By Dr. David Edward Marcinko MBA MEd CMP™

***

***

SPONSOR: http://www.CertifiedMedicalPlanner.org

Physicians are entrepreneurial by nature and take great pride in the creation of their businesses. Market pressures are motivating physicians to be proactive and to make informed decisions concerning the future of their businesses. The decision to sell, buy or merge while often financially driven and is inherently an emotional one. Other economic reasons for a practice valuation include changes in ownership, determining insurance coverage for a practice buy-sell agreement or upon a physician owners death, establishing stock options, or bringing in a new partner.

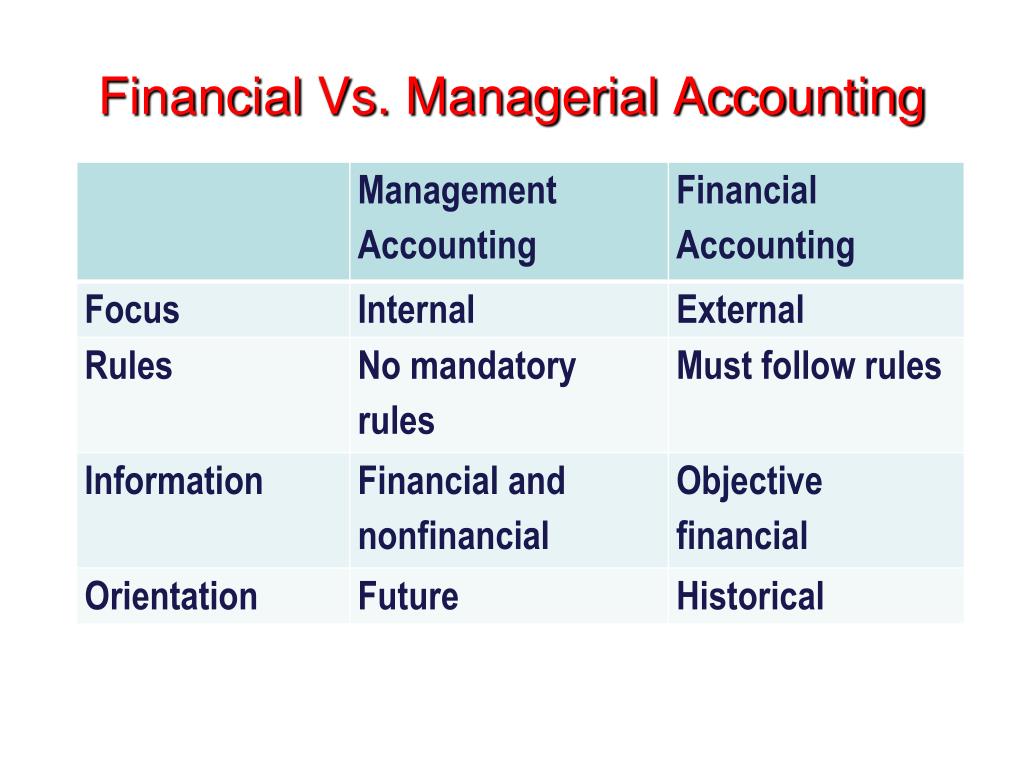

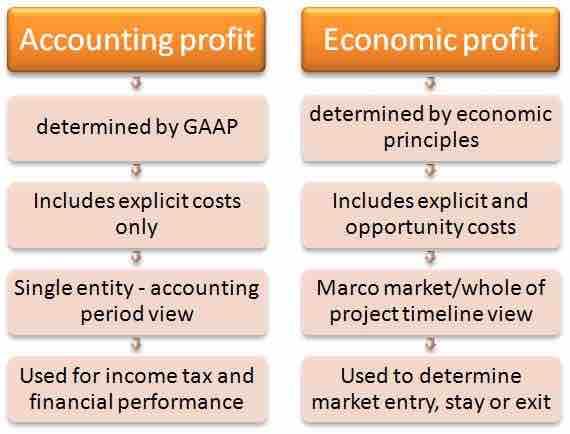

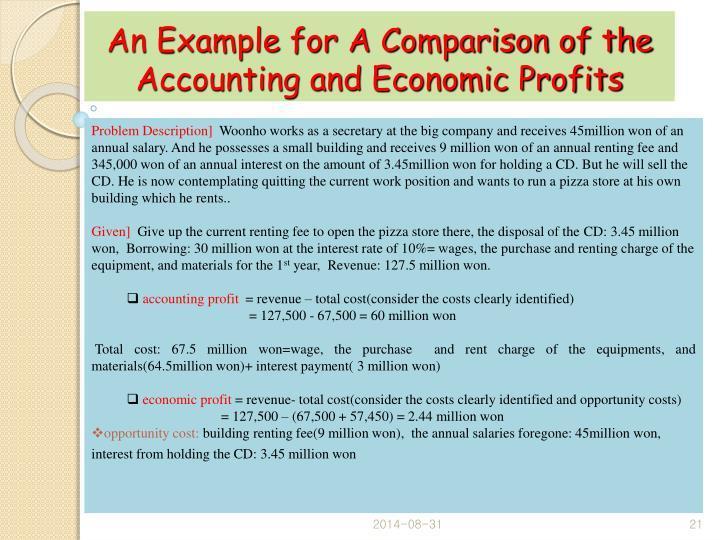

Practice appraisals are also used for legal reasons such as divorce, bankruptcy, breach of contract and minority shareholder complaints. In 2002, the Financial Accounting Standards Board (FASB) issued rules that required certain intangible assets to be valued, such as goodwill. This may be important for practices seeking start-up, service segmentation extensions, or operational funding.

Estate Planning is another reasons for a medical practice appraisal and the considerations that go along with it are discussed here.

***

***

Estate Planning

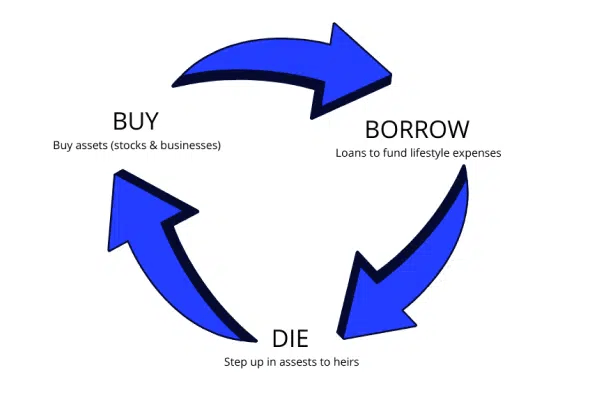

Medical practice valuation may be required for estate planning purposes. For a decedent physician with a gross estate of more than $1 million, his or her assets must be reported at fair market value on an estate tax return. If lifetime gifts of a medial practice business interest are made, it is generally wise to obtain an appraisal and attach it to the gift tax return.

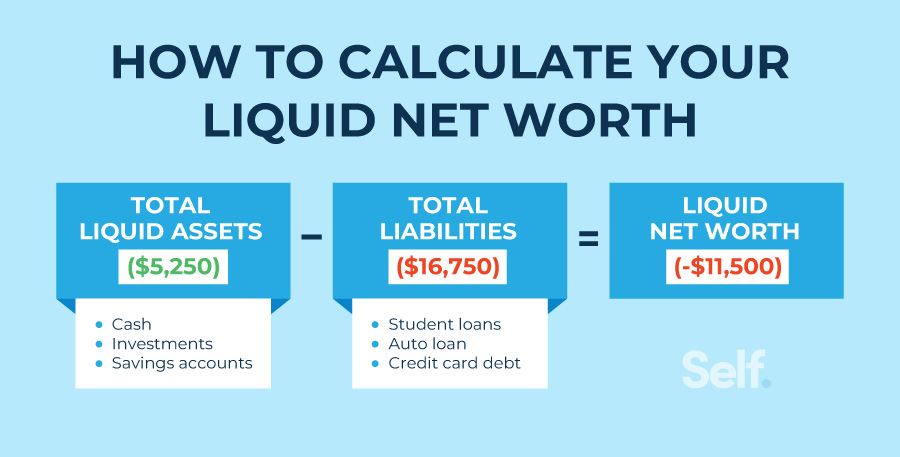

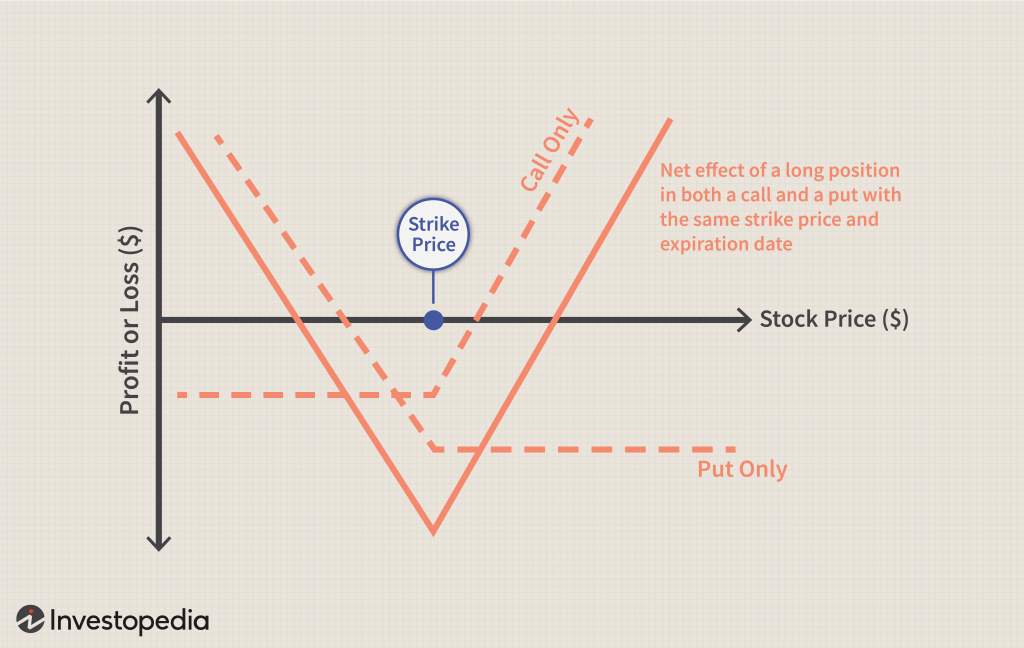

Note that when a “closely-held” level of value (in contrast to “freely traded,” “marketable,” or “publicly traded” level) is sought, the valuation consultant may need to make adjustments to the results. There are inherent risks relative to the liquidity of investments in closely held, non-public companies (e.g., medical group practice) that are not relevant to the investment in companies whose shares are publicly traded (freely-traded). Investors in closely-held companies do not have the ability to dispose of an invested interest quickly if the situation is called for, and this relative lack of liquidity of ownership in a closely held company is accompanied by risks and costs associated with the selling of an interest said company (i.e., locating a buyer, negotiation of terms, advisor/broker fees, risk of exposure to the market, etc.).

Conversely, investors in the stock market are most often able to sell their interest in a publicly traded company within hours and receive cash proceeds in a few days. Accordingly, a discount may be applicable to the value of a closely held company due to the inherent illiquidity of the investment. Such a discount is commonly referred to as a “discount for lack of marketability.”

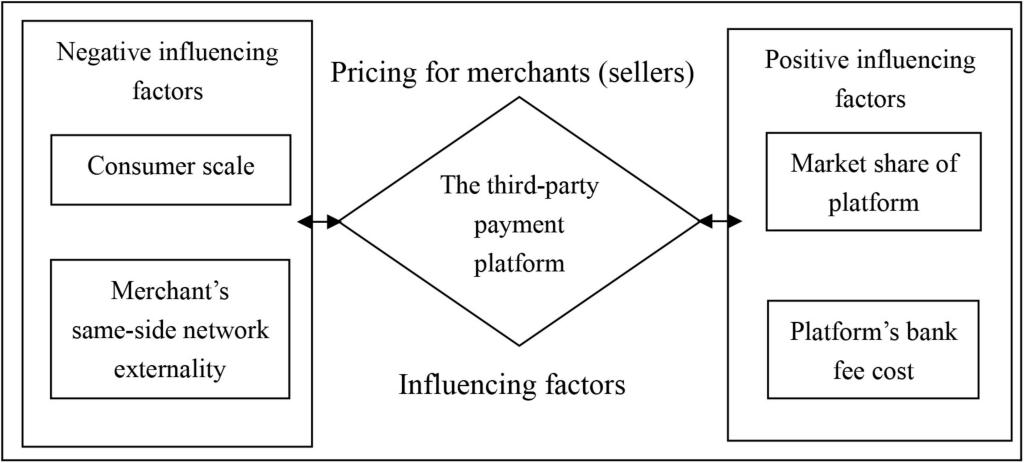

Discount for lack of marketability is typically discussed in three categories: (1) transactions involving restricted stock of publicly traded companies; (2) private transactions of companies prior to their initial public offering (IPO); and, (3) an analysis and comparison of the price to earnings (P/E) ratios of acquisitions of public and private companies respectively published in the “Mergerstat Review Study.”

With a non-controlling interest, in which the holder cannot solely authorize and cannot solely prevent corporate actions (in contrast to a controlling interest), a “discount for lack of control,” (DLOC), may be appropriate. In contrast, a control premium may be applicable to a controlling interest. A control premium is an increase to the pro rata share of the value of the business that reflects the impact on value inherent in the management and financial power that can be exercised by the holders of a control interest of the business (usually the majority holders).

Conversely, a discount for lack of control or minority discount is the reduction from the pro rata share of the value of the business as a whole that reflects the impact on value of the absence or diminution of control that can be exercised by the holders of a subject interest.

Several empirical studies have been done to attempt to quantify DLOC from its antithesis, control premiums. The studies include the Mergerstat Review, an annual series study of the premium paid by investors for controlling interest in publicly traded stock, and the Control Premium Study, a quarterly series study that compiles control premiums of publicly traded stocks by attempting to eliminate the possible distortion caused by speculation of a deal.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", Accounting, Career Development, Estate Planning, Ethics, Marcinko Associates | Tagged: Accounting, david marcinko, DLOC, Estate Planning, FASB, finance, Financial Planning, medical practice valuation, Mergerstat Review Study, personal-finance, tax-law | Leave a comment »

***

***