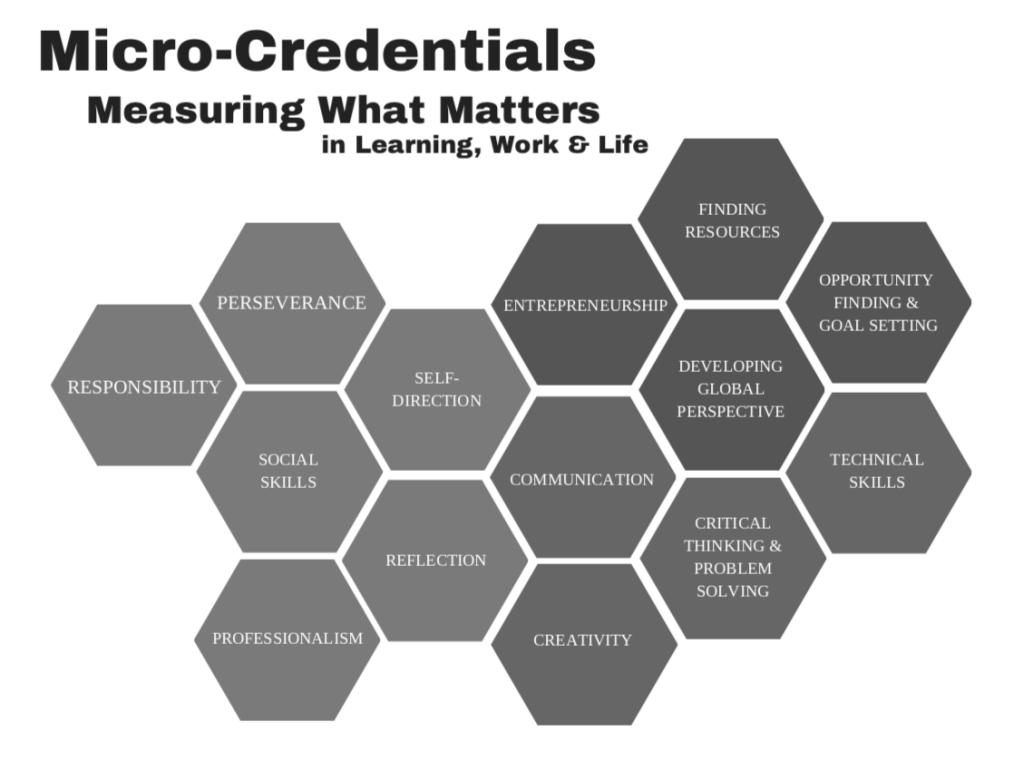

And so, I rejected my certified financial planner [marketing] designation status as useless for me, and launched the www.CertifiedMedicalPlanner.org on-line educational program for physician focused financial advisors and management consultants interested in the healthcare space … who wish to be fiduciaries.

And I thank Mike for the collegial good will. By the way, Mike is not a CPA, nor does he posses an MBA or related advanced degree or designation. He is not a middle-man FA. He is a physician. Unlike far too many other industry “financial advisors” he is not a lemming.

IOW: We are not salesman. We are out-of-the-box thinkers, innovators and contrarians by nature. www.MedicalBusinessAdvisors.com

From a Book Review

According to book reviewer Michael Osinski, writing in the March 22-29 issue of Businessweek.com, Lewis is at his best working with characters and Burry is rendered most vividly.

“A loner from a young age, in part because he has a glass eye that made it difficult to look people in the face, Burry excelled at topics that required intense and isolated concentration. Originally, investing was just a hobby while he pursued a career in medicine. As a resident neurosurgeon at Stanford Hospital in the late 1990s, Burry often stayed up half the night typing his ideas onto a message board. Unbeknownst to him, professional money managers began to read and profit from his freely dispensed insight, and a hedge fund eventually offered him $1 million for a quarter of his investment firm, which consisted of a few thousand dollars from his parents and siblings. Another fund later sent him $10 million”.

“Burry’s obsession with finding undervalued companies eventually led him to realize that his own home in San Jose, Calif., was grossly overpriced, along with houses all over the country. He wrote to a friend: “A large portion of the current [housing] demand at current prices would disappear if only people became convinced that prices weren’t rising. The collateral damage is likely to be orders of magnitude worse than anyone now considers.” This was in 2003.

“Through exhaustive research, Burry understood that subprime mortgages would be the fuse and that the bonds based on these mortgages would start to blow up within as little as two years, when the original “teaser” rates expired. But Burry did something that separated him from all the other housing bears—he found an efficient way to short the market by persuading Goldman Sachs (GS) to sell him a CDS against subprime deals he saw as doomed. A unique feature of these swaps was that he did not have to own the asset to insure it, and over time, the trade in these contracts overwhelmed the actual market in the underlying bonds”.

“By June 2005, Goldman was writing Burry CDS contracts in $100 million lots, “insane” amounts, according to Burry. In November, Lippmann contacted Burry and tried to buy back billions of dollars of swaps that his bank had sold. Lippmann had noticed a growing wave of subprime defaults showing up in monthly remittance reports and wanted to protect Deutsche Bank from potentially massive losses. All it would take to cause major pain, Lippmann and his analysts deduced, was a halt in price appreciation for homes. An actual fall in prices would bring a catastrophe. By that time, Burry was sure he held winning tickets; he politely declined Lippmann’s offer”

And the rest, as they say, is history.

Link: http://www.businessweek.com/magazine/content/10_12/b4171094664065.htm

My Story … Being a Bit like Mike

I first contacted Mike, by phone and email, more than a decade ago. His hedge fund, Scion Capital, had no employees at the time and he outsourced most of the front and back office activities to concentrate on position selection and management. Early investors were relatives and a few physicians and professors from his medical residency days. Asset gathering was a slosh, indeed. And, in a phone conversation, I remember him confirming my impressions that doctors were not particularly astute investors. For him, they generally had sparse funds to invest as SEC “accredited investors” and were better suited for emerging tax advantaged mutual funds. ETFs were not significantly on the radar screen, back then, and index funds were considered unglamorous. No, his target hedge-fund audience was Silicon Valley.

And, much like his value-hero Warren Buffett [also a Ben Graham and David Dodd devotee], his start while from the doctor space, did not derive its success because of them.

Moreover, like me, he lionized the terms “value investing”, “margin of safety” and “intrinsic value”.

Co-incidentally, as a champion of the visually impaired, I was referred to him by author, attorney and blogger Jay Adkisson www.jayadkisson.com Jay is an avid private pilot having earned his private pilot’s license after losing an eye to cancer.

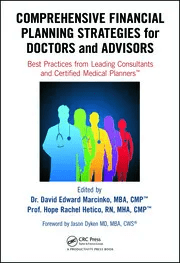

Mike again re-entered my cognitive space while doing research for the first edition of our successful print book: “Financial Planning Handbook for Physicians and Advisors” and while searching for physicians who left medicine for alternate careers!

In fact, he wrote the chapter on hedge funds in our print journal and thru the third book edition before becoming too successful for such mundane stuff. We are now in our fourth edition, with a fifth in progress once the Obama administration stuff [healthcare and financial services industry “reform” and new tax laws] has been resolved

http://www.amazon.com/Financial-Planning-Handbook-Physicians-Advisors/dp/0763745790/ref=sr_1_1?ie=UTF8&s=books&qid=1269211056&sr=1-1

Assessment

News: Dr. Burry appeared on 60 Minutes Sunday March 14th, 2010. His activities with Scion Capital are portrayed in Michael Lewis’s newest book, The Big Short. An excerpt is available in the April 2010 issue of Vanity Fair magazine, and at VanityFair.com

Video of Dr. Burry: http://www.cbsnews.com/video/watch/?id=6298040n&tag=contentBody;housing

Video of Dr. Burry: http://www.cbsnews.com/video/watch/?id=6298038n&tag=contentBody;housing

PS: Michael Osinski retired from Wall Street and now runs Widow’s Hole Oyster Co. in Greenport, NY http://www.widowsholeoysters.com

And, our www.MedicalBusinessAdvisors.com related books can be reviewed here: http://www.amazon.com/s/ref=nb_sb_noss?url=search-alias%3Dstripbooks&field-keywords=david+marcinko

Assessment

Visit Scion Capital LLC and tell us what you think http://www.scioncapital.com.

And to Mike himself, I say “Mazel Tov” and congratulations? I am sure you will be a good and faithful steward. The greatest legacy one can have is in how they treated the “little people.” You are a champ. Call me – let’s do lunch. And, I am still writing: www.BusinessofMedicalPractice.com for the conjoined space we both LOVE.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

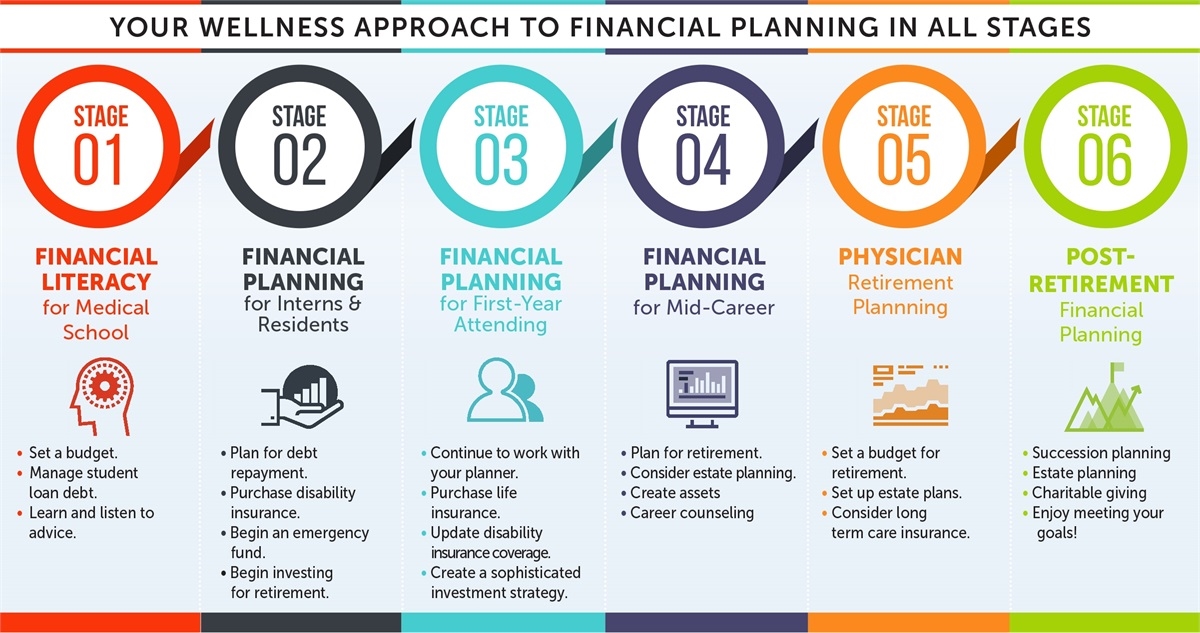

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

[PHYSICIAN FOCUSED FINANCIAL PLANNING AND RISK MANAGEMENT COMPANION TEXTBOOK SET]

[Dr. Cappiello PhD MBA] *** [Foreword Dr. Krieger MD MBA]

***

Filed under: Book Reviews, Breaking News, CMP Program, iMBA, Inc., Interviews, Investing, Portfolio Management, Recommended Books, Videos | Tagged: 60 Minutes, Ben Graham, CFP, CMP, Cornwall Capital, David Dodd, david marcinko, Greg Lippmann, Jay Adkisson, Michael Lewis, Nicahel Burry, Scion Capital, SEC, Steve Eisner, subprime mortgage market, The Big Short, value investing, Wall Street, www.certifiedmedicalplanner.com, www.HealthDictionaySeries.com, www.medicalbusinessadvisors.com | 34 Comments »