The Access to Medical Care Dilemma

By David E. Marcinko MBA

By Render S. Davis; MHA, CHE

[Certified Healthcare Executive]

Crawford Long Hospital at Emory University

Atlanta, Georgia, USA

In his book, “Back to Reform”, author Charles Dougherty writes that “cost containment is the goal for the healthy. Access is the goal for the sick.”

A Meaningless Distinction

So, for an increasing number of Americans, the concerns experienced in-vitro, in-vivo, or described on this Medical Executive-Post blog, are almost meaningless because they are, for the most part, outside the structure of the current health care system. Why?

-

Employers are downsizing staff or cutting out health insurance benefits in an effort to be financially successful in a global economy.

-

Demands for greater government accountability in the expenditure of tax dollars have brought about increasingly more stringent eligibility requirements for safety-net programs like Medicaid.

-

As insurance becomes more expensive or government programs undergo budget cuts, people are being excised from the system.

-

New competitive demands have fostered unprecedented consolidations, mergers, and closures of healthcare facilities.

This shake-out may have served to greatly reduce the overcapacity that plagued the system, but it has been done with greater emphasis on cutting costs than on fostering efficiency and effectiveness in creating a true system of care delivery.

The Healthcare Commodity Issue

Those who view health care as little different from any other commodity available through the free market see the present access concerns as simply a byproduct of the inevitable restructuring of the system. While they argue that we must adhere to market solutions to solve our health care access problems, others demand a different approach calling for governmental national health insurance or some form of subsidized care providing at least a basic level of treatment for all citizens.

Moreover, while Americans continue to proudly tout that we do not explicitly ration care as do some other countries (notably Great Britain and Canada); we tacitly accept a health care system that implicitly excludes citizens who are unable to overcome financial barriers to access.

Care Access Issues

Access to care represents the most visible issue at the very foundation of the ethical principle of justice.

In their text, “Principles of Biomedical Ethics”, authors Thomas Beauchamp, Ph.D. and James F. Childress, Ph.D. point out that “justice” is subject to interpretation and may even be evoked to support the positions of parties in direct opposition.

A Philosophical Mixed Bag

For example, those who support the predominant principle of distributive justice – the fair allocation of resources based on laws or cultural rules – still must decide on what basis these resources will be used.

On the other hand, this mix-ed bad of philosophical thoughts include among others:

-

Utilitarians, who argue for resource distribution based on achieving the “greatest good for the greatest number.”

-

Libertarians, who believe that recipients of resources should be those who have made the greatest contributions to the production of those resources – a free market approach to distribution.

-

Egalitarians, that support the distribution of resources based on the greatest need, irrespective of contribution or other considerations.

Consequently, developing a system of access based on “justice” will be fraught with enormous difficulty.

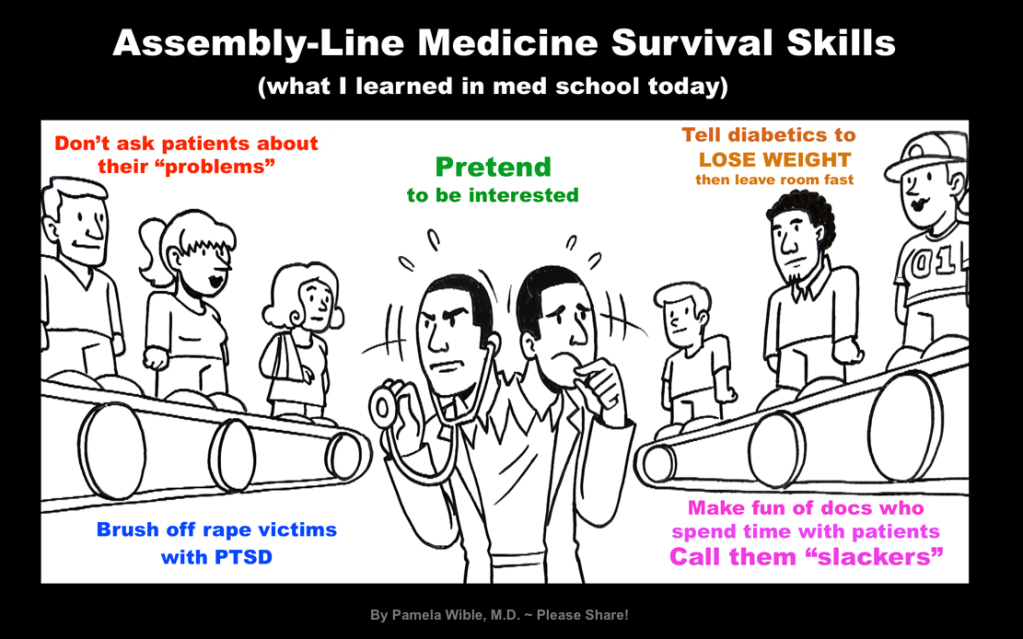

The Current System

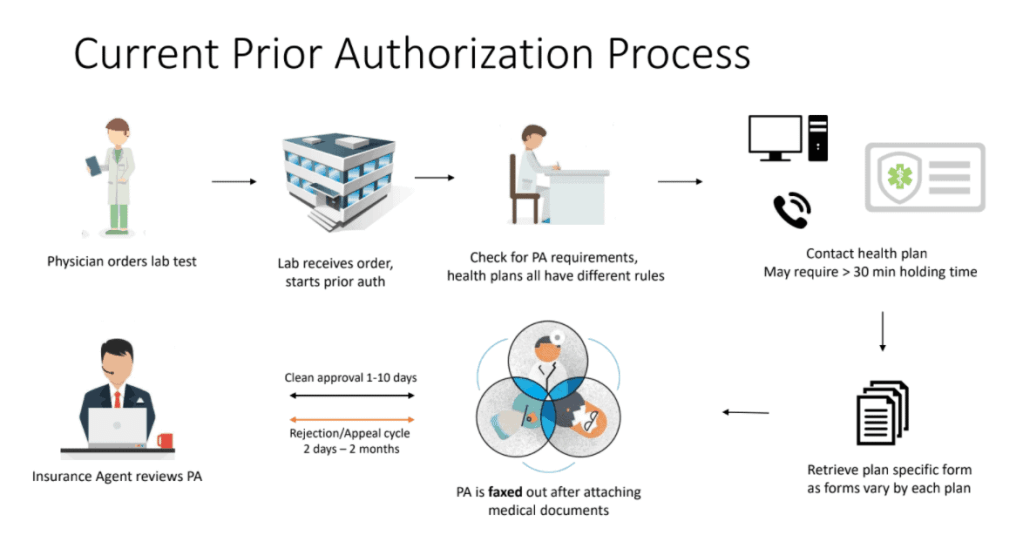

In the current health care environment, access to medical care is approaching crisis levels as increasing malpractice insurance premiums are driving physicians from high-risk specialties such as obstetrics, emergency medicine, and surgery in record numbers.

The impact is most dramatic in rural and under-served areas of the country where sole-practitioners and small group practices are discontinuing services, leaving local citizens with no choice but to forego care or travel greater distances to regional medical centers to find necessary treatment.

At the same time, significant budget cuts at both the federal and state levels have seriously eroded funding for Medicaid, leaving this especially-vulnerable segment of the population with even fewer options than before.

Issues Moving to the Forefront

Two areas of the medical care access dilemma are moving to the forefront.

1. The first is in emergency medicine.

An initial study by the Federal Centers for Disease Control and Prevention, cited statistics showing that in the decade ending in 2001, emergency room visits increased 20 percent, while the number of emergency departments shrank 15 percent. Increasingly, hospitals have closed emergency departments due to increasing costs, staffing shortages, and declining payments for services. This crisis comes at a time when post 9/11 fears of terrorism and global disease outbreaks like Severe Acute Respiratory Syndrome (SARS) have placed an even greater burden on the delivery of emergency services. It continues and is exacerbated, even today.

For example, Arthur Kellerman, MD, former director of emergency services at Atlanta’s Grady Memorial Hospital, the city’s only level one trauma center, writes that “the situation is alarming and has been for some time… It’s unconscionable that we are not coming to terms with the Achilles’ heel of our health care system.”

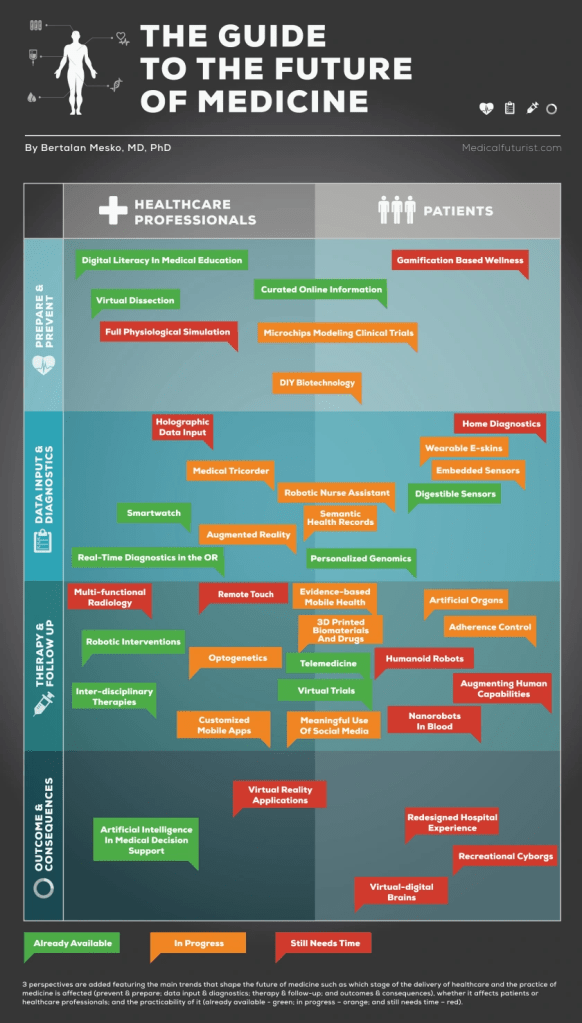

2. The second area that will grow in significance is in the area of genetic testing.

As technological capabilities improve, medicine’s ability to examine an individual’s genetic makeup will open up remarkable opportunities to predict a person’s susceptibility to certain diseases or handicapping conditions. From a scientific standpoint, we are on the threshold of an extraordinary new era in medicine, where identifications of and treatments for potential illnesses may begin before the person is even born.

“Medicine’s Iceberg”

However, there is a more troubling access side to the potential of genetic testing as noted by Johns Hopkins University president, Dr. William R. Brody. He described genetic testing as “medicine’s iceberg,” where serious dangers for access to care are lurking beneath the surface.

According to Brody, heated debate has already begun regarding the value of genetic information to insurance companies who could use the information to determine premium levels, even the overall insurability, for individuals and/or families with a member identified through testing as predisposed to a catastrophic and/or potentially expensive medical condition.

In this scenario, infants manifesting a genetic predisposition to certain illnesses or potential behavior disorders may find themselves faced with lifelong un-insurability based on the results of prenatal genetic testing.

Assessment

Furthermore, Brody persuasively argues that the potential of this technology, regardless of the incredible scientific potential it offers, could lead to dramatically diminished access to health insurance for tens of thousands of individuals and families and bring about an “end to private health insurance as we know it.” He suggests that some form of community-rated, universal health insurance may be the only reasonable alternative to assure that Americans at all levels, from indigent and working poor, to the most affluent, may receive needed, basic medical care.

CONCLUSION

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

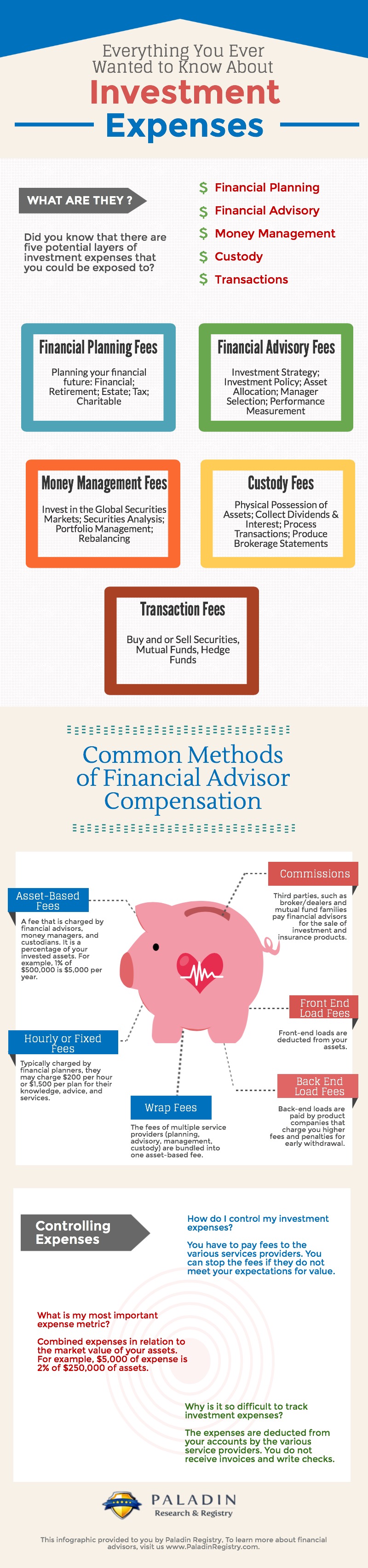

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Career Development, Ethics, Op-Editorials, Research & Development | 11 Comments »

***

***