***

By Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

DEFINITION

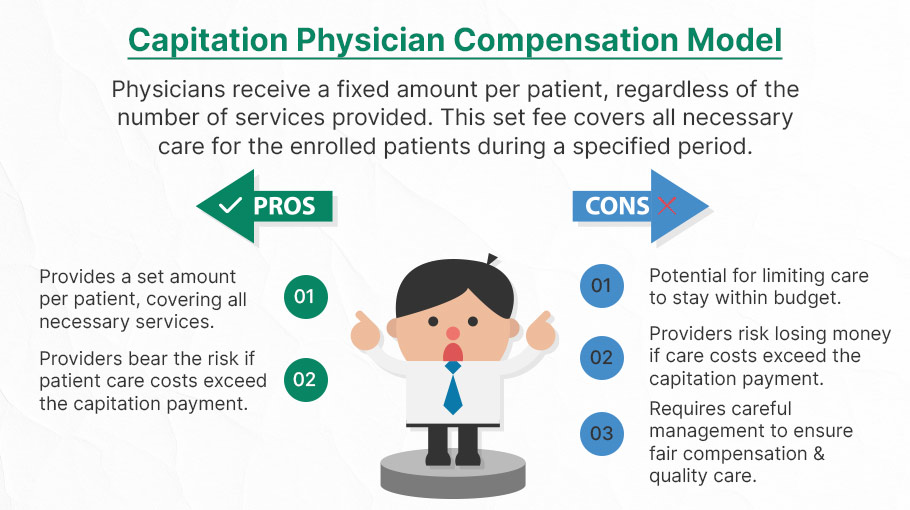

Capitation is a type of healthcare payment system in which a physician or hospital is paid a fixed amount of money per patient for a prescribed period by an insurer or physician association. The cost is based on the expected healthcare utilization costs for a group of patients for that year.

With capitation, the physician—otherwise known as the primary care physician— is paid a set amount for each enrolled patient whether a patient seeks care or not. The PCP is usually contracted with an HMO whose role it is to recruit patients.

ACOs: https://medicalexecutivepost.com/2024/12/01/record-breaking-savings-for-acos-in-2023/

***

***

CAPITATION REIMBURSEMENT HISTORY

According to Richard Eskow, CEO of Health Knowledge Systems of Los Angeles, capitated medical reimbursement has been used in one form or another, in every attempt at healthcare reform since the Norman Conquest. Some even say an earlier variant existed in ancient China [personal communication].

Initially, when Henry I assumed the throne of the newly combined kingdoms of England and Normandy, he initiated a sweeping set of healthcare reforms. Historical documents, though muddled, indicate that soon thereafter at least one “physician,” John of Essex, received a flat payment honorarium of one penny per day for his efforts. Historian Edward J. Kealey opined that sum was roughly equal to that paid to a foot-soldier or a blind person. Clearer historical evidence suggests that American doctors in the mid-19th century were receiving capitation-like payments. No less an authoritative figure than Mark Twain, in fact, is on record as saying that during his boyhood in Hannibal, MO his parents paid the local doctor $25/year for taking care of the entire family regardless of their state of health.

Later, Sidney Garfield MD [1905-1984] is noted as one of the great under-appreciated geniuses of 20th century American medicine stood in the shadow cast by his more celebrated partner, Henry J. Kaiser. Garfield was not the first physician to embrace the notion of prepayment capitation, nor was he the first to understand that physicians working together in multi-specialty groups could, through collaboration and continuity of care, outperform their solo practice colleagues in almost every measure of quality and efficiency. The Mayo brothers, of course, had prior claim to that distinction. What Garfield did, was marry prepayment to group practice, providing aligned financial incentives across every physician and specialty in his medical group, as well as a culture of group accountability for the care of every member of the affiliated health plan. He called it “the new economics of medicine,” and at its heart was a fundamentally new paradigm of care that emphasized – prevention before treatment – and health before sickness. Under his model: the fewer the sick – the greater the remuneration. And: the less serious the illness, the better off the patient and the doctors.

VBC: https://medicalexecutivepost.com/2018/12/07/the-state-of-value-based-care-vbc/

***

***

Such ideas were heresy to the reigning fee-for-service, solo practice, ideologues of the mainstream medical establishment of the 1940s and ‘50s, of course. Throughout the period, Garfield and his group physicians were routinely castigated by leaders of the AMA and county medical associations as socialistic and unethical. The local medical associations in Garfield’s expanding service areas – the San Francisco Bay Area, Los Angeles, and Portland, Oregon – blocked group practice physicians from association membership, effectively shutting them out of local hospitals, denying them patient referrals or specialty society accreditation. Twice in the 1940s, formal medical association charges were brought against Garfield personally, at one time temporarily succeeding in suspending his license to practice medicine.

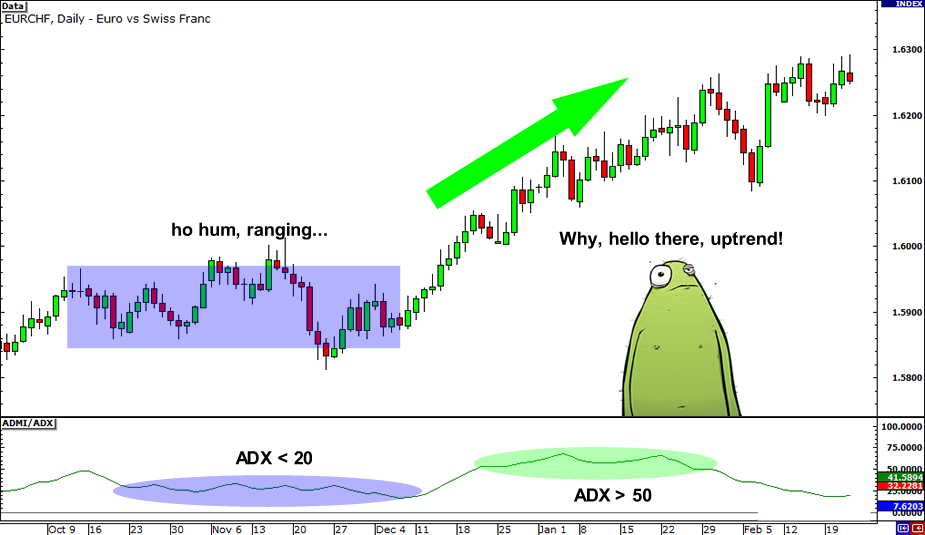

Of course, capitation payments made a comeback in the first cost-cutting managed care era of the 1980-90s because fee-for-service medicine created perverse incentives for physicians by paying more for treating illnesses and injuries than it does for preventing them — or even for diagnosing them early and reducing the need for intensive treatment later. Nevertheless, the modern managed care industry’s experience with capitation wasn’t initially a good one. The 1980-90s saw a number of HMOs attempt to put independent physicians, especially primary care doctors, into a capitation reimbursement model. The result was often negative for patients, who found that their doctors were far less willing to see them — and saw them for briefer visits — when they were receiving no additional income for their effort. Attempts were also made to aggregate various types of health providers — including hospitals and physicians in multiple specialties — into “capitation groups” that were collectively responsible for delivering care to a defined patient group. These included healthcare facilities and medical providers of all types: physicians, osteopaths, podiatrists, dentists, optometrists, pharmacies, physical therapists, hospitals and skilled nursing homes, etc.

However, the healthcare industry isn’t collective by nature, and these efforts tended to be too complicated to succeed. One lesson that these experiments taught is that provider behavior is difficult to change unless the relationship between that behavior and its consequences is fairly direct and easy to understand.

Today, the concept of prepayment and medical capitation is to uncouple compensation from the actual number of patients seen, or treatments and interventions performed. This is akin to a fixed price restaurant menu, as opposed to an àla carte eatery.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: Ask a Doctor, Career Development, CMP Program, curated experts,, economics, Ethics, Experts Invited, finance, Glossary Terms, Health Economics, Health Law & Policy, Healthcare Finance, Marcinko Associates | Tagged: AMA, capitation, capitation economics, CMP, david marcinko, DDS, DMD, DO, doctor compensation, DPM, exchange-server, Health Economics, Health Insurance, HMO, Managed Care, MD, PCP, physician compensation, powershell, primary care provider, Richard Eskow, RN, Sidney Garfield, system-center | Leave a comment »