***

Physicians Have Unique Challenges and Opportunities

ENCORE PRESENTATION

http://www.MarcinkoAssociates.com

By Ann Miller RN MHA CMP

[Executive-Director]

Medical Executive-Post Publisher-in-Chief, Dr. David Edward Marcinko MBA CMP™, and financial planner Paul Larson CFP™, were interviewed by Sharon Fitzgerald for Medical News, Inc. Here is a reprint of that interview.

Doctors Squeezed from both Ends

Physicians today “are getting squeezed from both ends” when it comes to their finances, according Paul Larson, president of Larson Financial Group. On one end, collections and reimbursements are down; on the other end, taxes are up. That’s why financial planning, including a far-sighted strategy for retirement, is a necessity.

Larson Speaks

“We help these doctors function like a CEO and help them quarterback their plan,” said Larson, a Certified Financial Planner™ whose company serves thousands of physicians and dentists exclusively. Headquartered in St. Louis, Larson Financial boasts 19 locations.

Larson launched his company after working with a few physicians and recognizing that these clients face unique financial challenges and yet have exceptional opportunities, as well.

What makes medical practitioners unique? One thing, Larson said, is because they start their jobs much later in life than most people. Physicians wrap up residency or fellowship, on average, at the age of 32 or even older. “The delayed start really changes how much money they need to be saving to accomplish these goals like retirement or college for their kids,” he said.

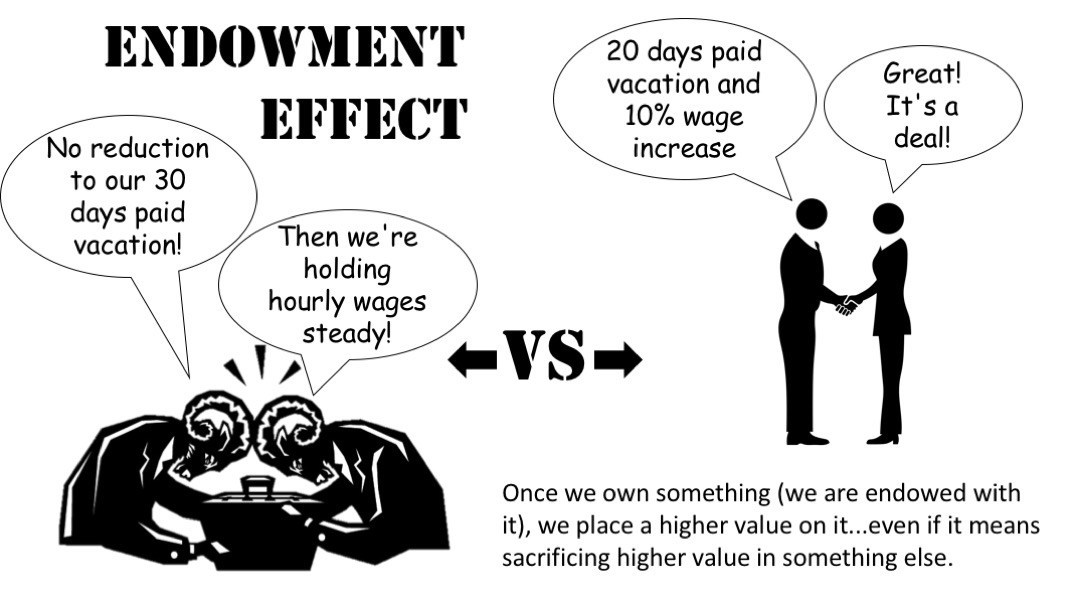

Another thing that puts physicians in a unique category is that most begin their careers with a student-loan debt of $175,000 or more. Larson said that there’s “an emotional component” to debt, and many physicians want to wipe that slate clean before they begin retirement saving.

Larson also said doctors are unique because they are a lawsuit target – and he wasn’t talking about medical malpractice suits. “You can amass wealth as a doctor, get sued in five years and then lose everything that you worked so hard to save,” he said. He shared the story of a client who was in a fender-bender and got out of his car wearing his white lab coat. “It was bad,” Larson said, and the suit has dogged the client for years.

The Three Mistake of Retirement Planning

Larson said he consistently sees physicians making three mistakes that may put a comfortable retirement at risk.

- The first is assuming that funding a retirement plan, such as a 401(k), is sufficient. It’s not. “There’s no way possible for you to save enough money that way to get to that goal,” he said. That’s primarily due to limits imposed by the Internal Revenue Service, which allows a maximum contribution of $49,000 annually if self-employed and just $16,500 annually until the age of 50. He recommends that physicians throughout their career sock away 20 percent of gross income in vehicles outside of their retirement plan.

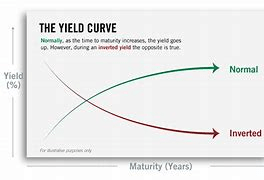

- The second common mistake is making investments that are inefficient from a tax perspective. In particular, real estate or bond investments in a taxable account prompt capital gains with each dividend, and that’s no way to make money, he said.

- The third mistake, and it’s a big one, is paying too much to have their money managed. A stockbroker, for example, takes a fee for buying mutual funds and then the likes of Fidelity or Janus tacks on an internal fee as well. “It’s like driving a boat with an anchor hanging off the back,” Larson said.

Marcinko Speaks

Dr. David E. Marcinko MBA MEd CPHQ, a physician and [former] certified financial planner] and founder of the more specific program for physician-focused fiduciary financial advisors and consultants www.CertifiedMedicalPlanner.org, sees another common mistake that wreaks havoc with a physician’s retirement plans – divorce.

Dr. David E. Marcinko MBA MEd CPHQ, a physician and [former] certified financial planner] and founder of the more specific program for physician-focused fiduciary financial advisors and consultants www.CertifiedMedicalPlanner.org, sees another common mistake that wreaks havoc with a physician’s retirement plans – divorce.

He said clients come to him “looking to invest in the next Google or Facebook, and yet they will get divorced two or three times, and they’ll be whacked 50 percent of their net income each time. It just doesn’t make sense.”

Marcinko practiced medicine for 16 years until about 10 years ago, when he sold his practice and ambulatory surgical center to a public company, re-schooled and retired. Then, his second career in financial planning and investment advising began. “I’m a doctor who went to business school about 20 years ago, before it was in fashion. Much to my mother’s chagrin, by the way,” he quipped. Marcinko has written 27 books about practice management, hospital administration and business, physician finances, risk management, retirement planning and practice succession. He’s the founder of the Georgia-based Institute of Medical Business Advisors Inc.

Succession Planning for Doctors

Succession planning, Marcinko said, ideally should begin five years before retirement – and even earlier if possible. When assisting a client with succession, Marcinko examines two to three years of financial statements, balance sheets, cash-flow statements, statements of earnings, and profit and loss statements, yet he said “the $50,000 question” remains: How does a doctor find someone suited to take over his or her life’s work? “We are pretty much dead-set against the practice broker, the third-party intermediary, and are highly in favor of the one-on-one mentor philosophy,” Marcinko explained.

“There is more than enough opportunity to befriend or mentor several medical students or interns or residents or fellows that you might feel akin to, and then develop that relationship over the years.” He said third-party brokers “are like real-estate agents, they want to make the sale”; thus, they aren’t as concerned with finding a match that will ensure a smooth transition.

The only problem with the mentoring strategy, Marcinko acknowledged, is that mentoring takes time, and that’s a commodity most physicians have too little of. Nonetheless, succession is too important not to invest the time necessary to ensure it goes off without a hitch.

Times are different today because the economy doesn’t allow physicians to gradually bow out of a practice. “My overhead doesn’t go down if I go part-time. SO, if I want to sell my practice for a premium price, I need to keep the numbers up,” he noted.

Assessment

Dr. Marcinko’s retirement investment advice – and it’s the advice he gives to anyone – is to invest 15-20 percent of your income in an Vanguard indexed mutual fund or diversified ETF for the next 30-50 years. “We all want to make it more complicated than it really is, don’t we?” he said.

QUESTION: What makes a physician moving toward retirement different from most others employees or professionals? Marcinko’s answer was simple: “They probably had a better shot in life to have a successful retirement, and if they don’t make it, shame on them. That’s the difference.”

More:

- Doctors and Divorce Settlements

- MD Salary versus Net-Worth Conundrum [.ppt slide-show presentation]

- Medical Practice Worth

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

![]()

Filed under: "Ask-an-Advisor", CMP Program, Experts Invited, iMBA, Inc., Interviews, Marcinko Associates, Retirement and Benefits, Risk Management | Tagged: CMP Program, divorce planning, Dr. David Edward Marcinko MBA CMP™, paul larson cfp, physician succession planning, retirement planning, www.CertifiedMedicalPlanner.org | 2 Comments »

Conclusion

Conclusion

***

***

***

***