Top Ten Appraisal Blunders to Avoid

By Dr. David Edward Marcinko; MBA, MEd, CMP™

MARCINKO & ASSOCIATES: https://marcinkoassociates.com/

Top Ten Appraisal Blunders to Avoid

The science of the modern medical practice valuation can be traced to the Estate of Edgar A. Berg v. Commissioner (T. C. Memo 1991-279). In this case, the Court criticized CPAs as not being qualified to perform business valuations, failing to provide analysis of an appropriate discount rates, and making only general references to justify their “Opinion of Value.”

In rejecting accountants, the Court accepted IRS economists because of background, education and training, as well as discount rate calculations and reproducible evidence applied to the assets being examined. This marked the beginning of the Tax Court leaning toward the side with the most comprehensive appraisal. Previously, it had a tendency to “split the difference.” Now, some feel the Berg case launched the valuation profession; especially for contemporaneous health economists.

But, it was not until after 1995 that the IRS issued guidelines for the valuation of physician practices. As a result, the Uniform Standards of Professional Appraisal Practice [USPAP] requires that a blended constellation of three recognized valuation approaches (income, market, and cost approaches) be considered when estimating fair market value.

Operative Valuation Definitions

When pursuing any discussion of medical practice worth, two key elements must be understood: (1) the valuation process, and (2) fair market value. According to the Dictionary of Health Economics and Finance

- Practice valuation is the “the formal process of determining the worth of a healthcare or other medical business entity, at a specific point in time, and the act or process of determining fair market value.”

- Fair market value [FMV] is “a legal term generally meaning the price at which a willing buyer will buy, and a willing seller will sell an asset in an open free market with full disclosure.” IRS Revenue Ruling 59-60 clearly states that FMV “is essentially a future prophesy and must be based on facts available at the required date of appraisal”

Unfortunately, the value of a medical practice cannot be directly observed by activity in thinly traded private markets. Perhaps this is why we continually observe the following valuation blunders? They are committed by both sellers and buyers who are pursuing opposite objectives; sale price maximization versus price minimization?

Top 10 Blunders:

Not Understanding What a Medical Practice Valuation Is and Is Not

- Valuations are not source document fraud audits.

- Valuations are material representations providing a range of transferable worth.

- Valuations are reproducible estimates based on economic assumptions.

- Valuations are not “back-of-the envelope multiples” using specious benchmarks.

- Valuations are defensible and “signed-off” attesting to USPAP/IRS formats.

- Financial accounting value [book-value] is not fair market value.

- Professional valuators represent only one party at arm’s length; not both sides.

- Engagement solicitor and/or valuation payer is the client.

- Unbiased valuators do not provide financing or equity-participation schemes. Although not standardized, the Institute of Medical Business Advisors, Inc uses the following three levels that approximate engagement types for the industry.

2. A Limited Valuation lacks additional suggested USPAP procedures. It is considered an “agreed-upon-procedure”, used in circumstances where the client is the only user [i.e., updating a buy-sell agreement, or practice buy-in for a valued associate] and not for external purposes. No onsite visit is needed. A formal Opinion of Value is not rendered.

3. Not Observing Industry Standards, Rules and Regulations

Specifically, in USPAP transactions involving physician practices, the IRS implied:

- Ad-Hoc Valuation is low level engagement that provides a gross and non-specific approximation of value based on limited meters by involved parties. Neither a written report, nor an Opinion of Value is rendered. It is often used periodically as an internal organic growth / decline gauge.

- A Comprehensive Valuation is an extensive service designed to provide an unambiguous Opinion of Value range. It is supported by all procedures that valuators deem relevant with mandatory onsite review. This “gold-standard” is suitable for contentious situations like divorce, partnership dissolution, estate planning and gifting, etc. The written Opinion of Value is applicable for litigation support activities like depositions and trial. It is also useful for external reporting to bankers, investors, the public and IRS, etc.

4. Not Understanding Engagement Types and Levels

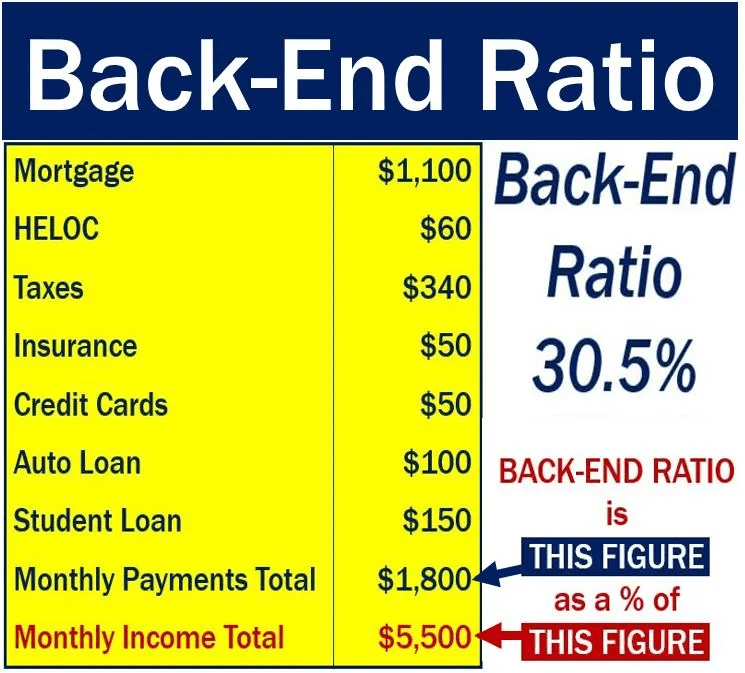

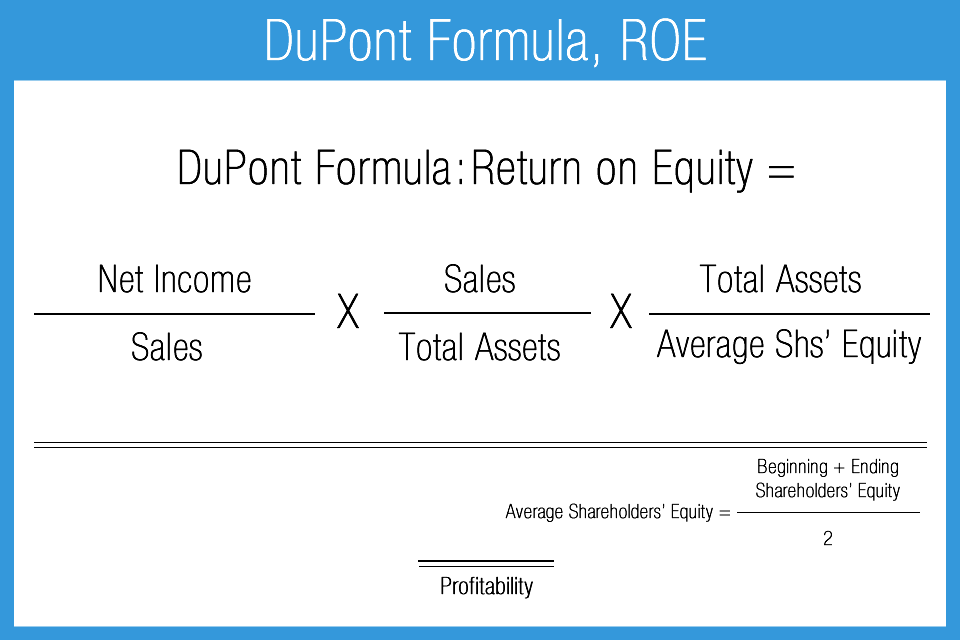

- Discounted cash flow (DCF) analysis is the most relevant income approach and must be done on an “after-tax” basis.

- Practice collections must be projected based on reasonable assumptions for the practice and market; etc.

- Physician compensation must be based on market rates consistent with age, experience and productivity.

- Majority premiums and minority discounts are to be considered.Goodwill represents the difference between practice purchase price and the value of the net assets. Personal goodwill results from the charisma, skills and reputation of a specific doctor. Its attributes accrue solely to the individual, are not transferable and can’t be sold. It has little or no economic value as it “goes to the grave” with the doctor. Transferable medical practice goodwill has value, may be transferred, and is defined as the unidentified residual attributes that contribute to the propensity of patients and managed care contracts (and their revenue streams) to return in the future (Schilbach v. Commissioner, T.C. Memo 1991-556). And so, one must also appreciate the: (i) impact of a changing environment; (ii) practice transfer in a local market which can augment or blunt goodwill value; and the (iii) determination of whether patients or HMOs return because of true goodwill, or are mandated by contractual obligations; among many other multi-variable determinants.

- Even the Goodwill Registry however, a classic source used to determine the average percentage of revenue contributed to practice goodwill, may be dated for some specialties leading to abnormally high values.

5. Not Understanding the Value of Practice Goodwill: Unlimited life span.

6. Not Understanding the Value of Personal Goodwill: Limited life span.

Now, to further confuse the issue, how each kind of goodwill is allocated in situations like divorce depends on state law. For example, some courts include both kinds of goodwill to be apportioned – some exclude both – and others pursue a case-by-case approach.

7. Not Understanding “Excess Earnings Capitalization”

Another way to determine goodwill value is through “excess earnings capitalization.” This economic method looks at the difference between salary, and what you’d have to pay a comparable doctor replacement.

As an example, when you subtract the numbers, and divide the result by 20%, an important percentage referred to as the Capitalization Rate emerges. The final number gives a dollar value for practice goodwill. Courts seem to prefer this method in divorces because it tends to reflect a practice’s current value.

8. Not Understanding the Present Compensation versus Future Value Paradox

Regardless of practice business model, physician compensation is inversely related to practice value. In other words, the more a doctor takes home in above-average salary, the less the practice is generally worth, and vice versa; ceteris paribus

9. Substituting Benchmarks and Formulas for Practice Specificity

In the stable economic past, industry benchmarks might have been used as quick and inexpensive substitutes for professionally prepared valuations. Muck like preparing one’s own income tax return today – while legal – it is a fraught with peril if challenged. The Courts seem to frown on this simplistic and dated methodology.

Moreover, generic benchmark formulas assume a financial statement reporting standard that just does not exist in public accounting.

Therefore, most every competitive issue that impacts value should be addressed with each practice engagement. This includes, but is not limited to contemporary dislocations by third parties, Medicare and commercial payers; retail clinics and changes in supply/demand and specialty trends; rise of ambulatory surgery centers and specialty hospitals; outsourced care and medical tourism, alterations in resource based-relative value units, APCs, DRGs and newer MS-DRGs; the Medicare Modernization Act, HIPAA, OSHA, EEOC, Sarbanes-Oxley and US Patriot Acts, PP-CA, and ACOs; among other regulations.

Current employee trends to high-deductible health care plans [HD-HCPs] and private concierge medicine must also be considered, as well as demographic and employer shifts to defined contribution plans – from defined benefits plans – to name just a few more complicating issues.

10. Not Aggregating or “Normalizing” Financial Information

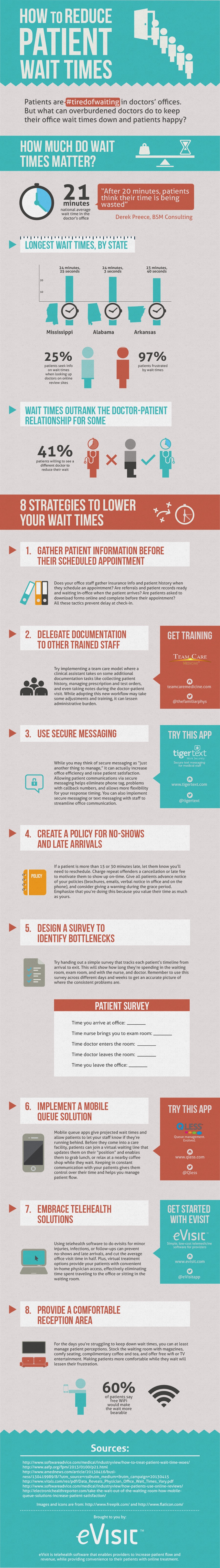

Employees may be interviewed and financial information must be gathered before a medical practice can be properly valued. The following data, for the most recent three year period, serves as a starting point:

- Practice (corporate) tax returns.

- Equipment / automobile leasing and/or tax depreciation schedules.

- Accounts Receivable aging-schedule.

- Practice consolidated financial statements (P&L, Cash Flow, Balance Sheet and Retained Earnings).

- Prior Buy-Sell and/or non-compete agreements, and;

- Sample medical record chart review is increasingly being demanded.

- It is especially important to eliminate one-time, non-recurring practice expenses. These are adjusted for excessive or below normal expenses on the profit and loss statement. Such “normalization” can produce a big surprise for benchmark proponents and formula-driven advocates when a selling doctor runs personal expenditures through the practice that a buyer [or Court] wouldn’t consider legitimate. Of course, such shenanigans are less noted using professional USPAP/IRS guidelines. Conversely, you may have to defend legitimate business expenses that an appraiser may seek to normalize. For example, doctors may pay for a vehicle through their practice, but if used to travel between multiple offices and hospitals, the expense may be legitimate. Of course, normalization is a sophisticated and time-intensive process. But, it is where the expert earns his/her professional fee, and defends the resulting valuation range when challenged.The most important credential to look for is fiduciary experience, specificity and independence. Some doctors mistakenly turn to those who may have never appraised a practice before. And, just because an appraiser has initials behind his name, doesn’t mean he understands the peculiarities of medical specialties, especially podiatry. We believe that only an independent health economist, who will be your advocate under Securities Exchange Commission [SEC] fiduciary [not lower “suitability”] guidelines, should be selected. Of course, it is almost impossible to answer concerns regarding fees without specific information. The cost of a valuation can range from $0 (benchmarks-rule of thumb) to $50,000 for an onsite team of experts for behemoth practices and ambulatory surgery centers. Keep in mind that in most cases you want to ensure the value determination will stand up to IRS scrutiny, so the $0 rule-of-thumb is not an optionExternal appraisals, or poorly aggregated financial information, onsite reviews and litigation support services incur additional costs; yet most doctors find the money well spent. Expect to pay a retainer and sign a formal professional engagement letter.

Assessment

Don’t be surprised if a sales-broker does not consider the above issues as the modern health era emerges. Most agent-appraisers are predominantly concerned with earning commissions by working both transaction parties, and may not represent your best interests. And, they are usually not obliged to disclose conflicts-of-interest and don’t provide legal testimony.

As a result, a good medical practice is no longer necessarily a good business; and retiring doctors can no longer automatically expect to extract premium sales prices. Moreover, uninformed young physicians should not be goaded to over-pay. Regardless of your dismay – or delight – in the changing healthcare milieu, always be foreword thinking and remember the admonition, Trust-but Verify, for any business transaction.

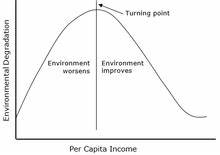

But, it is a fait accompli that medical practice worth is presently deteriorating. As the population ages and third-party reimbursements plummet, doctors are commoditized and traditional retail medicine is replaced by more efficient wholesale business models like workplace health clinics. The recent sub-prime mortgage de-fault fiasco, potential tax-reform law expiration and the political specter of a nationalized healthcare system, only adds fuel to the macro-economic fires of uncertainly.

Finally, once practice price is mutually agreed upon, sales contract terms and agreements present a plethora of financing challenges for both involved parties to consider [bank loan payment rates and length, personal promissory guarantees, down-payment offsets, earn-out arrangements, Uniform Commercial Codes-1 asset guarantees, etc] in their due-diligence efforts.

However, most reputable firms use a blended fee-schedule of fixed and hourly rates (plus expenses). So, doctors should expect to spend approximately $5,000-15,000 for an average sized – limited appraisal – that is completely suitable for most internal activities.

Moreover, look-out if the valuation not done at an-arm’s-length and independent manner; or worse still, if it is performed for both parties simultaneously.

Selecting the Wrong Valuator and Not Understanding Professional Fees

- Realize too, that the appraiser may also add expenses that have not been incurred; like an office manager’s salary if your spouse is in that role for free. This produces a lower appraised value and is common in small medical practices. Honoraria are another example that does not figure into value calculations.

- For example, we recall one doctor who painted his personal residence and wrote it-off as a valid business expense. Deleting other major expenses such as country club memberships, make a practice look more profitable—good news if you’re selling it, bad news if you’re getting a divorce.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

***

8

8

[Dr. Cappiello PhD MBA] *** [Foreword Dr. Krieger MD MBA]

Front Matter with Foreword by Jason Dyken MD MBA

***

***

Filed under: "Doctors Only", Accounting, Investing, Practice Worth, Taxation, Touring with Marcinko | Tagged: accounting valuations, david marcinko, Marcinko Associates, medical practice valuation, valuation blunders | Leave a comment »