Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

For decades, private equity has occupied a powerful and sometimes controversial position in global finance. It has been praised for revitalizing companies, generating strong returns, and driving innovation. It has also been criticized for excessive leverage, aggressive cost‑cutting, and widening inequality. But in recent years, a new question has emerged: Is private equity past its prime? The answer is more nuanced than a simple yes or no. Private equity is not disappearing, but the conditions that once made it a near‑unstoppable engine of outsized returns have shifted. The industry is entering a more mature, constrained, and competitive phase—one that challenges its traditional playbook and forces a rethinking of what “prime” even means.

The Golden Era: Why Private Equity Flourished

To understand whether private equity has peaked, it helps to recall why it thrived in the first place. For roughly three decades, the industry benefited from a rare alignment of favorable forces:

- Low interest rates made debt cheap, enabling firms to finance large leveraged buyouts at minimal cost.

- Abundant institutional capital—from pensions, endowments, and sovereign wealth funds—flowed into private equity in search of higher returns than public markets could offer.

- A plentiful supply of undervalued or underperforming companies created opportunities for operational turnarounds.

- Regulatory environments in many countries allowed for aggressive restructuring, asset sales, and financial engineering.

This combination created a powerful formula: buy companies using mostly borrowed money, streamline operations, sell at a higher valuation, and deliver returns that consistently beat public markets. For many years, private equity firms did exactly that.

The Changing Landscape

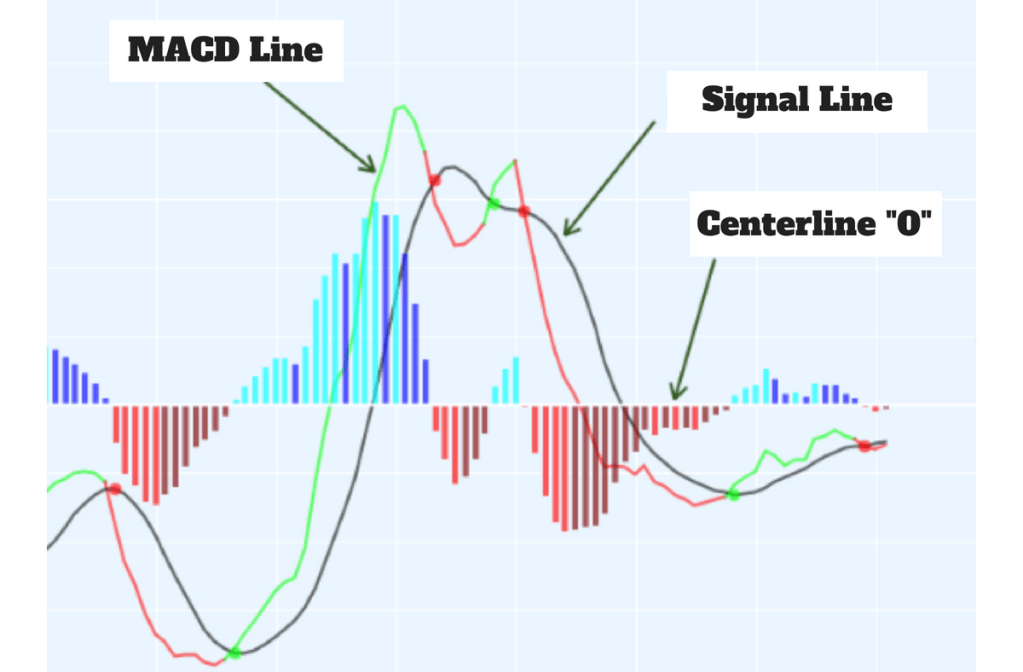

But the environment that fueled private equity’s rise has changed dramatically. The most obvious shift is the end of ultra‑low interest rates. When borrowing becomes more expensive, leveraged buyouts become harder to justify, and the math behind traditional private equity deals becomes less attractive. Higher rates squeeze returns, reduce deal volume, and force firms to hold assets longer than planned.

At the same time, competition has intensified. Private equity is no longer a niche strategy; it is a mainstream asset class with trillions of dollars under management. With so much capital chasing a finite number of attractive targets, valuations have risen. Buying companies at premium prices leaves less room for value creation and increases the risk of disappointing returns.

Another challenge is the scarcity of easy wins. Many of the low‑hanging fruit—industries ripe for consolidation, companies bloated with inefficiencies, or sectors overlooked by public markets—have already been picked over. Today’s deals often require deeper operational expertise, longer time horizons, and more complex strategies than the classic buy‑improve‑sell model.

Public Scrutiny and Political Pressure

Private equity also faces growing public and political scrutiny. Critics argue that some firms prioritize short‑term gains over long‑term stability, leading to layoffs, reduced investment, and weakened companies. Whether or not these criticisms are fair, they have shaped public perception and influenced policymakers.

In several countries, lawmakers have proposed or enacted regulations targeting leveraged buyouts, tax treatment of carried interest, and transparency requirements. These changes may not dismantle the industry, but they do increase compliance costs and limit certain strategies that once boosted returns.

The Maturation of an Industry

All of this raises the question: if private equity is no longer delivering the same level of outperformance, does that mean it is past its prime? One way to answer is to consider what “prime” means in the context of a financial industry.

If “prime” refers to a period of explosive growth, easy returns, and minimal competition, then yes—private equity’s prime may be behind it. The industry is no longer the scrappy outsider disrupting public markets. It is a mature, institutionalized part of the financial system, with all the constraints that maturity brings.

But if “prime” means relevance, influence, and adaptability, then private equity is far from finished. In fact, the industry is evolving in ways that may position it for a different kind of success.

***

***

A New Phase: Reinvention Rather Than Decline

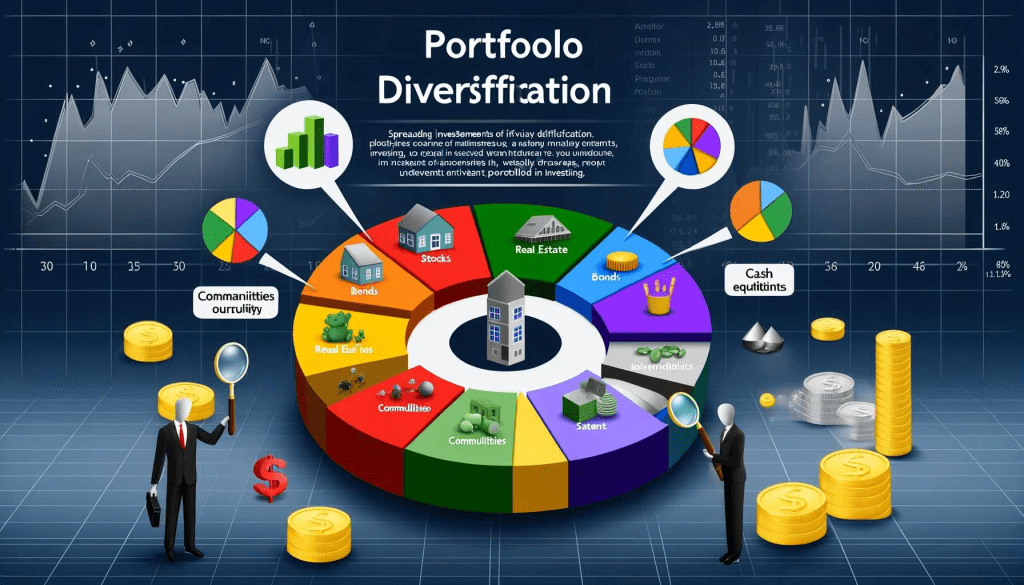

Private equity firms are not standing still. Many are expanding into adjacent areas such as private credit, infrastructure, real estate, and growth equity. These strategies rely less on leverage and more on specialized expertise, long‑term capital, and diversified revenue streams.

Firms are also investing heavily in operational capabilities—bringing in experts in technology, supply chain, digital transformation, and sustainability. Instead of relying primarily on financial engineering, they are increasingly focused on building stronger companies from the inside out.

Another trend is the rise of permanent capital vehicles, which allow firms to hold assets longer and avoid the pressure of short exit timelines. This shift aligns private equity more closely with long‑term value creation rather than quick turnarounds.

Finally, private equity is playing a growing role in sectors that require large, patient capital—such as renewable energy, healthcare, and technology infrastructure. These areas may define the next era of economic growth, and private equity is positioning itself to be a major player.

So, Is Private Equity Past Its Prime?

The most accurate answer is that private equity is transitioning from one prime to another. The era of easy leverage, abundant undervalued targets, and outsized returns relative to public markets is fading. But the industry is not declining; it is evolving. Its future will be shaped by innovation, specialization, and a broader definition of value creation.

Private equity’s first prime was defined by financial engineering. Its next prime—if it succeeds—will be defined by operational excellence, strategic insight, and long‑term investment in complex sectors. Whether this new phase will be as lucrative as the old one remains to be seen, but it is clear that private equity is not disappearing. It is simply growing up.

In that sense, private equity is not past its prime. It is past its first prime, and entering a second—one that may be less flashy, more demanding, and ultimately more sustainable.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Accounting, Financial Planning, Funding Basics, Glossary Terms, Investing, Touring with Marcinko | Tagged: business, david marcinko, finance, Investing, investors, Is Private Equity Past Its Prime?, Private Equity, stocks | Leave a comment »