Who Knew What?

By Jake Bernstein, ProPublica – June 2, 2010 2:40 pm EDT

When Bernard Madoff pleaded guilty to running the biggest Ponzi scheme in history, he insisted he was the lone perpetrator, asserting that no one – not his family, not his colleagues, not his friends – knew of the fraud.

Alternative Narrative

But an alternate narrative is emerging from the pile of Madoff-related civil suits and court motions that have been filed in the last two years – one in which a small circle of men played knowing, integral roles in the scheme, in some cases benefiting more from it than even Madoff himself.

The evidence for this remains largely circumstantial. These relationships were forged in the days before e-mail, and none of the cases has yet produced anything for public consumption that delivers insights into what these men were thinking. In the one instance in which a judge has ruled on allegations against some of the men, he dismissed the charges for lack of evidence.

But the men’s actions, as described in the court cases, appear to have furthered the scheme. The Securities and Exchange Commission and the trustee charged with recovering money for Madoff’s victims have alleged that some of the men had expectations and influence far beyond what is typical for the usual investor. Most tellingly, the documents say that in at least one instance, and possibly more, these men helped keep the Madoff scam afloat, providing hundreds of millions of dollars of cash when it was on the verge of collapsing.

If this was a conspiracy – and the available information is by no means complete – it does not seem to have been one in which the perpetrators plotted together around a tavern table. Irving Picard, the trustee, has sued several of Madoff’s biggest beneficiaries, alleging they “knew or willfully ignored” that they were participating in a fraud. The suits are silent on the question of whether those involved coordinated or knew of one another’s activities, but they don’t need to demonstrate that to be successful.

A Commonality

What these men undeniably shared were similar backgrounds and interests. Based largely in New York and South Florida, they moved through parallel milieus of affluent Jewish country clubs and synagogues. They were active in similar philanthropies and served on the boards of foundations, universities and yeshivas.

The cast of characters, spelled out mostly in complaints filed by the trustee and the SEC, includes: Carl Shapiro, [1] 97, a Boston-based philanthropist who made one fortune in ladies dresses and a larger one with Madoff; Robert Jaffe [2], 66, Shapiro’s son-in-law; Maurice “Sonny” Cohn, 79, a one-time Madoff neighbor turned business partner; Robert Jaffe [3], 83, a close friend of Madoff’s for more than 50 years and one of his earliest investors; and Jeffry Picower [4], a lawyer and accountant, who recently died of a heart attack at 67.

None of these men has been charged criminally. Thus far, federal authorities have indicated in court filings that just one of them – Chais – is the subject of a criminal inquiry. A year ago, The Wall Street Journal, citing anonymous sources, reported that the U.S. Attorney’s Office in Manhattan was investigating at least eight investors, including Picower, Chais and Shapiro [5].

All have denied being anything but victims of Madoff’s [6].

Chais, Cohn and Jaffe have drawn considerable ire from investors for running so-called feeder funds that channeled huge sums into Madoff’s investment business. Jaffe alone funneled more than $1 billion of investor money to Madoff, according to the SEC. He worked with Cohn in a business called Cohmad – a contraction of Cohn and Madoff – that operated out of Madoff’s offices. Contrary to what some investors in the funds believed, it appears the men did little to manage the money beyond simply collecting it for delivery to Madoff.

Inner Circle Fared Well

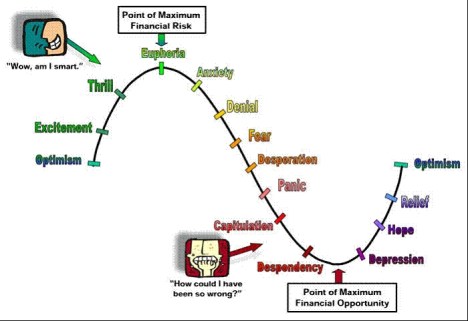

Members of this circle not only did far better than other investors, who averaged 10 percent to 12 percent returns annually, they also had a highly unusual level of input into the nature of their returns.

According to the trustee’s complaint, there were several instances in which Picower or his associates contacted Madoff’s office, asking for specific monthly returns [7]. Over a five-year period in the late ’90s, two of Picower’s accounts [8] had annual returns ranging between 120 percent and 550 percent. A third had yearly returns as high as 950 percent.

Chais and his family consistently received yearly returns higher than 100 percent, far exceeding the gains realized by investors in his funds. Moreover, according to an SEC complaint [9], when Madoff told Chais he was switching to a new strategy that might show occasional short-term trading losses without interfering with net gains, Chais made a special demand to maintain the appearance of loss-free investments.

“Chais told Madoff that he did not want there to be any losses in any of [his] Fund’s trades,” the SEC complaint alleges [9]. “Madoff complied with Chais’ request. Between 1999 and 2008, despite purportedly executing thousands of trades on behalf of the Funds, Madoff did not report a loss on a single equities trade.”

Chais disputes the allegations [9], and his lawyer characterized the SEC’s complaint in a statement as “a distorted and false picture of Stanley Chais.”

“Like so many others, Mr. Chais was blindsided and victimized by Bernard Madoff’s unprecedented and pervasive fraud,” the statement said. “Mr. Chais and his family have lost virtually everything – an impossible result were he involved in the underlying fraud.”

Many of those in the circle took money from the scheme as fees rather than investment gains.

Cohmad officials reaped a total of $98.4 million in payments between 1996 and 2008, most of it labeled income from “account supervision,” according to the SEC [10].

Chais charged fees equal to 25 percent of each Chais fund’s net profit for calendar years in which profits exceeded 10 percent, according to the trustee. As profits exceeded 10 percent every year, Chais took in almost $270 million in fees from 1995 to 2008.

Though Madoff receives the lion’s share of the blame and/or credit for his scheme, it appears that several of his close associates profited more handsomely than he did. Shortly after he confessed, Madoff declared in court documents that his household net worth was about $825 million.

Picower, the biggest beneficiary of the scheme by far, took in $7.2 billion in profit, according to the trustee. Picower’s widow and the trustee are currently haggling over the exact amount of a multibillion-dollar settlement. Carl Shapiro and his family received more than $1 billion, the trustee charged in a court document filed last November in U. S. Bankruptcy Court.

Chais and his family members withdrew approximately $200 million more than they invested with Madoff, according to the SEC. This came on top of the hundreds of millions in fees Chais charged investors.

Chais’ lawyer denied that his client had any knowledge of the Ponzi scheme or that he had raked in the vast riches alleged. “Despite the astronomical numbers mentioned by the Trustee in his complaint, the bulk of the funds alleged to have been distributed to Mr. Chais were in fact distributed to his investors,” his statement said.

Keeping the Scheme Going

At key moments, Madoff’s investors came to the rescue to keep the scheme going. The first instance came in 1992, when the SEC shut down a feeder fund run by the accountants Frank Avellino and Michael Bienes, then Madoff’s largest, accusing the pair of operating a Ponzi scheme. Avellino and Bienes admitted they had acted as unregistered investment managers, but insisted the money had been invested with Madoff, who promptly returned more than $300 million.

Ironically, the SEC mistook Madoff’s ability to raise that amount so quickly as proof that his business was legitimate and “the money was where we [the agency] would expect it to be,” a staff attorney told the SEC’s inspector general last year. Almost two decades later, investigators suspect Madoff may have tapped his circle to collect the cash while scrambling, with the help of his right-hand man, Frank DiPascali, to fabricate trading records, a scene detailed in the agency’s case against DiPascali.

Identifying precisely who helped Madoff repay Avellino and Bienes’ investors is currently an area of inquiry for law enforcement, according to a person familiar with the investigation.

Despite his ever-growing network of feeder funds, Madoff had another liquidity crisis in November 2005. According to a federal complaint [11] filed against his employee Daniel Bonventre, Madoff’s investor account had an end-of-day balance of about $13 million to cover about $105 million in wires scheduled to go out over the next three days.

Two days later, one of Madoff’s investors, identified in the complaint [11] as “Client A,” sent about $100 million in bonds to Madoff, which he used as collateral to secure a $95 million bank loan to continue the Ponzi scheme. The following January, Client A gave Madoff $54 million more in bonds, which were used as collateral for a $50 million loan.

Investigators have not revealed the identity of Client A, but a person close to the investigation said he was among Madoff’s group of longtime close associates.

The final bailout came toward the end of 2008, when Madoff was hit with a tidal wave of redemption requests from investors caught up in the larger financial crisis. Toward the end of 2008, he looked to Shapiro, who pitched in $250 million.

Shapiro and his family have said repeatedly through spokesmen that they were unaware of the true nature of Madoff’s business. The spokesman declined to comment on the $250 million.

No civil or criminal complaints have been filed against Shapiro, but a court filing by the trustee raised questions about the nonagenarian’s “contentions that he is a victim of Madoff’s scheme,” alleging “inconsistencies between Mr. Shapiro’s counsel’s account of the family history with Madoff and the records available to the Trustee.” The trustee is negotiating with the family to recover profits made over the years.

The emergency cash infusion failed. Just 10 days later, Madoff says he confessed to his sons that “it’s all just one big lie,” finally ending the scheme.

The Case-To-Date

So far, efforts to hold Madoff associates accountable have met with mixed results.

Civil claims by the SEC [10] against Jaffe, Cohmad and Cohn were largely rejected by Federal District Judge Louis Stanton, who ruled in February that the agency had failed to prove they “knew of, or recklessly disregarded, Madoff’s fraud.” The judge left the door open for the SEC to refile its complaint by June 18, if it can strengthen its case.

Lawyers for Maurice Cohn and Cohmad released the following statement in response to the ruling: “As we have maintained all along and Judge Stanton agrees, the SEC’s complaint supports nothing other than “the reasonable inference that Madoff fooled the defendants as he did individual investors, financial institutions and regulators.”

Assessment

If there were others involved in the Ponzi scheme, building federal or state criminal cases against Madoff’s circle may prove difficult. Though their relationships go back decades, most of their dealings were done verbally, and there isn’t a lot of correspondence, according to a person with knowledge of the investigations. Federal investigators are working with DiPascali to get a clearer picture of the degree of complicity of others in the scheme.

Illness and age also may become factors. Though a grand jury could consider charges against Chais by mid-June, he suffers from a rare blood disorder and is in and out of the hospital. Shapiro, too, is said to be in ill health.

The trustee is expected to file more lawsuits in coming months as the date approaches when the statute of limitations runs out.

Criminal cases brought against several former Madoff employees have already eroded the notion, lodged so powerfully in the public imagination, that Madoff worked alone, said Daniel Richman, a professor at Columbia Law School and a former prosecutor. With each additional case, he said, it may well crumble further.

“I imagine the paradigmatic Ponzi scheme with the evil genius who keeps all the secrets to himself and engineers this massive crime, like most stick figures, will probably not hold true,” he said.

Link: http://www.propublica.org/feature/the-madoff-circle-who-knew-what

Conclusion

Industry Indignation Index: 99

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Ethics, Financial Planning, Industry Indignation Index, Investing, Portfolio Management | Tagged: Bernard Madoff, Carl Shapiro, Frank Avellino, Frank DiPascali, Jeffry Picower, Maurice “Sonny” Cohn, Michael Bienes, Ponzi, Robert Jaffe, SEC, Securities and Exchange Commission, Securities fraud, Wall Sreet | 20 Comments »

Click to play

Click to play