A MID-YEAR UPDATE

By Staff Reporters

Are you the kind of ME-P reader who makes resolutions on New Year’s Day? If so, here are five steps we encourage all investors to consider taking to boost your financial fitness at any time of the year; according to Charles Schwab & Company. So, why not resolve to take them right now?

CITE: https://www.r2library.com/Resource/Title/082610254

***

Resolution 1: Create a budget

Committing to a saving and investing program during your working years is generally the best way to boost your net worth and achieve many of life’s most important goals. Of course, first you’ll need to know how much money you’ve got to work with. That’s where a budget and net worth statement can help. Here’s how to think about them.

- Budget and save. At a minimum, be sure to have a high-level budget with three things: how much you’re taking in after taxes, how much you’re spending, and how much you’re saving. If you’re not sure where your money is going, track your spending using a spreadsheet or an online budgeting tool for 30 days. Determine how much money you need to cover your fixed monthly expenses, such as your rent or mortgage and other living expenses, and how much you’d like to put away for other goals. For retirement, our rule of thumb is to save 10%–15% of pre-tax income, including any match from an employer, starting in your 20s. If you delay, the amount you may need to save goes up. Add 10% for every decade you delay saving for retirement. Once you commit to an amount, consider ways you can save automatically, such as through monthly direct deposits.

- Calculate your personal net worth annually. It doesn’t have to be complicated. Make a list of your assets (what you own) and subtract your liabilities (what you owe). Subtract the liabilities from the assets to determine your net worth. Don’t panic if your net worth declines when the market is struggling. What’s important is to see a general upward trend over your earning years. If you’re retired, you’ll want to plan an income and distribution strategy to help make your savings last as long as necessary and support other objectives.

- Project the cost of essential big-ticket items. If you have a big expense in the near term, like college tuition or roof repair, put the money aside or increase your savings and treat that money as spent. If you know that you’ll need the money within a few years, keep it in relatively liquid, safe investments like short-term certificates of deposit (CDs), a savings account, or money market funds purchased within a brokerage account. If you choose to invest in a CD, make sure the term ends by the time you need the cash. If you have more than a few years, invest wisely, based on your time horizon.

- Prepare for emergencies. If you aren’t retired, we suggest creating an emergency fund with three to six months’ worth of essential living expenses, set aside in a savings account. The emergency fund can help you cover unexpected but necessary expenses without having to sell more volatile investments.

- Retired? Invest your living-expense money conservatively. Consider keeping 12 months of living expenses—after accounting for non-portfolio income sources like Social Security or a pension—in short-term CDs, an interest-bearing savings account, or a money market fund. Then consider keeping another two to four years’ worth of spending laddered in short-term bonds or invested in short-term bond funds as part of your portfolio’s fixed income allocation. You can use this money to cover expenses in the near term. Having a chunk of savings invested conservatively should allow you to invest a portion of your remaining savings for growth, at a level of risk appropriate for you, while reducing the chances you’ll be forced to sell more volatile investments (like stocks) in a down market.

Resolution 2: Manage your debt

Debt is neither inherently good nor bad—it’s simply a tool. It all depends on how you use it. For most people, some level of debt is a practical necessity, especially to purchase an expensive long-term asset to pay back over time, such as a home. However, problems arise when debt becomes more of a burden than a tool. Here’s how to stay in control.

- Keep your total debt load manageable. Don’t confuse what you can borrow with what you should borrow. Keep the monthly costs of owning a home (principal, interest, taxes, and insurance) below 28% of your pre-tax income, and your total monthly debt payments (including credit cards, auto loans, and mortgage payments) below 36% of your pre-tax income.

- Eliminate high-cost, non-deductible consumer debt. Try to pay off credit-card debt and avoid borrowing to buy depreciating assets, such as cars. The cost of consumer debt adds up quickly if you carry a balance. Consider consolidating your debt in a low-rate home equity loan or line of credit (HELOC), set a realistic budget, and implement a schedule to pay it back.

- Match repayment terms to your time horizons. If you’re likely to move within five to seven years, you could consider a shorter-maturity loan or an adjustable-rate mortgage (ARM), depending on current mortgage rates and options. Don’t consider this if you think you may live in your home for longer or struggle to manage mortgage payment resets if interest rates or your plans change. We also don’t suggest that you borrow money under the assumption that your home will automatically increase in value. Historically, long-term home appreciation has significantly lagged the total return of a diversified stock portfolio. And, for any type of debt, have a disciplined payback schedule. Create a plan to pay off the mortgage on your primary home before you plan to retire.

Resolution 3: Optimize your portfolio

We all share the goal of getting better investment results. But research shows that it’s extremely difficult to always invest at the “perfect” time. So, create a plan that will help you stay disciplined in all kinds of markets. Follow your plan and adjust it as needed. Here are ideas to help you stay focused on your goals.

- Focus on your overall investment mix. After committing to a savings plan, how you invest is your next most important decision. Have a targeted asset allocation—that is, strategically proportioned mix of stocks, bonds, and cash in your portfolio—that you’re comfortable with, even in a down market. Make sure it fits your long-term goals, risk tolerance, and time frame. The longer your time horizon, the more time you’ll have to potentially benefit from up or down markets.

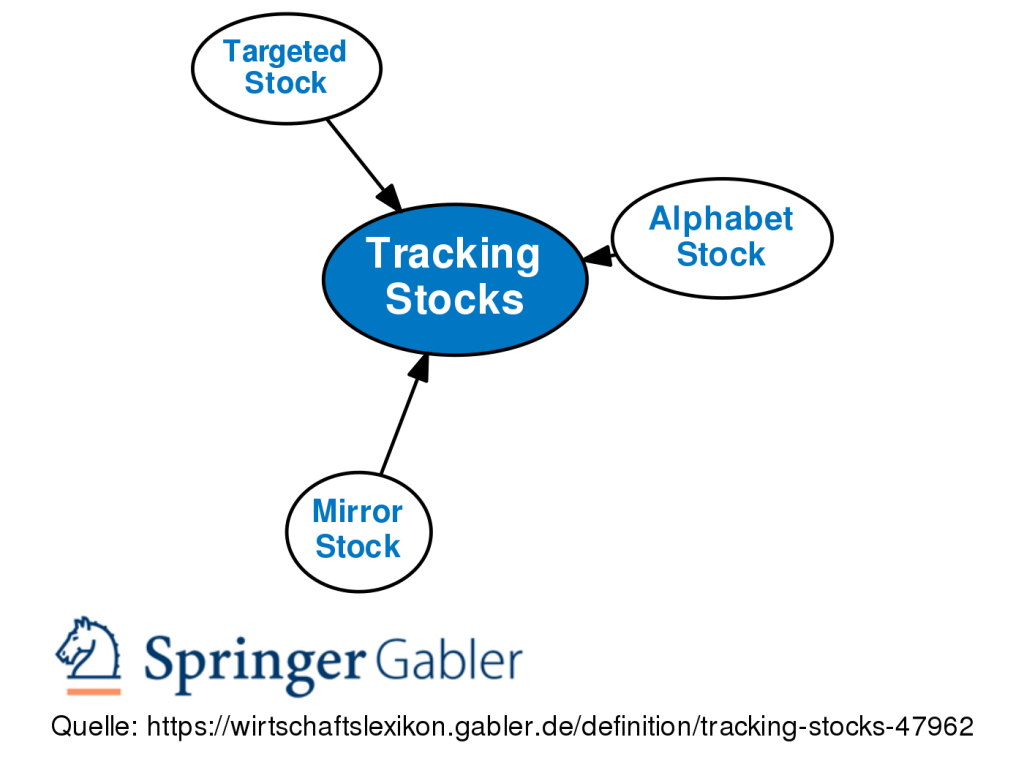

- Diversify across and within asset classes. Diversification can help reduce risk and can be a critical factor in helping you reach your goals. Mutual funds and exchange-traded funds (ETFs) are great ways to own a diversified basket of securities in just about any asset class.

- Consider taxes.Place relatively tax-efficient investments, like ETFs and municipal bonds, in taxable accounts, and relatively tax-inefficient investments, like mutual funds and real estate investment trusts (REITs), in tax-advantaged accounts. Tax-advantaged accounts include retirement accounts, such as a traditional or Roth individual retirement account (IRA). If you trade frequently, do so in tax-advantaged accounts to help reduce your tax bill.

- Monitor and rebalance your portfolio as needed. Evaluate your portfolio’s performance at least twice a year using a benchmark that makes sense for you. Remember, the long-term progress that you make toward your goals is more important than short-term portfolio performance. As you approach a savings goal, such as the beginning of a child’s education or retirement, begin to reduce investment risk, if appropriate, so you don’t have to sell more volatile investments, such as stocks, when you need them.

- Choose appropriate benchmarks. Lastly, your benchmark to measure investment performance should match your portfolio and your goals. Don’t be tempted to compare your portfolio to what performed best in the market last year or even a portfolio invested 100% in stocks. You should have a portfolio selected to best meet your goals, with an appropriate balance of potential return and risk as well. Progress toward your goals is more important than picking the top-performing stocks each year—which, for any investor, isn’t possible to predict.

Resolution 4: Prepare for the unexpected

Risk is a part of life, particularly in investments and finance. Your financial life can be upended by all kinds of surprises—an illness, job loss, disability, death, natural disasters, or lawsuits. If you don’t have enough assets to self-insure against major risks, make a resolution to get your insurance needs covered. Insurance helps protect against unforeseen events that don’t happen often but are expensive to manage yourself when they do. The following guidelines can help you prepare for life’s unexpected moments.

- Protect against large medical expenses with health insurance. Select a health insurance policy that matches your needs in areas such as coverage, deductibles, co-payments, and choice of medical providers. If you’re in good health and don’t visit the doctor often, consider a high-deductible policy to insure against the possibility of a serious illness or unexpected health-care event.

- Purchase life insurance if you have dependents or other obligations. First, take advantage of a group term insurance policy, if offered by your employer. Such programs don’t generally require a medical check and can be a cost-effective way to provide income replacement for dependents. If you have minor children or large liabilities that will continue after your death for which you can’t self-insure, you may need additional life insurance. Unless you have a permanent life insurance need or special circumstances, consider starting with a low-cost term life policy before a whole life policy.

- Protect your earning power with long-term disability insurance. The odds of becoming disabled are greater than the odds of dying young. According to the Social Security Administration, a 20-year-old American has a 25% chance of becoming disabled before normal retirement age and a 13% chance of dying before retirement age.1 If you can’t get adequate short- and long-term coverage through work, consider an individual policy.

- Protect your physical assets with property-casualty insurance. Check your homeowner’s or renter’s and auto insurance policies to make sure your coverage and deductibles are still right for you.

- Obtain additional liability coverage, if needed. A personal liability “umbrella” policy is a cost-effective way to increase your liability coverage by $1 million or more, in case you’re at fault in an accident or someone is injured on your property. Umbrella policies don’t cover business-related liabilities, so make sure your business is also properly insured, especially if you’re in a profession with unique risks and aren’t covered by an employer.

- Consider the pros and cons of long-term-care insurance. If you consider a long-term-care policy, look for a policy that provides the right type of care and is guaranteed renewable with locked-in premium rates. Long-term care typically is most cost-effective starting at about age 50 and generally becomes more expensive or difficult to find after age 70. You can get independent sources of information from your state insurance commissioner. A sound retirement savings strategy is another way to plan for long-term-care costs.

- Create a disaster plan for your safety and peace of mind. Review your homeowner’s or renter’s policy to see what’s covered and what’s not. Talk to your agent about flood or earthquake insurance if either is a concern for your area. Generally, neither is included in most homeowner’s policies. Keep an updated video inventory of valuable household items and possessions along with any professional appraisals and estimates of replacement values in a safe place away from your home.

Consider storing inventories and important documents on a portable hard drive. It’s also a good idea to have copies of birth certificates, passports, wills, trust documents, records of home improvements, and insurance policies in a small, secure evacuation box (the fireproof, waterproof kind you can lock is best) that you can grab in a hurry in case you have to evacuate immediately. Make sure your trusted loved ones know about this file as well, in case they need it.

Resolution 5: Protect your estate

An estate plan may seem like something only for the wealthy. But there are simple steps everyone should take. Without proper beneficiary designations, a will, and other basic steps, the fate of your assets or minor children may be decided by attorneys and tax agencies. Taxes and attorneys’ fees can eat away at these assets and delay the distribution of assets just when your heirs need them most. Here’s how to protect your estate—and your loved ones.

- Review your beneficiaries, especially for retirement accounts, annuities, and life insurance.The beneficiary designation is your first line of defense, to make your wishes for assets known, and ensure that they transfer to who you want quickly. Keep information on beneficiaries up-to-date to ensure the proceeds of life insurance policies and retirement accounts are consistent with your wishes, your will, and other documents.

- Update or prepare your will. A will isn’t just about transferring assets. It can provide for your dependents’ support and care and help you avoid the costs and delays associated with dying without one. It can also spell out plans to repay debts, such as a credit card or mortgage. Keep in mind that a beneficiary designation or asset titling trumps what’s written in a will, so make sure all documents are consistent and reflect your desires. When writing a will, we recommend working with an experienced lawyer or estate planning attorney.

- Coordinate asset titling with the rest of your estate plan. The titling of your property and non-retirement accounts can affect the ultimate disposition and taxation of your assets. Talk with an estate attorney or lawyer about debts and the titling of assets, such as a home, that don’t have a beneficiary designation, to make sure they reflect your wishes and are consistent with titling laws that can vary by state.

- Have in place durable powers of attorney for health care. In these documents, appoint trusted and competent confidants to make decisions on your behalf if you become incapacitated.

- Consider a revocable living trust. This is especially important if your estate is large and complex, and you want to spell out how your assets should be used in detail, or if you have dependent children and want to spell in detail how assets should be managed to support them, who will manage the assets, and other issues. A living trust may not be needed for smaller estates where beneficiaries, titling, and a will can be sufficient, but talk with a qualified financial planner or attorney to be sure.

- Take care of important estate documents. Make sure a trusted and competent family member or close friend knows the location of your important estate documents.

Finally, remember you don’t have to do everything at once. There’s a lot you can do to improve your financial health by taking one step at a time and think of these resolutions as a checklist. This ME-P and our books and posts can help. Make some real progress on your journey this year.

1Johanna Maleh and Tiffany Bosley. “Disability and Death Probability Tables for Insured Workers Who Attain Age 20 in 2022.” Social Security Administration, December 2022.

***

WELL- HOW DID YOU DO?

COMMENTS APPRECIATED

Thank You

***

ORDER: https://www.routledge.com/Comprehensive-Financial-Planning-Strategies-for-Doctors-and-Advisors-Best/Marcinko-Hetico/p/book/9781482240283

***

ORDER: https://www.routledge.com/Risk-Management-Liability-Insurance-and-Asset-Protection-Strategies-for/Marcinko-Hetico/p/book/9781498725989

***

Filed under: "Ask-an-Advisor", Accounting, Alternative Investments, Career Development, Experts Invited, Financial Planning, Funding Basics, Insurance Matters, Investing | Tagged: 2023, Charles Schwab, financial resolutions, financial resolutions 2023, resolutions | Leave a comment »