Understanding the operational and financial status of your organization or practice

[By Dr. David Edward Marcinko MBA MEd CMP™]

SPONSOR: http://www.MarcinkoAssociates.com

Financial benchmarking can assist healthcare managers and professional financial advisors in understanding the operational and financial status of their organization or practice.

Financial benchmarking can assist healthcare managers and professional financial advisors in understanding the operational and financial status of their organization or practice.

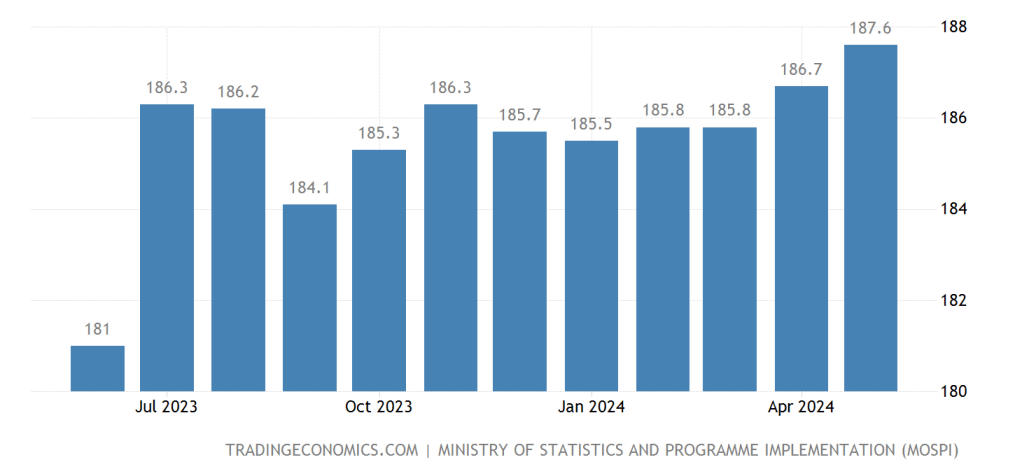

The general process of financial benchmarking analysis may include three elements: (1) Historical subject benchmarking; (2) Benchmarking to industry norms; and, (3) Financial ratio analysis.

History

Historical subject benchmarking compares a healthcare organization’s most recent performance with its reported performance in the past in order to: examine performance over time; identify changes in performance within the organization (e.g., extraordinary and non-recurring events); and, to predict future performance.

As a form of internal benchmarking, historical subject benchmarking avoids issues such as: differences in data collection and use of measurement tools; and, benchmarking metrics that often cause problems in comparing two different organizations.

However, it is necessary to common size data in order to account for company differences over time that may skew results.

Benchmarking

Benchmarking to industry norms, analogous to Fong and colleagues’ concept of industry benchmarking, involves comparing internal company-specific data to survey data from other organizations within the same industry. This method of benchmarking provides the basis for comparing the subject entity to similar entities, with the purpose of identifying its relative strengths, weaknesses, and related measures of risk.

***

***

Financial Ratio Analysis

The process of benchmarking against industry averages or norms will typically involve the following steps:

- Identification and selection of appropriate surveys to use as a benchmark, i.e., to compare with data from the organization of interest. This involves answering the question, “In which survey would this organization most likely be included?”;

- If appropriate, re-categorization and adjustment of the organization’s revenue and expense accounts to optimize data compatibility with the selected survey’s structure and definitions (e.g., common sizing); and,

- Calculation and articulation of observed differences of organization from the industry averages and norms, expressed either in terms of variance in ratio, dollar unit amounts, or percentages of variation.

Trends

Financial ratio analysis typically involves the calculation of ratios that are financial and operational measures representative of the financial status of an enterprise. These ratios are evaluated in terms of their relative comparison to generally established industry norms, which may be expressed as positive or negative trends for that industry sector. The ratios selected may function as several different measures of operating performance or financial condition of the subject entity.

The Selected Ratios

Common types of financial indicators that are measured by ratio analysis include:

- Liquidity. Liquidity ratios measure the ability of an organization to meet cash obligations as they become due, i.e., to support operational goals. Ratios above the industry mean generally indicate that the organization is in an advantageous position to better support immediate goals. The current ratio, which quantifies the relationship between assets and liabilities, is an indicator of an organization’s ability to meet short-term obligations. Managers use this measure to determine how quickly assets are converted into cash.

- Activity. Activity ratios, also called efficiency ratios, indicate how efficiently the organization utilizes its resources or assets, including cash, accounts receivable, salaries, inventory, property, plant, and equipment. Lower ratios may indicate an inefficient use of those assets.

- Leverage. Leverage ratios, measured as the ratio of long-term debt to net fixed assets, are used to illustrate the proportion of funds, or capital, provided by shareholders (owners) and creditors to aid analysts in assessing the appropriateness of an organization’s current level of debt. When this ratio falls equal to or below the industry norm, the organization is typically not considered to be at significant risk.

- Profitability. Indicates the overall net effect of managerial efficiency of the enterprise. To determine the profitability of the enterprise for benchmarking purposes, the analyst should first review and make adjustments to the owner(s) compensation, if appropriate. Adjustments for the market value of the “replacement cost” of the professional services provided by the owner are particularly important in the valuation of professional medical practices for the purpose of arriving at an ”economic level” of profit.

Data Homogeneity

The selection of financial ratios for analysis and comparison to the organization’s performance requires careful attention to the homogeneity of data. Benchmarking of intra-organizational data (i.e., internal benchmarking) typically proves to be less variable across several different measurement periods.

However, the use of data from external facilities for comparison may introduce variation in measurement methodology and procedure. In the latter case, use of a standard chart of accounts for the organization or recasting the organization’s data to a standard format can effectively facilitate an appropriate comparison of the organization’s operating performance and financial status data to survey results.

***

BOOK: Comprehensive Financial Planning Strategies for Doctors and Advisors: Best Practices from Leading Consultants and Certified Medical Planners™

***

Operational Performance Benchmarking

Operational benchmarking is used to target non-central work or business processes for improvement. It is conceptually similar to both process and performance benchmarking, but is generally classified by the application of the results, as opposed to what is being compared. Operational benchmarking studies tend to be smaller in scope than other types of benchmarking, but, like many other types of benchmarking, are limited by the degree to which the definitions and performance measures used by comparing entities differ. Common sizing is a technique used to reduce the variations in measures caused by differences (e.g., definition issues) between the organizations or processes being compared.

Common Sizing

Common sizing is a technique used to alter financial operating data prior to certain types of benchmarking analysis and may be useful for any type of benchmarking that requires the comparison of entities that differ on some level (e.g., scope of respective benchmarking measurements, definitions, business processes). This is done by expressing the data for differing entities in relative (i.e., comparable) terms.

Example:

For example, common sizing is often used to compare financial statements of the same company over different periods of time (e.g., historical subject benchmarking), or of several companies of differing sizes (e.g., benchmarking to industry norms). The latter type may be used for benchmarking an organization to another in its industry, to industry averages, or to the best performing agency in its industry. Some examples of common size measures utilized in healthcare include:

- Percent of revenue or per unit produced, e.g., relative value unit (RVU);

- Per provider, e.g., physician;

- Per capacity measurement, e.g., per square foot; or,

- Other standard units of comparison.

Assessment

As with any data, differences in how data is collected, stored, and analyzed over time or between different organizations may complicate the use of it at a later time. Accordingly, appropriate adjustments must be made to account for such differences and provide an accurate and reliable dataset for benchmarking.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: "Doctors Only", Accounting, Career Development, CMP Program, Funding Basics, Health Economics, Health Insurance, Healthcare Finance, Investing, Marcinko Associates, Practice Management | Tagged: CMP, david marcinko, FINANCIAL BENCHMARKING, HEALTH ECONOMICS BENCHMARKING, Marcinko | 2 Comments »