Professional Medical Career Development

- By Eugene Schmuckler; PhD, MBA

- By Dr. David E. Marcinko MBA

Dr. Marcinko with Future Medical Students

Invite Dr. Marcinko

Jimmy’s mother called out to him at seven in the morning, “Jimmy, get up. It’s time for school.” There was no answer. She called again, this time more loudly, “Jimmy, get up! It’s time for school!” Once more there was no more answer.

Exasperated, she went to his room and shook him saying, “Jimmy, it’s time to get ready for school.” He answered, “Mother, I’m not going to school. There are fifteen hundred kids at that school and every one of them hates me. I’m not going to school.” “Get to school!” she replied sharply. “But, Mother, all the teachers hate me, too. I saw three of them talking the other day and one of them was pointing his finger at me. I know they all hate me so I’m not going to school,” Jimmy answered. “Get to school!” his mother demanded again. “But mother, I don’t understand it. Why would you want to put me through all of that torture and suffering?” he protested. “Jimmy, for two good reasons,” she fired back.

“First, you’re forty-two years old.”

“Secondly, you’re the principal.”

Introduction

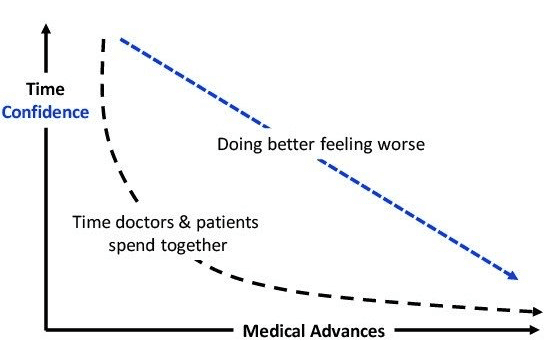

Many of us have had conversations with medical colleagues at which time sentiments of those expressed by Jimmy have been voiced. The career choice that was made many years ago is now, for some reason, no longer as exciting, interesting and enjoyable, as it was when we first began in the field. The career that was undertaken with great anticipation is now something to dread.

The reason for this is occurrence is not that difficult to understand. Two of the most important decisions individuals are asked to make are ones for which the least amount of training is offered: choice of spouse and choice of career. How many college students receive a degree in the field they identified when they first enrolled at the college or university?

In fact, how many entering freshmen list their choice of major as undecided? It is only during the sophomore year when a major must be declared is the choice actually made. So, career choices made at the age of 19 might be due to having taken a course that was interesting or easy, appeared to have many entry level jobs, did not require additional educational or professional training requirements, or was a form of the “family business.”

Now as an adult, the individual is functioning in a career field that was selected for him or her by an eighteen-year-old. How do we judge career success? A career represents more than just the job or sequence of jobs we hold in a lifetime. The typical standard for a successful career is by judging how high the individual goes in the organization, how much money is earned, or one’s standing attained in the profession.

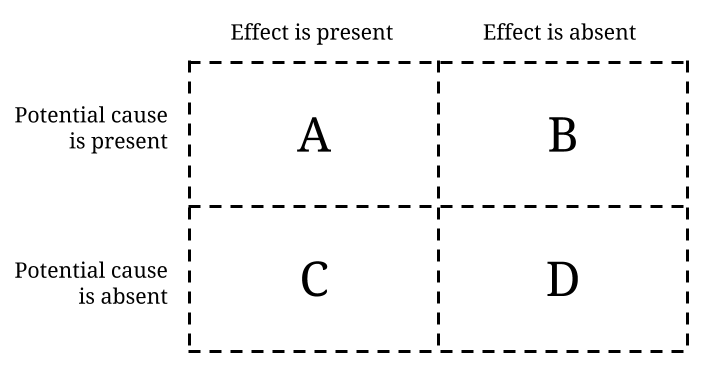

Career success actually needs to be judged on several dimensions. Career adaptability refers to the willingness and capacity to change occupations and/or the work setting to maintain a standard of career progress.

Many of you did not anticipate the changes in your chosen medical profession, or specialty, when you began your training. A second factor is career attitudes. These are your own attitudes about the work itself, our place of work, your level of achievement, and the relationship between work and other parts of your life. Career identity is that part of your life related to occupational and organizational activities. This is the unique way in which we believe that we fit into the world.

Our career is only one part of our being. We play many roles in life each of which combine to make up or totality. At any point in time one role may be more important than another. The importance of the roles will generally change over time. Thus at some point you may choose to identify more with your career, and at other times, with your family.

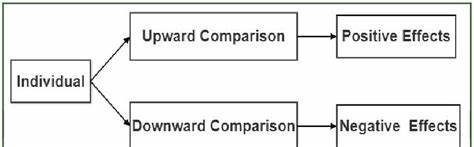

A final factor is career performance, a function of both the level of objective career success and the level of psychological success. How much you earn and your reputation factor into, and reflect, objective career success. To be recognized as a “leader” in a field and asked to submit chapters for inclusion in books such as this may be a more important indicator of career success than money. Psychological success is the second measure of career performance. It is achieved when your self-esteem, the value you place on yourself, increases.

As you can see, there is a direct relationship between psychological success and objective success. It may increase as you advance in pay and status at work or decrease with job disappointment and failure. Self-esteem may also increase as one begins to sense personal worth in other ways such as family involvement or developing confidence and competence in a particular field, such as consistently shooting par on the golf course. At that point, objective career success may be secondary in your life. This is why many persons choose to become active in their church or in politics. Even though one may have slowed down on the job, or in their professional career they can be extremely content with their life.

Consider the following situation. You are traveling on business. Although you are on a direct flight, you have a one-hour layover before the second leg of the flight and your final destination. Leaving the plane, after having placed the “occupied” card on your seat you walk down the concourse. On the way, you encounter a friend that you knew in high school. The two of you sit to have a cup of coffee and then you realize that your departure time is rapidly approaching. In fact, you will be cutting it quite close. Running down the concourse you return to the gate only to find that the door has been closed, the jetway is being retracted and the plane is being backed away from the gate. You stare out the window watching the plane go to the end of the runway and then begin its takeoff. Something goes horrible wrong and the plane crashes on takeoff, bursting into flames. It is apparent that there will be no survivors. To the world you are on that plane (remember the occupied card). Traveling on business your generous insurance policy will be activated. In anticipation of being in a location where they may not have ATM machines you have a good deal of cash, sufficient for at least a month.

The question for you to consider is: What do you do?

For many of you this will be a good indicator of your career as well as personal success.

Medical Career Paths

In retrospect how many persons are truly aware of their own interests, values, strengths and weaknesses during their teen years?

As with much of human behavior, career choices actually go through a series of stages. Psychologists have for years identified stages of human development. Kohlberg discussed stages of moral development. In the 1970’s, Daniel Levinson published The Season’s of a Man’s Life, a project he undertook when he began to look inward and tried to understand his behaviors, values and attitudes to work. Discussions with his university colleagues indicated that what he was experiencing was not unique to him.

For many years the prevailing thought was that the correct way to function in the labor market was to gain employment with a company progressing through the years until such time as you were eligible to receive the “gold watch”, the symbol of retirement. If you entered a professional discipline such as medicine or law, you did that for the rest of your life.

Today there are still individuals who follow these traditional patterns but there are other career paths that may be taken. The most traditional career route follows a linear path, one that most of you have rejected. This entails gaining employment in a large, bureaucratic organization with a tall pyramidal structure. It involves a series of upward (hopefully) moves in the organization until the career limit is reached. As the individual progresses upward in the organization he or she may work in different functional departments such as marketing, finance, and production. Organizations having these paths seek employees who tend to be highly oriented toward success defined in organizational terms and exhibit “leadership” skills.

In general, these people demonstrate a strong commitment to the workplace. A person with this type of orientation (Organizationalist) exhibits the following tendencies:

1. A strong identification with the organization; seeking organization rewards and advancement that are important measures of success and organizational status.

2. High morale and job satisfaction.

3. A low tolerance for ambiguity about work goals and assignments.

4. Identification with superiors, showing deference toward them, conforming and complying out of a desire to advance; maintains the chain of command and compliance, and views respect for authority as the way to succeed.

5. Emphasis on organizational goals of efficiency and effectiveness, avoiding controversy and showing concern for threats to organizational success.

As readers of this essay, you have followed the expert career path, building a career on the basis of personal competence, or the development of a profession (professionals). As you are so painfully aware, you invest heavily, personally and financially in acquiring a particular skill and then you spend the major portion of your life following that skill.

Unlike the pyramidal structure of the linear path, career paths are found in organizations that tend to be relatively flat, have departments in which there is a functional emphasis, emphasize quality and reliability, and have reward systems containing a strong recognition component. Medical professionals are persons who are job-centered – not organization centered – viewing the demands of the organization as a nuisance that they seek to avoid.

However, that avoidance is impossible since the professional must have an organization in which to work. This is even more prevalent in today’s era of managed health care. At work, professional experience more role conflict and are more alienated.

Medical professionals exhibit these four tendencies:

1. An experience of occupational socialization that instills high standards of performance in the chosen field; highly ideological about work values.

2. Sees organizational authority as nonrational when there is pressure to act in ways that are not professionally acceptable.

3. Tends to feel that their skills are not fully utilized in organizations; self-esteem may be threatened when they do not have the opportunity to do those things for which they have been trained.

4. Seeks recognition from other professionals outside the organization, and refuses to play the organizational status game except as it reflects their worth relative to others in the organization.

Professionals are very concerned with personal achievement and doing well in their chosen field. Organizational rewards serve to reflect the professional’s importance relative to others in the system. This recognition may be extremely fulfilling, especially when he or she is accorded higher status and pay than others. In the absence of organizational rewards the professional may use material objects (large homes, expensive cars) as a way of reflecting status and accomplishment.

Medical professionals are of the opinion that successful performance, not compliance with authority, is more reinforcing. With this mindset it is not surprising why may medical practitioners balk at working in the managed health care environment.

Many professionally oriented people come from the middle class and have become successful through a higher level of education or by other efforts to acquire competence. Those on the spiral career path make periodic moves from one occupation to another. Individuals who follow this career path tend to have high personal growth motives and are relatively creative.

Usually, these changes come after you have developed competence in the occupation you are working in and you think it is time to change what you do. The ideal spiral career path is to move from one occupation to an area related to it. This enables you to use some of the basic knowledge that you developed in your past work and to transfer it to your new occupation. The difference between this path and the linear path discussed above is that in this case the mobility pattern is lateral, not upward.

People who take the transitory career path cannot seem to, and perhaps do not want to settle down. The pattern is one of consistent inconsistency in their work. These are individuals who may find a great deal of satisfaction working as consultants. The work style is marked by an ability to do many things reasonably well. They value independence and variety, and they work best in relatively loose and unstructured organizations that tolerate the type of freedom they demand in their work.

We have so far discussed the four types of career paths and two career orientations.

A final form of career orientation is that of the indifferents, those who simply work for a paycheck. These are individuals who do their work well, but they are not highly committed to their job or the organization.

Some characteristics of indifferents are:

1. More oriented toward leisure, not the work ethic (is it Friday yet?); separates work from more meaningful aspects of life, and seeks higher-order need satisfaction outside the work organization.

2. Tends to be alienated from work and not committed to the organization.

3. Rejects status symbols in organizations.

4. Withdraws psychologically from work and organizations when possible.

Indifferents are not necessarily born that way; some are actually a product of their work experiences. People who once had an organizational orientation and were highly loyal may no longer follow orders without question.

For example, you may have had an officer manager who very early in his or her career was extremely committed to you and your organization. He or she may seek rewards and want to advance. However, in later career life, after having been passed over several times for promotion, the person seeks rewards elsewhere. Thus it is possible that through office practices, your organization may turn highly committed organizationalists (or professionals) into indifferents.

Medical Career Evaluation

Studs Turkel, in his outstanding book Working, makes the comment that work is the mechanism by which many of us get our daily bread and our daily purpose. If this is to be the case then the workplace needs to offer us something more than a paycheck.

A few years back, the Wilson Learning Corporation surveyed 1,500 people asking “If you had enough money to live comfortably for the rest of your life, would you continue to work?

Seventy percent said that they would continue to work, but 60 percent of those said they would change jobs and seek “more satisfying” work.

Each of us has in fact been put in charge of our own careers. Our personal career management is a lifelong process. Our task is to be able to discover our place in the world where we will be able to enjoy a high level of wellness.

This requires us to now assess our career, not from the eyes of the sixteen year old that initially chose the career. The career you are now pursuing needs to be compatible with your own unique skills, knowledge, personality and interests. It is important to keep in mind that no one is married to his or her job. When it comes to the workplace most of us are in dating relationships.

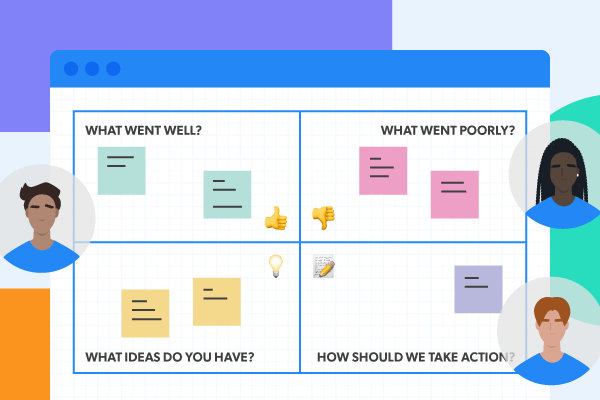

As part of your examining your current medical career, answer the following questions:

- Why do you work?

- What does work mean to you?

- What do you want from work?

Research shows that most people work for three major reasons.

The first of these is money. Not only is this necessary for our most basic needs it also serves as a means of determining our self-image.

A second reason is to be with other people. Being at work enables us to belong, to be part of something beyond ourselves. We become part of a team. Some offices consider co-workers to be part of an extended family. The work setting affords us the opportunity for receiving feedback, recognition and support.

The third most often given reason is that work validates us as people if we consider what we do as having meaning. “I chose the medical profession so as to make a difference.”

Individuals with career success have a sense of purpose, a feeling that their work has meaning and contributes to a worthwhile cause. This is not a trick question. How well does what you do in your office every day meet your needs for money, affiliation and meaning? Without a sense of purpose on the job the chances are that your performance while adequate will not place you in the excellent category.

Therefore, it is necessary for each and every one of us to be able to succinctly answer the question, “What is the purpose of your job?” That is a tough question to answer.

As a medical professional you may have seen what you considered to be the purpose of your job radically changed due to changes in the way services are now delivered. While we cannot bring back the past we can work around the present. Think about this for a moment, “If you want something to happen make a space for it.” What this means that whether you remain in your current profession or move elsewhere there is a need for you to establish long-range, medium-range, short-range, mini, and micro goals.

Long-range goals are those concerned with the overall style of life that you wish to live. Regardless of your current age these goals are necessary. Long-range goals don’t need to be too detailed, because like the federal budget surplus, changes will come along. Just as the government is making projections into the future you too need to be making projections including but not limited to retirement.

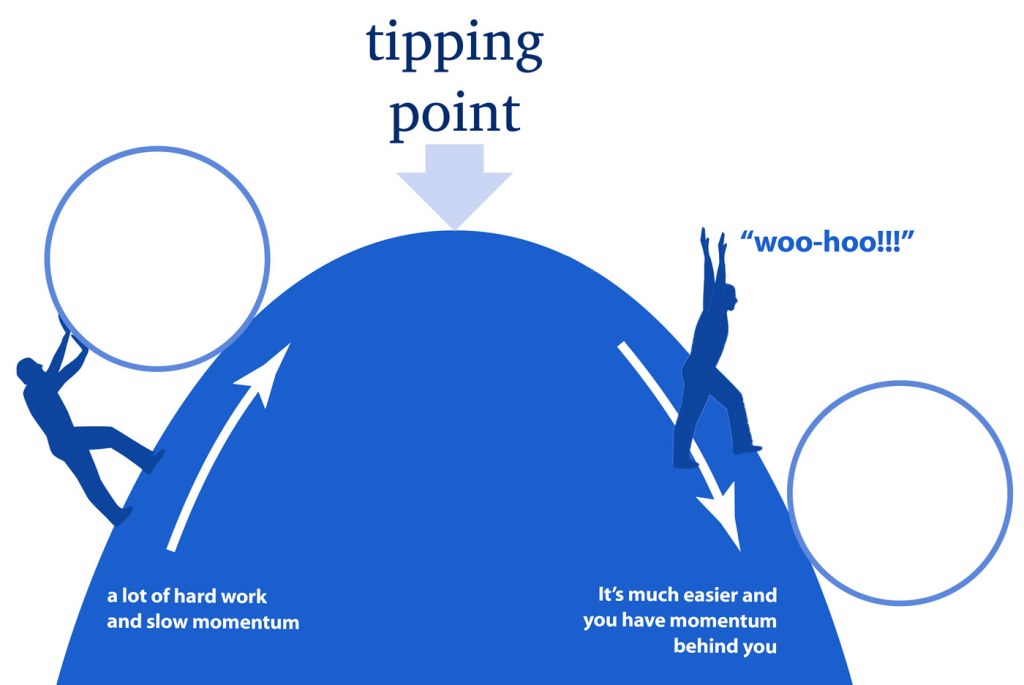

Medium-range goals are goals covering the next five years or so. These are the goals that include the next step in your career. These are goals over which we have control and we are able to monitor them and see whether we are on track to accomplishing them and modify our efforts accordingly.

Short-range goals generally cover a period of time about one month to one year from now. These are goals that can be set quite realistically and we are able to see fairly quickly whether or not we are on track to reaching them. We don’t want to set these goals at impossible levels but we do want to stretch ourselves. After all, that is the reason you are probably reading this chapter.

Mini-goals are those goals covering from about one day to one month. Obviously we have much greater control over these goals than you do over those of a longer-term. By thinking in small blocks of time there is much more control over each individual unit.

Micro-goals are goals covering the next 15 minutes to an hour. These are the only goals over which you have direct control. Because of this direct control, micro-goals, even though modest in impact, are extraordinarily important, for it is only through these micro-goals that you can attain your larger goals.

If you don’t take steps toward your long-range goals in the next 15 minutes, when will you? The following 15 minutes? The 15 minutes after that? Sooner or later, you have to pick 15 minutes and get going.

At some point procrastination has to be put aside. In thinking of your goals it now becomes necessary to evaluate your personal assets. Conducting this personal inventory requires you to identify your assets as well as your shortcomings.

First, look at a time in your life when you were performing at your best. What were your thoughts and feelings? How did you behave? What were you doing? Now look at the reverse when you were doing poorly. What were your thoughts and feelings at that time? How did you behave? What were you doing? If you are like others when you were at your best you described yourself as being confident, enthusiastic, organized, relaxed, focused, in control, friendly and decisive.

The flip side, when at your worst you were fearful, apathetic, messy, anxious, lacking direction, out of control, argumentative and frustrated.

As you can see the emotions when we are at our best are all positive. This leads to the conclusion that it is to our advantage to be at our best as much as possible.

Being at our best derives from working in those areas where we contribute our talents to something we believe in. As we continue our own personal inventory we need to look at our special abilities. That is, what are you good at and find easy to do.

Think of the following questions.

It’s not necessary to write down you answers just think about them:

1. How would you like to be remembered?

2. What have you always dreamed of contributing to the world?

3. Looking back on your life, what are some of your major contributions?

4. When people think of you, what might they say are your most outstanding characteristics?

5. What do you really want from your life and your work?

6. In what way may you still feel limited by the past? If so, by what?

7. What will it take to let go of what has happened, no matter how good or bad? Are you willing to let go?

8. How might the rut of conformity or comfort be limiting you? Why?

9. How different do you really want life to be? Why.

10. Have you ever stated what it is you truly desire? If no, why not?

11. How good could stand life to be?

Thinking about remaining in your present career or moving into another one is not easy. You are at the edge of a cliff and need to decide if you are going to turn back or to trust in yourself to successfully make it down to the bottom. People who are afraid of the dark lose their fear with just the slightest of a light in the room.

As you have been going through this chapter you have been shining a light, however dim it may appear to you. You can see all of the items around you. The obstacles are there but with your advance knowledge you can anticipate ways to avoid them. Having looked at and possibly re-evaluated your plans you can now do a thorough analysis of your assets.

The assets requiring the most scrutiny are the following:

1.Your talents and skills

2. Your intelligence

3. Your motivation

4. Your friends

5. Your education

6. Your family.

Your talents and skills are more than likely what has gotten you to the point you are at in your present career.

For purposes of definition talents are innate, skills are acquired. Some have talent in interpersonal relations and some in artistic pursuits. Skills may be selected to complement the already present talents. It is skills that are necessary for expanding your options. As you seek out new skill areas ask yourself these questions. Do the skills provide occupational relevance? Might you be able to get others to pay you to teach them the skill? Will the skill be useful throughout life? Will the skill help you conquer new environments and gain new experiences?

And, of course, is it something you like to do? Intelligence is considered to be the ability of the individual to cope with the world.

Originally, intelligence focused primarily in the area of cognitive skills. Recently attention has been directed to what is called emotional intelligence, a concept that directs attention to social skills. Whether you were able to breeze through your courses in college or you truly had to work hard, earning your degrees demonstrates a better than average amount of cognitive intellectual ability. In order to maximize your brainpower, challenge yourself regularly.

Motivation looks at how hard you are willing to work, your level of persistence, and the degree to which you want to do well. Different things motivate each of us and our personal motivators can vary from day to day. How many times have you had people say that they could not do your job? What are the activities that are attractive to you? More than likely an important motivator for you is to do something worthwhile.

It has also been found that we tend to perform at about the same level as those people who are close to us. What this means is that those people with whom you work are going to have s substantial impact on your motivation.

Friends, of course, are invaluable assets. We use our friends as models for our own behavior. Those persons we consider friends share many of our attitudes, actions and opinions. With time we will change to be like our friends and they will change to become like us. Associating with those like us tends to temper our behavior. We try not to associate with the “wrong crowd” lest we become like them. Education needs to be ongoing.

Recently, it was reported “all careers and businesses will be transformed by new technologies in often unpredictable ways. The era of the entrepreneur will make ‘boutique’ businesses more competitive with the behemoths, as mid-sized institutions get squeezed out. And, medical breakthroughs and the ongoing health movement will enhance-and extend-people’s lives.”

The implication of these changes is that new technologies often require a higher level of education and training to use them effectively and new biotechnology jobs will open up. The authors state that all the technological knowledge we work with today will represent only 1 percent of the knowledge that will be available in 2050.

The half-life of an engineer’s knowledge today is only five years; in ten years, 90 percent of what an engineer knows will be available on the computer.

In electronics, fully half of what a student learns as a freshman is obsolete by his or her senior year. The implication here is that all of us must get used to the idea of lifelong learning. Family influences who and what we are and do. They can be a support group or they can be a deterrent to your goals. It is incumbent on every individual reading this chapter to consult with immediate family members at all stages of your career planning process.

Conclusion

This essay has presented an overview of initial career selection, career pathing and career change in order to help you determine what you truly want to be when you grow up.

As I write, I can not help but reflect on an anecdote shared with me by a colleague.

An individual came to see him expressing concern that at 40 years of age he still hadn’t reached a satisfactory point in his life. My colleague then asked him where he wanted to be. The response was “I don’t know” to which my colleague responded, “Congratulations, you’ve arrived.

Too many times I encounter in my practice, physicians who express the same statements. Unhappy with what they are doing they have no idea as to what it is they would like to be doing.

Victor Frankl, a psychiatrist who was a holocaust survivor, created an entire school of psychotherapy based upon his experiences in the German concentration camps. In his book, Man’s Search for Meaning, he makes reference to the fact that it became possible for him to determine when a fellow prisoner was going to die simply by that person’s behavior – giving up.

Frankl writes, “Evermore people today have the means to live, but no meaning to live for.

Thus, it may be appropriate to conclude with this anonymous poem.

Take time to work-

It is the price of success.Take time to think-

It is the source of power.Take time to play-

It is the secret of perpetual youth.Take time to read-

It is the fountain of wisdom.Take time to be friendly-

It is the road to happiness.Take time to love and be loved-

It is nourishment for the soul.Take time to share-

It is too short a life to be selfish.Take time to laugh-

It is the music of the heart.Take time to dream-

It is hitching your wagon to a star.

Now, how do you view your medical, executive, professional or healthcare administrative career amid all the turmoil in the industry today?

McNally, D. Even Eagles Need A Push, New York, NY: Delacorte Press, 1991.

Brousseau, K.R., Driver, M.J., Eneroth, K. and Larson, R.: Career Pandemonium: Realigning organizations and individuals. Academy of Management Executive 10 (4), 52-66. 1996

Presthus, R. The Organizational Society. New York, NY: St. Martin’s Press.Campbell, D. If You Don’t Know Where You are Going You’ll Probably End Up Somewhere Else, Niles, IL: Argus Communications, 1974.

Campbell, D. op. cit.The Futurist, March–April 2001.

8

8

[Dr. Cappiello PhD MBA] *** [Foreword Dr. Krieger MD MBA]

Front Matter with Foreword by Jason Dyken MD MBA

***

Filed under: "Doctors Only", Career Development, Marcinko Associates | Tagged: Career Development, Eugene Schmuckler, Marcinko, physician career development | 2 Comments »