Necessary Today – Not So In the Past

http://www.MarcinkoAssociates.com

[By Dr. David Edward Marcinko; MBA, CMP™]

Invite Dr. Marcinko

Marketing plays a vital role in successful practice ventures. How well you market your practice, along with a few other considerations, will ultimately determine your degree of success or failure.

The key element of a successful marketing plan is to know your patients – their likes, dislikes and expectations. By identifying these factors, you can develop a strategy that will allow you to arouse and fulfill their wants and needs.

The Beginning

Identify your patients by their age, sex, income/educational level and residence. At first, target only those patients who are more likely to want or need your medical services. As your patient base expands, you may need to consider modifying the marketing plan to include other patient types or medical services.

Your marketing plan should be included in your medical business plan and contain answers to the questions asked below:

·Who are your patients; define your target market(s)?

·Are your markets growing; steady; or declining?

·How is the practice unique?

·What is its market position?

·Where will we implement the marketing strategy?

·How much revenue, expense and profit will the practice achieve?

·Are your markets large enough to expand?

·How will you attract, hold, increase your market share?

·If a franchise, how is your market segmented?

·How will you promote your practice and services?

Practice Competition

Competition is a way of life. We compete for jobs, promotions, scholarships to institutions of higher learning, medical school, residency and fellowship programs, and in almost every aspect of our lives.

When considering these and other factors, we can conclude that medical practice is a highly competitive, volatile arena. Because of this volatility and competitiveness, it is important to know your medical competitors. Questions like these can help you determine:

·Who are your five nearest direct physician competitors?

·Who are your indirect physician competitors?

·How are their practices: steady; increasing; or decreasing?

·What have you learned from their operations or advertising?

·What are their strengths and weaknesses?

·How do their services differ from yours?

***

***

Patient Targeting

Patient targeting generally describes the strategic competitive advantage and/or professional synergy that is specific and unique to the practice. Intuitively, it answers such questions as:

·Who is the target market?

·How is the practice unique?

·What is its market position?

·Where will we implement the marketing strategy?

· How much revenue, expense and profit will the practice achieve?

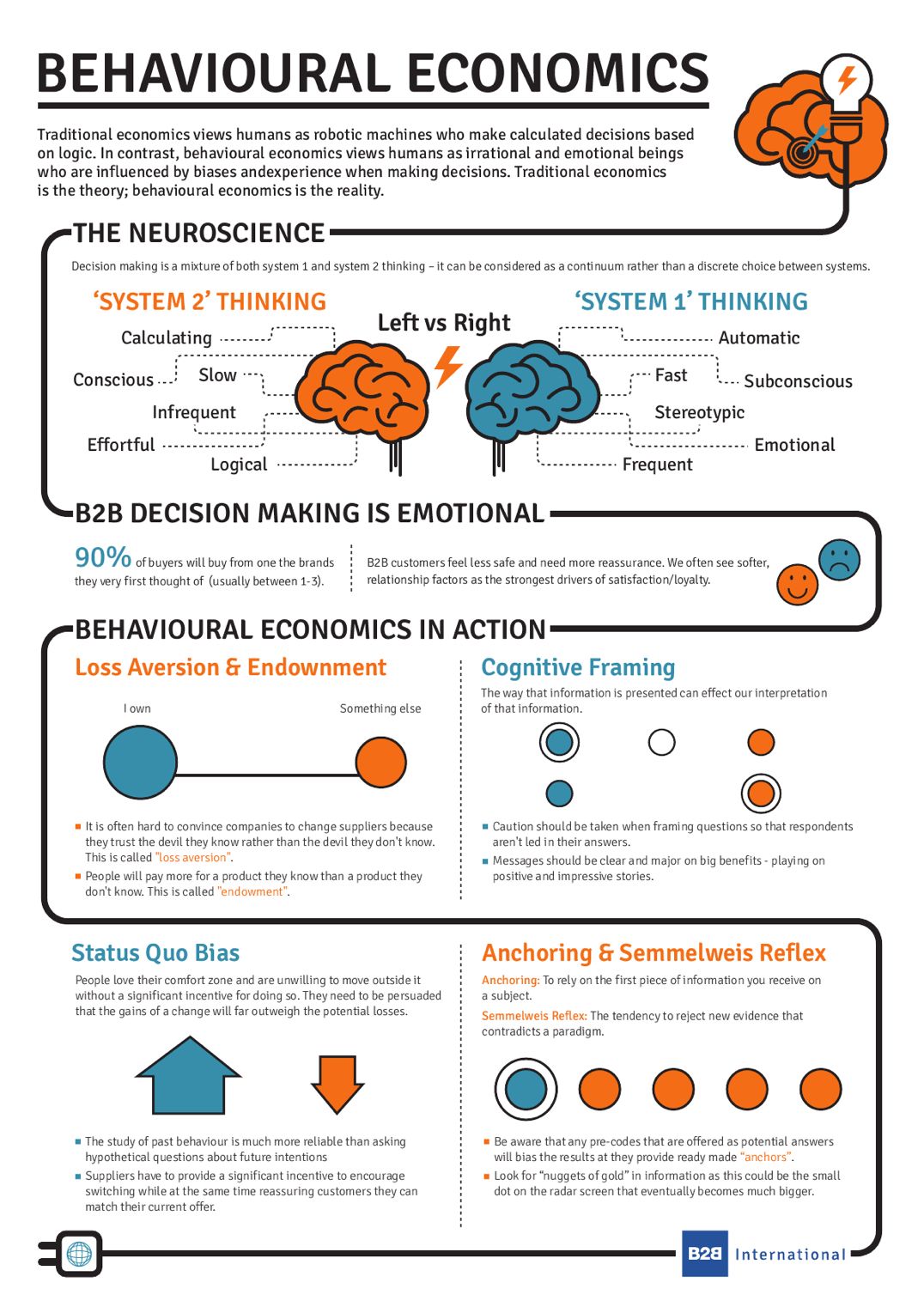

The science of modern marketing however, is based on intense competition largely derived from the interplay of five forces, codified in the early 1980s, by Professor Michael F. Porter of Harvard Business School. They are placed in this section of the business plan and include the following:

Power of suppliers: The bargaining power of physicians has weakened markedly in the last managed care decade. Reasons include demographics, technology, over/under supply and a lack of business acumen.

Power of buyers: Corporate buyers of employee healthcare are demanding increased quality and decreased premium costs within the entire healthcare industry. The extents to which these conduits succeed in their bargaining efforts depend on several factors:

·Switching Costs: Notable emotional switching costs include the turmoil caused by uprooting a trusted medical provider relationship.

·Integration Level: The practitioner must decide early on whether or not he will horizontally integrate as a solo practitioner, or vertically integrate into a bigger medical healthcare complex.

·Product Importance: Increasingly, HMOs do not often strive to delight their clients and may be responsible for the beginning backlash these entities are starting to experience. Additionally, some medical specialties have more perceived value than others (i.e., neurosurgery v. dermatology)

· Concentration: Insurance companies, not patients, represent buyers that can account for a large portion of practice revenue, thereby bringing about certain concessions. A danger sign is noted when any particular entity encompasses more than 15-25% of a practice’s revenues.

Threat of new entrants: Some authorities argue that medical schools produce more graduates than needed, inducing a supply side shock. Others suggest that there too many patients? Regardless, this often can be mitigated by practicing in rural or remote locations, away from managed care entities, or in areas with under-served populations.

Current or existing competition: Heightened inter-professional competition has increased the intensity and volume of certain medical services and referrals may be correspondingly with-held. Rivalry occurs because a competitor acts to improve his standing within the marketplace or to protect its position by reacting to moves made by other specialists.

Substitutions: Examples include: PAs for DOs, nurse practitioners for MDs, technicians for physical therapists, hygienists for dentists, cast technicians for orthopedists, nurse midwives for obstetricians, foot care extenders for podiatrists and even, hospital sanitation workers for medical and surgical care technicians. Any strategy to ameliorate these conditions will augment the successful business practice plan.

MORE: Healthcare Market.Tensions 2,0 MARCINKO

MORE: Strategic Management Improvement

Enter the Chief Marketing Officer [CMO]

A Chief Marketing Officer or marketing director is a corporate executive responsible for marketing activities in an organization. The CMO leads brand management, marketing communications, market research, product management, distribution channel management, pricing, often times sales, and customer service, etc.

***

Invite Dr. Marcinko

Academic Metaphor?

Now, with all the competition today at the college and university level; notwithstanding the recent Hollywood Elite University acceptance debacle, can you see how these basic ideas might also be helpful in the academic and educational strategic marketing ecosystem?

***

The changing role of a college / university Chief Marketing Office [narrow focus] –versus– Chief Strategy Officer [broader entity focus].

Assessment

A good way to accomplish and codify the above marketing plan concept is through a SWOT analysis. Mention the Strengths, Weaknesses, Opportunities and Threats of your specialty specific practice and what you plan do to maximize the positive, and minimize the negative aspects of the analysis.

Conclusion

Only after the above forces have been considered, should you begin the process that many physicians mistake for crafting their marketing efforts; executing the actual marketing plan.

If you are not going to the right audience, making the correct statements or delivering your message through the proper advertising channels, you might as well put your medical practice marketing plan into the trash can because it will not secure you funds, or benefit your practice.

Do you have a marketing plan, and more importantly, how well do you execute it?

More info: http://www.springerpub.com/prod.aspx?prod_id=23759

Speaker: If you need a moderator or a speaker for an upcoming event, Dr. David Edward Marcinko; MBA is available for speaking engagements. Contact him at: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

***

Filed under: "Doctors Only", Marketing & Advertising, Touring with Marcinko | Tagged: Marcinko, Marketing & Advertising | Leave a comment »