DIVIDEND REINVESTMENT PLANS

By Staff Reporters

***

DEFINITION

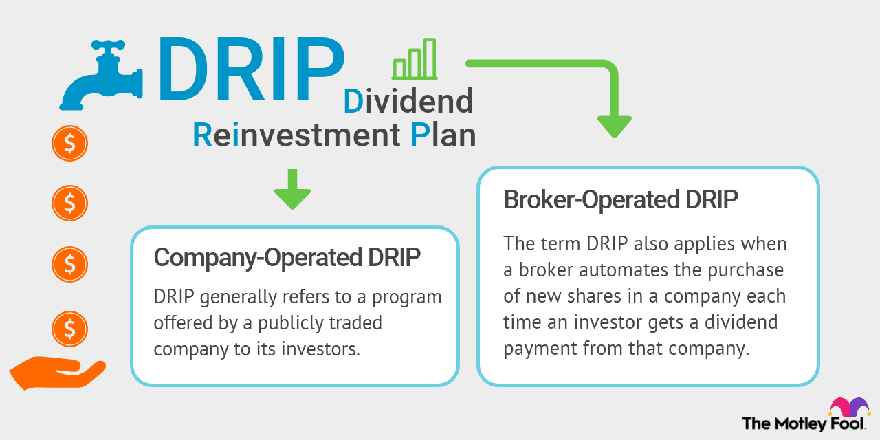

DRIPs are merely an automated strategy in which a company’s dividends are reinvested into additional shares of that company. Instead of being paid dividends in cash, you get additional shares of ownership in the company.

There are three ways to get involved in DRIPs: directly through the company, through your broker, or through a transfer agent.

Company-run DRIPs are generally only available through large, blue-chip dividend stocks.That’s because smaller companies don’t want to take on the overhead costs of tracking all their shareholders and going through the paperwork headache of calculating how much each one gets in dividends and additional fractional shares. The company benefits from gaining an additional source of capital, but most of all in creating a more stable base of shareholders, ones who are less likely to panic and sell during a market decline. This can help decrease the volatility of a company’s shares.

As a result, more and more companies are deciding to use transfer agents, which are third-party DRIP administrators such as American Stock Transfer and Trust or Computershare.

Finally, most large discount brokers, such as Scottrade, TD Ameritrade, and E*Trade, also offer DRIPs, though with different requirements and limitations.

CITE: https://www.r2library.com/Resource/Title/082610254

The Case Against DRIP Plans

While dividend reinvestment is powerful, there are a couple reasons why you might not want to reinvest your dividends.

DRIPs Drawback 1: You may need the dividend income

The most obvious reason is that you need the income. If you’re in the “distribution” phase of your investing life, dividends are a perfect source of passive income. Income from qualified dividends is taxed at the long-term capital gains rate (currently 15% for investors who are in the 25% to 35% tax bracket for ordinary income, 0% for taxpayers in a lower bracket and 20% for those in the highest bracket). So if you’re going to be looking to your portfolio for income every month anyway, it makes sense to have that cash deposited in your account.

DRIPs Drawback 2: You may need to reallocate your positions

You might also choose to stop reinvesting your dividends for allocation reasons. Reinvesting your dividends, through DRIP plans or otherwise, will cause your stock positions to grow over time, and if you’ve owned a particular issue for a long time, it may already be a large enough percentage of your portfolio. Higher-yielding positions will grow faster, which can throw your allocations out of whack pretty quickly. So once a stock position is as big as you want it to get (for now) feel free to turn off dividend reinvestment for that position, and either enjoy the extra income or save up the cash to invest in other stocks.

DRIPs Drawback 3: You may not want to buy that stock at that time

Finally, you may also have stock-specific reasons not to reinvest dividends—if a stock is temporarily overvalued, or you simply don’t want to buy any more of it at current prices.

But bottom line, reinvesting dividends through a broker or by signing up for DRIP plans directly through the dividend-paying companies, is a surprisingly powerful tool to passively improve your investment returns.

***

NOTE: Former Microsoft CEO Steve Ballmer is on pace to earn $1 billion in dividends annually from his massive 4% stake in the software company.

- Steve Ballmer is on pace to collect annual dividend payments of $1 billion from Microsoft.

- He is the former CEO of Microsoft and is the largest individual shareholder of the software giant.

- Ballmer’s Microsoft stake has surged to a value of $128 billion this year following Microsoft’s 55% stock rally.

Other dividend billionaires include: https://www.dividend.com/dividend-education/14-executives-getting-rich-off-dividends/

So yes, DRIP plans are still worth it, as long as they fit with your investing goals.

***

***

COMMENTS APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", Financial Planning, Funding Basics, Glossary Terms, Investing | Tagged: dividend reinvestment plan, DRIP, DRIPS, DRIPS: Disadvantages, MSFT, Problems and Cons, Steve Ballmer | Leave a comment »