On Investment Portfolio Analysis

By Lon Jefferies MBA CFP®

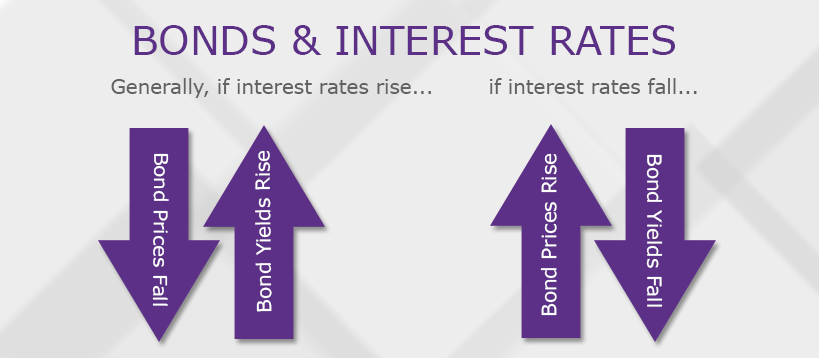

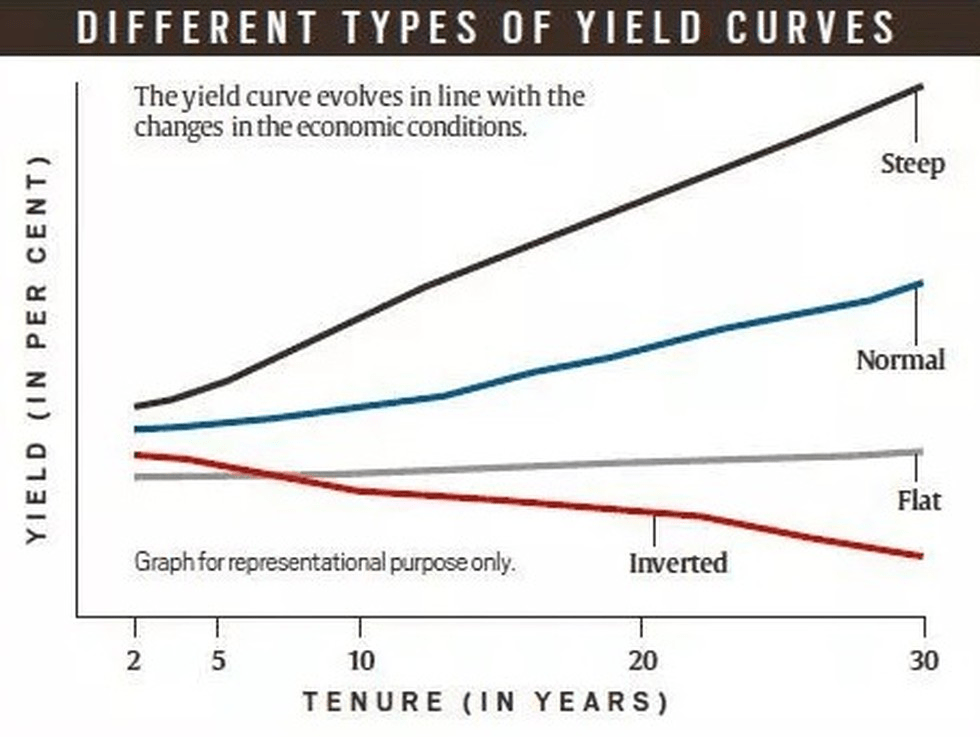

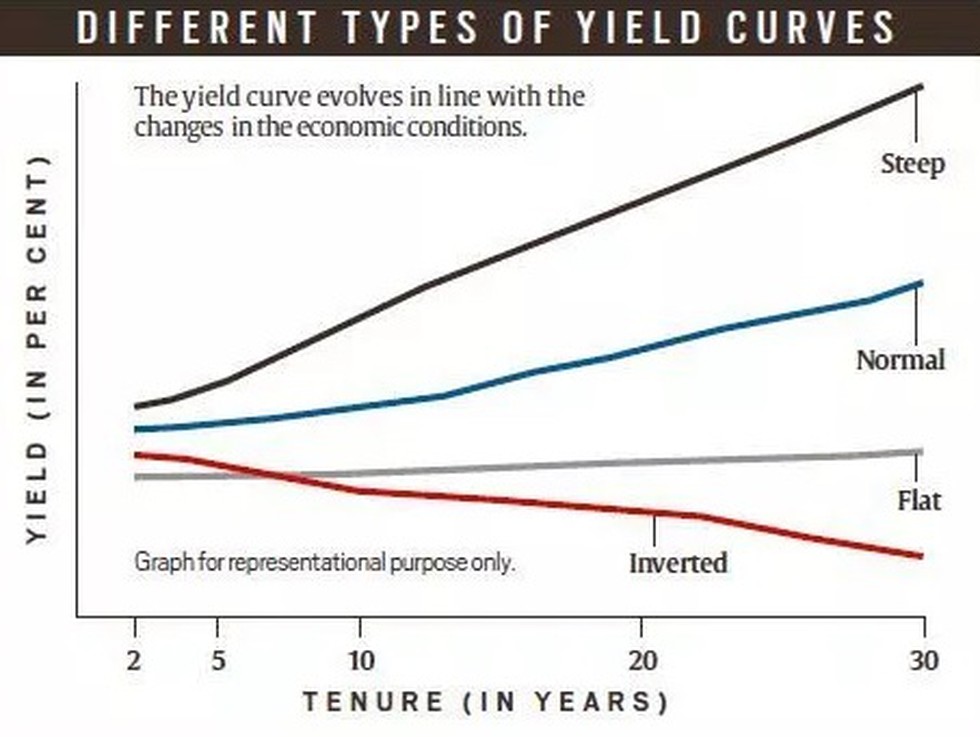

For the last half-decade, investors have been continually concerned about rising interest rates and the effect they may have on the bond portion of their investment portfolio.

The fear is that if interest rates rise, the bonds currently held by investors will be outdated and provide investment returns that are less than what new bonds issued at the higher yields would return.

Concerned?

There is validity to this concern – if an investor could buy a bond yielding 4% on the open market, why would anyone buy a bond that yields only 3%, unless they could do so at a significant discount? Given that today’s interest rates are considerably lower than historical averages and expected to rise in the future, would now be a good time to sell some of the bonds in your portfolio?

Consider the Timing

First, let’s consider one of the most basic principles of investing – that markets are unpredictable. Are we certain that interest rates will rise, and are we confident this rate increase will happen soon? I’d contend the answer to both questions is no.

Actually, the majority of investors have believed interest rates would rise since the first round of quantitative easing took place in 2009, and have suspected rates would rise in every calendar year since. Quite simply, this has not happened. In fact, interest rates are currently lower than they were during the majority of 2009 despite five years of buzz about interest rate hikes.

During this five-year period, how have bonds performed? From 2009 through 2013, the Barclays Aggregate Bond Index (AGG) returned 5.93%, 6.54%, 7.84%, 4.22%, and -2.02%, respectively. Bonds only declined once during the five-year period, by a relatively nominal -2.02%, and still averaged a compound rate of return of 4.86%—not bad for the conservative portion of a portfolio.

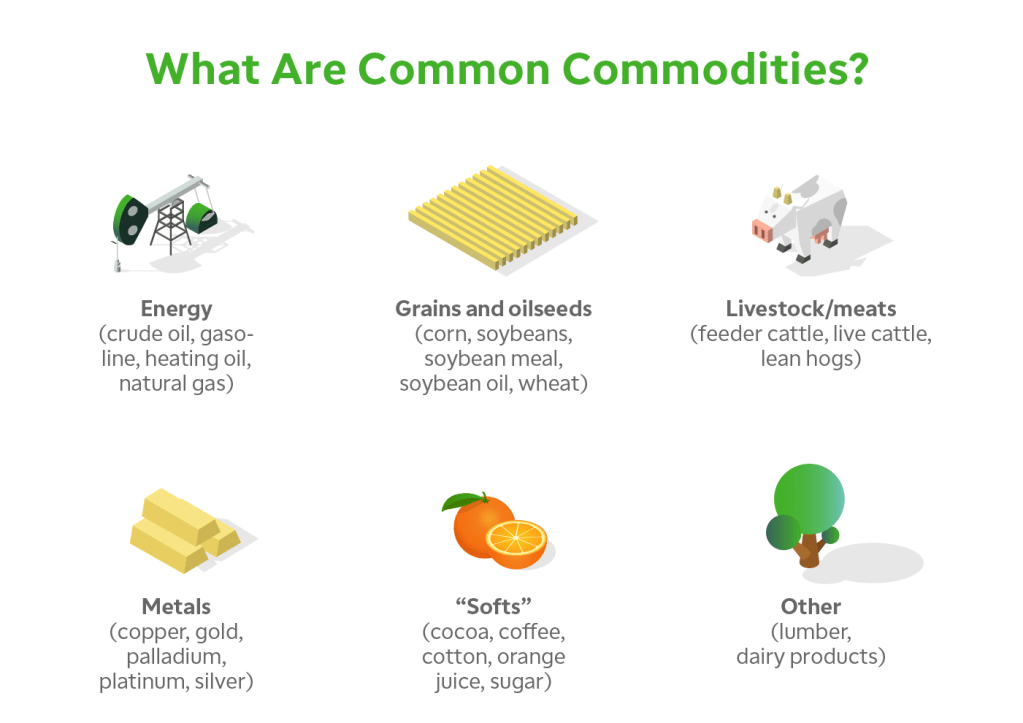

Additionally, various bond categories have done even better than the Aggregate Bond Index, which consists of just U.S. government and corporate bond holdings. For instance, emerging market bonds (EMB) achieved a compounded return of 9.30%, while high yield bonds (HYG) returned 12.26% annually over the same five-year span. An investor whose bond portfolio was diversified among a range of asset categories has far from suffered since the expectation of a rate increases began.

Will You Miss the Stability of Bonds?

Let’s also consider the consistency of bonds. Since 1980, the Aggregate Bond Index has achieved a positive return an astonishing 31 out of 34 years (91% of the time!). Given this data, perhaps bonds aren’t as likely to decline in value as some investors think.

Equally amazing, although the bond index has achieved an annual return as high as 32.65% during this time period (in 1982), the largest loss it ever suffered in a calendar year over the same period was just -2.92% (in 1994). Over the entire 34-year period, the index obtained an average annual gain of 8.42%. Bottom line: Over the last 34 years, bonds have offered a lot of return for relatively little risk.

Diversification: the Most Important Factor

Not putting all your eggs in one basket is another basic principal of investing, and the primary motivation for having a significant portion of your portfolio allocated in bonds. It is important to remember that for an investor with a long-term perspective, equities will likely provide the majority of investment growth and return in a portfolio while bonds are needed to reduce volatility and risk.

For example, while a portfolio that was 100% stocks suffered a 38.6% loss in 2008, a portfolio that was 50% stocks and 50% bonds suffered a loss of only 14.5% the same year—still not pleasant, but much more manageable.

***

***

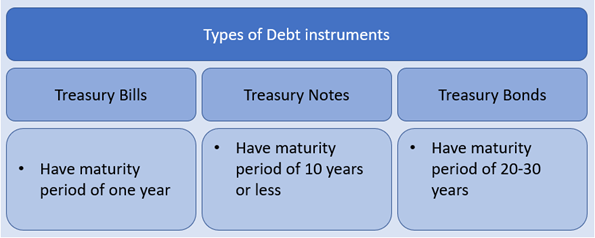

Correlation

Bonds reduce risk in a portfolio because their return has a low correlation to the return of stocks. How low? Since 1928, both the S&P 500 and the 10-year treasury note have lost value during a calendar year only three times (in 1931, 1941 and 1969). That is less than 4% of all annual periods!

Further, since the Barclays Aggregate Bonds Index was created in 1973, the index has never decreased in value in the same year as the S&P 500. Amazing, but true! Clearly, bonds are fulfilling their role as a diversifier and reducing the volatility in your portfolio.

There is Always a Role for Bonds

Despite the continuous threat of rising interest rates, bonds have continued to perform. More importantly, history illustrates that mixing bonds with stocks smoothes out the investment results of your portfolio.

Assessment

Don’t get sucked in by the media buzz. Bonds are too valuable an asset to disregard.

The Author:

Lon Jefferies is a Certified Financial Planner with a fee-only approach to ensure the client’s best interest is the top priority. He isn’t paid commission and gains nothing through recommendations but his client’s satisfaction. He has contributed to national publications like The Wall Street Journal, The New York Times, USA Today, Morningstar.com and Investment News.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Investing, Portfolio Management | Tagged: bonds, Investing, Investment Portfolio Analysis, Lon Jefferies MBA CFP® | 1 Comment »